Individual Investor Mutual Fund Flows

... sell and past fund performance, although tax considerations matter only in taxable accounts. On the other hand, psychological considerations seem to play an important role in individuals’ trading decisions. For example, the disposition effect—the propensity to cash in gains and aversion to realize l ...

... sell and past fund performance, although tax considerations matter only in taxable accounts. On the other hand, psychological considerations seem to play an important role in individuals’ trading decisions. For example, the disposition effect—the propensity to cash in gains and aversion to realize l ...

Dalton Street Capital Absolute Return Fund Product Disclosure

... subsidiary of Prodigy. The team is made up of investment professionals with deep Australian and Asian equity market experience coupled with detailed derivative and leveraged fund management knowledge. Dalton Street uses complex systematic investment strategies that aims to deliver positive absolute ...

... subsidiary of Prodigy. The team is made up of investment professionals with deep Australian and Asian equity market experience coupled with detailed derivative and leveraged fund management knowledge. Dalton Street uses complex systematic investment strategies that aims to deliver positive absolute ...

Factors affecting the price of catastrophe bonds

... − Risk Load for Parametric bonds a bit lower than that for index/modelled portfolio, but not statistically significant ...

... − Risk Load for Parametric bonds a bit lower than that for index/modelled portfolio, but not statistically significant ...

Time-varying risk premia and the cost of capital

... of investments that are written off, or changes in compensation practices toward the use of stock options which are not treated as an expense, can all create one-time movements in measured price–earnings ratios that are unrelated to the future path of earnings or discount rates. By contrast, data on ...

... of investments that are written off, or changes in compensation practices toward the use of stock options which are not treated as an expense, can all create one-time movements in measured price–earnings ratios that are unrelated to the future path of earnings or discount rates. By contrast, data on ...

Implied Excess Return

... 3. EIR: Spreadsheet implementation The spreadsheet comprises five columns: one refers to market input and the subsequent four refer to individual firms. A graph plots a firm’s implied return (IR) on y-axis and its CAPM required return on x-axis. To make it easy to see how much IR differs from the CA ...

... 3. EIR: Spreadsheet implementation The spreadsheet comprises five columns: one refers to market input and the subsequent four refer to individual firms. A graph plots a firm’s implied return (IR) on y-axis and its CAPM required return on x-axis. To make it easy to see how much IR differs from the CA ...

Cypress Capital Management, LLC 1 FIRM

... Government obligations and a select group of higher quality corporate issues. If our equity and fixed income research indicates the possibility of future upgrading in credit ratings, we will consider purchasing below-investment grade bonds. We may also consider purchasing below investment grade bond ...

... Government obligations and a select group of higher quality corporate issues. If our equity and fixed income research indicates the possibility of future upgrading in credit ratings, we will consider purchasing below-investment grade bonds. We may also consider purchasing below investment grade bond ...

Forms of Complex Dynamics in Transforming Economies

... rate of state sector layoffs, as a positive function of the difference between the private and state sector wages, with s = 0 ...

... rate of state sector layoffs, as a positive function of the difference between the private and state sector wages, with s = 0 ...

Expected value

... risk. She will opt for a combination of assets that are reasonably representative of the overall market (M). Finally, investor III is a real speculator. She will accept a risky combination of assets (N) – more risky than the overall ...

... risk. She will opt for a combination of assets that are reasonably representative of the overall market (M). Finally, investor III is a real speculator. She will accept a risky combination of assets (N) – more risky than the overall ...

Financial markets and growth

... on growth have been analyzed extensively, in most models the degree of financial development is assumed to be exogenous. But understanding what determines the emergence of financial markets or their degree of development is at least as important as assessing their effects on growth. For if indeed fi ...

... on growth have been analyzed extensively, in most models the degree of financial development is assumed to be exogenous. But understanding what determines the emergence of financial markets or their degree of development is at least as important as assessing their effects on growth. For if indeed fi ...

1 Two periods market

... the risk (variance, volatility) is larger. My comment is: if you take more risks, don’t be surprised to loose money.... the probability of such an event is non null.... ...

... the risk (variance, volatility) is larger. My comment is: if you take more risks, don’t be surprised to loose money.... the probability of such an event is non null.... ...

Collaborative Business Networks and Technology Companies

... human resource. Following World War II, this was the only resource that Germany and Japan had to draw on. Consequently, they built economic systems that encourage private employers to make business decisions that emphasize improved productivity and quality, rather than price. ...

... human resource. Following World War II, this was the only resource that Germany and Japan had to draw on. Consequently, they built economic systems that encourage private employers to make business decisions that emphasize improved productivity and quality, rather than price. ...

Introduction to Unigestion`s nowcaster indicators

... “Nowcasting” is a contraction of ”now” and ’’forecasting” that is used to describe the practice of estimating current economic conditions. Nowcasting indicators have emerged over the past 10 years, essentially through the efforts of the research departments of various central banks. Many internation ...

... “Nowcasting” is a contraction of ”now” and ’’forecasting” that is used to describe the practice of estimating current economic conditions. Nowcasting indicators have emerged over the past 10 years, essentially through the efforts of the research departments of various central banks. Many internation ...

Deutsche AM Flagship Fund Reporting

... When the custodian sets the price on the last trading day of the month there can be a difference of up to ten hours between the times at which the fund price and the benchmark are calculated. In the event of strong market movements during this period, this may result in the over- or understatement o ...

... When the custodian sets the price on the last trading day of the month there can be a difference of up to ten hours between the times at which the fund price and the benchmark are calculated. In the event of strong market movements during this period, this may result in the over- or understatement o ...

CFIN

... and thus increase profits 2. to buy back stock, which would lower shares outstanding and thus raise EPS ...

... and thus increase profits 2. to buy back stock, which would lower shares outstanding and thus raise EPS ...

THE CAPITAL ASSET PRICING MODEL`S RISK

... U.S. and five other large stock markets. These studies indicate that researchers have measured the equity premium relative to both T. Bills and long-term government bonds, with varying results. Some studies have indicated that the return interval used in the regression has a significant impact on th ...

... U.S. and five other large stock markets. These studies indicate that researchers have measured the equity premium relative to both T. Bills and long-term government bonds, with varying results. Some studies have indicated that the return interval used in the regression has a significant impact on th ...

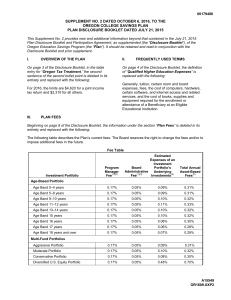

Disclosure Booklet - Oregon College Savings Plan

... share of the Plan Manager Fee and the Board Administrative Fee as these fees reduce the Investment Portfolio’s return. (2) Each Investment Portfolio (with the exception of the Principal Plus Interest Portfolio) pays the Plan Manager a fee at an annual rate of 0.17% of the average daily net assets of ...

... share of the Plan Manager Fee and the Board Administrative Fee as these fees reduce the Investment Portfolio’s return. (2) Each Investment Portfolio (with the exception of the Principal Plus Interest Portfolio) pays the Plan Manager a fee at an annual rate of 0.17% of the average daily net assets of ...

Information Asymmetry within Financial Markets and Corporate

... (1984) highlight that when the market can no longer distinguish good quality investment opportunities from the poor ones, firms with favorable opportunities would often opt for self-financing. Consequently, the resultant adverse selection would lead to an increase in external financing related cost ...

... (1984) highlight that when the market can no longer distinguish good quality investment opportunities from the poor ones, firms with favorable opportunities would often opt for self-financing. Consequently, the resultant adverse selection would lead to an increase in external financing related cost ...

Macro-economics of Innovation 1

... • However, from a business cycle perspective, the analysis cannot be restricted to individual innovation. • Qualitative aspects and the systems of inter-relatedness of innovations must be taken into account, which under favorable conditions lead to an economic boom. • Favorable conditions include, c ...

... • However, from a business cycle perspective, the analysis cannot be restricted to individual innovation. • Qualitative aspects and the systems of inter-relatedness of innovations must be taken into account, which under favorable conditions lead to an economic boom. • Favorable conditions include, c ...

Making Sense of the Markets

... This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor. International and emerging market investing involves special risks such as currency fluctuation and political instability and ...

... This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor. International and emerging market investing involves special risks such as currency fluctuation and political instability and ...

Examples of Level II exam item set questions

... use derivatives to hedge her husband’s position because these types of trades do not require advance approval from the compliance department. The next morning, on Martineau’s recommendation, Sherman’s trader sells all of SMC’s mutual fund’s entire positions of Muryan for a sizable gain. Martineau he ...

... use derivatives to hedge her husband’s position because these types of trades do not require advance approval from the compliance department. The next morning, on Martineau’s recommendation, Sherman’s trader sells all of SMC’s mutual fund’s entire positions of Muryan for a sizable gain. Martineau he ...