Michael S. Taht

... (4) Surplus and Related Assets provide for adverse deviation over and above that absorbed by policyholder dividends ...

... (4) Surplus and Related Assets provide for adverse deviation over and above that absorbed by policyholder dividends ...

NBER WORKING PAPER SERIES RATIONAL ASSET PRICES George M. Constantinides 8826

... inflation. Over the period 1872 to 2000, the sample mean of the real equity return is 8.9 percent and of the premium is 6.9 percent. Over the period 1926 to 2000, the sample mean of the equity return is 9.7 percent and of the premium is 9.3 percent. Over the postwar period 1951 to 2000, the sample ...

... inflation. Over the period 1872 to 2000, the sample mean of the real equity return is 8.9 percent and of the premium is 6.9 percent. Over the period 1926 to 2000, the sample mean of the equity return is 9.7 percent and of the premium is 9.3 percent. Over the postwar period 1951 to 2000, the sample ...

Investing in a Time of Climate Change

... The international community will negotiate a new global climate agreement at the end of 2015 in Paris. With this report, Mercer and our study partners aim to help asset owners and investment managers increase the sophistication with which they consider the impact of climatepolicy changes and related ...

... The international community will negotiate a new global climate agreement at the end of 2015 in Paris. With this report, Mercer and our study partners aim to help asset owners and investment managers increase the sophistication with which they consider the impact of climatepolicy changes and related ...

Impact Investing as a Supplement to Nicaragua’s Traditional Microfinance Robert Book

... responsibly investment” or philanthropy. Some investments only expect the return of nominal principal while others will negotiate a low interest rate or the purchase of some equity to compensate for the opportunity costs associated with investing. Currently, high net-worth individuals, through inves ...

... responsibly investment” or philanthropy. Some investments only expect the return of nominal principal while others will negotiate a low interest rate or the purchase of some equity to compensate for the opportunity costs associated with investing. Currently, high net-worth individuals, through inves ...

Schwab Advisor Cash Reserves

... Schwab Advisor Cash Reserves (the fund) seeks the highest current income consistent with stability of capital and liquidity. To pursue its goal, the fund invests in high-quality, short-term money market investments issued by U.S. and foreign issuers. Examples of these securities include commercial p ...

... Schwab Advisor Cash Reserves (the fund) seeks the highest current income consistent with stability of capital and liquidity. To pursue its goal, the fund invests in high-quality, short-term money market investments issued by U.S. and foreign issuers. Examples of these securities include commercial p ...

File

... 2. As a short-term creditor concerned with a company’s ability to meet its financial obligation to you, which one of the combinations of ratios shown in Figure 5.04 A, ...

... 2. As a short-term creditor concerned with a company’s ability to meet its financial obligation to you, which one of the combinations of ratios shown in Figure 5.04 A, ...

Stock Return Predictability and Model Uncertainty

... It should be noted that in the traditional regression paradigm, one may find that an economic variable is significant based on a particular collection of regressors, but becomes insignificant when an alternative specification is examined. Whether such a variable is a robust predictor or not is ambig ...

... It should be noted that in the traditional regression paradigm, one may find that an economic variable is significant based on a particular collection of regressors, but becomes insignificant when an alternative specification is examined. Whether such a variable is a robust predictor or not is ambig ...

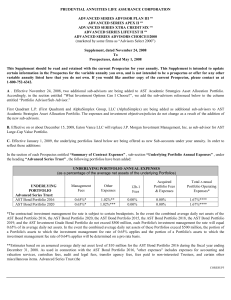

PRUDENTIAL ANNUITIES LIFE ASSURANCE CORP/CT (Form

... services fee is 0.10% of the AST Bond Portfolio 2016 's average daily net assets, subject to certain voluntary asset-based breakpoints. ***Estimates based on an assumed average daily net asset level of $10 million for the AST Bond Portfolio 2020 during the fiscal year ending December 31, 2008. As us ...

... services fee is 0.10% of the AST Bond Portfolio 2016 's average daily net assets, subject to certain voluntary asset-based breakpoints. ***Estimates based on an assumed average daily net asset level of $10 million for the AST Bond Portfolio 2020 during the fiscal year ending December 31, 2008. As us ...

Towards a Contingency Theory of Enterprise Risk Management

... processes actually implemented in the firm. Because of these shortcomings, most empirical studies explain only a small fraction of the variability in the adoption or impact of risk management and have low statistical significance for key explanatory variables. Further, the large-sample cross-section ...

... processes actually implemented in the firm. Because of these shortcomings, most empirical studies explain only a small fraction of the variability in the adoption or impact of risk management and have low statistical significance for key explanatory variables. Further, the large-sample cross-section ...

From the financial crisis to sustainability

... can produce a range of very different results - some of them decidedly problematic. The market economy does not necessarily produce just one possible equilibrium; it opens up opportunities that can be used in different ways. For example, in the course of its long-term development, the German economy ...

... can produce a range of very different results - some of them decidedly problematic. The market economy does not necessarily produce just one possible equilibrium; it opens up opportunities that can be used in different ways. For example, in the course of its long-term development, the German economy ...

Chapter 9 PowerPoint Slides

... • The Risk Premium is the additional return (over and above the risk-free rate) resulting from bearing risk. • One of the most significant observations of stock and bond market data is this long-run excess of security return over the risk-free return. – The average excess return from Canadian largec ...

... • The Risk Premium is the additional return (over and above the risk-free rate) resulting from bearing risk. • One of the most significant observations of stock and bond market data is this long-run excess of security return over the risk-free return. – The average excess return from Canadian largec ...

What is a realistic aversion to risk for real

... wealth, where the investment wealth includes appropriately discounted, some kind of certainty equivalent of, labor income. My arguments would not hold if an agent calculates her investment as a proportion of currently available cash, while she is reasonably certain of (and ignores for the purposes o ...

... wealth, where the investment wealth includes appropriately discounted, some kind of certainty equivalent of, labor income. My arguments would not hold if an agent calculates her investment as a proportion of currently available cash, while she is reasonably certain of (and ignores for the purposes o ...

Ethical investment: How do moral considerations influence

... investors and therefore are not traded. Rational decision theorists argue that moral considerations would introduce inefficiency by reducing the number of investment options and therefore only financial considerations should govern investment decisions. However, the increasing demand for ethical inv ...

... investors and therefore are not traded. Rational decision theorists argue that moral considerations would introduce inefficiency by reducing the number of investment options and therefore only financial considerations should govern investment decisions. However, the increasing demand for ethical inv ...

Sovereign Credit Ratings and Spreads in Emerging Markets: Does

... liquidity conditions—appears to have changed since the mid 2000s, and now these two indicators tend to move in opposite directions.6 ...

... liquidity conditions—appears to have changed since the mid 2000s, and now these two indicators tend to move in opposite directions.6 ...

Financial Market: May 2015

... 33.00, the level we believe it should have reached since year-end 2014. A surprise policy rate cut on April 29 and the BoT’s relaxed FX regulation delivered the twin effect of rising USD/THB. Most accommodative outflows measures facilitate an up-move of USD/THB and are perceived as market-friendly t ...

... 33.00, the level we believe it should have reached since year-end 2014. A surprise policy rate cut on April 29 and the BoT’s relaxed FX regulation delivered the twin effect of rising USD/THB. Most accommodative outflows measures facilitate an up-move of USD/THB and are perceived as market-friendly t ...

CEE Investment Report 2016

... Poland, Romania and Slovakia will remain in the group of the fastest growing economies in the EU in the coming years1. In 2015, GDP growth in CEE (3.1%) was nearly double that of the euro area (1.6%). According to data provided by the International Monetary Fund, the CEE countries* combined generate ...

... Poland, Romania and Slovakia will remain in the group of the fastest growing economies in the EU in the coming years1. In 2015, GDP growth in CEE (3.1%) was nearly double that of the euro area (1.6%). According to data provided by the International Monetary Fund, the CEE countries* combined generate ...

The changing policy framework

... 3. VARs Caveats: -- technical problems often severe (identification / reverse causality, spurious regressions…) -- all else equal: the costs of “getting there” are not explored – large tax rises or cuts in other expenditures that may have an output cost… ...

... 3. VARs Caveats: -- technical problems often severe (identification / reverse causality, spurious regressions…) -- all else equal: the costs of “getting there” are not explored – large tax rises or cuts in other expenditures that may have an output cost… ...

Thoughts on the macroeconomic situation: the role of La Caixa presentation

... NOTE: In countries where offshore banking is important, external debt could be larger than total debt (i.e UK) Source: Research Department, “la Caixa” ...

... NOTE: In countries where offshore banking is important, external debt could be larger than total debt (i.e UK) Source: Research Department, “la Caixa” ...

2015

... megaprojects would provide positive tailwinds supporting economic recovery going forward. 2) The prolonged low interest rate environment encouraged more search for yield behavior in capital market, bond market and other asset markets. In the first half of 2015, the amount of investment by retail inv ...

... megaprojects would provide positive tailwinds supporting economic recovery going forward. 2) The prolonged low interest rate environment encouraged more search for yield behavior in capital market, bond market and other asset markets. In the first half of 2015, the amount of investment by retail inv ...

Banco Bradesco S.A - University of Oregon Investment Group

... a domestic central bank to satisfy requirements, but most deposits are used to create loans that generate revenue. In today’s economy, banks have become vastly more sophisticated and have developed instruments for debt and equity that generates generous amounts of profits. The banking industry is hi ...

... a domestic central bank to satisfy requirements, but most deposits are used to create loans that generate revenue. In today’s economy, banks have become vastly more sophisticated and have developed instruments for debt and equity that generates generous amounts of profits. The banking industry is hi ...

Distribution Risk and Equity Returns

... the allocation of resources conforms to the maximization of a social welfare function under aggregate feasibility constraints. There are, however, two distinguishing features to this economy. First, the welfare weights in the social welfare function are time-varying and this risk is uninsurable. Se ...

... the allocation of resources conforms to the maximization of a social welfare function under aggregate feasibility constraints. There are, however, two distinguishing features to this economy. First, the welfare weights in the social welfare function are time-varying and this risk is uninsurable. Se ...