Efectos Fiscales sobre el Crecimiento Económico en la República

... rate and then levels off (at approximately 25 percent of national income). The Dominican Republic’s average domestic savings ratio over the period 1970-2000 was 15.3 percent with an average per capita income of $US 1385 (at 1995 prices). On the basis of the international cross-section evidence, this ...

... rate and then levels off (at approximately 25 percent of national income). The Dominican Republic’s average domestic savings ratio over the period 1970-2000 was 15.3 percent with an average per capita income of $US 1385 (at 1995 prices). On the basis of the international cross-section evidence, this ...

IOSR Journal Of Humanities And Social Science (IOSR-JHSS)

... differences in the economies under study and possibly the time frame which were adopted. Another likely explanation may be that the size of national income employed may be too small to have any significant impact on FDI. That notwithstanding, market size still serves as a very robust determinant of ...

... differences in the economies under study and possibly the time frame which were adopted. Another likely explanation may be that the size of national income employed may be too small to have any significant impact on FDI. That notwithstanding, market size still serves as a very robust determinant of ...

Asset Write-down - Rutgers University

... timing choice of either 1995 or 1996 to write down assets and recognize their impairments. Therefore, the time is running out for them to differentiate themselves from the rest of the firms if they desire to demonstrate that they engage in an efficiency enhancement activity. In this paper, we first ...

... timing choice of either 1995 or 1996 to write down assets and recognize their impairments. Therefore, the time is running out for them to differentiate themselves from the rest of the firms if they desire to demonstrate that they engage in an efficiency enhancement activity. In this paper, we first ...

Telstra Financial and Economic Profit Analysis

... investment spend. In 1999 Telstra’s cash outflows for investments were AUD112m. 2000 investment outflows were five times this. 2001 was five times again at AUD3.2bn/USD1.6bn. Total capital expenditure outflows have risen from AUD4.4bn in 1999 to AUD7.6bn in 2001 on a stable operating cashflow base o ...

... investment spend. In 1999 Telstra’s cash outflows for investments were AUD112m. 2000 investment outflows were five times this. 2001 was five times again at AUD3.2bn/USD1.6bn. Total capital expenditure outflows have risen from AUD4.4bn in 1999 to AUD7.6bn in 2001 on a stable operating cashflow base o ...

Private Equity Institutional Investor Trends for

... limited look at developing new general partner relationships (Chart VII). Based on our discussions with investors, many are continuing to triage their relationships, looking to upgrade their portfolio quality by not re-upping with fund managers that had weak returns over the last cycle and puttin ...

... limited look at developing new general partner relationships (Chart VII). Based on our discussions with investors, many are continuing to triage their relationships, looking to upgrade their portfolio quality by not re-upping with fund managers that had weak returns over the last cycle and puttin ...

SAP NetWeaver

... Powers business-ready solutions that reduce custom integration It’s Enterprise Services Architecture increases business process flexibility ...

... Powers business-ready solutions that reduce custom integration It’s Enterprise Services Architecture increases business process flexibility ...

department of labor retirement initiative fails to consider current

... PRESIDENT’S COUNCIL OF ECONOMIC ADVISERS, THE EFFECTS OF CONFLICTED INVESTMENT ADVICE ON RETIREMENT SAVINGS at 6 (Feb. 2015) (CEA REPORT). For purposes of this memorandum, references to investors, customers, and clients are to non-institutional investors, customers, and clients. The term “investment ...

... PRESIDENT’S COUNCIL OF ECONOMIC ADVISERS, THE EFFECTS OF CONFLICTED INVESTMENT ADVICE ON RETIREMENT SAVINGS at 6 (Feb. 2015) (CEA REPORT). For purposes of this memorandum, references to investors, customers, and clients are to non-institutional investors, customers, and clients. The term “investment ...

Expected Returns on Major Asset Classes

... The equity risk premium was not discussed much during this period, but one could calculate such a premium by subtracting the bond yield from the DDM-based expected return on stocks. According to this way of thinking, the equity risk premium is an artifact, a derived quantity that depends on the time ...

... The equity risk premium was not discussed much during this period, but one could calculate such a premium by subtracting the bond yield from the DDM-based expected return on stocks. According to this way of thinking, the equity risk premium is an artifact, a derived quantity that depends on the time ...

Religious Activity, Risk Taking Preferences, and Financial Behaviour

... financial matters. Moreover, our present paper adds to the literature a specific within-country analysis, as opposed to cross-country studies, to provide further empirical evidence on the impact of religiosity. Studying the economic consequences of religion in Germany may shed light on the distincti ...

... financial matters. Moreover, our present paper adds to the literature a specific within-country analysis, as opposed to cross-country studies, to provide further empirical evidence on the impact of religiosity. Studying the economic consequences of religion in Germany may shed light on the distincti ...

Equity Investments as a Hedge against Inflation, Part 1

... Over the past two or three decades the world has seen an economy marked with unusually low rates of inflation, despite normal growth. This has been a result, in part, of globalization and deregulation, but also successful monetary policy in most countries in the Organisation for Economic Co-operatio ...

... Over the past two or three decades the world has seen an economy marked with unusually low rates of inflation, despite normal growth. This has been a result, in part, of globalization and deregulation, but also successful monetary policy in most countries in the Organisation for Economic Co-operatio ...

Efficacy of Economic Value Added Concept in Business

... business entity should be to maximize shareholders wealth by enhancing the firm’s value and all the activities of a firm should be directed to achieve this objective. In order to materialize this objective, shareholder wealth is conventionally substituted by either standard accounting magnitudes (su ...

... business entity should be to maximize shareholders wealth by enhancing the firm’s value and all the activities of a firm should be directed to achieve this objective. In order to materialize this objective, shareholder wealth is conventionally substituted by either standard accounting magnitudes (su ...

Morningstar and Barron`s 2014-2015 Alternative Investment Survey

... /Organic growth rates for alts slowed in 2014 to 12.3%, from 42.2% for 2013. While this sudden deceleration is significant, alts still grew at the fastest clip relative to all other asset classes. /Alternative fund launches also reached their highest level in 2014, as more companies are seeking a cl ...

... /Organic growth rates for alts slowed in 2014 to 12.3%, from 42.2% for 2013. While this sudden deceleration is significant, alts still grew at the fastest clip relative to all other asset classes. /Alternative fund launches also reached their highest level in 2014, as more companies are seeking a cl ...

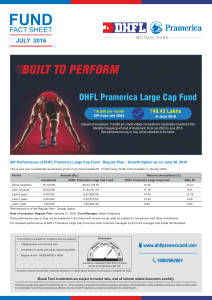

DHFL Pramerica Large Cap Fund

... higher than in May (5.76%). Most of the upward pressure came again from food inflation. Food inflation continued its upward journey printing at 7.4% as against 7.2% and 6.3% in the preceding two months, respectively. Core inflation offered some solace recording almost a 20 bps decline to 4.5% as com ...

... higher than in May (5.76%). Most of the upward pressure came again from food inflation. Food inflation continued its upward journey printing at 7.4% as against 7.2% and 6.3% in the preceding two months, respectively. Core inflation offered some solace recording almost a 20 bps decline to 4.5% as com ...

What Are Services?

... Nonlife Insurance: Measurement of Output /Insurance Services Adjustments for claims volatility: • In case of a significant unforeseeable event during the accounting period, the derived insurance services rendered by the insurance company to the policyholders should not turn into a negative figure ...

... Nonlife Insurance: Measurement of Output /Insurance Services Adjustments for claims volatility: • In case of a significant unforeseeable event during the accounting period, the derived insurance services rendered by the insurance company to the policyholders should not turn into a negative figure ...

33 Journal of the Statistical and Social Inquiry Society of

... to which other firms do not have access (Markusen, 1995). Examples of such an asset are unique management techniques, or access to a particular knowledge base, patents, know how as a result of R&D. Such assets can be transferred easily, at low or zero costs, between different plants of the firm, and ...

... to which other firms do not have access (Markusen, 1995). Examples of such an asset are unique management techniques, or access to a particular knowledge base, patents, know how as a result of R&D. Such assets can be transferred easily, at low or zero costs, between different plants of the firm, and ...

Document

... subject to change without notice. Any opinions made may be personal to the author and may not reflect the opinions of FxPro. This communication must not be reproduced or further distributed without prior permission of FxPro. ...

... subject to change without notice. Any opinions made may be personal to the author and may not reflect the opinions of FxPro. This communication must not be reproduced or further distributed without prior permission of FxPro. ...

proposal seminar bisnis dan keuangan

... ur = was the output r that was produced by the insurance company j; yrj = the number ouput r, was produced by the insurance company, was counted from r = 1 to s ; vi = was the weight input i that was produced by the insurance company j; and xij = the number input i, was produced by the insurance com ...

... ur = was the output r that was produced by the insurance company j; yrj = the number ouput r, was produced by the insurance company, was counted from r = 1 to s ; vi = was the weight input i that was produced by the insurance company j; and xij = the number input i, was produced by the insurance com ...

IBLLC Firm-Specific Disclosure 12-09-16

... prospective customers. Much of the information included in this document can be found on the IB website at www.interactivebrokers.com. A paper copy is available upon request. Interactive is an agency-only, direct market access broker and Futures Commission Merchant (“FCM”) that provides execution, c ...

... prospective customers. Much of the information included in this document can be found on the IB website at www.interactivebrokers.com. A paper copy is available upon request. Interactive is an agency-only, direct market access broker and Futures Commission Merchant (“FCM”) that provides execution, c ...

Political risk: what market impact

... economic policies is very limited; ii/ uncertainty about future decisions is maintained by the fact that institutions are being called into question, by the growth in alternative political forces and by partisan stalemates. These factors explain the trend increase in political risk from end-2015 to ...

... economic policies is very limited; ii/ uncertainty about future decisions is maintained by the fact that institutions are being called into question, by the growth in alternative political forces and by partisan stalemates. These factors explain the trend increase in political risk from end-2015 to ...

cultura y gestión de los resultados un análisis con 6

... International Financial Reporting Standards have hardened into a compliance exercise, rather than acting towards innovation and fair competition, while there is still no concrete answer about the opportunities and constraints managers trade off to choose one set of earnings attributes over the other ...

... International Financial Reporting Standards have hardened into a compliance exercise, rather than acting towards innovation and fair competition, while there is still no concrete answer about the opportunities and constraints managers trade off to choose one set of earnings attributes over the other ...

Bubbles, Financial Crises, and Systemic Risk

... economy that was affected by a bubble and spread the effects to other parts of the economy. Amplification mechanisms that arise during financial crises can either be direct (caused by direct contractual links) or indirect (caused by spillovers or externalities that are due to common exposures or th ...

... economy that was affected by a bubble and spread the effects to other parts of the economy. Amplification mechanisms that arise during financial crises can either be direct (caused by direct contractual links) or indirect (caused by spillovers or externalities that are due to common exposures or th ...

Ijara by Zubair Usmani

... SALE AND LEASE BACK When the client sells the asset to the bank the entire risk and rewards are transferred to the bank who is then is responsible for the ownership related expenses In this case the bank is allowed to lease the asset to the client but there are conditions which have to be followed ...

... SALE AND LEASE BACK When the client sells the asset to the bank the entire risk and rewards are transferred to the bank who is then is responsible for the ownership related expenses In this case the bank is allowed to lease the asset to the client but there are conditions which have to be followed ...

Optimal research in financial markets with heterogeneous private

... signals. The research cost decisions will be made before each trading period and before the realisation of the private signals. Therefore, investors are homogeneous in their research cost decision stage. The model will be solved as a two stage game, where investors make their research decisions bas ...

... signals. The research cost decisions will be made before each trading period and before the realisation of the private signals. Therefore, investors are homogeneous in their research cost decision stage. The model will be solved as a two stage game, where investors make their research decisions bas ...

Download paper (PDF)

... economy that was affected by a bubble and spread the effects to other parts of the economy. Amplification mechanisms that arise during financial crises can either be direct (caused by direct contractual links) or indirect (caused by spillovers or externalities that are due to common exposures or th ...

... economy that was affected by a bubble and spread the effects to other parts of the economy. Amplification mechanisms that arise during financial crises can either be direct (caused by direct contractual links) or indirect (caused by spillovers or externalities that are due to common exposures or th ...