Is Inflation Too Low?

... With regard to the current outlook, I will say only that I am optimistic that we will work through current problems, painful as they have been for many, with no significant damage to the U.S. economy. My optimism stems from the economy’s strong initial conditions of low inflation, low and stable inf ...

... With regard to the current outlook, I will say only that I am optimistic that we will work through current problems, painful as they have been for many, with no significant damage to the U.S. economy. My optimism stems from the economy’s strong initial conditions of low inflation, low and stable inf ...

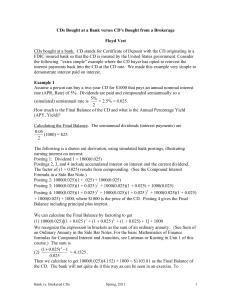

CDs Bought at a Bank verses CD`s Bought from a Brokerage Floyd

... summarize, the CD has earned interest of $103.81 and the principal was repaid. The interest on interest was $3.81. (See the exercises and Side Bar Notes for formulas.) You Try It #1 (a) Do a derivation similar to the above Example 1 for a semiannual two-year bank CD of $10,000 that pays an annual 2 ...

... summarize, the CD has earned interest of $103.81 and the principal was repaid. The interest on interest was $3.81. (See the exercises and Side Bar Notes for formulas.) You Try It #1 (a) Do a derivation similar to the above Example 1 for a semiannual two-year bank CD of $10,000 that pays an annual 2 ...

Stressed, Not Frozen: The Federal Funds Market in the Financial Crisis

... lending rates increases after August 2007. They estimate that more liquid lenders charge higher rates after August 2007 (liquidity hoarding), but the economic magnitude of the estimated effect is small.4 Finally, Kuo, Skeie, and Vickery (2010) document that while maturities seem to shorten, the U.S. ...

... lending rates increases after August 2007. They estimate that more liquid lenders charge higher rates after August 2007 (liquidity hoarding), but the economic magnitude of the estimated effect is small.4 Finally, Kuo, Skeie, and Vickery (2010) document that while maturities seem to shorten, the U.S. ...

FX Weekly 22/04/13

... economy continues to perform well; (2) The mix of a drought-induced supply constraint and improving growth in Asia continues to support global dairy prices; (3) New Zealand bond yields remain attractive. The New Zealand-US 3-year swap spread is currently 255bpts; (4) Although we expect the RBNZ to r ...

... economy continues to perform well; (2) The mix of a drought-induced supply constraint and improving growth in Asia continues to support global dairy prices; (3) New Zealand bond yields remain attractive. The New Zealand-US 3-year swap spread is currently 255bpts; (4) Although we expect the RBNZ to r ...

Bulletin Contents Volume 75 No. 3, September 2012

... Interviewed by Bernard Hodgetts On 25 September 2012, Alan Bollard completed his second five-year term as Governor and Chief Executive of the Reserve Bank. Dr Bollard was appointed to the role in 2002 following four years as Secretary to the Treasury. Prior to that, he was Chairman of the New Zealan ...

... Interviewed by Bernard Hodgetts On 25 September 2012, Alan Bollard completed his second five-year term as Governor and Chief Executive of the Reserve Bank. Dr Bollard was appointed to the role in 2002 following four years as Secretary to the Treasury. Prior to that, he was Chairman of the New Zealan ...

The Federal Reserve`s Framework for Monetary Policy

... announcement of the “balance of risks” following FOMC meetings in 2000, and expediting the publication of FOMC minutes from 2006 onward. 4 A. Providing greater clarity regarding policy objectives and strategy In recent years, the Committee has taken a sequence of steps to improve public understandi ...

... announcement of the “balance of risks” following FOMC meetings in 2000, and expediting the publication of FOMC minutes from 2006 onward. 4 A. Providing greater clarity regarding policy objectives and strategy In recent years, the Committee has taken a sequence of steps to improve public understandi ...

PPT

... Lenders will increase nominal rates of interest. Fisher effect: the tendency for nominal interest rates to rise with expected inflation. The nominal rate of interest will be equal to expected inflation rate plus the equilibrium rate of return. BACK TO ...

... Lenders will increase nominal rates of interest. Fisher effect: the tendency for nominal interest rates to rise with expected inflation. The nominal rate of interest will be equal to expected inflation rate plus the equilibrium rate of return. BACK TO ...

Three Essays in Monetary Economics

... Does money matter for inflation? And if so, at what horizon is the comovement most pronounced? While the literature is very ambiguous in answering the first question, it is very vague on the second. From a policy perspective, however, both questions are highly relevant and may become of particular imp ...

... Does money matter for inflation? And if so, at what horizon is the comovement most pronounced? While the literature is very ambiguous in answering the first question, it is very vague on the second. From a policy perspective, however, both questions are highly relevant and may become of particular imp ...

slide 1 of 2

... The effective interest rate method of amortization provides for a constant rate of interest over the life of the bonds. The interest rate used in the interest method of amortization, sometimes called the interest method, is the market rate on the date the bonds are issued. The carrying amount of the ...

... The effective interest rate method of amortization provides for a constant rate of interest over the life of the bonds. The interest rate used in the interest method of amortization, sometimes called the interest method, is the market rate on the date the bonds are issued. The carrying amount of the ...

Download (pdf)

... difficulties and describes such firms as (p. 32): “These firms would be unable to service their debts in the medium term unless they make adjustments such as reducing debt, operating costs, or capital expenditures.” Correspondingly, such firms cannot use their assets efficiently, which in turn causes sever ...

... difficulties and describes such firms as (p. 32): “These firms would be unable to service their debts in the medium term unless they make adjustments such as reducing debt, operating costs, or capital expenditures.” Correspondingly, such firms cannot use their assets efficiently, which in turn causes sever ...

Quantitative Easing in Joseph`s Egypt with Keynesian Producers

... given a fixed real interest rate and the rational anticipation that consumption will equal its flexible-price level when the shock to desired savings has passed. With storage, future consumption is a free variable. This allows the static coordination game’s multiplicity to manifest itself in a dynam ...

... given a fixed real interest rate and the rational anticipation that consumption will equal its flexible-price level when the shock to desired savings has passed. With storage, future consumption is a free variable. This allows the static coordination game’s multiplicity to manifest itself in a dynam ...

11-8 (Key Question) Suppose the Yukon Bank has the following

... Public goods are non-rival (one person’s consumption does not prevent consumption by another) and non-excludable (once the goods are produced nobody—including free riders—can be excluded from the goods’ benefits). If goods are non-rival, there is less incentive for private firms to produce them – th ...

... Public goods are non-rival (one person’s consumption does not prevent consumption by another) and non-excludable (once the goods are produced nobody—including free riders—can be excluded from the goods’ benefits). If goods are non-rival, there is less incentive for private firms to produce them – th ...

Bonds Payable

... The amortization each year for Sean Construction Corporation would be $2,250 ($22,500 ÷ 10 years). The entry in Slide 29 appears as an adjusting entry at the end of the fiscal period. ...

... The amortization each year for Sean Construction Corporation would be $2,250 ($22,500 ÷ 10 years). The entry in Slide 29 appears as an adjusting entry at the end of the fiscal period. ...

Poland`s policy mix: fiscal or monetary leadership?

... crisis, which had severely hit export performance from autumn 1998 onwards. Monetary policy had eased during 1998 – but real interest rates were still relatively high – while fiscal policy had tightened moderately. Disinflation had proceeded well, with CPI inflation falling to 8½% by December 1998, ...

... crisis, which had severely hit export performance from autumn 1998 onwards. Monetary policy had eased during 1998 – but real interest rates were still relatively high – while fiscal policy had tightened moderately. Disinflation had proceeded well, with CPI inflation falling to 8½% by December 1998, ...

24.3 Implementing Monetary Policy: Tools of the Fed

... 24.3 Implementing Monetary Policy: Tools of the Fed ...

... 24.3 Implementing Monetary Policy: Tools of the Fed ...

Decision Avoidance and Deposit Interest Rate Setting

... suggesting factors other than cost influence the setting of interest rates. Previously Heffernan (2002) examining intra-bank variation in interest rate setting reported dual peaks of more and less competitive interest rates existed for financial services; an outcome attributed to bank interest rate ...

... suggesting factors other than cost influence the setting of interest rates. Previously Heffernan (2002) examining intra-bank variation in interest rate setting reported dual peaks of more and less competitive interest rates existed for financial services; an outcome attributed to bank interest rate ...

To Cut or Not to Cut? That is the (Central Bank`s)

... during recent years. Stronger domestic economic fundamentals (lower exchange rate risk and inflation risk premiums, as well as fiscal consolidation) and easing global financial conditions are possible explanations for this trend. In all cases, we observe that near-record low global interest rates fo ...

... during recent years. Stronger domestic economic fundamentals (lower exchange rate risk and inflation risk premiums, as well as fiscal consolidation) and easing global financial conditions are possible explanations for this trend. In all cases, we observe that near-record low global interest rates fo ...

Chapter 4: Money and Inflation

... 4.6) The Social Costs of Inflation → A Common Misperception About Inflation? Common misperception: Inflation reduces real wages This is true only in the short run, when nominal wages are fixed by contracts. (Chap. 3) In the long run, the real wage is determined by labor supply and the marginal prod ...

... 4.6) The Social Costs of Inflation → A Common Misperception About Inflation? Common misperception: Inflation reduces real wages This is true only in the short run, when nominal wages are fixed by contracts. (Chap. 3) In the long run, the real wage is determined by labor supply and the marginal prod ...

Bondch6s

... short-term yields (rST) are greater (or when short-term prices are lower) and when the yields on short-term government securities (rGST) are lower. Similarly, for long-term corporate bonds let us assume investors have a greater demand for such bonds when their yields (rLT) are higher and the yields ...

... short-term yields (rST) are greater (or when short-term prices are lower) and when the yields on short-term government securities (rGST) are lower. Similarly, for long-term corporate bonds let us assume investors have a greater demand for such bonds when their yields (rLT) are higher and the yields ...

Has Forward Guidance Been Effective?

... Forward guidance is thought to operate through a similar interest rate channel but doesn’t require a change in the current target federal funds rate. FOMC statements that policy rates will remain exceptionally low in the future can reduce both components of long-term rates—the term premium and the e ...

... Forward guidance is thought to operate through a similar interest rate channel but doesn’t require a change in the current target federal funds rate. FOMC statements that policy rates will remain exceptionally low in the future can reduce both components of long-term rates—the term premium and the e ...

Money demand in the euro area

... Monetary dynamics in the euro area has been exceptionally strong in recent years. The annual growth in M3 averaged 7.9% in the 2001-2008 period, reaching even two-digit growth rates from February 2007 to May 2008. At the same time, prices were comparably stable, with yearly inflation rates averaging ...

... Monetary dynamics in the euro area has been exceptionally strong in recent years. The annual growth in M3 averaged 7.9% in the 2001-2008 period, reaching even two-digit growth rates from February 2007 to May 2008. At the same time, prices were comparably stable, with yearly inflation rates averaging ...

Inflation and deflation

... However, as noted in Chapter 16, monetary policy is carried out by central banks, and in most industrialised countries the central bank is an independent body whose main goal is the maintenance of a low and stable rate of inflation. In some countries, including Poland, South Korea, Canada, England, ...

... However, as noted in Chapter 16, monetary policy is carried out by central banks, and in most industrialised countries the central bank is an independent body whose main goal is the maintenance of a low and stable rate of inflation. In some countries, including Poland, South Korea, Canada, England, ...

Was ECB`s monetary policy optimal? - Fritz Breuss

... Union (EU) has been quite a success so far. When the EMU started its third stage with 11 out of 15 EU member states in January 1999, the European and US business cycle were still on an upswing. GDP growth was satisfactory, inflation was low, even some kind of convergence of the European business cyc ...

... Union (EU) has been quite a success so far. When the EMU started its third stage with 11 out of 15 EU member states in January 1999, the European and US business cycle were still on an upswing. GDP growth was satisfactory, inflation was low, even some kind of convergence of the European business cyc ...

External financing and economic activity in the euro area

... response of other financing sources can potentially mitigate the negative impact of adverse bank loan supply shocks on the economy. Failing to take this reaction into account might thus bias the inference drawn regarding the impact of bank loan supply shocks on key macroeconomic variables such as r ...

... response of other financing sources can potentially mitigate the negative impact of adverse bank loan supply shocks on the economy. Failing to take this reaction into account might thus bias the inference drawn regarding the impact of bank loan supply shocks on key macroeconomic variables such as r ...

Disputes over Macro Theory and Policy

... as shown in Figure IC1-1a. This line is located at the full-employment level of real output, which in this designation is also the full-capacity real GDP. According to the classical economists, the economy will operate at its full-employment level of output, Qf, because of (1) Say’s law (Chapter 8), ...

... as shown in Figure IC1-1a. This line is located at the full-employment level of real output, which in this designation is also the full-capacity real GDP. According to the classical economists, the economy will operate at its full-employment level of output, Qf, because of (1) Say’s law (Chapter 8), ...