Taking Stock: What Ever Happened to the "Invisible Hand"?

... banks. Perhaps we also want to feel this way because we know that central banks are here to stay, and we have tremendous hope that they will do a better job the next time around, since we see no plausible solution otherwise. A person can be severely attacked if they even suggest that they have the a ...

... banks. Perhaps we also want to feel this way because we know that central banks are here to stay, and we have tremendous hope that they will do a better job the next time around, since we see no plausible solution otherwise. A person can be severely attacked if they even suggest that they have the a ...

THE CRISIS AND MONETARY POLICY: WHAT WE LEARNED

... Consider an ANZAC dollar. The NZ dollar has fallen by over 10 percent against the AU dollar since 2006, a period in which Australia experienced an unprecedented minerals boom and very strong growth. If our currency had been pegged to the AU dollar, New Zealand’s exchange rate to the rest of the worl ...

... Consider an ANZAC dollar. The NZ dollar has fallen by over 10 percent against the AU dollar since 2006, a period in which Australia experienced an unprecedented minerals boom and very strong growth. If our currency had been pegged to the AU dollar, New Zealand’s exchange rate to the rest of the worl ...

Valuing Floating Rate Notes (FRN) in Excel/VBA

... and its price shows very low sensitivity to changes in market rates. When market rates rise, the expected coupons of the FRN increase in line with the increase in forward rates, which means its price remains constant. Thus, FRNs differ from fixed rate bonds, whose prices decline when market rates ri ...

... and its price shows very low sensitivity to changes in market rates. When market rates rise, the expected coupons of the FRN increase in line with the increase in forward rates, which means its price remains constant. Thus, FRNs differ from fixed rate bonds, whose prices decline when market rates ri ...

Federal Reserve and Monetary Policy - Database of K

... When there is a fire, what government officials/agencies might show up to help affected citizens? What do these individuals do to help put out the fire? When there is a hurricane, what government officials/agencies might show up to help affected citizens? What do these individuals do to help wit ...

... When there is a fire, what government officials/agencies might show up to help affected citizens? What do these individuals do to help put out the fire? When there is a hurricane, what government officials/agencies might show up to help affected citizens? What do these individuals do to help wit ...

CHAPTER 26: The Art of Central Banking: Targets, Instruments, and

... The Record on Inflation Control: In the recent past, a growing number of countries have adopted inflation targets. In addition to price stability, the stability of economic performance in terms of economic growth and employment has been an advantage of adopting inflation targets. There is an increas ...

... The Record on Inflation Control: In the recent past, a growing number of countries have adopted inflation targets. In addition to price stability, the stability of economic performance in terms of economic growth and employment has been an advantage of adopting inflation targets. There is an increas ...

Financial Versus Real Assets

... Treasury Bills: government issue Certificates of Deposit (CD): time deposit Commercial Paper: short-term unsecured Banker’s Acceptance: order to a bank to pay Eurodollar: dollar denominated deposits at foreign banks • Repos and Reverses: agreement,government securities, sell and buy back overnight ...

... Treasury Bills: government issue Certificates of Deposit (CD): time deposit Commercial Paper: short-term unsecured Banker’s Acceptance: order to a bank to pay Eurodollar: dollar denominated deposits at foreign banks • Repos and Reverses: agreement,government securities, sell and buy back overnight ...

Are We In A Recession?

... But the biggest fools were the banks lending them the money. Zero down payment mortgages, easy terms now, high interest rates later. Banks (and the investors they then resold the mortgages to) who assumed that housing prices would continue to skyrocket, and that their collateral, the house itself, w ...

... But the biggest fools were the banks lending them the money. Zero down payment mortgages, easy terms now, high interest rates later. Banks (and the investors they then resold the mortgages to) who assumed that housing prices would continue to skyrocket, and that their collateral, the house itself, w ...

1) Gross domestic product is calculated by summing up A) the total

... 19) Refer to Scenario 14-2. As a result of Kristy's deposit, Bank A's excess reserves increase by A) $2,000. B) $8,000. C) $10,000. D) $50,000. 20) Refer to Scenario 14-2. As a result of Kristy's deposit, Bank A can make a maximum loan of A) $2,000. B) $8,000. C) $10,000. D) $50,000. 21) Refer to Sc ...

... 19) Refer to Scenario 14-2. As a result of Kristy's deposit, Bank A's excess reserves increase by A) $2,000. B) $8,000. C) $10,000. D) $50,000. 20) Refer to Scenario 14-2. As a result of Kristy's deposit, Bank A can make a maximum loan of A) $2,000. B) $8,000. C) $10,000. D) $50,000. 21) Refer to Sc ...

IOSR Journal of Economics and Finance (IOSR-JEF)

... Monetary policy influence the performance of the economy’s crucial factors such as output, inflation and Commercial Bank Loans Advances and also prices of goods, exchange rate, consumption rate, asset prices and investment decisions. Nevertheless, the central Bank of Nigeria cannot directly control ...

... Monetary policy influence the performance of the economy’s crucial factors such as output, inflation and Commercial Bank Loans Advances and also prices of goods, exchange rate, consumption rate, asset prices and investment decisions. Nevertheless, the central Bank of Nigeria cannot directly control ...

Open economies in PK stock-flow consistent models: Applying the

... Mainstream authors would say that the UK (or Chinese) central bank of our model is “sterilizing” foreign reserves, by selling domestic Treasury bills on the open market. In a way, it is true. But this is not the result of any intentional policy, where central bankers are actively intervening in fina ...

... Mainstream authors would say that the UK (or Chinese) central bank of our model is “sterilizing” foreign reserves, by selling domestic Treasury bills on the open market. In a way, it is true. But this is not the result of any intentional policy, where central bankers are actively intervening in fina ...

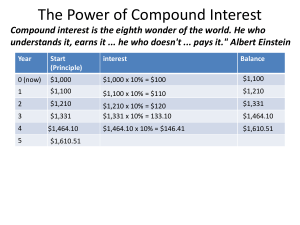

The Power of Compound Interest

... • The Rule of 72 is a great mental math shortcut to estimate the effect of any growth rate, from quick financial calculations to population estimates. Here’s the formula: • Years to double = 72 / Interest ...

... • The Rule of 72 is a great mental math shortcut to estimate the effect of any growth rate, from quick financial calculations to population estimates. Here’s the formula: • Years to double = 72 / Interest ...

Monetary policy: many targets, many instruments. Where do we stand?

... Second, as Hyman Minsky described, periods of stability encourage exuberance in credit markets, leading eventually to instability. And third, low short-term policy rates may encourage investors to take on more risk than they would otherwise accept as they ‘search for yield’. ...

... Second, as Hyman Minsky described, periods of stability encourage exuberance in credit markets, leading eventually to instability. And third, low short-term policy rates may encourage investors to take on more risk than they would otherwise accept as they ‘search for yield’. ...

Money, Liquidity

... • Every economic unit has a balance sheet. Governments, businesses, households, all have balance sheets. You have a balance sheet, even if you never write it down. A balance sheet is simply a list of the unit’s asset and liabilities. We often write balance sheets with assets on the left and liabilit ...

... • Every economic unit has a balance sheet. Governments, businesses, households, all have balance sheets. You have a balance sheet, even if you never write it down. A balance sheet is simply a list of the unit’s asset and liabilities. We often write balance sheets with assets on the left and liabilit ...

Rethinking the Central Bank`s Mandate (and Other Things)

... Inflation rising despite aggressive MP ...

... Inflation rising despite aggressive MP ...

Guidelines on Investment of Idle Funds in Nigeria Treasury bill NTB

... Departments and Agencies in 91 days Primary Market Nigeria Treasury Bills (NTB). However, one half or 50% of all idle fund balances in overheads bank accounts shall be invested in the Treasury Bills of tenor 30, 45 or 60 days depending on the need of each organisation. ...

... Departments and Agencies in 91 days Primary Market Nigeria Treasury Bills (NTB). However, one half or 50% of all idle fund balances in overheads bank accounts shall be invested in the Treasury Bills of tenor 30, 45 or 60 days depending on the need of each organisation. ...

What else is at the NY Fed?

... • In 1978, Jimmy Carter signed the Humphrey-Hawkins Full Employment and Balanced Growth Act – Among other things, this law directed the Federal Reserve to conduct monetary policy that controlled inflation and promoted full employment — the first time the real economy was formally linked to monetary ...

... • In 1978, Jimmy Carter signed the Humphrey-Hawkins Full Employment and Balanced Growth Act – Among other things, this law directed the Federal Reserve to conduct monetary policy that controlled inflation and promoted full employment — the first time the real economy was formally linked to monetary ...

Central banks start to wonder about low bond yields

... Forecasts: Failing another unexpected shock that affects Canada’s economy, the monetary authorities will not cut key interest rates again, especially in the context of high consumer debt. However, it will be quite some time before an increase is ordered to the target for the overnight rate. Only in ...

... Forecasts: Failing another unexpected shock that affects Canada’s economy, the monetary authorities will not cut key interest rates again, especially in the context of high consumer debt. However, it will be quite some time before an increase is ordered to the target for the overnight rate. Only in ...

History Central Banking - Federal Reserve Bank of Philadelphia

... some Reserve Banks sold Treasury securities at times when other Reserve Banks were buying Treasury securities. ...

... some Reserve Banks sold Treasury securities at times when other Reserve Banks were buying Treasury securities. ...

review - Harper College

... group whose income changes because of the spending change will in turn have a new level of spending which reflects their new level of income. When their spending increases or decreases, another group will find its income affected. Their spending will change by a fraction of that amount and so on. Th ...

... group whose income changes because of the spending change will in turn have a new level of spending which reflects their new level of income. When their spending increases or decreases, another group will find its income affected. Their spending will change by a fraction of that amount and so on. Th ...

March 12, 2004

... If two multiple choice answers both seem to be approximately correct, choose the best of the two answers. Write answers to the multiple choice questions on this front sheet. If answers are not written on this sheet, there will be no marks given for answers. Note: this exam consists of 8 pages, inclu ...

... If two multiple choice answers both seem to be approximately correct, choose the best of the two answers. Write answers to the multiple choice questions on this front sheet. If answers are not written on this sheet, there will be no marks given for answers. Note: this exam consists of 8 pages, inclu ...

The Money Demand Curve

... interest rate, the interest rate is determined by the supply and demand for money. • The money supply curve shows how the nominal quantity of money supplied varies with the interest rate. ...

... interest rate, the interest rate is determined by the supply and demand for money. • The money supply curve shows how the nominal quantity of money supplied varies with the interest rate. ...

Schroders Multi-Asset Investments Views and Insights - June 2015

... authorities have embarked on monetary easing, economic reform and fiscal consolidation in seeking to end deflation, revive the economy through boosting competitiveness and ultimately seeking to avoid looming debt troubles by boosting the denominator and shrinking the numerator of the nation’s debt t ...

... authorities have embarked on monetary easing, economic reform and fiscal consolidation in seeking to end deflation, revive the economy through boosting competitiveness and ultimately seeking to avoid looming debt troubles by boosting the denominator and shrinking the numerator of the nation’s debt t ...

Chris Diaz Commentary - Snowden Lane Partners

... U.S. corporate bonds offer attractive risk-adjusted returns on a selective basis given corporate growth prospects and ongoing balance sheet improvement for many firms. ...

... U.S. corporate bonds offer attractive risk-adjusted returns on a selective basis given corporate growth prospects and ongoing balance sheet improvement for many firms. ...