ch29

... Uncertainty about the Monetary Policy Transmission Process The Fed faces uncertainty regarding: 1. the magnitude of the policy response − our analysis does not tell us how much the target for the federal funds rate needs to change to close an ...

... Uncertainty about the Monetary Policy Transmission Process The Fed faces uncertainty regarding: 1. the magnitude of the policy response − our analysis does not tell us how much the target for the federal funds rate needs to change to close an ...

Federal Open Market Committee (FOMC)

... the deposits and thus the money supply increases. The bank also presents the check back to the Federal Reserve, which in turn adds the amount to the bank’s reserves. Because the bank has to keep only a portion of those reserves, the bank makes loans with the remainder. Thus the money supply expands ...

... the deposits and thus the money supply increases. The bank also presents the check back to the Federal Reserve, which in turn adds the amount to the bank’s reserves. Because the bank has to keep only a portion of those reserves, the bank makes loans with the remainder. Thus the money supply expands ...

Chapter 29

... Monetary Policy Target Why the Fed does not use the money supply as a target? The Fed is unable to predict accurately the position of the MD curve at any given time. - largely due to innovations in the financial sector Like the Fed, most central banks choose to influence the interest rate directly. ...

... Monetary Policy Target Why the Fed does not use the money supply as a target? The Fed is unable to predict accurately the position of the MD curve at any given time. - largely due to innovations in the financial sector Like the Fed, most central banks choose to influence the interest rate directly. ...

Understanding Systemic Risk: The Trade

... endogenous outcome of the interaction between market liquidity risk, solvency risk, and the structure of banks’ funding. Ahead of the crisis, the theoretical literature was almost silent on how to link funding liquidity and bank solvency risks, concentrating for the most part on one type of risk or ...

... endogenous outcome of the interaction between market liquidity risk, solvency risk, and the structure of banks’ funding. Ahead of the crisis, the theoretical literature was almost silent on how to link funding liquidity and bank solvency risks, concentrating for the most part on one type of risk or ...

Saginaw Township Community Schools

... If the athletic director feels that large amounts of money will be collected, money may be removed from the ticket seller’s cash box periodically. If this occurs, money must be counted by both the ticket seller and athletic director and recorded on the ticket seller’s reconciliation. After the sport ...

... If the athletic director feels that large amounts of money will be collected, money may be removed from the ticket seller’s cash box periodically. If this occurs, money must be counted by both the ticket seller and athletic director and recorded on the ticket seller’s reconciliation. After the sport ...

The German Banking Crisis of 1931 - University of California, Berkeley

... Government borrowing became an important part of the banks’ actions as reflected by an increase in bills in their portfolios. There were two important changes to the German banking system during the hyperinflation. First, at the end of the war, the real value of monetary aggregates and demand for ma ...

... Government borrowing became an important part of the banks’ actions as reflected by an increase in bills in their portfolios. There were two important changes to the German banking system during the hyperinflation. First, at the end of the war, the real value of monetary aggregates and demand for ma ...

Chapter 31 MONETARY POLICY AND THE NATIONAL ECONOMY

... America’s Central Bank: The Federal Reserve System ● Central Bank Independence ♦ In some other countries, the central banks are less independent. ♦ Countries without independent central banks often have less stable economies. ...

... America’s Central Bank: The Federal Reserve System ● Central Bank Independence ♦ In some other countries, the central banks are less independent. ♦ Countries without independent central banks often have less stable economies. ...

P a g e 1

... Collateral facilitates the intermediation of funds from savers to borrowers and, hence, helps the financial system allocate capital in support of real economic activity. The use of collateral has risen considerably in the aftermath of the financial crisis, and may well increase further as risk manag ...

... Collateral facilitates the intermediation of funds from savers to borrowers and, hence, helps the financial system allocate capital in support of real economic activity. The use of collateral has risen considerably in the aftermath of the financial crisis, and may well increase further as risk manag ...

DNB Bank International Bond Portfolio

... consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs) in connection with any use of the Note, even if advised of the possibility of such damages. Any opinions expressed herein reflect the Bank’s judgment at th ...

... consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs) in connection with any use of the Note, even if advised of the possibility of such damages. Any opinions expressed herein reflect the Bank’s judgment at th ...

Innovation and performance of European banks adopting Internet

... electronically already (Berger, 2003). In Italy trading online has also been offered by some internet banks. This has also been the case in the UK since early 2000. ...

... electronically already (Berger, 2003). In Italy trading online has also been offered by some internet banks. This has also been the case in the UK since early 2000. ...

Some the Stock oj Money

... Two different multiplier models are considered. Both postulate a predictable relationship between bank reserves and the money stock. While never specified, the structure of these models is most consistent with a money-supply function in which the interest elasticity is zero, because no variables inf ...

... Two different multiplier models are considered. Both postulate a predictable relationship between bank reserves and the money stock. While never specified, the structure of these models is most consistent with a money-supply function in which the interest elasticity is zero, because no variables inf ...

Income distribution and the size of the financial sector

... pressure groups at the expenses of society as a whole. He argued for a general tendency towards the formation of large and diversified financial groups able to influence the exertion of power, to control relevant sections of the economy, of the media and of the political world and to disguise the ai ...

... pressure groups at the expenses of society as a whole. He argued for a general tendency towards the formation of large and diversified financial groups able to influence the exertion of power, to control relevant sections of the economy, of the media and of the political world and to disguise the ai ...

Capital Requirement and Financial Frictions in

... reproducing the dynamic effects of most key macroeconomic variables. We also find that bank leverage is procyclical following demand and supply shocks, indicating that banks are willing to expand more loans during booms and tend to restrict their supply of credit during recessions. Interestingly, fi ...

... reproducing the dynamic effects of most key macroeconomic variables. We also find that bank leverage is procyclical following demand and supply shocks, indicating that banks are willing to expand more loans during booms and tend to restrict their supply of credit during recessions. Interestingly, fi ...

Principles of Economics, Case/Fair/Oster, 10e

... The study found that the demand for cash responds to changes in the interest rate paid on checking accounts. The higher the interest rate, the less cash held. In other words, when the interest rate on checking accounts rises, people go to ATM machines more often and take out less in cash each time, ...

... The study found that the demand for cash responds to changes in the interest rate paid on checking accounts. The higher the interest rate, the less cash held. In other words, when the interest rate on checking accounts rises, people go to ATM machines more often and take out less in cash each time, ...

Business Cycles and the Bible

... rebalancing of their portfolios away from risky assets toward safer ones will be complemented by a reduction on goods and services spending as an additional way to increase their money holdings. Now if everyone begins selling off assets a fire sale will emerge and cause asset values to plunge. This ...

... rebalancing of their portfolios away from risky assets toward safer ones will be complemented by a reduction on goods and services spending as an additional way to increase their money holdings. Now if everyone begins selling off assets a fire sale will emerge and cause asset values to plunge. This ...

Chapter 28(13): Monetary Policy

... The Federal Reserve System The Federal Reserve System (or the Fed) is the central bank for the United States. A central bank is a bank for banks and a public authority that regulates financial firms. The Fed is responsible for monetary policy, so it adjusts the quantity of money in circulation. Th ...

... The Federal Reserve System The Federal Reserve System (or the Fed) is the central bank for the United States. A central bank is a bank for banks and a public authority that regulates financial firms. The Fed is responsible for monetary policy, so it adjusts the quantity of money in circulation. Th ...

The recession of 1937—A cautionary tale

... the Fed bought commercial paper and bankers’ acceptances, compared with open-market rates. The Fed’s rate in panel A is somewhat lower than the market rate because the latter pertains to paper of four to six months maturity, whereas the Fed purchased shorter maturities. Both panels in figure 6 show ...

... the Fed bought commercial paper and bankers’ acceptances, compared with open-market rates. The Fed’s rate in panel A is somewhat lower than the market rate because the latter pertains to paper of four to six months maturity, whereas the Fed purchased shorter maturities. Both panels in figure 6 show ...

Banking Union: Common Deposit Guarantee Schemes, Monetary

... which had been merely ‘deposited’ with the bank. The economic reality is, however, that a bank ‘deposit’ constitutes a credit, which can never be 100 % certain unless the bank makes only totally safe investments (see the proposal by Mayer, (2013). The political reality is that small depositors must ...

... which had been merely ‘deposited’ with the bank. The economic reality is, however, that a bank ‘deposit’ constitutes a credit, which can never be 100 % certain unless the bank makes only totally safe investments (see the proposal by Mayer, (2013). The political reality is that small depositors must ...

Monetary policy and its implementation

... described as relatively stable and marginally above its long-term average value. At present, the real effective exchange rate is slightly stronger than on average over the last quarter of a century. A wide current account deficit could potentially erode confidence in the króna. The Central Bank has ...

... described as relatively stable and marginally above its long-term average value. At present, the real effective exchange rate is slightly stronger than on average over the last quarter of a century. A wide current account deficit could potentially erode confidence in the króna. The Central Bank has ...

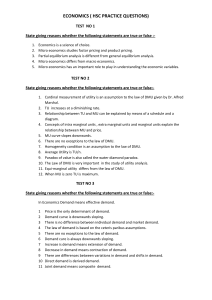

economics ( hsc practice questions)

... State giving reasons whether the following statements are true or false:1. The degree of responsiveness of demand to the change in the price of the commodity is called elasticity of demand. 2. Total expenditure method is also called the total outlay method. 3. Demand for life saving medicines is hig ...

... State giving reasons whether the following statements are true or false:1. The degree of responsiveness of demand to the change in the price of the commodity is called elasticity of demand. 2. Total expenditure method is also called the total outlay method. 3. Demand for life saving medicines is hig ...

Microfinance

... households’ needs • Campaign and test non-farm micro-credit services to micro-entrepreneurs • Enhance BAAC’s staff competency and service culture to improve financial services quality to rural people ...

... households’ needs • Campaign and test non-farm micro-credit services to micro-entrepreneurs • Enhance BAAC’s staff competency and service culture to improve financial services quality to rural people ...

The Demand for Money in Tanzania

... second half of the 1990s is puzzling. None of the standard determinants of money demand deteriorated during this period: real GDP was rising (in contrast to the more typical contraction in a money-based stabilization), inflation was falling, nominal depreciation remained modest, and interest rates f ...

... second half of the 1990s is puzzling. None of the standard determinants of money demand deteriorated during this period: real GDP was rising (in contrast to the more typical contraction in a money-based stabilization), inflation was falling, nominal depreciation remained modest, and interest rates f ...

The Benefits of Privatizing Banks to Strategic Foreign Investors: A

... most recent balance sheet reported. For each bank, the Banker’s Almanac provides coverage on the nature of services provided, years of operations and major events in the development of the bank, mainly, mergers and acquisitions, as well as a description of the current ownership structure. It goes on ...

... most recent balance sheet reported. For each bank, the Banker’s Almanac provides coverage on the nature of services provided, years of operations and major events in the development of the bank, mainly, mergers and acquisitions, as well as a description of the current ownership structure. It goes on ...