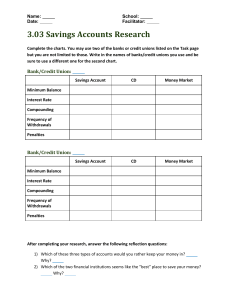

3.03 Savings Account Research

... Complete the charts. You may use two of the banks or credit unions listed on the Task page but you are not limited to those. Write in the names of banks/credit unions you use and be sure to use a different one for the second chart. ...

... Complete the charts. You may use two of the banks or credit unions listed on the Task page but you are not limited to those. Write in the names of banks/credit unions you use and be sure to use a different one for the second chart. ...

Section 5 Guided Reading

... 6. What would decrease the demand for money? Module 29 1. The rate of return = 2. Describe figure 29.1. What changes the quantity of loanable funds demanded? 3. Describe figure 29.2. What changes the supply of loanable funds? 4. In Figure 29.3 - which lenders will have their loan offers accepted? Wh ...

... 6. What would decrease the demand for money? Module 29 1. The rate of return = 2. Describe figure 29.1. What changes the quantity of loanable funds demanded? 3. Describe figure 29.2. What changes the supply of loanable funds? 4. In Figure 29.3 - which lenders will have their loan offers accepted? Wh ...

Monetary Policy Practice

... becomes ______________ expensive. If this is the case, people and businesses want ________________ loans. This will cause economic activity to_________________. If the Fed believes there is not enough money in the economy, they can try to increase lending activity by banks. In order to do this, they ...

... becomes ______________ expensive. If this is the case, people and businesses want ________________ loans. This will cause economic activity to_________________. If the Fed believes there is not enough money in the economy, they can try to increase lending activity by banks. In order to do this, they ...

open market operations

... When banks need to borrow reserves from other banks they go to the Fed Funds Market. Banks offer their excess funds to other banks for overnight lending to meet their reserve requirements. The Federal Reserve does not decree this interest rate, but they use bonds to add or take from this pool of mon ...

... When banks need to borrow reserves from other banks they go to the Fed Funds Market. Banks offer their excess funds to other banks for overnight lending to meet their reserve requirements. The Federal Reserve does not decree this interest rate, but they use bonds to add or take from this pool of mon ...

Economics

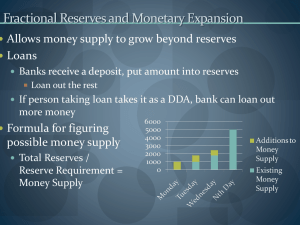

... Money Multiplier = 1/reserve ratio = The amount of money the banking system generates with each $1 of reserves This is the most money the system could generate, recall the assumptions: • Assume banks hold 10 percent of deposits as reserves. • Assume individuals hold no currency. ...

... Money Multiplier = 1/reserve ratio = The amount of money the banking system generates with each $1 of reserves This is the most money the system could generate, recall the assumptions: • Assume banks hold 10 percent of deposits as reserves. • Assume individuals hold no currency. ...

Banking System Notes

... • Buying and selling government bonds and securities • This helps control the money supply ...

... • Buying and selling government bonds and securities • This helps control the money supply ...

Units 4 Breakdown: Money Market, Banking and Multiple Deposit

... Open Market Operations Excess Reserves Discount Rate Federal Funds Rate Key Information to Know (answer): 1. List and explain the 3 tools of monetary 3. How does the government target interest policy. rates of banks? 2. If there is a recession, what monetary policy 4. What changes the demand for mon ...

... Open Market Operations Excess Reserves Discount Rate Federal Funds Rate Key Information to Know (answer): 1. List and explain the 3 tools of monetary 3. How does the government target interest policy. rates of banks? 2. If there is a recession, what monetary policy 4. What changes the demand for mon ...

VBA Bank Day Scholarship Program Sample schedule for your bank

... Loan Department - Reviewing the loan process, the importance of good credit, and the importance of saving to become a qualified borrower. You might complete a mock loan application to gain an understanding of the loan process. Marketing Department - Learning how banks are involved in the community. ...

... Loan Department - Reviewing the loan process, the importance of good credit, and the importance of saving to become a qualified borrower. You might complete a mock loan application to gain an understanding of the loan process. Marketing Department - Learning how banks are involved in the community. ...

The crisis

... 6. Because of low interest rates, it is easy to borrow. 7. But after some time, interest rates go up. (RB:p.43-44) ...

... 6. Because of low interest rates, it is easy to borrow. 7. But after some time, interest rates go up. (RB:p.43-44) ...

Money and Banking

... Tight Money Policy Restricts growth Increases interest rates Slows economic growth ...

... Tight Money Policy Restricts growth Increases interest rates Slows economic growth ...

Chapter 27

... produced or issued. There are three different ways to create money: manufacturing a new monetary unit, such as paper currency or metal coins (money creation) loaning out a physical monetary unit multiple times through fractional-reserve lending (credit creation) buying of government securities ...

... produced or issued. There are three different ways to create money: manufacturing a new monetary unit, such as paper currency or metal coins (money creation) loaning out a physical monetary unit multiple times through fractional-reserve lending (credit creation) buying of government securities ...

Unit 2 Review (Word Document)

... d. Discovering money in your coat that you placed there last winter e. Putting a price on a meal f. Buying a ticket to a rodeo Banking and Money Creation 15. Why is there a money multiplier and what is its formula? Why in reality is it smaller than in theory? 16. Suppose the reserve requirement is 1 ...

... d. Discovering money in your coat that you placed there last winter e. Putting a price on a meal f. Buying a ticket to a rodeo Banking and Money Creation 15. Why is there a money multiplier and what is its formula? Why in reality is it smaller than in theory? 16. Suppose the reserve requirement is 1 ...

Money Creation

... How Is Money Measured in the United States Today? M1: The Narrowest Definition of the Money Supply: Means of Payment Measuring the Money ...

... How Is Money Measured in the United States Today? M1: The Narrowest Definition of the Money Supply: Means of Payment Measuring the Money ...

The History of American Banking American Banking Before the Civil

... The National Banking Acts of 1863 and 1864 gave the federal government the power to: 1. Charter banks 2. Require banks to hold adequate reserves of silver and gold 3. Issue a single national currency In 1900, the nation shifted to the gold standard, a monetary system in which paper money and coins a ...

... The National Banking Acts of 1863 and 1864 gave the federal government the power to: 1. Charter banks 2. Require banks to hold adequate reserves of silver and gold 3. Issue a single national currency In 1900, the nation shifted to the gold standard, a monetary system in which paper money and coins a ...

Federal Reserve System

... ▫ The oldest, Sweden's Riks bank, has existed since 1668 and the Bank of England since 1694 ...

... ▫ The oldest, Sweden's Riks bank, has existed since 1668 and the Bank of England since 1694 ...

ch2note

... Moreover it can affect the whole economy thorough its monetary policy. But how does it affect the economy? It simply makes changes in its balance sheet, and this is transmitted into the economy. The Balance Sheet of The Central Bank: Changes in assets and liabilities of the Central Bank determine th ...

... Moreover it can affect the whole economy thorough its monetary policy. But how does it affect the economy? It simply makes changes in its balance sheet, and this is transmitted into the economy. The Balance Sheet of The Central Bank: Changes in assets and liabilities of the Central Bank determine th ...

Impact of Bank credit on economic activity

... The present paper is a study on the impact of bank lending fluctuations on economic activity in Australia, New Zealand, Belgium, France, Germany, Italy, Argentina, Brazil, Venezuela, Japan and USA. The period investigated is between January 1997 – December 2007 using monthly high frequency data. The ...

... The present paper is a study on the impact of bank lending fluctuations on economic activity in Australia, New Zealand, Belgium, France, Germany, Italy, Argentina, Brazil, Venezuela, Japan and USA. The period investigated is between January 1997 – December 2007 using monthly high frequency data. The ...

the federal reserve and the money supply

... The Federal Reserve is America’s central bank. It has the unique right to create U.S. dollars. Counterparts abroad: the Bank of Japan, the Bundesbank, the Bank of England, etc.. Jan. 1 the Bundesbank, Banque de France, Banca d’Italia will cede their roles to the new European Central Bank. A central ...

... The Federal Reserve is America’s central bank. It has the unique right to create U.S. dollars. Counterparts abroad: the Bank of Japan, the Bundesbank, the Bank of England, etc.. Jan. 1 the Bundesbank, Banque de France, Banca d’Italia will cede their roles to the new European Central Bank. A central ...

Reserve requirements

... case of the Mainland, which is running a large current account surplus and is rapidly accumulating foreign reserves, the sum of balances in the clearing accounts with the central bank, what we call here in Hong Kong the Aggregate Balance, keeps increasing. Although the People's Bank of China has bee ...

... case of the Mainland, which is running a large current account surplus and is rapidly accumulating foreign reserves, the sum of balances in the clearing accounts with the central bank, what we call here in Hong Kong the Aggregate Balance, keeps increasing. Although the People's Bank of China has bee ...

short-answer questions - Iowa State University Department of

... a) Why is open market operations the most important monetary policy tool? b) What are the two types of open market operations? c) List the advantages of open market operations? d) List the three types of discount loans. e) Why might it be important to have a lender of last resort even with the exist ...

... a) Why is open market operations the most important monetary policy tool? b) What are the two types of open market operations? c) List the advantages of open market operations? d) List the three types of discount loans. e) Why might it be important to have a lender of last resort even with the exist ...

Quiz #4 - Christopher R. Zapalski

... 25. One of the main arguments against further growth for industrialized nations focuses on the problem of: A. technological knowledge. B. environmental quality. C. feedback mechanisms. D. infrastructure. ...

... 25. One of the main arguments against further growth for industrialized nations focuses on the problem of: A. technological knowledge. B. environmental quality. C. feedback mechanisms. D. infrastructure. ...

تحميل الملف المرفق

... King Abdulaziz University, Jeddah, Saudi Arabia ABSTRACT. While commenting on the topic of discussionGurantee of Islamic Bank for Investment Deposit” a few question have been raised that seek their answers: - Is there need for such a guarntee by the Islamic bank? What is that? and why is that? - ...

... King Abdulaziz University, Jeddah, Saudi Arabia ABSTRACT. While commenting on the topic of discussionGurantee of Islamic Bank for Investment Deposit” a few question have been raised that seek their answers: - Is there need for such a guarntee by the Islamic bank? What is that? and why is that? - ...