Bank Lending to Businesses in a Jobless Recovery

... The jobless recoveries from the 1990–1991 and 2001 recessions An economic recovery can be defined as the period of time from the official trough of the business cycle up to the date at which real GDP per capita returns to its prior peak. (There are some anomalies in using this definition; for exampl ...

... The jobless recoveries from the 1990–1991 and 2001 recessions An economic recovery can be defined as the period of time from the official trough of the business cycle up to the date at which real GDP per capita returns to its prior peak. (There are some anomalies in using this definition; for exampl ...

OVERVIEW

... A recovery, albeit limited, has recently been observed in loans with the impact on market interest rates of cumulative policy rate cuts since the last quarter of 2008, the liquidity measures taken and the improvement in risk perceptions. Nonetheless, non-performing loans (NPLs) are still rising and ...

... A recovery, albeit limited, has recently been observed in loans with the impact on market interest rates of cumulative policy rate cuts since the last quarter of 2008, the liquidity measures taken and the improvement in risk perceptions. Nonetheless, non-performing loans (NPLs) are still rising and ...

Would you trust the Central Bank to borrow Treasury securities for

... bank issues its own debt potentially competing with similar treasury debt already in the domestic market and causing market fragmentation. In order to avoid market fragmentation, it has frequently been suggested that mechanisms be found to ensure that central banks continue to use only treasury debt ...

... bank issues its own debt potentially competing with similar treasury debt already in the domestic market and causing market fragmentation. In order to avoid market fragmentation, it has frequently been suggested that mechanisms be found to ensure that central banks continue to use only treasury debt ...

File

... This model is simplified in that it is assumed that all deposits go into the banks. In reality, people hold part of their loans as cash. The cash that people hold is not available for the banking system to lend out. The more money people hold in cash, the lower the amount they have on deposit that c ...

... This model is simplified in that it is assumed that all deposits go into the banks. In reality, people hold part of their loans as cash. The cash that people hold is not available for the banking system to lend out. The more money people hold in cash, the lower the amount they have on deposit that c ...

THE IMPORTANCE OF THE BANKING SYSTEM

... issuance of bonds from the banks for a total of 155 billion euro. With the debt’s “haircut” in 2012 came the new support of 48.2 billion euro, despite the fact that the banks’ losses from the Greek bond portfolio reached 25 billion euro. If we sum all funds, the total bailout, with all the possible ...

... issuance of bonds from the banks for a total of 155 billion euro. With the debt’s “haircut” in 2012 came the new support of 48.2 billion euro, despite the fact that the banks’ losses from the Greek bond portfolio reached 25 billion euro. If we sum all funds, the total bailout, with all the possible ...

Chapter 14

... • M2: Includes everything in M1, plus savings accounts and money market mutual funds. M2 = about 1/2 of the GDP • M3: Includes everything in M2, plus cds and other deposits. ...

... • M2: Includes everything in M1, plus savings accounts and money market mutual funds. M2 = about 1/2 of the GDP • M3: Includes everything in M2, plus cds and other deposits. ...

Monetary Policy

... 1. The Fed monitors member banks’ reserves. 2. The Fed oversees foreign banks operating in the United States as well as the international operations of U.S. member banks operating in foreign countries 3. The Fed approves bank mergers like when ...

... 1. The Fed monitors member banks’ reserves. 2. The Fed oversees foreign banks operating in the United States as well as the international operations of U.S. member banks operating in foreign countries 3. The Fed approves bank mergers like when ...

Fractional Reserve Banking

... can lend out, therefore less expansion of deposits and the money supply 2. Every bank must hold reserves no larger than the legal minimum -Banks will for the most part always have money in excess reserves and therefore have money to lend out ...

... can lend out, therefore less expansion of deposits and the money supply 2. Every bank must hold reserves no larger than the legal minimum -Banks will for the most part always have money in excess reserves and therefore have money to lend out ...

Chapter 3

... Meaning and Function of Money Economist’s Meaning of Money 1. Anything that is generally accepted in payment for goods and services or in the repayment of debts 2. Not the same as wealth or income Wealth is the total collection of pieces of property that serve to store value. Wealth includes money a ...

... Meaning and Function of Money Economist’s Meaning of Money 1. Anything that is generally accepted in payment for goods and services or in the repayment of debts 2. Not the same as wealth or income Wealth is the total collection of pieces of property that serve to store value. Wealth includes money a ...

The European Savings Banks Group (ESBG)

... covered deposits, i.e. the eligible deposits not exceeding the coverage level (instead of eligible deposits, i.e. deposits that are not excluded from protection) - In a first step limiting the payout on the nominal value, pay out interests in a second step ...

... covered deposits, i.e. the eligible deposits not exceeding the coverage level (instead of eligible deposits, i.e. deposits that are not excluded from protection) - In a first step limiting the payout on the nominal value, pay out interests in a second step ...

Miami Dade College ECO 2013 Section 2 Principles of

... 31. In which city is the Federal Reserve's Board of Governors? A) Boston B) New York C) Philadelphia D) Washington, DC ...

... 31. In which city is the Federal Reserve's Board of Governors? A) Boston B) New York C) Philadelphia D) Washington, DC ...

Financial innovation has greatly changed the busi-

... theory, good securitization candidates are less information-intensive assets, such as mortgages and credit card receivables, but not the more information-intensive assets, which include most business loans. Thus, this self-selection of loans for securitization leaves the bank’s balance sheet with a ...

... theory, good securitization candidates are less information-intensive assets, such as mortgages and credit card receivables, but not the more information-intensive assets, which include most business loans. Thus, this self-selection of loans for securitization leaves the bank’s balance sheet with a ...

Money matters

... used traditional open-market operations to buy gilts from the non-bank public to increase bank deposits to boost the broad deal money supply. This increase in deposits at banks (their liabilities) is entirely different from increases in bank lending (their - Cinema on his mind assets). The former re ...

... used traditional open-market operations to buy gilts from the non-bank public to increase bank deposits to boost the broad deal money supply. This increase in deposits at banks (their liabilities) is entirely different from increases in bank lending (their - Cinema on his mind assets). The former re ...

3. LEARNING NEEDS ANALYSIS Output of Responses on

... context of central banking to their respective central bank’s mandates, priorities and national circumstances. Target Audience: Senior level staff involved in the specific central bank governance areas, with a view to enhance institutional governance and drive strategic change. ...

... context of central banking to their respective central bank’s mandates, priorities and national circumstances. Target Audience: Senior level staff involved in the specific central bank governance areas, with a view to enhance institutional governance and drive strategic change. ...

The ECB`s policy of printing money will not lead to wealth creation

... ECB’s recent policy practices. Under the European Union treaties, the ECB’s funding of governments is considered illegal because it is viewed as a major threat for the stability of the monetary union. Prior to his ejection from office, Nicolas Sarkozy, however, was a vociferous critic of the ECB for ...

... ECB’s recent policy practices. Under the European Union treaties, the ECB’s funding of governments is considered illegal because it is viewed as a major threat for the stability of the monetary union. Prior to his ejection from office, Nicolas Sarkozy, however, was a vociferous critic of the ECB for ...

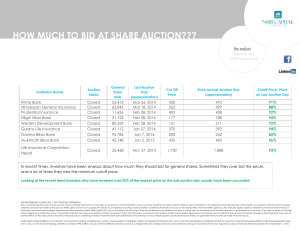

How Much to Bid in Share Auctions

... without reference or notification to you. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Changes in exchange rates may have an adverse effect ...

... without reference or notification to you. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Changes in exchange rates may have an adverse effect ...

Name: Ivan Bakubi Section: 2020 E

... is naturally at AD* but finds itself at AD2, as seen in the graph on the previous page. Briefly explain how each of these policies would work to correct the situation. (12pts) Who does fiscal policy: A fiscal policy is a tool which is used by national governments to influence the direction of the ec ...

... is naturally at AD* but finds itself at AD2, as seen in the graph on the previous page. Briefly explain how each of these policies would work to correct the situation. (12pts) Who does fiscal policy: A fiscal policy is a tool which is used by national governments to influence the direction of the ec ...

Statement to TFAC

... put into circulation. Most people have never really thought about how money is created and put into circulation. I have spent a lot of time studying the process. In my research I wrote the United States Treasury and asked how money was created. Russell L. Munk, Assistant General Council answered sta ...

... put into circulation. Most people have never really thought about how money is created and put into circulation. I have spent a lot of time studying the process. In my research I wrote the United States Treasury and asked how money was created. Russell L. Munk, Assistant General Council answered sta ...

Chapter 16 The Federal Reserve and Monetary Policy

... charges on loans to financial institutions. 3. With a lower discount rate and federal funds rate, it is much easier for banks to borrow money. They are then able to lower the interest rate some loans. Companies can borrow money to finance their ...

... charges on loans to financial institutions. 3. With a lower discount rate and federal funds rate, it is much easier for banks to borrow money. They are then able to lower the interest rate some loans. Companies can borrow money to finance their ...

Money Market

... bank is likely to offer short-term loans at a rate significantly higher than the Official Cash Rate. That's because other banks would undercut that, using credit from the Reserve Bank. ...

... bank is likely to offer short-term loans at a rate significantly higher than the Official Cash Rate. That's because other banks would undercut that, using credit from the Reserve Bank. ...