EDITragan_12ce_ch27

... The money supply grows faster than the growth in GDP - money’s role as a ‘store of value’ deteriorates and inflation uncertainties result. If the loans/credit created as part of the money creation process are not repaid then the financial institutions which support our monetary system become suspect ...

... The money supply grows faster than the growth in GDP - money’s role as a ‘store of value’ deteriorates and inflation uncertainties result. If the loans/credit created as part of the money creation process are not repaid then the financial institutions which support our monetary system become suspect ...

Patterns in international banking: Key take

... Sum of all cross-border claims and locally extended claims in foreign currency. 2 Intraregional share is the sum of international claims on the emerging Asia-Pacific region of banks headquartered in Chinese Taipei, Hong Kong SAR, India, Singapore and the offices of banks located in the region that h ...

... Sum of all cross-border claims and locally extended claims in foreign currency. 2 Intraregional share is the sum of international claims on the emerging Asia-Pacific region of banks headquartered in Chinese Taipei, Hong Kong SAR, India, Singapore and the offices of banks located in the region that h ...

Financial Policy Committee

... have met before. • These capital requirements are totally different from the reserve requirements a central bank requires commercial banks must hold of cash and deposits with the central bank with respect to its lending. ...

... have met before. • These capital requirements are totally different from the reserve requirements a central bank requires commercial banks must hold of cash and deposits with the central bank with respect to its lending. ...

Money, Banking, and Financial Markets 2e

... A period that lasted until the Civil War during which each state had its own banking rules, and many states permitted relatively open competition among banks. U.S. Treasury operated without a central banking institution. ...

... A period that lasted until the Civil War during which each state had its own banking rules, and many states permitted relatively open competition among banks. U.S. Treasury operated without a central banking institution. ...

The Evolution of Money By Anand Shirur

... The First Evolutionary Step Standard Coinage Egypt used gold bars in 400 BC Discovery of Touchstone – tool for assaying value of gold in an alloy Concept of Standard Coinage was introduced Govt. assertion that value of money lay in the ...

... The First Evolutionary Step Standard Coinage Egypt used gold bars in 400 BC Discovery of Touchstone – tool for assaying value of gold in an alloy Concept of Standard Coinage was introduced Govt. assertion that value of money lay in the ...

Bank Performance, Efficiency and Ownership in Transition Countries

... Balance sheet ratios effects on ROA Ratios to assets of loans, deposits, non-interest expenditures Real GDP growth ...

... Balance sheet ratios effects on ROA Ratios to assets of loans, deposits, non-interest expenditures Real GDP growth ...

Bank of Ireland Mortgage Bank

... downgrading of Bank of Ireland’s long term credit rating in April 2011. The Firm’s credit transaction assets consisted of deposits in Bank of Ireland. This downgrade in Bank of Ireland’s rating led to certain deposits held by the Firm in Bank of Ireland being reclassified as credit transaction asset ...

... downgrading of Bank of Ireland’s long term credit rating in April 2011. The Firm’s credit transaction assets consisted of deposits in Bank of Ireland. This downgrade in Bank of Ireland’s rating led to certain deposits held by the Firm in Bank of Ireland being reclassified as credit transaction asset ...

Insert title here

... supply. The Fed monitors the levels of M1 and M2 and compares these measures of the money supply with the current demand for money. Factors That Affect Demand for Money ...

... supply. The Fed monitors the levels of M1 and M2 and compares these measures of the money supply with the current demand for money. Factors That Affect Demand for Money ...

Insert title here

... supply. The Fed monitors the levels of M1 and M2 and compares these measures of the money supply with the current demand for money. Factors That Affect Demand for Money ...

... supply. The Fed monitors the levels of M1 and M2 and compares these measures of the money supply with the current demand for money. Factors That Affect Demand for Money ...

Economic Depressions: Their Cause and Cure

... the injection of bank credit adds another crucial and disruptive element. For the banks expand credit and therefore bank money in the form of notes or deposits which are theoretically redeemable on demand in gold, but in practice clearly are not. For example, if a bank has 1000 ounces of gold in its ...

... the injection of bank credit adds another crucial and disruptive element. For the banks expand credit and therefore bank money in the form of notes or deposits which are theoretically redeemable on demand in gold, but in practice clearly are not. For example, if a bank has 1000 ounces of gold in its ...

Slide 1

... • Central banks typically (though not in HK) change the money supply through open market operation (OMO). An OMO is the purchase or sale of government bonds by the central bank. • In an open market purchase, the central bank prints new money and uses it to buy bonds from banks. This increases the su ...

... • Central banks typically (though not in HK) change the money supply through open market operation (OMO). An OMO is the purchase or sale of government bonds by the central bank. • In an open market purchase, the central bank prints new money and uses it to buy bonds from banks. This increases the su ...

Yes “It” Did Happen Again—A Minsky Crisis Happened in Asia

... flows 2. Increases the interest cost of its foreign funding 3. Reduces the credit quality of its loans and reduces its own credit rating If these conditions occur a bank can find itself transforming into a Ponzi unit This creates a situation where banks are unwilling to lend to each other, so the do ...

... flows 2. Increases the interest cost of its foreign funding 3. Reduces the credit quality of its loans and reduces its own credit rating If these conditions occur a bank can find itself transforming into a Ponzi unit This creates a situation where banks are unwilling to lend to each other, so the do ...

Banks in an Arrow

... Banks choose the unit size (denomination) of its products (deposits and loans) in a way that is convenient for their clients Banks play the role of intermediaries by collecting small deposits and investing the proceeds into large loans • Quality transformation Bank deposits offer better risk-return c ...

... Banks choose the unit size (denomination) of its products (deposits and loans) in a way that is convenient for their clients Banks play the role of intermediaries by collecting small deposits and investing the proceeds into large loans • Quality transformation Bank deposits offer better risk-return c ...

Macro Unit 4 Study Guide

... money supply will ______ and interest rates _______. 2. If the FED sells bonds the money supply will _____ interest rates _____, and investment ______. 3. If the FED decreases the reserve requirement the money supply will ______ and interest rates ______. 4. If the FED decreases the discount rate, t ...

... money supply will ______ and interest rates _______. 2. If the FED sells bonds the money supply will _____ interest rates _____, and investment ______. 3. If the FED decreases the reserve requirement the money supply will ______ and interest rates ______. 4. If the FED decreases the discount rate, t ...

Functions of Money - Los Angeles Harbor College

... deposits into his account in Bank Y. At this step, the original $100 remains in the system, and we can now add Customer A’s $90. Bank Y sets aside 10%, and lends out the rest. This process continues until no new excess reserves can be created. Federal deposit Insurance Corporation (FDIC) Deposits at ...

... deposits into his account in Bank Y. At this step, the original $100 remains in the system, and we can now add Customer A’s $90. Bank Y sets aside 10%, and lends out the rest. This process continues until no new excess reserves can be created. Federal deposit Insurance Corporation (FDIC) Deposits at ...

Causes of the Panic of 1907 and Its Implications for the Future

... wanted to create a single currency within the United States because after the Civil War there had been several forms of specie used within the country. Therefore, by backing the national banks with a United States Treasury five percent redemption fund, the United States could take more control o ...

... wanted to create a single currency within the United States because after the Civil War there had been several forms of specie used within the country. Therefore, by backing the national banks with a United States Treasury five percent redemption fund, the United States could take more control o ...

Money, Banking and

... and then they would exchange theirs for fish. Voiceover: But barter had limitations in the marketplace. Joseph Salerno: Well, actually people perceived pretty quickly problems with their direct exchange: if you wanted, for example, fish and you had wheat but the people who had fish didn't desire the ...

... and then they would exchange theirs for fish. Voiceover: But barter had limitations in the marketplace. Joseph Salerno: Well, actually people perceived pretty quickly problems with their direct exchange: if you wanted, for example, fish and you had wheat but the people who had fish didn't desire the ...

What are the limits on Commercial Bank Lending?

... by removing the immediate lender’s incentive to ensure that the underlying loans could be repaid. However significant monetary issues can accompany any form of increased commercial bank lending, and these appear to have been overlooked by this analysis. In this paper we propose a general explanation ...

... by removing the immediate lender’s incentive to ensure that the underlying loans could be repaid. However significant monetary issues can accompany any form of increased commercial bank lending, and these appear to have been overlooked by this analysis. In this paper we propose a general explanation ...

Diploma Macro Paper 2

... (a) M4 excluding intermediate other financial corporations (OFCs). Intermediate OFCs are: mortgage and housing credit corporations; non-bank credit grantors; bank holding companies; securitisation special purpose vehicles; and other activities auxiliary to financial intermediation. In addition to th ...

... (a) M4 excluding intermediate other financial corporations (OFCs). Intermediate OFCs are: mortgage and housing credit corporations; non-bank credit grantors; bank holding companies; securitisation special purpose vehicles; and other activities auxiliary to financial intermediation. In addition to th ...

Lesson 11 - ECO 151

... proceeds as cash), then the effect of the money multiplier will be reduced, and money supply will not grow to the same levels as dictated by the simple money multiplier. ...

... proceeds as cash), then the effect of the money multiplier will be reduced, and money supply will not grow to the same levels as dictated by the simple money multiplier. ...

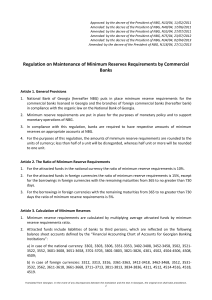

Regulation on Maintenance of Minimum Reserves Requirements by

... such by NBG, regardless of whether or not it is included in the calculation of the regulatory capital. c) such liabilities on the balance sheet which are not related to the movement of cash flows. d) in certain occasions, other types of liabilities with prior written approval of NBG. e) liabilities ...

... such by NBG, regardless of whether or not it is included in the calculation of the regulatory capital. c) such liabilities on the balance sheet which are not related to the movement of cash flows. d) in certain occasions, other types of liabilities with prior written approval of NBG. e) liabilities ...

200301PRI-Inauguration Speech of the New Governor of Banco…

... Even with only one goal and with only one instrument, in theory Central Bank actions can be organized in different ways. For a long time in the past, monetary policy was conducted through the control of monetary aggregates. This practice, however, proved to be increasingly inefficient as economic sy ...

... Even with only one goal and with only one instrument, in theory Central Bank actions can be organized in different ways. For a long time in the past, monetary policy was conducted through the control of monetary aggregates. This practice, however, proved to be increasingly inefficient as economic sy ...