Document

... central bank to sacrifice its ability to use monetary policy for stabilization. Fiscal policy has a more powerful effect on output under fixed exchange rates than under floating rates. Balance of payments crises occur when market participants expect the central bank to change the exchange rate from ...

... central bank to sacrifice its ability to use monetary policy for stabilization. Fiscal policy has a more powerful effect on output under fixed exchange rates than under floating rates. Balance of payments crises occur when market participants expect the central bank to change the exchange rate from ...

The Evolution of Paper Money

... money by claiming that it followed the emergence of token money. Tokens were coins made of cheap metal which circulated with market value significantly higher then their intrinsic metallic value. Their main use was as small denomination money, “small change,” as precious metals were not suitable for ...

... money by claiming that it followed the emergence of token money. Tokens were coins made of cheap metal which circulated with market value significantly higher then their intrinsic metallic value. Their main use was as small denomination money, “small change,” as precious metals were not suitable for ...

lower interest rates

... whenever government itself wishes to borrow from the banks! However, if Nigerian government treasury bills and bonds are often oversubscribed, it may not be true that credit crunch is the real reason for credit limitations to manufacturers. The glaring failure of CBN’s monetary policy framework is a ...

... whenever government itself wishes to borrow from the banks! However, if Nigerian government treasury bills and bonds are often oversubscribed, it may not be true that credit crunch is the real reason for credit limitations to manufacturers. The glaring failure of CBN’s monetary policy framework is a ...

Open Knowledge Repository

... demand and rising world food prices persist. Employment grew 4.6 percent per year between 1998 and 2006, more than the labor force (3.9 percent), leading to a decline in the unemployment rate from 11.7 percent in 1998 to about 8 percent in 2006. An ambitious financial sector reform program was under ...

... demand and rising world food prices persist. Employment grew 4.6 percent per year between 1998 and 2006, more than the labor force (3.9 percent), leading to a decline in the unemployment rate from 11.7 percent in 1998 to about 8 percent in 2006. An ambitious financial sector reform program was under ...

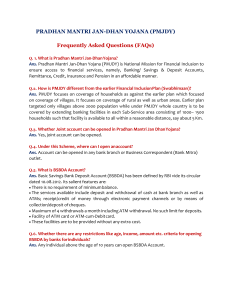

Frequently Asked Questions

... Ans. Business Correspondent Agents (Bank Mitra) are retail agents engaged by banks for providing banking services at locations where opening of a brick and mortar branch / ATM is not viable. Scope of activities of Business Correspondents / Bank Mitra are as under: a) Creating Awareness about savings ...

... Ans. Business Correspondent Agents (Bank Mitra) are retail agents engaged by banks for providing banking services at locations where opening of a brick and mortar branch / ATM is not viable. Scope of activities of Business Correspondents / Bank Mitra are as under: a) Creating Awareness about savings ...

HR Khan: Banks in India - challenges and opportunities

... uncontested market space. These strategic moves create value for the company, its buyers and its employees, while unlocking new demand and making the competition irrelevant. Unlike the Red Ocean Strategy, the conventional approach to business of beating competition, the “Blue Ocean Strategy” tries t ...

... uncontested market space. These strategic moves create value for the company, its buyers and its employees, while unlocking new demand and making the competition irrelevant. Unlike the Red Ocean Strategy, the conventional approach to business of beating competition, the “Blue Ocean Strategy” tries t ...

4. definitions/terminologies

... All demand deposits in national or in foreign currency i.e., exchangeable on demand at par without penalty or restriction, freely transferable by cheque or otherwise, commonly used to make payments, are known as transferable deposits. These deposits include special savings accounts with a possibilit ...

... All demand deposits in national or in foreign currency i.e., exchangeable on demand at par without penalty or restriction, freely transferable by cheque or otherwise, commonly used to make payments, are known as transferable deposits. These deposits include special savings accounts with a possibilit ...

This PDF is a selection from an out-of-print volume from... Volume Title: Money, Financial Flows, and Credit in the Soviet...

... forced versus voluntary savings, for instance, that may involve money and credit only in an implementary way. In the context of Soviet economic policy, monetary management replaces monetary policy. Management of money is part of an overall financial strategy. It involves direct determination (referr ...

... forced versus voluntary savings, for instance, that may involve money and credit only in an implementary way. In the context of Soviet economic policy, monetary management replaces monetary policy. Management of money is part of an overall financial strategy. It involves direct determination (referr ...

Bank Supervisor Independence and the Health of Banking Systems

... Sensitivity Tests • Summary indexes were also calculated using random weights instead of equal weights – Results are robust with slight variations • Using Moody’s or Fitch measures of banking system soundness yields similar results • ‘Mature’ supervisory agencies are associated with stronger bankin ...

... Sensitivity Tests • Summary indexes were also calculated using random weights instead of equal weights – Results are robust with slight variations • Using Moody’s or Fitch measures of banking system soundness yields similar results • ‘Mature’ supervisory agencies are associated with stronger bankin ...

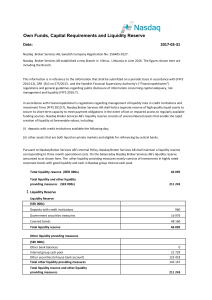

Own Funds, Capital Requirements and Liquidity Reserve

... 2014:12), CRR (EU) no 575/2013, and the Swedish Financial Supervisory Authority’s (“Finansinspektionen”) regulations and general guidelines regarding public disclosure of information concerning capital adequacy, risk management and liquidity (FFFS 2010:7). In accordance with Finansinspektionen's reg ...

... 2014:12), CRR (EU) no 575/2013, and the Swedish Financial Supervisory Authority’s (“Finansinspektionen”) regulations and general guidelines regarding public disclosure of information concerning capital adequacy, risk management and liquidity (FFFS 2010:7). In accordance with Finansinspektionen's reg ...

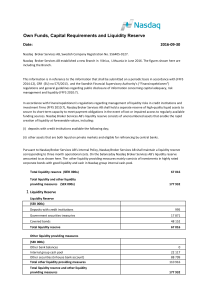

Own Funds, Capital Requirements and Liquidity Reserve

... 2014:12), CRR (EU) no 575/2013, and the Swedish Financial Supervisory Authority’s (“Finansinspektionen”) regulations and general guidelines regarding public disclosure of information concerning capital adequacy, risk management and liquidity (FFFS 2010:7). In accordance with Finansinspektionen's reg ...

... 2014:12), CRR (EU) no 575/2013, and the Swedish Financial Supervisory Authority’s (“Finansinspektionen”) regulations and general guidelines regarding public disclosure of information concerning capital adequacy, risk management and liquidity (FFFS 2010:7). In accordance with Finansinspektionen's reg ...

The Effect of Restructuring on the Financing Pattern of Development Banks in Nigerian:

... that it is because the commercial banks are not tailored to provide long-term financing. Other arguments put forward by researchers as reasons are peculiar to the nature of the financing. Caprio et al (1997), notes that a leading reason for the absence of long term financing is high inflation and un ...

... that it is because the commercial banks are not tailored to provide long-term financing. Other arguments put forward by researchers as reasons are peculiar to the nature of the financing. Caprio et al (1997), notes that a leading reason for the absence of long term financing is high inflation and un ...

МУ для выполнения контрольной работы №2 по английскому языку

... higher price. Being motivated by profit, they expect to earn more profit when they supply more. In pure market the two factors of supply and demand will balance each other out in such a way that some middle ground called an equilibrium price will be achieved. Producers will make as many units of a p ...

... higher price. Being motivated by profit, they expect to earn more profit when they supply more. In pure market the two factors of supply and demand will balance each other out in such a way that some middle ground called an equilibrium price will be achieved. Producers will make as many units of a p ...

evidence from Spain 1856-1874

... of San Carlos, which was introduced in the country during the kingdom of Carlos III. It was inspired by the ideas of the Enlightenment and followed the example of the Bank of England and the Sveriges Riksbank. The aim of the Bank was to help the Treasury to raise funds. Unfortunately, the increase ...

... of San Carlos, which was introduced in the country during the kingdom of Carlos III. It was inspired by the ideas of the Enlightenment and followed the example of the Bank of England and the Sveriges Riksbank. The aim of the Bank was to help the Treasury to raise funds. Unfortunately, the increase ...

Jackson and the Bank Speech “Frame”

... resented the Second Bank for this practice, as did investors and other supporters of state banks. "Hard money" advocates also criticized the Second Bank but for a different reason. They believed that specie--gold and silver coins--was the only safe currency. They thought that no bank, regardless of ...

... resented the Second Bank for this practice, as did investors and other supporters of state banks. "Hard money" advocates also criticized the Second Bank but for a different reason. They believed that specie--gold and silver coins--was the only safe currency. They thought that no bank, regardless of ...

Slices - personal.kent.edu

... • FDIC proposed merger of BIF and SAIF • FDIC proposed deposit insurance be indexed to inflation to maintain real value • FDIC proposed that current fixed designated minimum reserve ratio of 1.25% be changed to a ratio ranging from 1.00 to 1.50% • FDIC proposed charging premium for risk McGraw-Hill ...

... • FDIC proposed merger of BIF and SAIF • FDIC proposed deposit insurance be indexed to inflation to maintain real value • FDIC proposed that current fixed designated minimum reserve ratio of 1.25% be changed to a ratio ranging from 1.00 to 1.50% • FDIC proposed charging premium for risk McGraw-Hill ...

ECO 120- Macroeconomics

... (2) The bank doesn’t keep the cash. Instead the bank has to keep R, called the “reserve ratio” (0 < R < 1), of the $1 as reserves and then loans out $(1 - R). (3) The person who receives the loan of $(1-R) spends the cash, and the merchant who receives the $(1-R) puts that in his bank. This increase ...

... (2) The bank doesn’t keep the cash. Instead the bank has to keep R, called the “reserve ratio” (0 < R < 1), of the $1 as reserves and then loans out $(1 - R). (3) The person who receives the loan of $(1-R) spends the cash, and the merchant who receives the $(1-R) puts that in his bank. This increase ...

i BANKING REFORM IN ETHIOPIA Charles Harvey Summary The

... construction sector, for which provisions were made after 1990). In practice, the CBE clearly expected the government to carry any unrecovered losses eventually. The losses incurred from lending to the construction sector have been "presented" to government, and government is expected to issue bond ...

... construction sector, for which provisions were made after 1990). In practice, the CBE clearly expected the government to carry any unrecovered losses eventually. The losses incurred from lending to the construction sector have been "presented" to government, and government is expected to issue bond ...

Taking Firms and Markets Seriously: A Study on Bank Behavior

... arguments to account for this observation, which cuts against prevailing views on how regulation affects the banking sector. Those studying domestic banking sectors have argued that banks experience opportunity costs and may face reduced profits when they increase CAR. If these reasons were not enou ...

... arguments to account for this observation, which cuts against prevailing views on how regulation affects the banking sector. Those studying domestic banking sectors have argued that banks experience opportunity costs and may face reduced profits when they increase CAR. If these reasons were not enou ...

Basic Theories of the Balance of Payments

... negatively sloped, then the devaluation of the peso leads to an excess demand for the dollar, which causes the Mexican trade deficit to increase. ...

... negatively sloped, then the devaluation of the peso leads to an excess demand for the dollar, which causes the Mexican trade deficit to increase. ...

Further Reforms after the “BIG BANG”: The JGB Market

... Agricultural Bank of China: 50,000 branches Industrial and Commerce Bank of China: 44,000 branches Construction Bank: 23,000 branches Bank of China: 13,000 branches Foreign bank branches’ loan guarantee income is shrinking fast because of local competition from Chinese banks Return on Assets earned ...

... Agricultural Bank of China: 50,000 branches Industrial and Commerce Bank of China: 44,000 branches Construction Bank: 23,000 branches Bank of China: 13,000 branches Foreign bank branches’ loan guarantee income is shrinking fast because of local competition from Chinese banks Return on Assets earned ...

Chapter 2 - State Bank of Pakistan

... Portfolio investment implies holding by non-resident of less than 10% share in equity securities, investment in debt securities (in the form of bonds and notes) and investment in money market instruments of local company. Other Investment Other investment includes all financial transactions that are ...

... Portfolio investment implies holding by non-resident of less than 10% share in equity securities, investment in debt securities (in the form of bonds and notes) and investment in money market instruments of local company. Other Investment Other investment includes all financial transactions that are ...

Week 7 Practice Quiz c Answers - The University of Chicago Booth

... Intuitive explanation: There was originally $100 billion in the banking system as reserves initially. There were no new reserves injected into the system. That means that at the end, there could only be $100 billion of reserves in the banking system. ...

... Intuitive explanation: There was originally $100 billion in the banking system as reserves initially. There were no new reserves injected into the system. That means that at the end, there could only be $100 billion of reserves in the banking system. ...