Part 3. Financial Institutions

... Monetary Policy: What goes on behind the scenes The actual situation is more complicated. The Federal Reserve does not literally set interest rates in the sense of telling anyone that they must borrow or lend at a particular number. If fact, the Federal Reserve intervenes in a rather small market: t ...

... Monetary Policy: What goes on behind the scenes The actual situation is more complicated. The Federal Reserve does not literally set interest rates in the sense of telling anyone that they must borrow or lend at a particular number. If fact, the Federal Reserve intervenes in a rather small market: t ...

Consultation Conclusions on the draft Securities and Futures

... on the application of the draft Notice. The other one was from the Hong Kong Securities Institute attaching the results of a survey to its members on the draft Notice. According to the Hong Kong Securities Institute, the two members who responded to the survey had no comment on the draft Notice. ...

... on the application of the draft Notice. The other one was from the Hong Kong Securities Institute attaching the results of a survey to its members on the draft Notice. According to the Hong Kong Securities Institute, the two members who responded to the survey had no comment on the draft Notice. ...

simplified prospectus

... following characteristics: a reasonable valuation based on the issuer’s discounted cash flow, sustainable competitive advantages, sound management and presence of a catalyst for price revaluation. The sub-managers’ investment decisions are backed by original research, strict accounting validation an ...

... following characteristics: a reasonable valuation based on the issuer’s discounted cash flow, sustainable competitive advantages, sound management and presence of a catalyst for price revaluation. The sub-managers’ investment decisions are backed by original research, strict accounting validation an ...

The Venture Capital Industry`s Crisis: A Problem of

... cleaned up by the industry. A brutal epitaph no doubt but substantially supported by the data. So what is the future of the VC industry? From the perspective of entrepreneurs good ideas will certainly continue to percolate to the surface of the market and that the smartest entrepreneurs will pass up ...

... cleaned up by the industry. A brutal epitaph no doubt but substantially supported by the data. So what is the future of the VC industry? From the perspective of entrepreneurs good ideas will certainly continue to percolate to the surface of the market and that the smartest entrepreneurs will pass up ...

FINANCIAL INSTRUMENTS, INSTITUTIONS, AND STRATEGY

... COURSE DESCRIPTION This course covers financial markets, instruments, and institutions, with the primary focus being on the capital raising and financing activities of firms at different stages in their life cycle. One of the critical activities a company must do well, to succeed is the raising of c ...

... COURSE DESCRIPTION This course covers financial markets, instruments, and institutions, with the primary focus being on the capital raising and financing activities of firms at different stages in their life cycle. One of the critical activities a company must do well, to succeed is the raising of c ...

Fund Performance - 13D Activist Fund

... Fund's investments goes down, your investment in the Fund decreases in value and you could lose money. The Fund is a non-diversified investment company, which makes the value of the Fund's shares more susceptible to certain risks than shares of a diversified investment company. The Fund has a greate ...

... Fund's investments goes down, your investment in the Fund decreases in value and you could lose money. The Fund is a non-diversified investment company, which makes the value of the Fund's shares more susceptible to certain risks than shares of a diversified investment company. The Fund has a greate ...

201002-AndrewCampelli.pps

... Partners (A), L.P., Sageview Capital Partners (B), L.P., Sageview Capital Partners (C), L.P. or in any other fund or investment product. The information presented herein is intended to be a summary only and Sageview makes no representation as to the accuracy of such information. This presentation ma ...

... Partners (A), L.P., Sageview Capital Partners (B), L.P., Sageview Capital Partners (C), L.P. or in any other fund or investment product. The information presented herein is intended to be a summary only and Sageview makes no representation as to the accuracy of such information. This presentation ma ...

The Asset Management Industry and Retail Clients

... When viewing basic investor information such as daily pricing, it may be a surprise to see how difficult it can be for retail investors to obtain a correct price and, consequently, to accurately evaluate their investments. With the over-abundance of information available, the challenge today is to g ...

... When viewing basic investor information such as daily pricing, it may be a surprise to see how difficult it can be for retail investors to obtain a correct price and, consequently, to accurately evaluate their investments. With the over-abundance of information available, the challenge today is to g ...

ch20 - Csulb.edu

... Traditional Performance Measures The Capital Market Line The Security Market Line ...

... Traditional Performance Measures The Capital Market Line The Security Market Line ...

2014-2015 Asset Worksheet

... These figures MUST reflect your assets as of the date your original FAFSA was filed. ...

... These figures MUST reflect your assets as of the date your original FAFSA was filed. ...

l+m development and nelson management acquire 257

... building through common area upgrades, enhanced amenities and apartment renovations, while preserving it as a source of high-quality mixed-income housing in the Lower East Side. L+M has been involved in the Lower East Side neighborhood for more than three decades, most notably through the ongoing de ...

... building through common area upgrades, enhanced amenities and apartment renovations, while preserving it as a source of high-quality mixed-income housing in the Lower East Side. L+M has been involved in the Lower East Side neighborhood for more than three decades, most notably through the ongoing de ...

Heding Grain Production with Futures

... or investment strategy mentioned are suitable for your circumstances. The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy o ...

... or investment strategy mentioned are suitable for your circumstances. The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy o ...

The Challenge of Regulatory Implementation

... Many of the sources of revenue that sustained a banking boom that lasted from the 1990s until the banking crisis of 2008 have largely disappeared, and with it the heady days of double digit ROE. The near-meltdown experienced by many large global and investment banks in 2008 and 2009 was a significan ...

... Many of the sources of revenue that sustained a banking boom that lasted from the 1990s until the banking crisis of 2008 have largely disappeared, and with it the heady days of double digit ROE. The near-meltdown experienced by many large global and investment banks in 2008 and 2009 was a significan ...

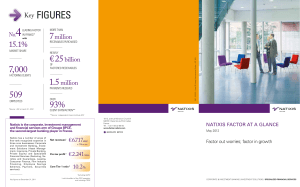

Key FIGURES - Natixis Factor

... first-rank recognized expertise in three core businesses: Corporate and Investment Banking, Investment Solutions (Asset Management, Insurance, Private Banking, Private Equity) and Specialized Financial Services (Factoring, Sureties and Guarantees, Leasing, Consumer Finance, Film Industry Financing, ...

... first-rank recognized expertise in three core businesses: Corporate and Investment Banking, Investment Solutions (Asset Management, Insurance, Private Banking, Private Equity) and Specialized Financial Services (Factoring, Sureties and Guarantees, Leasing, Consumer Finance, Film Industry Financing, ...

Document

... future inflation, the saving curve does not move. This implies that for a given level of GDP level (which determines the position of the saving curve), a rightward shift of the investment results in a higher equilibrium nominal interest rate. In other words, the IS curve moves up for every GDP level ...

... future inflation, the saving curve does not move. This implies that for a given level of GDP level (which determines the position of the saving curve), a rightward shift of the investment results in a higher equilibrium nominal interest rate. In other words, the IS curve moves up for every GDP level ...

3i agrees sale of Inspecta to ACTA*

... Helsinki-headquartered Inspecta Group (“the Company”) to Netherlands-based ACTA*. ACTA* is the Dutch Holding company of Kiwa and Shield Group International. The transaction remains conditional upon approval by the relevant Competition Authorities, but is expected to complete in May 2015. 3i, and fun ...

... Helsinki-headquartered Inspecta Group (“the Company”) to Netherlands-based ACTA*. ACTA* is the Dutch Holding company of Kiwa and Shield Group International. The transaction remains conditional upon approval by the relevant Competition Authorities, but is expected to complete in May 2015. 3i, and fun ...

finance and audit advisory

... Review and discuss the Financial Report for the period ending April 30, 2017 and the Town’s investment portfolio. ...

... Review and discuss the Financial Report for the period ending April 30, 2017 and the Town’s investment portfolio. ...

Private Sector Perspective

... While CDM is a means of increasing the return on investment, it will rarely change a bad investment into a good one as long as carbon prices are low. Therefore, the CER stream is rarely the most important factor deciding whether a CDM investment is sound or not. It is just the glazing of the cake. I ...

... While CDM is a means of increasing the return on investment, it will rarely change a bad investment into a good one as long as carbon prices are low. Therefore, the CER stream is rarely the most important factor deciding whether a CDM investment is sound or not. It is just the glazing of the cake. I ...

Chilean tax ruling may affect foreign institutional investors

... Prior to the enactment of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the Dodd-Frank Act) in 2010, hedge funds, private equity funds and venture capital funds were exempt from registering with the SEC, if they (i) had fewer than fifteen clients during the preceding twelve months, ...

... Prior to the enactment of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the Dodd-Frank Act) in 2010, hedge funds, private equity funds and venture capital funds were exempt from registering with the SEC, if they (i) had fewer than fifteen clients during the preceding twelve months, ...

Goldman Sachs Absolute Return Tracker Portfolio

... Exchange rate risk changes in exchange rates may reduce or increase the returns an investor might expect to receive independent of the performance of such assets. If applicable, investment techniques used to attempt to reduce the risk of currency movements (hedging), may not be effective. Hedging a ...

... Exchange rate risk changes in exchange rates may reduce or increase the returns an investor might expect to receive independent of the performance of such assets. If applicable, investment techniques used to attempt to reduce the risk of currency movements (hedging), may not be effective. Hedging a ...

Open PDF of Monika Beck`s presentation at

... › Structuring of the bonds and feasibility of the bond issuance ...

... › Structuring of the bonds and feasibility of the bond issuance ...

Market Musings

... this material. No representation is made that the information contained herein is accurate in all material respects, complete or up to date, or that it has been independently verified by TD Securities. Recipients of this analysis or report are to contact the representative in their local jurisdictio ...

... this material. No representation is made that the information contained herein is accurate in all material respects, complete or up to date, or that it has been independently verified by TD Securities. Recipients of this analysis or report are to contact the representative in their local jurisdictio ...

FOR IMMEDIATE RELEASE Contact: Scott

... “Capital Guardian brings Compass an open architecture platform for optimal client solutions. I look forward to new avenues of growth with a young, smart and well capitalized Capital Guardian team,” said Mr. Shanahan. “This partnership brings together a constellation of financial resources with a wel ...

... “Capital Guardian brings Compass an open architecture platform for optimal client solutions. I look forward to new avenues of growth with a young, smart and well capitalized Capital Guardian team,” said Mr. Shanahan. “This partnership brings together a constellation of financial resources with a wel ...

duETS™ US Commercial Property 2X

... in this document. The securities may only be purchased and traded by “Qualified Institutional Buyers,” as defined in Rule 144A under the Securities Act of 1933 (“1933 Act”), or investors who are not “U.S. Persons,” as defined in Regulation S under the 1933 Act and pursuant to the terms of Regulation ...

... in this document. The securities may only be purchased and traded by “Qualified Institutional Buyers,” as defined in Rule 144A under the Securities Act of 1933 (“1933 Act”), or investors who are not “U.S. Persons,” as defined in Regulation S under the 1933 Act and pursuant to the terms of Regulation ...

Taiwan 2015 - 2016.docx

... 5.12 Restrictions eased on the acquisition and post-acquisition selling of stocks for securities investment trust and consulting professionals On May 25th, 2015, the FSC loosened the restrictions on employee and their spouses involved in securities investment trust companies or discretionary investm ...

... 5.12 Restrictions eased on the acquisition and post-acquisition selling of stocks for securities investment trust and consulting professionals On May 25th, 2015, the FSC loosened the restrictions on employee and their spouses involved in securities investment trust companies or discretionary investm ...