Disruption in the Capital Markets: What Happened? Joseph P. Forte

... With this adjustment to the structured finance capital stack, the real estate finance market continued its enormous growth trajectory over the last several years. The availability of capital continued to grow, spurred on by the appetite of capital markets investors for more high yield product. Yet ...

... With this adjustment to the structured finance capital stack, the real estate finance market continued its enormous growth trajectory over the last several years. The availability of capital continued to grow, spurred on by the appetite of capital markets investors for more high yield product. Yet ...

DOES FINANCIAL LEVERAGE INFLUENCE INVESTMENT

... using leverage because they have enough cash flows to mitigate the risk arises from the use of leverage for availing investment opportunity. On the contrary, low growth firms’ face major difficulties to use leverage for availing any investment opportunity. The reason for this is that these firms hav ...

... using leverage because they have enough cash flows to mitigate the risk arises from the use of leverage for availing investment opportunity. On the contrary, low growth firms’ face major difficulties to use leverage for availing any investment opportunity. The reason for this is that these firms hav ...

Stock Return Probabilities - The American Association of Individual

... clusion: American companies make far better use of their physical capital stock, with productivity in Germany and Japan at only two-thirds of U.S. levels. According to the report, a number of factors explain the higher capital productivity. At the firm level, this includes not only better use of pla ...

... clusion: American companies make far better use of their physical capital stock, with productivity in Germany and Japan at only two-thirds of U.S. levels. According to the report, a number of factors explain the higher capital productivity. At the firm level, this includes not only better use of pla ...

Theory of speculative bubble

... No, doubt, you are extremely competitive: winning is everything. Often, you wish to be someone other than yourself: someone bigger or better. Your investment performance is directly related to how you feel about yourself – a successful trade makes you feel like a million bucks, an unsuccessful one i ...

... No, doubt, you are extremely competitive: winning is everything. Often, you wish to be someone other than yourself: someone bigger or better. Your investment performance is directly related to how you feel about yourself – a successful trade makes you feel like a million bucks, an unsuccessful one i ...

Cara Denver Jacobsen, Nierenberg, D3 Family Funds

... relationship o Market share leader o Uses ‘points’ which are like float in insurance and have an expiration o Spun out 2-1/2 years ago & average ROE has been 37% o Cash flow machine Compare to toll road Negative working capital 10 month float Minimum fixed assets and little capex o Risk is p ...

... relationship o Market share leader o Uses ‘points’ which are like float in insurance and have an expiration o Spun out 2-1/2 years ago & average ROE has been 37% o Cash flow machine Compare to toll road Negative working capital 10 month float Minimum fixed assets and little capex o Risk is p ...

Large Cap Strategies

... The value of an investment in the Fund will fluctuate, which means that an investor could lose the principal amount invested. Investing in emerging and foreign markets may involve additional risks such as economic and political instability, market illiquidity, and currency volatility. Growth stocks ...

... The value of an investment in the Fund will fluctuate, which means that an investor could lose the principal amount invested. Investing in emerging and foreign markets may involve additional risks such as economic and political instability, market illiquidity, and currency volatility. Growth stocks ...

With regards to Section 33, Affirmative Action, our standard practice

... In regards to the objective stated in the RFP (80 bps alpha vs. the S&P 500), can you please advise over what time period this will be enforced? For instance, if we did not meet this threshold on a 1 year basis, but do meet this threshold in a 3, 5 and 10 year basis, would be still be eligible for c ...

... In regards to the objective stated in the RFP (80 bps alpha vs. the S&P 500), can you please advise over what time period this will be enforced? For instance, if we did not meet this threshold on a 1 year basis, but do meet this threshold in a 3, 5 and 10 year basis, would be still be eligible for c ...

UCI Group Strategy A. Profumo, CEO of

... Profitability will benefit from the contribution of both net interest income and net non interest income, which will be sustained by the recovery of the equity and AuM markets ...

... Profitability will benefit from the contribution of both net interest income and net non interest income, which will be sustained by the recovery of the equity and AuM markets ...

securities offerings on the internet

... 11. Osterland, supra note 6, at 25 (“A secondary market for the unlisted, illiquid shares would go a long way toward making Internet IPOs more attractive to investors.”). Some companies have done DPOs and have been accepted for listing on traditional stock exchanges, although these companies had rel ...

... 11. Osterland, supra note 6, at 25 (“A secondary market for the unlisted, illiquid shares would go a long way toward making Internet IPOs more attractive to investors.”). Some companies have done DPOs and have been accepted for listing on traditional stock exchanges, although these companies had rel ...

MiFID II: New challenges in the area of Product Governance

... All costs & charges have to be disclosed throughout the product lifecycle • All internal and external costs and charges for the investment services and/or ancillary services provided to the client must be disclosed inclusive • All Costs associated with the manufacturing and managing of the financia ...

... All costs & charges have to be disclosed throughout the product lifecycle • All internal and external costs and charges for the investment services and/or ancillary services provided to the client must be disclosed inclusive • All Costs associated with the manufacturing and managing of the financia ...

Ibbotson® SBBI - New York Life Investment Management

... Note: This is for illustrative purposes only and not indicative of any investment. The data assumes reinvestment of all income and does not account for taxes or transaction costs. The average return represents a compound annual return. Government bonds and Treasury bills are guaranteed by the full f ...

... Note: This is for illustrative purposes only and not indicative of any investment. The data assumes reinvestment of all income and does not account for taxes or transaction costs. The average return represents a compound annual return. Government bonds and Treasury bills are guaranteed by the full f ...

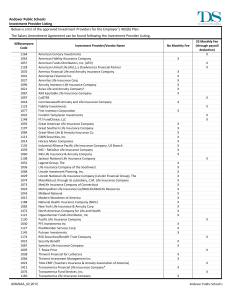

SALARY REDUCTION AGREEMENT (SRA) 403(b)

... The Employee is solely responsible for the completion of all documents to establish the annuity contract or custodial account which must be established prior to the submission of this Agreement. Employee acknowledges that they have received Employer’s list of approved providers and understands that ...

... The Employee is solely responsible for the completion of all documents to establish the annuity contract or custodial account which must be established prior to the submission of this Agreement. Employee acknowledges that they have received Employer’s list of approved providers and understands that ...

Global Equity Income Fund (Unhedged)

... sentiment included earnings reports from high-profile US companies, uncertainty over the manner of the UK’s exit from the EU, poor Chinese trade figures and, as ever, speculation about potential changes in central-bank policy. Fluctuating oil prices were also in the headlines. Early surges, driven b ...

... sentiment included earnings reports from high-profile US companies, uncertainty over the manner of the UK’s exit from the EU, poor Chinese trade figures and, as ever, speculation about potential changes in central-bank policy. Fluctuating oil prices were also in the headlines. Early surges, driven b ...

How to invest offshore?

... currency spending power, how best should investors go about investing offshore? It depends on investors’ personal circumstances, risk profile and longer-term financial planning objectives. Financial advisors can help identify investment solutions that address the specific requirements of an investor ...

... currency spending power, how best should investors go about investing offshore? It depends on investors’ personal circumstances, risk profile and longer-term financial planning objectives. Financial advisors can help identify investment solutions that address the specific requirements of an investor ...

Stifel to Acquire Ziegler Lotsoff Capital Management

... ST. LOUIS, October 16, 2013 – Stifel Financial Corp. (NYSE: SF) today announced that it has entered into an agreement to acquire Ziegler Lotsoff Capital Management, LLC (“ZLCM”) a Chicago and Milwaukee-based asset management business. The acquisition will bring new asset management strategies and ca ...

... ST. LOUIS, October 16, 2013 – Stifel Financial Corp. (NYSE: SF) today announced that it has entered into an agreement to acquire Ziegler Lotsoff Capital Management, LLC (“ZLCM”) a Chicago and Milwaukee-based asset management business. The acquisition will bring new asset management strategies and ca ...

Feasibility and Restriction Factors Analysis of Personal Financial

... 2007, and the database has included more than 560 million people’s credit records. This will help commercial banks raise their efficiency, effectively guard against credit risk, design and provide the client with appropriate personal financial products and services based on the comprehensive grasp o ...

... 2007, and the database has included more than 560 million people’s credit records. This will help commercial banks raise their efficiency, effectively guard against credit risk, design and provide the client with appropriate personal financial products and services based on the comprehensive grasp o ...

SAS Intraday Risk Aggregation and Analysis

... capabilities and protecting investment. It enables: • Orchestration of trade and risk data from a variety of existing systems; • On demand analysis and exploration of complex and large data sets; • Scalable, high performance architecture capable of performing complex, iterative analytical calcula ...

... capabilities and protecting investment. It enables: • Orchestration of trade and risk data from a variety of existing systems; • On demand analysis and exploration of complex and large data sets; • Scalable, high performance architecture capable of performing complex, iterative analytical calcula ...

File ch21 Type: Multiple Choice 1. Which of the following is NOT one

... Response: Although the investment policies of institutions are set up by people, the text details how individuals define risk as “losing money,” but institutions use more sophisticated definitions. Section: Formulate an Appropriate Investment Strategy. ...

... Response: Although the investment policies of institutions are set up by people, the text details how individuals define risk as “losing money,” but institutions use more sophisticated definitions. Section: Formulate an Appropriate Investment Strategy. ...

SAVINGS, INVESTMENT AND CAPITAL FLOWS: AN EMPIRICAL

... by productive activities transformed effectively from the increased domestic resources and the mobilized international resources in the forms of foreign capital inflow and foreign direct investment. The increase in investment enhanced aggregate output and national income, which in turn induce furthe ...

... by productive activities transformed effectively from the increased domestic resources and the mobilized international resources in the forms of foreign capital inflow and foreign direct investment. The increase in investment enhanced aggregate output and national income, which in turn induce furthe ...

Working Paper No. 66 - Levy Economics Institute of Bard College

... sheet in which real and financial instruments are entered as assets. The liabilities of these units consist of financial instruments and the units’ net wealth. The units’ net wealth is the arithmetic difference of the values assigned to the entries on the asset side and those on the liabilities side ...

... sheet in which real and financial instruments are entered as assets. The liabilities of these units consist of financial instruments and the units’ net wealth. The units’ net wealth is the arithmetic difference of the values assigned to the entries on the asset side and those on the liabilities side ...

Networking Solutions for the Financial Trading Industry

... In Canada the only type of ATS are the ECNs and, as a consequence of that, they are generically called ATSs. Those ATSs can be “lit” (publishing information about their transactions) or “dark” (not disseminating information about their transactions in any way). Over The Counter (OTC) are venues outs ...

... In Canada the only type of ATS are the ECNs and, as a consequence of that, they are generically called ATSs. Those ATSs can be “lit” (publishing information about their transactions) or “dark” (not disseminating information about their transactions in any way). Over The Counter (OTC) are venues outs ...

Blackstone Alternative Multi

... well as other investments. BXMIX’s investments involve special risks including, but not limited to, loss of all or a significant portion of the investment due to leveraging, short-selling, or other speculative practices, lack of liquidity and volatility of returns. The following is a summary descrip ...

... well as other investments. BXMIX’s investments involve special risks including, but not limited to, loss of all or a significant portion of the investment due to leveraging, short-selling, or other speculative practices, lack of liquidity and volatility of returns. The following is a summary descrip ...

Beth Pearce - Vermont ABLE

... You can put your money in up to five different saving and investment options, including four mutual fund based options and a FDIC-insured savings option. TAX-FREE EARNINGS Investment earnings are tax-free when used to pay for qualified expenses. ...

... You can put your money in up to five different saving and investment options, including four mutual fund based options and a FDIC-insured savings option. TAX-FREE EARNINGS Investment earnings are tax-free when used to pay for qualified expenses. ...

Saving and Investment - Webster Elementary School

... and Long-Run Growth Our analysis: Increase in budget deficit causes fall in investment. The govt borrows to finance its deficit, leaving less funds available for investment. ...

... and Long-Run Growth Our analysis: Increase in budget deficit causes fall in investment. The govt borrows to finance its deficit, leaving less funds available for investment. ...

ESG - Mondrian Investment Partners

... Mondrian Investment Partners Limited (“Mondrian”)’s long-term, fundamental research process has always demanded that analysts strive to consider all material risks that could influence a security’s valuation, including those factors rooted in environmental, social and governance concerns. Recognisin ...

... Mondrian Investment Partners Limited (“Mondrian”)’s long-term, fundamental research process has always demanded that analysts strive to consider all material risks that could influence a security’s valuation, including those factors rooted in environmental, social and governance concerns. Recognisin ...