Investment Analysis Eco/Bus350

... http://www.qc.edu/~twang/course/350/i nvestments.html. Announcements, homework, cases, exam dates are all on the webpage. ...

... http://www.qc.edu/~twang/course/350/i nvestments.html. Announcements, homework, cases, exam dates are all on the webpage. ...

NBER WORKING PAPER SERIES FINANCIAL REFORMS AND CAPITAL FLOWS: Alberto Martin

... JEL No. F34,F36,G15,O19,O43 ABSTRACT As a result of debt enforcement problems, many high-productivity firms in emerging economies are unable to pledge enough future profits to their creditors and this constrains the financing they can raise. Many have argued that, by relaxing these credit constraint ...

... JEL No. F34,F36,G15,O19,O43 ABSTRACT As a result of debt enforcement problems, many high-productivity firms in emerging economies are unable to pledge enough future profits to their creditors and this constrains the financing they can raise. Many have argued that, by relaxing these credit constraint ...

How to reduce negative side effects of ECB policy

... With excess liquidity at 0, which was the case before the introduction of LTROs, TLTOs and QE, this was not an issue as banks are competing for liquidity from asset managers, corporates, individuals etc. The idea basically comes down to giving non-MFIs indirect access to the ECB through banks. With ...

... With excess liquidity at 0, which was the case before the introduction of LTROs, TLTOs and QE, this was not an issue as banks are competing for liquidity from asset managers, corporates, individuals etc. The idea basically comes down to giving non-MFIs indirect access to the ECB through banks. With ...

Overview - Audit Analytics

... Overview Audit Analytics is an independent provider of audit, regulatory and disclosure intelligence, serving the accounting, financial, corporate, legal and academic communities. Using our suite of products, our clients gain comprehensive insight into the issues, trends and opportunities in a range ...

... Overview Audit Analytics is an independent provider of audit, regulatory and disclosure intelligence, serving the accounting, financial, corporate, legal and academic communities. Using our suite of products, our clients gain comprehensive insight into the issues, trends and opportunities in a range ...

Westfield Form ADV Part 2A - Westfield Capital Management

... dedicated to providing quality, separate account investment management services for institutions and high net worth individuals. Westfield is 100% owned by WMS Management, LLC, which is the sole managing member of WMS General Partner LLC, the general partner for Westfield. WMS Management is whollyow ...

... dedicated to providing quality, separate account investment management services for institutions and high net worth individuals. Westfield is 100% owned by WMS Management, LLC, which is the sole managing member of WMS General Partner LLC, the general partner for Westfield. WMS Management is whollyow ...

United States-China Two-way Direct Investment: Opportunities and

... property rights, including intellectual property rights, which limits the potential benefits that U.S. firms can receive from their technology and brands; and China’s restrictions on direct investment in many sectors important to U.S. firms. Among G-20 countries, China is the most restrictive in ter ...

... property rights, including intellectual property rights, which limits the potential benefits that U.S. firms can receive from their technology and brands; and China’s restrictions on direct investment in many sectors important to U.S. firms. Among G-20 countries, China is the most restrictive in ter ...

Chapter 4 - AUEB e

... Investment • In touch with data and research: investment and the stock market – Data show general tendency of investment to rise when stock market rises; but relationship isn’t strong because many other things change at the same time (Figure 4.7) – This theory is similar to text discussion • Higher ...

... Investment • In touch with data and research: investment and the stock market – Data show general tendency of investment to rise when stock market rises; but relationship isn’t strong because many other things change at the same time (Figure 4.7) – This theory is similar to text discussion • Higher ...

Axis Long Term Equity Fund - Growth

... Disclaimer: CRISIL Research, a division of CRISIL Limited (CRISIL) has taken due care and caution in preparing this Report based on the information obtained by CRISIL from sources which it considers reliable (Data). However, CRISIL does not guarantee the accuracy, adequacy or completeness of the Dat ...

... Disclaimer: CRISIL Research, a division of CRISIL Limited (CRISIL) has taken due care and caution in preparing this Report based on the information obtained by CRISIL from sources which it considers reliable (Data). However, CRISIL does not guarantee the accuracy, adequacy or completeness of the Dat ...

Chronology of policy measures

... The Government invited applications from domestic or foreign interests for a limited number of banking authorities and decided to initiate proceedings to enable the Bank of China to open a branch in Australia. The Treasurer also announced the temporary waiving (for one year) of some sections of its ...

... The Government invited applications from domestic or foreign interests for a limited number of banking authorities and decided to initiate proceedings to enable the Bank of China to open a branch in Australia. The Treasurer also announced the temporary waiving (for one year) of some sections of its ...

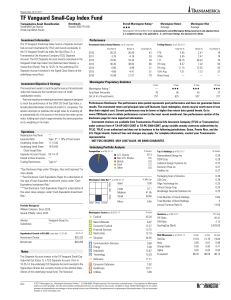

TF Vanguard Small-Cap Index Fund

... results. The investment return and principal value will fluctuate. Upon redemption, shares may be worth more or less than their original cost. Current performance may be lower or higher than return data quoted herein. Go to www.TRSfunds.com to obtain performance current to the most recent month-end. ...

... results. The investment return and principal value will fluctuate. Upon redemption, shares may be worth more or less than their original cost. Current performance may be lower or higher than return data quoted herein. Go to www.TRSfunds.com to obtain performance current to the most recent month-end. ...

Co-Investment Funds - IP Conference

... Historical analysis: e.g. 3-5 yrs evolution of dealflow by source, sector, etc. ...

... Historical analysis: e.g. 3-5 yrs evolution of dealflow by source, sector, etc. ...

Appetite for co-investment opportunities has never been greater

... Additionally, his experience includes tax cases in U.S. Tax Court and U.S. District Court involving taxpayers with previously unaddressed income characterization issues. C. Walker Brierre is an Associate in Thompson & Knight’s Houston office. Walker focuses his practice on mergers and acquisitions a ...

... Additionally, his experience includes tax cases in U.S. Tax Court and U.S. District Court involving taxpayers with previously unaddressed income characterization issues. C. Walker Brierre is an Associate in Thompson & Knight’s Houston office. Walker focuses his practice on mergers and acquisitions a ...

Key Investor Information

... The risk category was calculated using historical performance data and may not be a reliable indicator of the fund's future risk profile. The fund's risk category is not guaranteed to remain fixed and may ...

... The risk category was calculated using historical performance data and may not be a reliable indicator of the fund's future risk profile. The fund's risk category is not guaranteed to remain fixed and may ...

Listed vs Unlisted rgc - RARE Infrastructure Limited

... Investors should be aware that past performance is not indicative of future performance. Returns can be volatile, reflecting rises and falls in the value of underlying investments. Potential investors should seek independent advice as to the suitability of the Fund to their investment needs. Treasur ...

... Investors should be aware that past performance is not indicative of future performance. Returns can be volatile, reflecting rises and falls in the value of underlying investments. Potential investors should seek independent advice as to the suitability of the Fund to their investment needs. Treasur ...

Tsung Sheng Liu , Polaris Financial Group, Taiwan

... • Polaris has become the 4th largest investment trust company in Taiwan in 2007 • Discounting bond fund AUM, Polaris’ market share stands at 8.5% and ranks as the 2nd largest Investment Trust Company Polaris Investment Trust Historical AUM ...

... • Polaris has become the 4th largest investment trust company in Taiwan in 2007 • Discounting bond fund AUM, Polaris’ market share stands at 8.5% and ranks as the 2nd largest Investment Trust Company Polaris Investment Trust Historical AUM ...

Promoting Inward and Outward Investment Activities in Japan

... Japanese government has worked on promoting the foreign direct investment in Japan by developing plans to double the foreign direct investment in Japan. As described above, the amount of the foreign direct investment in Japan remains small in comparison with major countries. In view of such a reali ...

... Japanese government has worked on promoting the foreign direct investment in Japan by developing plans to double the foreign direct investment in Japan. As described above, the amount of the foreign direct investment in Japan remains small in comparison with major countries. In view of such a reali ...

Key Issues for Reporters

... Report Depositary Receipts (DRs) held by U.S. residents, including ADRs, ADSs, GDRs, and IDRs, which serve as proxies for foreign securities. The actual foreign shares held in trust by the DR issuer should not be reported by the DR issuer, as this would lead to double counting. ...

... Report Depositary Receipts (DRs) held by U.S. residents, including ADRs, ADSs, GDRs, and IDRs, which serve as proxies for foreign securities. The actual foreign shares held in trust by the DR issuer should not be reported by the DR issuer, as this would lead to double counting. ...

Banks and the FinTech Challenge

... equity. These programmes are also indicative of general support for FinTech solutions from banks; historically Asian banks have embraced innovation, rather than trying to fight it. ...

... equity. These programmes are also indicative of general support for FinTech solutions from banks; historically Asian banks have embraced innovation, rather than trying to fight it. ...

Mission accomplished... In Focus: Markets as we see them

... central bank ownership probably suggests that the bond market will remain more or less orderly and may lag a pick-up in inflation. Nonetheless, our continuing small strategic and tactical allocation to the area suggests that higher real returns lie ...

... central bank ownership probably suggests that the bond market will remain more or less orderly and may lag a pick-up in inflation. Nonetheless, our continuing small strategic and tactical allocation to the area suggests that higher real returns lie ...

Sun Pharmaceuticals (SUNPHA)

... gGleevec (four months exclusivity), Japanese traction from H2 and likely product launches in H2FY17 from Halol (assuming USFDA resolution). This indicates that the management is expecting some genuine pricing pressure in the US base business. The proposed buy-back is also likely to be perceived nega ...

... gGleevec (four months exclusivity), Japanese traction from H2 and likely product launches in H2FY17 from Halol (assuming USFDA resolution). This indicates that the management is expecting some genuine pricing pressure in the US base business. The proposed buy-back is also likely to be perceived nega ...

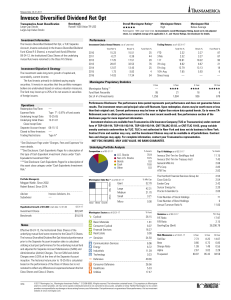

Invesco Diversified Dividend Ret Opt

... The Morningstar RatingTM for funds, or "star rating", is calculated for managed products (including mutual funds, variable annuity and variable life subaccounts, exchange-traded funds, closed-end funds, and separate accounts) with at least a three-year history. Exchange-traded funds and open-ended m ...

... The Morningstar RatingTM for funds, or "star rating", is calculated for managed products (including mutual funds, variable annuity and variable life subaccounts, exchange-traded funds, closed-end funds, and separate accounts) with at least a three-year history. Exchange-traded funds and open-ended m ...

Teachers Guide Lesson Twelve

... The Johnson family includes Marv (age 34), Gail (33), Andrew (8), and Molly (4). What are some investment goals that might be appropriate for this family? What types of investments might be used to achieve these goals? Common investment goals in this situation might be to create an emergency fund, t ...

... The Johnson family includes Marv (age 34), Gail (33), Andrew (8), and Molly (4). What are some investment goals that might be appropriate for this family? What types of investments might be used to achieve these goals? Common investment goals in this situation might be to create an emergency fund, t ...

Investments in land and water - Food and Agriculture Organization

... recognize that increasing agricultural productivity is the main means to meet the increasing demand for food given the constraints on expanding land and water used for food production”. In face, by 2050 there will be an estimated 2.3 billion more people to feed, one-third more than reported in the W ...

... recognize that increasing agricultural productivity is the main means to meet the increasing demand for food given the constraints on expanding land and water used for food production”. In face, by 2050 there will be an estimated 2.3 billion more people to feed, one-third more than reported in the W ...

FIN 616 - Seminar in Investment

... such as CAPM, APT, and other factor models and consumption-based asset pricing. BA 521. ...

... such as CAPM, APT, and other factor models and consumption-based asset pricing. BA 521. ...