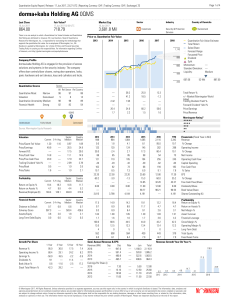

dorma+kaba Holding AG 0QMS

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

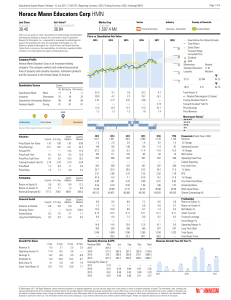

Horace Mann Educators Corp HMN

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

The Green Investment Report The ways and means to unlock private

... various workstreams to assist the Mexican G20 Chair with a series of refreshed B20 Task Forces that provided guidance and input to the G20 Summit in Los Cabos, including a Task Force on Green Growth. The Green Growth Task Force brought together for the first time leading public finance agencies, pri ...

... various workstreams to assist the Mexican G20 Chair with a series of refreshed B20 Task Forces that provided guidance and input to the G20 Summit in Los Cabos, including a Task Force on Green Growth. The Green Growth Task Force brought together for the first time leading public finance agencies, pri ...

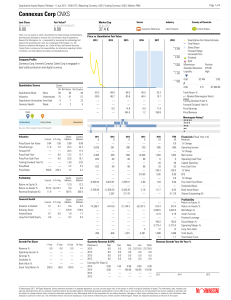

Connexus Corp CNXS

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

Impact of Foreign Institutional Investors

... Saha, Malayendu. (2009)6, investigated the participation of foreign institutional investors and the other financial institutions in India and the performance of the Indian stock markets and she concluded that Indian stock market is regarded at par with the developed markets Moreover, it had a very u ...

... Saha, Malayendu. (2009)6, investigated the participation of foreign institutional investors and the other financial institutions in India and the performance of the Indian stock markets and she concluded that Indian stock market is regarded at par with the developed markets Moreover, it had a very u ...

Ethical investment: How do moral considerations influence

... Kirchler, under review; Lewis, Webley, Winnett & Mackenzie, 1998). Positive ethical criteria involve e.g., environmental protection and fair trade with the Third World, negative ethical criteria include e.g., the utilisation of nuclear power, the disdain of human rights, and so called ‘sin stocks’, ...

... Kirchler, under review; Lewis, Webley, Winnett & Mackenzie, 1998). Positive ethical criteria involve e.g., environmental protection and fair trade with the Third World, negative ethical criteria include e.g., the utilisation of nuclear power, the disdain of human rights, and so called ‘sin stocks’, ...

The Myths and Fallacies about Diversified Portfolios

... all appear to agree that the most diversified portfolio – for a given level of return or risk – is the one that lies on the efficient frontier. Claimants to the Holy Grail of diversification summarily dismiss the extension of this theory to Figure 2 and the conclusion that the most-efficient portfol ...

... all appear to agree that the most diversified portfolio – for a given level of return or risk – is the one that lies on the efficient frontier. Claimants to the Holy Grail of diversification summarily dismiss the extension of this theory to Figure 2 and the conclusion that the most-efficient portfol ...

19. Investments 3: Securities Market Basics

... Over-the-counter (OTC) market is an electronic network of dealers that allows investors to execute trades without going through specialists or intermediaries. That is, there is no single physical location where stocks are traded; rather, these trades are executed through NASDAQ, which links various ...

... Over-the-counter (OTC) market is an electronic network of dealers that allows investors to execute trades without going through specialists or intermediaries. That is, there is no single physical location where stocks are traded; rather, these trades are executed through NASDAQ, which links various ...

Mutual Funds Sharekhan`s Top Equity Fund Picks

... Past performance of any scheme of the Mutual fund do not indicate the future performance of the Schemes of the Mutual Fund. Sharekhan shall not responsible or liable for any loss or shortfall incurred by the investors. ...

... Past performance of any scheme of the Mutual fund do not indicate the future performance of the Schemes of the Mutual Fund. Sharekhan shall not responsible or liable for any loss or shortfall incurred by the investors. ...

The High Dividend Yield Return Advantage

... In a later paper, entitled Taxes, Dividend Yields and Returns in the UK Equity Market, Journal of Banking & Finance (1998), Gareth Morgan and Stephen Thomas of the University of Southampton also found a return premium associated with higher dividend yield securities, but their data rejected a tax-ba ...

... In a later paper, entitled Taxes, Dividend Yields and Returns in the UK Equity Market, Journal of Banking & Finance (1998), Gareth Morgan and Stephen Thomas of the University of Southampton also found a return premium associated with higher dividend yield securities, but their data rejected a tax-ba ...

Trends in Institutional Investor Use of Fixed Income ETFs

... Note: Based on 201 responses: 49 institutional funds, 19 investment consultants, 31 insurance companies, 70 RIAs, and 32 asset managers in 2014. Percentages may not add to 100 due to respondents preferring not to answer. ...

... Note: Based on 201 responses: 49 institutional funds, 19 investment consultants, 31 insurance companies, 70 RIAs, and 32 asset managers in 2014. Percentages may not add to 100 due to respondents preferring not to answer. ...

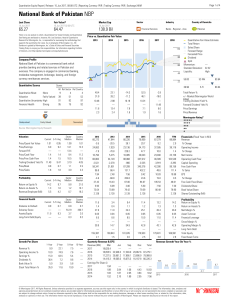

National Bank of Pakistan NBP

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

The Retirement Risk Zone: A Baseline Study

... The retirement risk zone (also known as the ‘conversion’ phase) is commonly defined as the final 10 years of working life (the ‘accumulation’ phase) and the first 10 years of retirement (the ‘decumulation’ phase). Importantly, it is this 20 year period when the greatest amount of retirement savings ...

... The retirement risk zone (also known as the ‘conversion’ phase) is commonly defined as the final 10 years of working life (the ‘accumulation’ phase) and the first 10 years of retirement (the ‘decumulation’ phase). Importantly, it is this 20 year period when the greatest amount of retirement savings ...

The_Socio - Migration for development

... In Mexico, studies done using national household survey data on income and expenditure indicate that remittance recipients are less likely to be poor In Guatemala, it is reported that remittances have the largest impact on the depth and severity of poverty, with poverty rates being reduced by roughl ...

... In Mexico, studies done using national household survey data on income and expenditure indicate that remittance recipients are less likely to be poor In Guatemala, it is reported that remittances have the largest impact on the depth and severity of poverty, with poverty rates being reduced by roughl ...

Obstfeld Working Paper No. 1692

... mOst likely to be informative about the extent of international capital mobility involve assets denomi nated in the same currency but issued in different countries. There are two countries in the world, a "home" country and a 'foreign' country, each with its own, country—specific currency. On any da ...

... mOst likely to be informative about the extent of international capital mobility involve assets denomi nated in the same currency but issued in different countries. There are two countries in the world, a "home" country and a 'foreign' country, each with its own, country—specific currency. On any da ...

chimera investment corporation - Morningstar Document Research

... * The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter the disclosures provided in a prior cover page. The information requi ...

... * The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter the disclosures provided in a prior cover page. The information requi ...

Form ADV - Boys Arnold

... goals of the client. The Investment Policy Statement outlines the types of investments BAC will make or recommend on behalf of the client to meet those goals. The Profile and the IPS are discussed regularly with each client, but are not necessarily written documents. Financial Planning Services One ...

... goals of the client. The Investment Policy Statement outlines the types of investments BAC will make or recommend on behalf of the client to meet those goals. The Profile and the IPS are discussed regularly with each client, but are not necessarily written documents. Financial Planning Services One ...

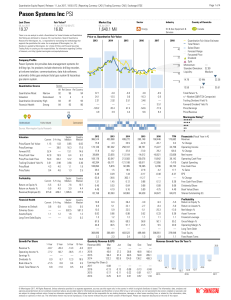

Pason Systems Inc PSI

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

... (“Users”) and should not be the sole piece of information used by such Users or their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verifica ...

Statement of Advice sample wording

... ANZ is a major Australian financial institution and provider of loans, insurance and deposit products. Established in 1835, ANZ is one of the largest companies in Australia and New Zealand and among the top 50 international banking and financial service providers. ANZ has more than six million perso ...

... ANZ is a major Australian financial institution and provider of loans, insurance and deposit products. Established in 1835, ANZ is one of the largest companies in Australia and New Zealand and among the top 50 international banking and financial service providers. ANZ has more than six million perso ...

Closing the Open Door to Foreign Direct Investment

... Foreign investors perceive the United States as a politically stable investment environment and relatively free from governmental regulatory controls on the economy. Concerned by an apparent long-run trend toward socialism in many parts of the world, many investors regard the United States as the la ...

... Foreign investors perceive the United States as a politically stable investment environment and relatively free from governmental regulatory controls on the economy. Concerned by an apparent long-run trend toward socialism in many parts of the world, many investors regard the United States as the la ...

liberty high yield fund

... a related party of the Responsible Entity (Related Party Issuers), the Responsible Entity will assess the market value of the assets in the following manner: * Where an independent third party acquires the same interest rate securities as the Fund at or about the same time as the Fund, the price pa ...

... a related party of the Responsible Entity (Related Party Issuers), the Responsible Entity will assess the market value of the assets in the following manner: * Where an independent third party acquires the same interest rate securities as the Fund at or about the same time as the Fund, the price pa ...

The UK Social Investment Market

... investors than other social investment strategies, and we focus on this strategy in this report, while also discussing most other social investment strategies available in the United Kingdom. We define impact investments as investments made in enterprises that offer market-based solutions to a parti ...

... investors than other social investment strategies, and we focus on this strategy in this report, while also discussing most other social investment strategies available in the United Kingdom. We define impact investments as investments made in enterprises that offer market-based solutions to a parti ...

download, ENG - NBI INVESTMENTS Ltd

... Where the Client provides a specific instruction in relation to its entire Order, or any particular aspect of the Order, including an instruction for the order to be executed on a particular venue, the Company will execute the Order according to these instructions. However, in following these specif ...

... Where the Client provides a specific instruction in relation to its entire Order, or any particular aspect of the Order, including an instruction for the order to be executed on a particular venue, the Company will execute the Order according to these instructions. However, in following these specif ...