HERMES GLOBAL HIGH YIELD BOND FUND

... use an active approach to seek high risk-adjusted returns from bottom-up analysis of below investment grade corporate and/or government issuers. Fundamental, bottom-up analysis of individual credit will be used to generate returns through anticipated price changes. In addition, the Investment Manage ...

... use an active approach to seek high risk-adjusted returns from bottom-up analysis of below investment grade corporate and/or government issuers. Fundamental, bottom-up analysis of individual credit will be used to generate returns through anticipated price changes. In addition, the Investment Manage ...

CAP S.A. `BB` Ratings Placed On CreditWatch Positive On Higher

... The ratings on CAP reflect its somewhat modest scale of operations both in the iron ore and steel segments, which adds volatility to credit metrics, despite the historically low the company's debt. However, its cost-cutting measures and focus on its more profitable operations, combined with higher-t ...

... The ratings on CAP reflect its somewhat modest scale of operations both in the iron ore and steel segments, which adds volatility to credit metrics, despite the historically low the company's debt. However, its cost-cutting measures and focus on its more profitable operations, combined with higher-t ...

Chapter 11

... value, current market conditions, and selling price. • After obtaining the bond’s yield, a simple adjustment must be made to account for the fact that interest is a tax-deductible expense. • This will have the effect of reducing the cost of debt. ...

... value, current market conditions, and selling price. • After obtaining the bond’s yield, a simple adjustment must be made to account for the fact that interest is a tax-deductible expense. • This will have the effect of reducing the cost of debt. ...

VanEck Starts ETF Distribution in Austria and Italy

... Founded in 1955, VanEck was a pioneer in global investing with a history of placing clients’ interests first in all market environments. The firm continues this tradition by offering active and ETF portfolios in hard assets, emerging markets, fixed income, and other assets classes. The Morningstar® ...

... Founded in 1955, VanEck was a pioneer in global investing with a history of placing clients’ interests first in all market environments. The firm continues this tradition by offering active and ETF portfolios in hard assets, emerging markets, fixed income, and other assets classes. The Morningstar® ...

2017-01-0130-SBIMF_Blue Chip Leaflet Dec A5

... long-term investing goals. SBI Blue Chip Fund invests predominantly in such blue chip companies and hence, is a must-have scheme for every portfolio. The focus of the fund is on generating optimal risk-adjusted returns by better stock selection and taking opportunistic allocation to mid-caps when re ...

... long-term investing goals. SBI Blue Chip Fund invests predominantly in such blue chip companies and hence, is a must-have scheme for every portfolio. The focus of the fund is on generating optimal risk-adjusted returns by better stock selection and taking opportunistic allocation to mid-caps when re ...

mfa mortgage investments, inc - Apollo REIT

... Certain statements contained in this press release constitute forward-looking statements as such term is defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and such statements are intended to be covered by the safe ha ...

... Certain statements contained in this press release constitute forward-looking statements as such term is defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and such statements are intended to be covered by the safe ha ...

What is an investment?

... • Any private benefit arising from a social investment has to be incidental to the furtherance of the charity’s purposes • An educational charity investing in a profit making private school would not be an appropriate way of furthering the charity’s purposes by way of a social investment. It may be ...

... • Any private benefit arising from a social investment has to be incidental to the furtherance of the charity’s purposes • An educational charity investing in a profit making private school would not be an appropriate way of furthering the charity’s purposes by way of a social investment. It may be ...

CMAA Investment Policy - Construction Management Association of

... Investment Policy are to (1) provide liquidity; (2) protect assets; (3) preserve principal; and (4) maximize returns. Given that these funds are primarily of an operational nature, conservative investment will be practiced at all times (see section VII). II. ...

... Investment Policy are to (1) provide liquidity; (2) protect assets; (3) preserve principal; and (4) maximize returns. Given that these funds are primarily of an operational nature, conservative investment will be practiced at all times (see section VII). II. ...

Document

... its solutions the highest quality standards for many best‐known brands. In fiscal 2016, Darex Packaging Technologies generated sales of around 300 million US dollars (around 285 million euros). Darex has about 700 employees and 20 sites in 19 countries. ...

... its solutions the highest quality standards for many best‐known brands. In fiscal 2016, Darex Packaging Technologies generated sales of around 300 million US dollars (around 285 million euros). Darex has about 700 employees and 20 sites in 19 countries. ...

Corporate Superannuation Association

... significant margin above this target, for reasons which include potential disputes over ownership of the surplus. Hence, there is an incentive to fund to an amount very close to 100% VBI at all times. This can constrain the nature of the investments, artificially. Funds invest to match the liability ...

... significant margin above this target, for reasons which include potential disputes over ownership of the surplus. Hence, there is an incentive to fund to an amount very close to 100% VBI at all times. This can constrain the nature of the investments, artificially. Funds invest to match the liability ...

CI LifeCycle Portfolios

... returns, adjusted for volatility, relative to peers. Lipper Leader ratings change monthly. For more information, see lipperweb.com. Although Lipper makes reasonable efforts to ensure the accuracy and reliability of the data contained herein, the accuracy is not guaranteed by Lipper. Users acknowledg ...

... returns, adjusted for volatility, relative to peers. Lipper Leader ratings change monthly. For more information, see lipperweb.com. Although Lipper makes reasonable efforts to ensure the accuracy and reliability of the data contained herein, the accuracy is not guaranteed by Lipper. Users acknowledg ...

Stock Underwriting

... used as a backdoor way of becoming a public company. The easiest way to become a public company is to merge into the public shell. – One big advantage is the time and money saved. The entrepreneurs pay little to “acquire” the shell. The entrepreneurs essentially purchase control of the shell by buyi ...

... used as a backdoor way of becoming a public company. The easiest way to become a public company is to merge into the public shell. – One big advantage is the time and money saved. The entrepreneurs pay little to “acquire” the shell. The entrepreneurs essentially purchase control of the shell by buyi ...

Notice Regarding the Determination of Issue Price, Disposal Price

... Note: The underwriter will purchase the shares at the amount to be paid in, and offer the shares at the issue price (offer price). 2. Disposal of treasury shares by way of public offering (public offering) ...

... Note: The underwriter will purchase the shares at the amount to be paid in, and offer the shares at the issue price (offer price). 2. Disposal of treasury shares by way of public offering (public offering) ...

Chapter 2 The Financial Markets and Interest Rates

... externally generated sources of funds. • Understand the financing mix that tends to be used by the firms raising long-term capital. • Explain why the financial markets exist in a developed country. • Explain the financing process by which savings are supplied and raised by major sectors in the econo ...

... externally generated sources of funds. • Understand the financing mix that tends to be used by the firms raising long-term capital. • Explain why the financial markets exist in a developed country. • Explain the financing process by which savings are supplied and raised by major sectors in the econo ...

Free Writing Prospectus Filed Pursuant to Rule 433 To Prospectus

... *Note: A securities rating is not a recommendation to buy, sell or hold securities and may be subject to review, revision, suspension, reduction or withdrawal at any time by the assigning rating agency. The issuer has filed a registration statement (including a prospectus), as amended, with the SEC ...

... *Note: A securities rating is not a recommendation to buy, sell or hold securities and may be subject to review, revision, suspension, reduction or withdrawal at any time by the assigning rating agency. The issuer has filed a registration statement (including a prospectus), as amended, with the SEC ...

Key input factors for discounted cash flow valuations

... and it is possible to estimate it by looking at asset´s fundamentals. It would be perfect if it could exist analyst with access to all information available right now and perfect valuation model. However, it is not true. But we can still aspire to be close as we can. The problem lies in the fact tha ...

... and it is possible to estimate it by looking at asset´s fundamentals. It would be perfect if it could exist analyst with access to all information available right now and perfect valuation model. However, it is not true. But we can still aspire to be close as we can. The problem lies in the fact tha ...

Corporate Governance Reform (3) — Private Placement —

... dividend policies and business strategies by pressuring existing management. Many such so-called shareholder activists do not take over management but utilize their influence with the expectation that current management will optimize retained earnings and streamline unprofitable operations. ...

... dividend policies and business strategies by pressuring existing management. Many such so-called shareholder activists do not take over management but utilize their influence with the expectation that current management will optimize retained earnings and streamline unprofitable operations. ...

INVESTMENT-CASH FLOW SENSITIVITY IN SMALL AND MEDIUM

... According to Myers (1984) and Myers and Majluf (1984), when additional financing is required there is a hierarchy in the use of funds, which is based on information asymmetry. Whenever possible, funding a firm should be covered by internally generated funds, which are not affected by adverse selecti ...

... According to Myers (1984) and Myers and Majluf (1984), when additional financing is required there is a hierarchy in the use of funds, which is based on information asymmetry. Whenever possible, funding a firm should be covered by internally generated funds, which are not affected by adverse selecti ...

Municipal Bonds: Finding Value Through Credit Analysis

... Municipal yields shows Municipal yields rise only a fraction of Treasury yields. The top left chart shows that during the 1993-2007 time period, when Treasury yields move 100bp, Municipal yields move just 61bp. It also shows that this was a relatively “tight” relationship. The bottom chart at left s ...

... Municipal yields shows Municipal yields rise only a fraction of Treasury yields. The top left chart shows that during the 1993-2007 time period, when Treasury yields move 100bp, Municipal yields move just 61bp. It also shows that this was a relatively “tight” relationship. The bottom chart at left s ...

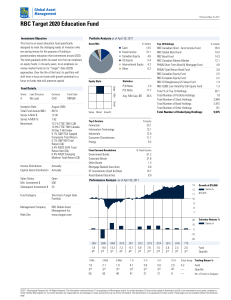

RBC Target 2020 Education Fund

... funds are available at www.sedar.com. MER (%) for RBC Funds and PH&N Funds is based on actual expenses for the full-year period, January 1 to December 31, 2016, expressed on an annualized basis. MER (%) for RBC Corporate Class Funds is based on actual expenses for the half-year period, April 1, 2016 ...

... funds are available at www.sedar.com. MER (%) for RBC Funds and PH&N Funds is based on actual expenses for the full-year period, January 1 to December 31, 2016, expressed on an annualized basis. MER (%) for RBC Corporate Class Funds is based on actual expenses for the half-year period, April 1, 2016 ...

IEF 213 - Portfolio Management

... Portfolio management is both an art and a science. It is a dynamic decision making process, one that is continuous and systematic but also requires a great deal of judgment. The objective of this class is to blend theory and practice to achieve a consistent portfolio management process. This dynamic ...

... Portfolio management is both an art and a science. It is a dynamic decision making process, one that is continuous and systematic but also requires a great deal of judgment. The objective of this class is to blend theory and practice to achieve a consistent portfolio management process. This dynamic ...

Chapter 2 -- The Business, Tax, and Financial Environments

... Describe the four basic forms of business organization in the United States – and the advantages and disadvantages of each. Understand how to calculate a corporation's taxable income and how to determine the corporate tax rate - both average and marginal. Understand various methods of depreciation. ...

... Describe the four basic forms of business organization in the United States – and the advantages and disadvantages of each. Understand how to calculate a corporation's taxable income and how to determine the corporate tax rate - both average and marginal. Understand various methods of depreciation. ...

An Overview of The New Regime for Foreign Investment In France

... companies, is now subject to an administrative declaration. New filing requirements of certain investments for statistical purposes have been created. The prior authorization formerly required for the sale in France of securities issued by foreign companies has been suppressed1 (thus facilitating pr ...

... companies, is now subject to an administrative declaration. New filing requirements of certain investments for statistical purposes have been created. The prior authorization formerly required for the sale in France of securities issued by foreign companies has been suppressed1 (thus facilitating pr ...

MANAGING VOLATILITY: A STRATEGIC FRAMEWORK

... point for institutional investors with regard to their level of tolerance for investment volatility. Institutional investors of all types were impacted by the drop in asset prices and protracted volatility, as well as the resulting regulatory response. Plan sponsors as well as endowments and foundat ...

... point for institutional investors with regard to their level of tolerance for investment volatility. Institutional investors of all types were impacted by the drop in asset prices and protracted volatility, as well as the resulting regulatory response. Plan sponsors as well as endowments and foundat ...

View item 7. as RTF 725 KB

... Management and Annual Investment Strategy for the financial year 2016/17 as approved by the Authority on 17 March 2016 (FEP 2576), alongside best practice suggested by the Chartered Institute of Public Finance and Accountancy (CIPFA) and Central Government. 3. Under the treasury management shared se ...

... Management and Annual Investment Strategy for the financial year 2016/17 as approved by the Authority on 17 March 2016 (FEP 2576), alongside best practice suggested by the Chartered Institute of Public Finance and Accountancy (CIPFA) and Central Government. 3. Under the treasury management shared se ...

Leveraged buyout

A leveraged buyout (LBO) is a transaction when a company or single asset (e.g., a real estate property) is purchased with a combination of equity and significant amounts of borrowed money, structured in such a way that the target's cash flows or assets are used as the collateral (or ""leverage"") to secure and repay the borrowed money. Since the debt (be it senior or mezzanine) has a lower cost of capital (until bankruptcy risk reaches a level threatening to the lender[s]) than the equity, the returns on the equity increase as the amount of borrowed money does until the perfect capital structure is reached. As a result, the debt effectively serves as a lever to increase returns-on-investment.The term LBO is usually employed when a financial sponsor acquires a company. However, many corporate transactions are partially funded by bank debt, thus effectively also representing an LBO. LBOs can have many different forms such as management buyout (MBO), management buy-in (MBI), secondary buyout and tertiary buyout, among others, and can occur in growth situations, restructuring situations, and insolvencies. LBOs mostly occur in private companies, but can also be employed with public companies (in a so-called PtP transaction – Public to Private).As financial sponsors increase their returns by employing a very high leverage (i.e., a high ratio of debt to equity), they have an incentive to employ as much debt as possible to finance an acquisition. This has, in many cases, led to situations, in which companies were ""over-leveraged"", meaning that they did not generate sufficient cash flows to service their debt, which in turn led to insolvency or to debt-to-equity swaps in which the equity owners lose control over the business and the debt providers assume the equity.