879_Paula Lopez Paper

... Why are annuities not voluntarily taken up by a larger number of retirees? In the individual consumption/savings-portfolio choice literature, a very important participation puzzle arises from the revealed preference of households not to voluntarily buy annuities at retirement, despite the strong the ...

... Why are annuities not voluntarily taken up by a larger number of retirees? In the individual consumption/savings-portfolio choice literature, a very important participation puzzle arises from the revealed preference of households not to voluntarily buy annuities at retirement, despite the strong the ...

Forms of Benefit Payment at Retirement

... pension systems (notably in Central and Eastern Europe, China, etc.) have successfully launched the capital accumulation phase. Policymakers introducing these new systems have focused on this phase as the number of retirees (beneficiaries) is initially low, even more so because older workers are oft ...

... pension systems (notably in Central and Eastern Europe, China, etc.) have successfully launched the capital accumulation phase. Policymakers introducing these new systems have focused on this phase as the number of retirees (beneficiaries) is initially low, even more so because older workers are oft ...

Download attachment

... in a single capital stock.3 By 1992, almost 95% of employees had shifted to the AFPs. Chile has provided a widely discussed early model for increased reliance on private plans as an alternative to collective state pension provision. Many have identified it as an example of the advantages of market pr ...

... in a single capital stock.3 By 1992, almost 95% of employees had shifted to the AFPs. Chile has provided a widely discussed early model for increased reliance on private plans as an alternative to collective state pension provision. Many have identified it as an example of the advantages of market pr ...

Two Essays on Adverse Selection in Annuity Markets

... A fourth explanation is that in reality annuities may not be actuarially fair, in the sense that individuals are insufficiently compensated for their risk of dying. This may be due to administrative costs and taxes, or monopoly profits as a result of imperfect competition among annuity firms. The i ...

... A fourth explanation is that in reality annuities may not be actuarially fair, in the sense that individuals are insufficiently compensated for their risk of dying. This may be due to administrative costs and taxes, or monopoly profits as a result of imperfect competition among annuity firms. The i ...

Risk Factors A number of risk factors affect Prudential`s operating

... fluctuations. Prudential’s operations in the US and Asia, which represent a significant proportion of operating profit based on longer-term investment returns and shareholders’ funds, generally write policies and invest in assets denominated in local currencies. Although this practice limits the eff ...

... fluctuations. Prudential’s operations in the US and Asia, which represent a significant proportion of operating profit based on longer-term investment returns and shareholders’ funds, generally write policies and invest in assets denominated in local currencies. Although this practice limits the eff ...

Market-Consistent Valuations of Life Insurance Business

... We also find significant differences between firms using different models. In many cases, firms using the BH model had the highest put option prices, then insurers using TSM, with those using the “other” models having the lowest. For 15-year at-the-money put options on equities, insurers using the B ...

... We also find significant differences between firms using different models. In many cases, firms using the BH model had the highest put option prices, then insurers using TSM, with those using the “other” models having the lowest. For 15-year at-the-money put options on equities, insurers using the B ...

Open Research Online How Might We Create a Secondary Annuity

... market can render competition ineffective. Effective competition also requires that pensioners shop around for the best price and that bidders are able to collect the information necessary to prevent adverse selection. If pensioners don’t shop around, for example if they surrender their annuity back ...

... market can render competition ineffective. Effective competition also requires that pensioners shop around for the best price and that bidders are able to collect the information necessary to prevent adverse selection. If pensioners don’t shop around, for example if they surrender their annuity back ...

Automatic Annuitization: New Behavioral Strategies for Expanding

... Given the success of 401(k) automatic enrollment, would making an annuity the default option at retirement similarly increase the percentage of pension participants taking annuities? The evidence suggests it would not. Although a useful element in a strategy to encourage the selection of annuities, ...

... Given the success of 401(k) automatic enrollment, would making an annuity the default option at retirement similarly increase the percentage of pension participants taking annuities? The evidence suggests it would not. Although a useful element in a strategy to encourage the selection of annuities, ...

charitable gift annuities at the university of california

... University of California to support undergraduate programs. After consulting with her attorney and financial advisor, she decides that a charitable gift annuity is the most beneficial way for her to make the gift. Using appreciated securities valued at $20,000, Mrs. Roberts establishes a charitable ...

... University of California to support undergraduate programs. After consulting with her attorney and financial advisor, she decides that a charitable gift annuity is the most beneficial way for her to make the gift. Using appreciated securities valued at $20,000, Mrs. Roberts establishes a charitable ...

A guide to how we manage our with-profits fund

... So, for example, in good years we will hold back some of the profits and use them to top up bonuses in poorer years. However, smoothing will not stop bonuses or other payouts from getting progressively smaller if investment returns remain low over several years. So, when times are not so good, you m ...

... So, for example, in good years we will hold back some of the profits and use them to top up bonuses in poorer years. However, smoothing will not stop bonuses or other payouts from getting progressively smaller if investment returns remain low over several years. So, when times are not so good, you m ...

1 ANTARES PHARMA, INC. AMENDED AND RESTATED

... The Compensation Committee shall receive appropriate funding from the Company, as determined by the Compensation Committee in its capacity as a committee of the Board, for the payment of compensation to its compensation consultants, outside legal counsel and any other advisors. However, the Compensa ...

... The Compensation Committee shall receive appropriate funding from the Company, as determined by the Compensation Committee in its capacity as a committee of the Board, for the payment of compensation to its compensation consultants, outside legal counsel and any other advisors. However, the Compensa ...

Document

... SMI Work Plan Analyze other financial supervisory modernization initiatives, to the extent appropriate. Analysis should include •the Basel II international capital framework for banks and implementation in the U.S.; •solvency work by the International Association of Insurance Supervisors (IAIS); ...

... SMI Work Plan Analyze other financial supervisory modernization initiatives, to the extent appropriate. Analysis should include •the Basel II international capital framework for banks and implementation in the U.S.; •solvency work by the International Association of Insurance Supervisors (IAIS); ...

Present Value of an Ordinary Annuity

... Input 18 and then press N. Input 10 and then press I/Y. Input 0, and then press PV. Input 60,000 and then press FV Press CPT PMT = 1,315.81 If Moore Company pays $1,315.81 at the end of each period for 18 years, then $60,000 will be available to pay off the bond issue at maturity. ...

... Input 18 and then press N. Input 10 and then press I/Y. Input 0, and then press PV. Input 60,000 and then press FV Press CPT PMT = 1,315.81 If Moore Company pays $1,315.81 at the end of each period for 18 years, then $60,000 will be available to pay off the bond issue at maturity. ...

How do you manage a with-profits firm under IFRS 4 Phase II?

... Leverage current complex modelling of with-profits business ...

... Leverage current complex modelling of with-profits business ...

RetireOneTM Transamerica II Eligible Strategies

... The RetireOne Transamerica II Contingent Deferred Annuity requires an investor’s holdings to remain fully invested in certain specific investments (“eligible assets”). It does not guarantee eligible asset performance or against a loss of principal. Ownership of the eligible assets on which the guara ...

... The RetireOne Transamerica II Contingent Deferred Annuity requires an investor’s holdings to remain fully invested in certain specific investments (“eligible assets”). It does not guarantee eligible asset performance or against a loss of principal. Ownership of the eligible assets on which the guara ...

Your guide to investing in With-Profits

... Any change to this practice would apply immediately, both to bonds existing at the time the change was made and to subsequent new bonds. The way that PAC applies smoothing depends on the period of your investment in the fund. ...

... Any change to this practice would apply immediately, both to bonds existing at the time the change was made and to subsequent new bonds. The way that PAC applies smoothing depends on the period of your investment in the fund. ...

LIQUIDITY PAPER v4 - Institute and Faculty of Actuaries

... In the UK, liquidity has become more of an issue. Portfolios are becoming mature and cashflow is frequently negative. In addition, the experience of Equitable Life has highlighted the possibility of large discretionary outflows where consumer confidence is lost in a company. At least one credit rati ...

... In the UK, liquidity has become more of an issue. Portfolios are becoming mature and cashflow is frequently negative. In addition, the experience of Equitable Life has highlighted the possibility of large discretionary outflows where consumer confidence is lost in a company. At least one credit rati ...

Long-Term Insurance Act: Prescribed

... a financial institution as defined in paragraph (a) of the c1efinition of 'financial institution' in section 1 of the Finaneial Services Board Act, 1990 (Act No. 97 of 1990); a bank as defined in section 1(1) of the Banks Act, 1990 (Act No. 94 of 1990), or a mutual bank as defined in section 1(1) of ...

... a financial institution as defined in paragraph (a) of the c1efinition of 'financial institution' in section 1 of the Finaneial Services Board Act, 1990 (Act No. 97 of 1990); a bank as defined in section 1(1) of the Banks Act, 1990 (Act No. 94 of 1990), or a mutual bank as defined in section 1(1) of ...

Universal Life with No Lapse Guarantees: What You Need to Know!

... want to sell their policies, with the buyers continuing to maintain them until the insured’s death.2 Both Fitch in its report and Professor Joseph Belth in his March/April 2004 issue of The Insurance Forum cite the history from the 1980’s and early 90’s of term life insurance to age 100 with no cash ...

... want to sell their policies, with the buyers continuing to maintain them until the insured’s death.2 Both Fitch in its report and Professor Joseph Belth in his March/April 2004 issue of The Insurance Forum cite the history from the 1980’s and early 90’s of term life insurance to age 100 with no cash ...

Conventional annuity solution

... • We repair their confidence in equity markets • We allow their investment to recover its value ...

... • We repair their confidence in equity markets • We allow their investment to recover its value ...

Blues Plans Are Criticized on Executive Compensation

... Oklahoma and Texas "have performed very well over the past several years." The compensation practice, he asserts, is reviewed annually "to ensure it's in line with our industry's expectations. And based on both independent analyses and our own analysis, our executive pay is well within the compensat ...

... Oklahoma and Texas "have performed very well over the past several years." The compensation practice, he asserts, is reviewed annually "to ensure it's in line with our industry's expectations. And based on both independent analyses and our own analysis, our executive pay is well within the compensat ...

How critical the built up of estate is in participating fund and how

... Shareholders prefer early return on their investment – higher regular bonus and low terminal bonus - fluctuation in regular bonus would be acceptable. Policyholder expects steady bonuses in line with PRE created by illustrated bonuses, past declared bonuses and bonuses declared by other companie ...

... Shareholders prefer early return on their investment – higher regular bonus and low terminal bonus - fluctuation in regular bonus would be acceptable. Policyholder expects steady bonuses in line with PRE created by illustrated bonuses, past declared bonuses and bonuses declared by other companie ...

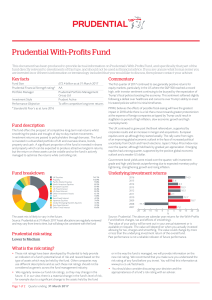

Prudential With

... profit. Policyholders receive a distribution of profits by means of bonuses, or other methods as specified in the relevant policy documentation. There are two types of bonus, regular (or reversionary) and final (or terminal) bonus. The performance figures shown are overall annualised returns for con ...

... profit. Policyholders receive a distribution of profits by means of bonuses, or other methods as specified in the relevant policy documentation. There are two types of bonus, regular (or reversionary) and final (or terminal) bonus. The performance figures shown are overall annualised returns for con ...

U.S. Annuity Market Dynamics and Regulatory Requirements

... contracts have annual household income of less than $100,000; that includes 64% who earn less than $75,000. Nine in 10 Baby Boomers who own annuities believe that they are doing a good job preparing for retirement. ...

... contracts have annual household income of less than $100,000; that includes 64% who earn less than $75,000. Nine in 10 Baby Boomers who own annuities believe that they are doing a good job preparing for retirement. ...