Credit Where it Counts: The Community Reinvestment Act and its

... response to these problems. Using recent empirical evidence, I demonstrate that over the last decade CRA has enhanced access to credit for low-income, moderate-income, and minority borrowers at relatively low cost, consistent with the theory that CRA is helping to overcome market failures. I argue t ...

... response to these problems. Using recent empirical evidence, I demonstrate that over the last decade CRA has enhanced access to credit for low-income, moderate-income, and minority borrowers at relatively low cost, consistent with the theory that CRA is helping to overcome market failures. I argue t ...

The Community Reinvestment Act, Bank

... to affordable housing in Broward County’s low- and moderate-income communities and to low- and moderate-income persons. The following report explains how the Community Reinvestment Act (CRA) works, summarizes key housing credit needs, provides a review of Home Mortgage Disclosure data, analyzes the ...

... to affordable housing in Broward County’s low- and moderate-income communities and to low- and moderate-income persons. The following report explains how the Community Reinvestment Act (CRA) works, summarizes key housing credit needs, provides a review of Home Mortgage Disclosure data, analyzes the ...

Title of presentation

... UK vs. US: equalizing gross yields, UK consumer platforms appear to generate better returns • Anecdotally, UK offers better risk reward than US: Comparing Zopa loans of equal gross yield (USD swapped) to Lending Club ‘A grade’ and ‘B grade’ loans shows that equivalent Zopa loans yields an extra 0.4- ...

... UK vs. US: equalizing gross yields, UK consumer platforms appear to generate better returns • Anecdotally, UK offers better risk reward than US: Comparing Zopa loans of equal gross yield (USD swapped) to Lending Club ‘A grade’ and ‘B grade’ loans shows that equivalent Zopa loans yields an extra 0.4- ...

here - Empirical Legal Studies

... We vigorously dispute the factual basis for both of these assertions. First, national banks, their operating subsidiaries, their affiliates, and their stock holders are profiting extensively from loans which are defined as predatory in a broad variety of arenas.14 In the next section of these comme ...

... We vigorously dispute the factual basis for both of these assertions. First, national banks, their operating subsidiaries, their affiliates, and their stock holders are profiting extensively from loans which are defined as predatory in a broad variety of arenas.14 In the next section of these comme ...

IRAC 040413-RBI - College of Agricultural Banking

... sanctioned limit of Rs. 30.00 lacs 23 ACA-TM-37 (v2.2-20-Nov-10) ...

... sanctioned limit of Rs. 30.00 lacs 23 ACA-TM-37 (v2.2-20-Nov-10) ...

Can Jane Get a Mortgage Loan? Depends on When

... approach is its failure to detect discrimination in cases where applicants that are unfairly denied credit eventually succeed in obtaining it from other nondiscriminatory lenders. A more recent study by Bayer et al. (2014) examines racial discrimination in loan pricing by comparing interest rates re ...

... approach is its failure to detect discrimination in cases where applicants that are unfairly denied credit eventually succeed in obtaining it from other nondiscriminatory lenders. A more recent study by Bayer et al. (2014) examines racial discrimination in loan pricing by comparing interest rates re ...

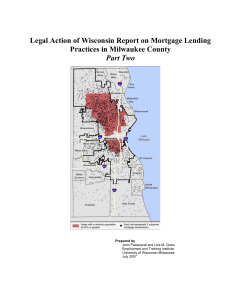

Legal Action of Wisconsin Report on Mortgage Lending

... activity in Milwaukee County was analyzed separately for the low income neighborhoods targeted by the City of Milwaukee’s Community Development Block Grant (CDBG) program (i.e., 53204, 53205, 53206, 53208, 53210, 53212, 53216, 53218 and 53233), the rest of the City of Milwaukee, and the Milwaukee Co ...

... activity in Milwaukee County was analyzed separately for the low income neighborhoods targeted by the City of Milwaukee’s Community Development Block Grant (CDBG) program (i.e., 53204, 53205, 53206, 53208, 53210, 53212, 53216, 53218 and 53233), the rest of the City of Milwaukee, and the Milwaukee Co ...

Exploring Racial Disparities in High Cost Lending

... The current foreclosure crisis has devastated many predominantly black or Hispanic communities, in part because blacks and Hispanics were disproportionately likely to finance their home purchases or refinance existing mortgages with subprime mortgages, which enter foreclosure at far higher rates tha ...

... The current foreclosure crisis has devastated many predominantly black or Hispanic communities, in part because blacks and Hispanics were disproportionately likely to finance their home purchases or refinance existing mortgages with subprime mortgages, which enter foreclosure at far higher rates tha ...

NCRC Action Alert

... the Call Report data would miss indications that a predatory lender was making unsafe loans. In this case, the bank would not be reporting detailed Call Report data on delinquencies, defaults, and recoveries because the criteria only covered a small part of its subprime business (less than the propo ...

... the Call Report data would miss indications that a predatory lender was making unsafe loans. In this case, the bank would not be reporting detailed Call Report data on delinquencies, defaults, and recoveries because the criteria only covered a small part of its subprime business (less than the propo ...

Tool 2: Fair Lending Legal Foundations

... Equal Credit Opportunity Act (ECOA) The law that promotes the availability of credit to all creditworthy applicants. Fair Housing Act (FHA) The law that prohibits discrimination both in residential real estate-related transactions and in the terms or conditions of the sale or rental of a dwelling. H ...

... Equal Credit Opportunity Act (ECOA) The law that promotes the availability of credit to all creditworthy applicants. Fair Housing Act (FHA) The law that prohibits discrimination both in residential real estate-related transactions and in the terms or conditions of the sale or rental of a dwelling. H ...

Riding the Stagecoach to Hell: A Qualitative Analysis of

... a federal seal of approval and contributed to the institutionalization of redlining throughout the lending industry. According to Jackson (1985), neighborhoods that were coded red were much less likely to receive federally insured loans, though research by Hillier (2003) in Philadelphia found that r ...

... a federal seal of approval and contributed to the institutionalization of redlining throughout the lending industry. According to Jackson (1985), neighborhoods that were coded red were much less likely to receive federally insured loans, though research by Hillier (2003) in Philadelphia found that r ...

Investor Presentation May 2014

... • Lending Club loans are available to borrowers in all but six states while Prosper is available in all but three states. Investors face greater restrictions. Investors in only 29 states plus the District of Columbia are given access to Prosper. Investors in a slightly different set of 28 states hav ...

... • Lending Club loans are available to borrowers in all but six states while Prosper is available in all but three states. Investors face greater restrictions. Investors in only 29 states plus the District of Columbia are given access to Prosper. Investors in a slightly different set of 28 states hav ...

justice foreclosed

... able to get credit were suddenly flooded with highcost loans. As early as 2000, the government concluded that minority borrowers were more likely than comparable white homebuyers to get a subprime loan and those loans would have higher interest rates. By the time the housing bubble burst in 2007, bo ...

... able to get credit were suddenly flooded with highcost loans. As early as 2000, the government concluded that minority borrowers were more likely than comparable white homebuyers to get a subprime loan and those loans would have higher interest rates. By the time the housing bubble burst in 2007, bo ...

mortny m McCormally 3-14

... Requirement and Estimated Costs – Insufficient supervision of affiliate’s subprime lending activity – Submission of Plan of Remediation to address: 1. borrowers whose creditworthiness not adequately considered; and 2. borrowers who incurred large broker and/or lender fees. ...

... Requirement and Estimated Costs – Insufficient supervision of affiliate’s subprime lending activity – Submission of Plan of Remediation to address: 1. borrowers whose creditworthiness not adequately considered; and 2. borrowers who incurred large broker and/or lender fees. ...

PDF - Urban Institute

... which were subprime. The former would have a total of only 2 such loans, whereas the latter would have 25. In a preliminary analysis of all census tracts in the 100 largest metro areas in 2005, we found that the share of all loans that were subprime was considerably higher in highpoverty tracts (pov ...

... which were subprime. The former would have a total of only 2 such loans, whereas the latter would have 25. In a preliminary analysis of all census tracts in the 100 largest metro areas in 2005, we found that the share of all loans that were subprime was considerably higher in highpoverty tracts (pov ...

Mortgage Lending Discrimination - Fair Housing Center of West

... Data analysis should include comparison of types of loans Does lender deny high income AA home purchase loans but doesn’t deny high income AA refinance loans, more likely to be random error in data rather than discrimination ...

... Data analysis should include comparison of types of loans Does lender deny high income AA home purchase loans but doesn’t deny high income AA refinance loans, more likely to be random error in data rather than discrimination ...

Ohio - WordPress.com

... to bring about integrated suburbs. But there were conflicts between him and President Nixon who was opposed to this. Romney resigned in 1972. Residential segregation persisted. ...

... to bring about integrated suburbs. But there were conflicts between him and President Nixon who was opposed to this. Romney resigned in 1972. Residential segregation persisted. ...

Redlining

In the United States, redlining is the practice of denying services, either directly or through selectively raising prices, to residents of certain areas based on the racial or ethnic makeups of those areas. While some of the most famous examples of redlining regard denying financial services such as banking or insurance, other services such as health care or even supermarkets, can be denied to residents to carry out redlining. The term ""redlining"" was coined in the late 1960s by John McKnight, a sociologist and community activist. It refers to the practice of marking a red line on a map to delineate the area where banks would not invest; later the term was applied to discrimination against a particular group of people (usually by race or sex) irrespective of geography.During the heyday of redlining, the areas most frequently discriminated against were black inner city neighborhoods. For example, in Atlanta in the 1980s, a Pulitzer Prize-winning series of articles by investigative-reporter Bill Dedman showed that banks would often lend to lower-income whites but not to middle- or upper-income blacks. The use of blacklists is a related mechanism also used by redliners to keep track of groups, areas, and people that the discriminating party feels should be denied business or aid or other transactions. In the academic literature, redlining falls under the broader category of credit rationing.Reverse redlining occurs when a lender or insurer targets nonwhite consumers, not to deny them loans or insurance, but rather to charge them more than could be charged to a comparable white consumer.