Income Taxes - Australian Accounting Standards Board

... calculated in accordance with the legislation after taking into account tax offsets (credits and rebates) under the legislation. For financial reporting purposes, income tax payable or income tax recoverable that arises in an annual reporting period (current tax) is recognised as an expense or a rev ...

... calculated in accordance with the legislation after taking into account tax offsets (credits and rebates) under the legislation. For financial reporting purposes, income tax payable or income tax recoverable that arises in an annual reporting period (current tax) is recognised as an expense or a rev ...

CHAPTER 11: NONFARM PROPRIETORS’ INCOME (December 2015) Definitions and Concepts

... single individual. Partnerships include most associations of two or more of: individuals, corporations, noncorporate organizations that are organized for profit, or of other private businesses. Other private businesses are made up of tax-exempt cooperatives, including credit unions, mutual insuranc ...

... single individual. Partnerships include most associations of two or more of: individuals, corporations, noncorporate organizations that are organized for profit, or of other private businesses. Other private businesses are made up of tax-exempt cooperatives, including credit unions, mutual insuranc ...

Full Year 2015 Results

... o Portfolio Management: Increased focus at Business Intelligence and Knowledge & Networking through selective disposals, latterly our Russian conference business; o Investment: More than 20 GAP organic initiatives launched, with over £25m deployed; margin impact offset by trading momentum and strong ...

... o Portfolio Management: Increased focus at Business Intelligence and Knowledge & Networking through selective disposals, latterly our Russian conference business; o Investment: More than 20 GAP organic initiatives launched, with over £25m deployed; margin impact offset by trading momentum and strong ...

(Chair) Transparency in reporting financial data by multinational

... of tax information by multinational enterprises. The report reviews and discusses them, as well as the central issues involved in the debate about transparency in financial reporting. It tries to answer some of the fundamental questions about the objectives of greater transparency, how it can be bet ...

... of tax information by multinational enterprises. The report reviews and discusses them, as well as the central issues involved in the debate about transparency in financial reporting. It tries to answer some of the fundamental questions about the objectives of greater transparency, how it can be bet ...

full paper · 1MB PDF

... firms pay dividends instead of repurchasing shares (see also Bagwell and Shoven, 1989) and that firms simultaneously pay dividends and issue new shares. Several potential solutions have been offered for the various aspects of the dividend puzzle. One common explanation is that the signaling or agenc ...

... firms pay dividends instead of repurchasing shares (see also Bagwell and Shoven, 1989) and that firms simultaneously pay dividends and issue new shares. Several potential solutions have been offered for the various aspects of the dividend puzzle. One common explanation is that the signaling or agenc ...

session22test

... 2. d. Companies feel much less secure or certain about future earnings. The tax disadvantage associated with dividends has actually decreased over the last three decades and the link between transactions costs or short termism with dividend policy is not clearly established. 3. c. Dividend increases ...

... 2. d. Companies feel much less secure or certain about future earnings. The tax disadvantage associated with dividends has actually decreased over the last three decades and the link between transactions costs or short termism with dividend policy is not clearly established. 3. c. Dividend increases ...

personal real estate corporations

... Licensed realtors may have several good reasons to incorporate a PREC. Incorporating a PREC is a good strategy for minimizing of income tax for a licensed realtor who can retain income in the PREC or can benefit from income splitting. However, a PREC is not right for everyone. Licensed realtors shou ...

... Licensed realtors may have several good reasons to incorporate a PREC. Incorporating a PREC is a good strategy for minimizing of income tax for a licensed realtor who can retain income in the PREC or can benefit from income splitting. However, a PREC is not right for everyone. Licensed realtors shou ...

SOVEREIGN REPORT - The Sovereign Group

... this re-licensing process is complete. It is likely that the Malta Financial Services Authority (MFSA) will finish the process towards the end of the year. ...

... this re-licensing process is complete. It is likely that the Malta Financial Services Authority (MFSA) will finish the process towards the end of the year. ...

WP78.2

... This paper examines the evolution of the Zambian tax system with two aims. First, it will identify how patterns of taxation contribute to state capacity, and in particular state resilience. This follows a long line of research that links state formation and consolidation to the capacity of the state ...

... This paper examines the evolution of the Zambian tax system with two aims. First, it will identify how patterns of taxation contribute to state capacity, and in particular state resilience. This follows a long line of research that links state formation and consolidation to the capacity of the state ...

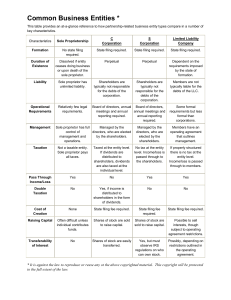

SOLE PROPRIETORSHIP The sole proprietorship is

... limited partner, but on the other hand it is still susceptible to the disadvantages of the general partnership. C-CORPORATION Corporations differ from proprietorships and partnerships largely in that they are themselves their own entity, independent and separate from the owners. Corporations have l ...

... limited partner, but on the other hand it is still susceptible to the disadvantages of the general partnership. C-CORPORATION Corporations differ from proprietorships and partnerships largely in that they are themselves their own entity, independent and separate from the owners. Corporations have l ...

Chapter 19 slides - McGraw

... Debt assumed by the shareholder reduces the (net) FMV of property received. FMV of the property cannot be less than the debt assumed by the shareholder (IRC § 336(b)). ...

... Debt assumed by the shareholder reduces the (net) FMV of property received. FMV of the property cannot be less than the debt assumed by the shareholder (IRC § 336(b)). ...

U.S. Federal Income Tax Issues in Acquisitions and Amalgamations

... U.S. Federal Income Tax Issues in Acquisitions and Amalgamations of Mining and Exploration Companies Special U.S. federal income tax rules may raise significant issues in acquisition and amalgamation transactions involving mining companies, especially mining companies that are still in the explorati ...

... U.S. Federal Income Tax Issues in Acquisitions and Amalgamations of Mining and Exploration Companies Special U.S. federal income tax rules may raise significant issues in acquisition and amalgamation transactions involving mining companies, especially mining companies that are still in the explorati ...

dor strategies in auditing the marketing arm-

... As pointed out in the Acacia/Autumn case, the marketing armcontracting arm structure works for state sales tax purposes but not for city sales tax purposes. That is because the Model City Sales Tax Code is structured quite differently from the state statutes dealing with the taxation of contracting. ...

... As pointed out in the Acacia/Autumn case, the marketing armcontracting arm structure works for state sales tax purposes but not for city sales tax purposes. That is because the Model City Sales Tax Code is structured quite differently from the state statutes dealing with the taxation of contracting. ...

UK Company Structure - qLegal - Queen Mary University of London

... A sequence of steps should be followed in order to establish any company: - Members or shareholders subscribe to a memorandum of association: through this document they agree to become members of the company. - The rules governing the company will be agreed in an article of association: this documen ...

... A sequence of steps should be followed in order to establish any company: - Members or shareholders subscribe to a memorandum of association: through this document they agree to become members of the company. - The rules governing the company will be agreed in an article of association: this documen ...

On the Hook: Directors Liability for Corporate Tax

... proceeding can be brought against a director if it is commenced more than two years after the person last ceased to be a director of the corporation.12 If there is more than one director of a corporation, the director who absorbs the liability of the claim is entitled to seek contribution from the o ...

... proceeding can be brought against a director if it is commenced more than two years after the person last ceased to be a director of the corporation.12 If there is more than one director of a corporation, the director who absorbs the liability of the claim is entitled to seek contribution from the o ...

income tax computation and property income

... – loss arising in final 12m of trade (+ overlap profits) – carried back 3 yrs against trading profits ...

... – loss arising in final 12m of trade (+ overlap profits) – carried back 3 yrs against trading profits ...

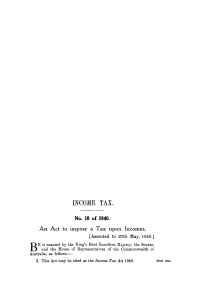

INCOME TAX.

... to which Division 16 of Part III. of the Income Tax Assessment Act 1936-1940 applies shall be as'set out in the Fourth Schedule to this Act. (5.) The rate or rates of income tax in respect of a taxable income in any case where sub-section (1.) of section eighty-six of the Income Tax Assessment Act 1 ...

... to which Division 16 of Part III. of the Income Tax Assessment Act 1936-1940 applies shall be as'set out in the Fourth Schedule to this Act. (5.) The rate or rates of income tax in respect of a taxable income in any case where sub-section (1.) of section eighty-six of the Income Tax Assessment Act 1 ...

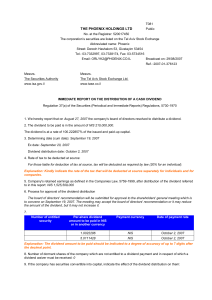

dividend

... For those liable for deduction of tax at source, tax will be deducted as required by law (20% for an individual). Explanation: Kindly indicate the rate of the tax that will be deducted at source separately for individuals and for companies. 5. Company's retained earnings as defined in the Companies ...

... For those liable for deduction of tax at source, tax will be deducted as required by law (20% for an individual). Explanation: Kindly indicate the rate of the tax that will be deducted at source separately for individuals and for companies. 5. Company's retained earnings as defined in the Companies ...

India-Cyprus tax treaty renegotiated: key provisions–MNE Tax

... current DTAA, has been subsumed within the Royalty and Fees for Technical Services Article in the renegotiated treaty. Provisions in relation to exchange of information have been updated in the new treaty and are now in in accordance with international standards and Indian tax treaty policy. The pro ...

... current DTAA, has been subsumed within the Royalty and Fees for Technical Services Article in the renegotiated treaty. Provisions in relation to exchange of information have been updated in the new treaty and are now in in accordance with international standards and Indian tax treaty policy. The pro ...

Tax Planning Problems

... reduce taxes. Taxpayers would still have incentives to shift activities across periods to defer taxation as well as to exploit changes in tax rates across periods. Taxpayers would still have incentives to restructure activities/transactions into those that are granted tax exemption (shifting from on ...

... reduce taxes. Taxpayers would still have incentives to shift activities across periods to defer taxation as well as to exploit changes in tax rates across periods. Taxpayers would still have incentives to restructure activities/transactions into those that are granted tax exemption (shifting from on ...

Choosing a Business Entity - Capitol Private Wealth Group

... government and are formed under the laws of the state in which they are registered. These laws will generally govern requirements for things such as shareholder meeting frequency (the minimum across all 50 states is one per year) and records maintenance. You must file for incorporation by preparing ...

... government and are formed under the laws of the state in which they are registered. These laws will generally govern requirements for things such as shareholder meeting frequency (the minimum across all 50 states is one per year) and records maintenance. You must file for incorporation by preparing ...

Profit Taxation in Germany - Luther Rechtsanwaltsgesellschaft

... sheet of the new partner. Reason for this is that the direct acquisition of a partnership share is treated like an asset deal. The supplementary balance sheet only belongs to this partner. Special purpose balance sheets are generated in case special purpose assets or liabilities exist. Special purpo ...

... sheet of the new partner. Reason for this is that the direct acquisition of a partnership share is treated like an asset deal. The supplementary balance sheet only belongs to this partner. Special purpose balance sheets are generated in case special purpose assets or liabilities exist. Special purpo ...