TAXATION GUIDANCE INTRODUCTION Shareholders` Odd

... to retain their Odd-lot Holdings. In making their decision whether or not to elect to retain their Odd-lot Holdings (and thereby exclude themselves from the Odd-lot Offer) shareholders should take into account the tax implications for them of participating in the Odd-lot Offer. In order to assist sh ...

... to retain their Odd-lot Holdings. In making their decision whether or not to elect to retain their Odd-lot Holdings (and thereby exclude themselves from the Odd-lot Offer) shareholders should take into account the tax implications for them of participating in the Odd-lot Offer. In order to assist sh ...

Read the Full Report

... Canada needs competitive tax rates for high-income earners, or we run the risk of a brain drain and the risk of being less able to attract foreign talent. Excessively taxing the talent that fuels a more innovative, creative and successful economy is ultimately self-defeating. As mentioned, it may be ...

... Canada needs competitive tax rates for high-income earners, or we run the risk of a brain drain and the risk of being less able to attract foreign talent. Excessively taxing the talent that fuels a more innovative, creative and successful economy is ultimately self-defeating. As mentioned, it may be ...

Mexico - Chevez Ruiz Zamarripa

... consolidation regime such as offsetting net operating losses incurred by one entity against profits of another entity, as well as the tax-free dividend payment between entities of the group when distributed out of retained tax earnings, remain in place, the tax-deferral benefits resulting from the c ...

... consolidation regime such as offsetting net operating losses incurred by one entity against profits of another entity, as well as the tax-free dividend payment between entities of the group when distributed out of retained tax earnings, remain in place, the tax-deferral benefits resulting from the c ...

Jackson Hewett Tax Service

... credit. Jonathan continues to pay his premium until October, when he forgets to make his insurance payment because he is busy at work and it slips his mind. Not fully understanding how the three month grace period works, he decides to wait until after the Christmas holidays to true up on his premium ...

... credit. Jonathan continues to pay his premium until October, when he forgets to make his insurance payment because he is busy at work and it slips his mind. Not fully understanding how the three month grace period works, he decides to wait until after the Christmas holidays to true up on his premium ...

Primer on Colorado Real Property Withholding

... deemed to have a permanent place of business in Colorado if it is a Colorado domestic corporation, if it is qualified by law to transact business in Colorado, or if it maintains and staffs a permanent office in Colorado). A nonresident is an individual who did not consider his/her home to be in Colo ...

... deemed to have a permanent place of business in Colorado if it is a Colorado domestic corporation, if it is qualified by law to transact business in Colorado, or if it maintains and staffs a permanent office in Colorado). A nonresident is an individual who did not consider his/her home to be in Colo ...

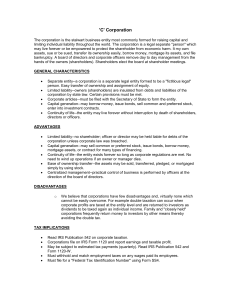

`C` Corporation

... A Limited Liability Company (LLC) may elect to pass gains or losses, credits or deductions, on to the members of the LLC in much the same manner that partnerships are taxes. An LLC status avoids the corporate potential problem of "double taxation." Individual members may benefit from a reduction in ...

... A Limited Liability Company (LLC) may elect to pass gains or losses, credits or deductions, on to the members of the LLC in much the same manner that partnerships are taxes. An LLC status avoids the corporate potential problem of "double taxation." Individual members may benefit from a reduction in ...

Taxable Benefit - Canadian Employee Relocation Council

... 3. Maintain a self-contained domestic establishment (home) at another location which is available for use at all times 4. Because of the distance between two areas, the ...

... 3. Maintain a self-contained domestic establishment (home) at another location which is available for use at all times 4. Because of the distance between two areas, the ...

Sole Proprietorship Entity – Key Factors Analysis

... As a family business grows, the possibility of expanding beyond state (or national) borders may be a viable business option. This raises a host of tax issues: for example, has the business in the new jurisdiction established “nexus” (i.e., are there sufficient operations in the new location to justi ...

... As a family business grows, the possibility of expanding beyond state (or national) borders may be a viable business option. This raises a host of tax issues: for example, has the business in the new jurisdiction established “nexus” (i.e., are there sufficient operations in the new location to justi ...

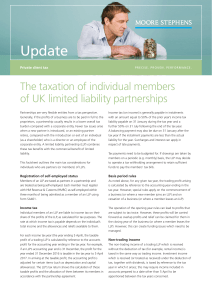

The taxation of individual members of UK limited

... If tax losses are incurred in the trade of the LLP, these are allocated to the members in accordance with the partnership agreement. It should be noted that the losses that a member can offset against other income or gains is limited to an amount equal to their capital contribution to the partnershi ...

... If tax losses are incurred in the trade of the LLP, these are allocated to the members in accordance with the partnership agreement. It should be noted that the losses that a member can offset against other income or gains is limited to an amount equal to their capital contribution to the partnershi ...

Texas Revenues III

... The Texas gasoline tax rate of 20 cents a gallon is well below the national average of 30 cents a gallon. (The figure above shows the COMBINED state and federal gasoline tax rate in each state.) ...

... The Texas gasoline tax rate of 20 cents a gallon is well below the national average of 30 cents a gallon. (The figure above shows the COMBINED state and federal gasoline tax rate in each state.) ...

Characteristics of A Corporation

... corporation plus any loans made by the stockholders to the corporation. Merely forming a corporation will not guarantee that the stockholders’ liability will be limited, however. The corporation must have a legitimate purpose and comply with corporate formalities and procedures such as the requireme ...

... corporation plus any loans made by the stockholders to the corporation. Merely forming a corporation will not guarantee that the stockholders’ liability will be limited, however. The corporation must have a legitimate purpose and comply with corporate formalities and procedures such as the requireme ...

15-3 - McGraw Hill Higher Education - McGraw

... 1. Dividends are always taxable to a shareholder. True or False? True 2. If a corporation pays a dividend in property, the stockholder will have a dividend equal to the corporate basis in the property. True or False? False 3. A corporation has earnings and profits of $10,000 and makes a cash distrib ...

... 1. Dividends are always taxable to a shareholder. True or False? True 2. If a corporation pays a dividend in property, the stockholder will have a dividend equal to the corporate basis in the property. True or False? False 3. A corporation has earnings and profits of $10,000 and makes a cash distrib ...

For the time being Hungary does not provide a participation

... significantly increasing the present offshore tax burdens. Tax benefits on film production The regime was introduced in detail in the “The Euromoney – Global Tax Handbook 2005”. Therefore in this article we simply remind the reader that the tax-planning opportunities, which were successfully introdu ...

... significantly increasing the present offshore tax burdens. Tax benefits on film production The regime was introduced in detail in the “The Euromoney – Global Tax Handbook 2005”. Therefore in this article we simply remind the reader that the tax-planning opportunities, which were successfully introdu ...

Powerpoint presentation available

... best to distinguish ‘debt’ from ‘equity’ for tax purposes or how to tax hybrid (part debt and part equity) instruments…there are a number of different definitions of ‘debt’ in the current tax law and an unacceptable level of uncertainty at the debt/equity borderline” (Australian Treasury, 2004). ...

... best to distinguish ‘debt’ from ‘equity’ for tax purposes or how to tax hybrid (part debt and part equity) instruments…there are a number of different definitions of ‘debt’ in the current tax law and an unacceptable level of uncertainty at the debt/equity borderline” (Australian Treasury, 2004). ...

Sole Proprietorship - hrsbstaff.ednet.ns.ca

... be quickly re-sold through a stockbroker. The owners of the corporation are called shareholders, and any given corporation can have a few or thousands of shareholders. Shareholders elect a board of directors for the day-to-day business. Investors are attracted to owning shares because they do not ...

... be quickly re-sold through a stockbroker. The owners of the corporation are called shareholders, and any given corporation can have a few or thousands of shareholders. Shareholders elect a board of directors for the day-to-day business. Investors are attracted to owning shares because they do not ...

Companies - Tax Saving Opportunities

... Consideration should be given to the timing of any chargeable disposals to ensure advantage is taken where possible of minimising the tax liability at small companies rate (currently 21%) rather than full rate (currently 28%). This could be achieved depending on circumstances by accelerating or dela ...

... Consideration should be given to the timing of any chargeable disposals to ensure advantage is taken where possible of minimising the tax liability at small companies rate (currently 21%) rather than full rate (currently 28%). This could be achieved depending on circumstances by accelerating or dela ...

Huard, Paul - Submission on Tax Discussion Paper

... system is motivated by the conflict that governments face in setting public policy. It is quite apparent that non-elected entities place considerable pressure on governments as all levels to achieve their priorities often at the expense of the voting population. These non-elected entities often pay ...

... system is motivated by the conflict that governments face in setting public policy. It is quite apparent that non-elected entities place considerable pressure on governments as all levels to achieve their priorities often at the expense of the voting population. These non-elected entities often pay ...

WHAT WOULD HAPPEN? - University of North Texas

... were 10% of total pretax income for the 100 largest U.S. companies in 2000. However, total deductions exceeded total pretax income for the Nasdaq 100. (Graham, Lang, and Shackelford, Journal of Finance, 2004) ...

... were 10% of total pretax income for the 100 largest U.S. companies in 2000. However, total deductions exceeded total pretax income for the Nasdaq 100. (Graham, Lang, and Shackelford, Journal of Finance, 2004) ...

Finding Just the Right Tax Rate

... company. (For this reason, this type of transaction has been called an inversion.) Often, this restructuring does not shift the company’s production, employment, sales, or even management. And it has little to do with where the shareholders of the corporate group live. But it can substantially reduc ...

... company. (For this reason, this type of transaction has been called an inversion.) Often, this restructuring does not shift the company’s production, employment, sales, or even management. And it has little to do with where the shareholders of the corporate group live. But it can substantially reduc ...

Submission to Review of Australia’s Tax System

... company failures can be expected over the next few years. But the reasons for over-borrowing are more than just reckless financial management. They are ingrained in a taxation system that actually encourages borrowing. Tax deductability of interest on borrowings creates a price distortion that favou ...

... company failures can be expected over the next few years. But the reasons for over-borrowing are more than just reckless financial management. They are ingrained in a taxation system that actually encourages borrowing. Tax deductability of interest on borrowings creates a price distortion that favou ...