“China is a sleeping giant. Let her sleep for when she wakes she will

... important coverage emanated from China. After over five years of GDP growth between 8-10%, more recently inflation fears resulted in China initiating policies that were intended to create a “soft landing” and reduce GDP growth to 7% levels. At the same time, China has been attempting to lessen its d ...

... important coverage emanated from China. After over five years of GDP growth between 8-10%, more recently inflation fears resulted in China initiating policies that were intended to create a “soft landing” and reduce GDP growth to 7% levels. At the same time, China has been attempting to lessen its d ...

Section 1 - Analy High School Faculty

... bond is issued by the U.S. government. 12. A steady drop in the stock market over time is called a(n) market. 13. An electronic market that trades stock not listed on an organized exchange is termed over-the. 16. Using assets to earn income or profit constitutes a(n) ...

... bond is issued by the U.S. government. 12. A steady drop in the stock market over time is called a(n) market. 13. An electronic market that trades stock not listed on an organized exchange is termed over-the. 16. Using assets to earn income or profit constitutes a(n) ...

Power Point Presentation

... There is an economic role for government to play in a market economy whenever the benefits of a government policy outweigh its costs. Governments often provide for national defense, address environmental concerns, define and protect property rights, and attempt to make markets more competitive. Mo ...

... There is an economic role for government to play in a market economy whenever the benefits of a government policy outweigh its costs. Governments often provide for national defense, address environmental concerns, define and protect property rights, and attempt to make markets more competitive. Mo ...

Consumer Confidence Index

... 64 trade days last quarter that showed a rising 200 day moving average. Likewise, the NASDAQ Composite experienced only four days of the 200 day moving average that was rising for the entire quarter. The 200 day moving average is a broadly accepted indicator of the market(s) trend. This indicator is ...

... 64 trade days last quarter that showed a rising 200 day moving average. Likewise, the NASDAQ Composite experienced only four days of the 200 day moving average that was rising for the entire quarter. The 200 day moving average is a broadly accepted indicator of the market(s) trend. This indicator is ...

Different Market Structures

... competition from entering the market. Monopolies will try to establish barriers to entry or use marketing and pricing strategies which will prevent new entrants gaining a foothold in their marketplace. They may even sell their goods or services at prices that do not maximize profits, but instead pre ...

... competition from entering the market. Monopolies will try to establish barriers to entry or use marketing and pricing strategies which will prevent new entrants gaining a foothold in their marketplace. They may even sell their goods or services at prices that do not maximize profits, but instead pre ...

Technical Market Overview

... This “chasing gains” strategy often introduces volatile portfolio movement without sustainable progress. I believe a process by which an investor truly establishes how much risk they are willing to accept in a portfolio and then focuses on extracting as much profit from that risk profile as the mar ...

... This “chasing gains” strategy often introduces volatile portfolio movement without sustainable progress. I believe a process by which an investor truly establishes how much risk they are willing to accept in a portfolio and then focuses on extracting as much profit from that risk profile as the mar ...

From Top Down To Bottom Up Strategies/Challenges

... Innovation NOT Innovation in Scale nor collaborative The process results in further Fragmentation On the Funding side >>Small band aid solutions or Large Foundation take up to 2 years + to do due diligence Cost of Capital Allocation 20-50% vs. 2-5% Irony for Donors – 50 cents on the Dollar ...

... Innovation NOT Innovation in Scale nor collaborative The process results in further Fragmentation On the Funding side >>Small band aid solutions or Large Foundation take up to 2 years + to do due diligence Cost of Capital Allocation 20-50% vs. 2-5% Irony for Donors – 50 cents on the Dollar ...

Competition and Monopoly

... • It comes from Greek words meaning one (mono) seller (polein, which is Anglicized to "poly"). • The correct term for a "buyers' monopoly," where there is only one buyer, is "monopsony." ...

... • It comes from Greek words meaning one (mono) seller (polein, which is Anglicized to "poly"). • The correct term for a "buyers' monopoly," where there is only one buyer, is "monopsony." ...

Labor Markets and Macroeconomics

... Pierre Cahuc (Ecole Polytechnique), Mike Elsby (University of Edinburgh) and Wouter den Haan (London School of Economics) have confirmed their participation. The conference aims to bring together high-quality research that is at the intersection of labor economics and macroeconomics. We invite resea ...

... Pierre Cahuc (Ecole Polytechnique), Mike Elsby (University of Edinburgh) and Wouter den Haan (London School of Economics) have confirmed their participation. The conference aims to bring together high-quality research that is at the intersection of labor economics and macroeconomics. We invite resea ...

Time to look at developed markets throu...ging

... Investing in emerging markets requires an intense focus on country risks and political economy. Investors in the West have long been able to ignore political risk and focus on the sectors’ or individual companies’ prospects. But the prospect of a new independence referendum in Scotland is only the ...

... Investing in emerging markets requires an intense focus on country risks and political economy. Investors in the West have long been able to ignore political risk and focus on the sectors’ or individual companies’ prospects. But the prospect of a new independence referendum in Scotland is only the ...

The continued Chinese slowdown and Greek

... pressures. Inflation has also been low in most major trading partners, reducing the chance of pressure from global sources. As result, there are a few other uncertainties that the RBA will be monitoring for its policy decisions. Global growth, in particular in China, is one of the biggest concerns f ...

... pressures. Inflation has also been low in most major trading partners, reducing the chance of pressure from global sources. As result, there are a few other uncertainties that the RBA will be monitoring for its policy decisions. Global growth, in particular in China, is one of the biggest concerns f ...

Lecture 19

... • The major market forms are: – Perfect competition, in which the market consists of a very large number of firms producing a homogeneous product. – Monopolistic competition, also called competitive market, where there are a large number of independent firms which have a very small proportion of the ...

... • The major market forms are: – Perfect competition, in which the market consists of a very large number of firms producing a homogeneous product. – Monopolistic competition, also called competitive market, where there are a large number of independent firms which have a very small proportion of the ...

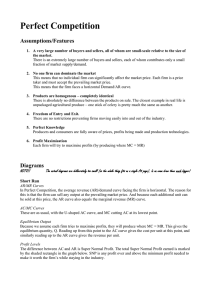

Perfect Competition

... Producers and consumers are fully aware of prices, profits being made and production technologies. 6. Profit Maximisation Each firm will try to maximise profits (by producing where MC = MR) ...

... Producers and consumers are fully aware of prices, profits being made and production technologies. 6. Profit Maximisation Each firm will try to maximise profits (by producing where MC = MR) ...

Established stock an Achilles heel

... rentals had the po tential to be an Achilles heel for new a partment developers. He said declining values of established properties had serious consequences for developers, especially those that had pre-sold to buyers who had borrowed a large percentage of the purchase price. "The problem is when th ...

... rentals had the po tential to be an Achilles heel for new a partment developers. He said declining values of established properties had serious consequences for developers, especially those that had pre-sold to buyers who had borrowed a large percentage of the purchase price. "The problem is when th ...

smarterinsightTM - Donald Wealth Management

... o'clock news, we would all do well to consider the wider context. The global economy actually grew by around 4% in 2011, according to the IMF. The US and German economies have grown in the first quarter of this year, too. Emerging economies continue to grow strongly, even if at a lower pace than the ...

... o'clock news, we would all do well to consider the wider context. The global economy actually grew by around 4% in 2011, according to the IMF. The US and German economies have grown in the first quarter of this year, too. Emerging economies continue to grow strongly, even if at a lower pace than the ...

Markets Update - Salford City Council

... In view of declining income, investigations are constantly made to reduce overheads and running costs. ...

... In view of declining income, investigations are constantly made to reduce overheads and running costs. ...

1 The temptation to sell is always when the market drops the furthest.

... making them perfect candidates for the downwardly mobile investor. 3. Buy when the m arket is up. If the market is on a tear, how can you lose? Just ask the hordes of inv estors who flocked to stocks in 1 999 and early 2000—and then lost their shirts in the ensuing bear market. 4. Sell when the mark ...

... making them perfect candidates for the downwardly mobile investor. 3. Buy when the m arket is up. If the market is on a tear, how can you lose? Just ask the hordes of inv estors who flocked to stocks in 1 999 and early 2000—and then lost their shirts in the ensuing bear market. 4. Sell when the mark ...

How can Hedge Funds take advantage of inefficiencies and

... In the last financial crisis, some of these funds bet against the housing market through the credit default swap market. While these complex derivatives did the job in this situation, having instruments that allow an investor to directly express an opinion about either residential or commercial real ...

... In the last financial crisis, some of these funds bet against the housing market through the credit default swap market. While these complex derivatives did the job in this situation, having instruments that allow an investor to directly express an opinion about either residential or commercial real ...