Mapping Citizenship: Status, Membership, and the Path in Between

... the polity-however that might be defined-in a substantive way. 7 But it is not clear how the various paths to U.S. citizenship qualify an individual for the same package of rights and benefits. 8 A two-day-old infant born in Ohio to French immigrants and a forty-five-year-old school teacher from Vie ...

... the polity-however that might be defined-in a substantive way. 7 But it is not clear how the various paths to U.S. citizenship qualify an individual for the same package of rights and benefits. 8 A two-day-old infant born in Ohio to French immigrants and a forty-five-year-old school teacher from Vie ...

Political Hot Potato - University of Cincinnati College of Law

... founders, such as James Madison, understood that this separation of government functions would not be strictly maintained and that the resulting checks and balances would often achieve beneficial ends. 3 This system was to preserve the American public's liberty, even at the price of raising the cost ...

... founders, such as James Madison, understood that this separation of government functions would not be strictly maintained and that the resulting checks and balances would often achieve beneficial ends. 3 This system was to preserve the American public's liberty, even at the price of raising the cost ...

Taxing Away Citizenship: Do American

... 1.4 Canadian Nationality Laws: Implications for Dual Citizens ............................................................ 20 1.5 American Nationality Laws: Implications for Dual Citizens ............................................................ 22 ...

... 1.4 Canadian Nationality Laws: Implications for Dual Citizens ............................................................ 20 1.5 American Nationality Laws: Implications for Dual Citizens ............................................................ 22 ...

Soak-the-Rich Republicans? The Puzzling Persistence of High Tax

... justice. As the nation struggled through the Great Depression, fairness was the touchstone of federal tax reform. For most of the 1930s, federal tax policy reflected a dismal set of assumptions about the nation’s economic future. While most political leaders and policy experts believed the Great Dep ...

... justice. As the nation struggled through the Great Depression, fairness was the touchstone of federal tax reform. For most of the 1930s, federal tax policy reflected a dismal set of assumptions about the nation’s economic future. While most political leaders and policy experts believed the Great Dep ...

i. facts - EFTA Surveillance Authority

... Fourthly, the measure must affect competition and trade between the Contracting Parties. ITCs can trade in goods, which are not covered by the EEA Agreement, and which do not originate in Iceland. But the trading activity as such may be considered as a service falling inside the scope of the EEA Agr ...

... Fourthly, the measure must affect competition and trade between the Contracting Parties. ITCs can trade in goods, which are not covered by the EEA Agreement, and which do not originate in Iceland. But the trading activity as such may be considered as a service falling inside the scope of the EEA Agr ...

HERE - Yokwe.net

... Recognition in the Compact that the immigration benefits are derived from the “special and unique” relationship between the United States and the RMI; RMI citizens may use their passports and entry documentation as U.S. work authorization, so that reliance on the one-year “Employment Authorization D ...

... Recognition in the Compact that the immigration benefits are derived from the “special and unique” relationship between the United States and the RMI; RMI citizens may use their passports and entry documentation as U.S. work authorization, so that reliance on the one-year “Employment Authorization D ...

I. Introduction - The University of Akron

... Second, no state can deprive any American citizen of the privileges or immunities of citizenship—which means, for example, that the state cannot deprive a citizen of U.S. citizenship by seceding.12 The Privileges or Immunities Clause explicitly prohibits a state from depriving citizens of their fede ...

... Second, no state can deprive any American citizen of the privileges or immunities of citizenship—which means, for example, that the state cannot deprive a citizen of U.S. citizenship by seceding.12 The Privileges or Immunities Clause explicitly prohibits a state from depriving citizens of their fede ...

abraham lincoln, german-born republicans, and american citizenship

... European Revolutions of 1848. Political refugees such as Schurz ...

... European Revolutions of 1848. Political refugees such as Schurz ...

Constitutionality of Federal Gift Tax

... The court's comments on the retroactive feature of the tax are very brief. It states that Congress has the power to enact retroactive tax legislation and in view of the clear language of the statute and its positive direction there can be no doubt that a gift made any time after January I, 1924, is ...

... The court's comments on the retroactive feature of the tax are very brief. It states that Congress has the power to enact retroactive tax legislation and in view of the clear language of the statute and its positive direction there can be no doubt that a gift made any time after January I, 1924, is ...

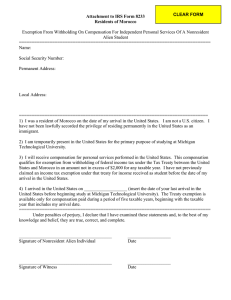

Attachment to IRS Form 8233 Residents of Morocco

... States and Morocco in an amount not in excess of $2,000 for any taxable year. I have not previously claimed an income tax exemption under that treaty for income received as student before the date of my arrival in the United States. 4) I arrived in the United States on ___________________ (insert th ...

... States and Morocco in an amount not in excess of $2,000 for any taxable year. I have not previously claimed an income tax exemption under that treaty for income received as student before the date of my arrival in the United States. 4) I arrived in the United States on ___________________ (insert th ...

How to become a citizen

... States, having been lawfully admitted for permanent residence, for five years immediately preceding the date you filed your application for naturalization, or Have, after having been removed from conditional permanent resident status, based upon your marriage to a U.S. citizen, having resided in the ...

... States, having been lawfully admitted for permanent residence, for five years immediately preceding the date you filed your application for naturalization, or Have, after having been removed from conditional permanent resident status, based upon your marriage to a U.S. citizen, having resided in the ...

1 Rutgers Model Congress Michigan/ Republican House Committee

... of illegal immigration, birthright citizenship would also be able to decrease in conjunction. In the Immigration Reform and Control Act of 1986 (IRCA), Congress granted amnesty to more than three million illegal aliens and sought to curb the flow of illegals by imposing stiff penalties on businesses ...

... of illegal immigration, birthright citizenship would also be able to decrease in conjunction. In the Immigration Reform and Control Act of 1986 (IRCA), Congress granted amnesty to more than three million illegal aliens and sought to curb the flow of illegals by imposing stiff penalties on businesses ...

Taxing and Spending Clause

... Springer v. U.S. (1881) Challenge to temporary income tax during Civil War Question was whether this was direct federal tax, rather than properly apportioned among the states Court unanimously find that prohibition on direct taxes only applied to head taxes & property taxes levied on land ...

... Springer v. U.S. (1881) Challenge to temporary income tax during Civil War Question was whether this was direct federal tax, rather than properly apportioned among the states Court unanimously find that prohibition on direct taxes only applied to head taxes & property taxes levied on land ...

Taxing and Spending Clause

... Springer v. U.S. (1881) Challenge to temporary income tax during Civil War Question was whether this was direct federal tax, rather than properly apportioned among the states Court unanimously find that prohibition on direct taxes only applied to head taxes & property taxes levied on land ...

... Springer v. U.S. (1881) Challenge to temporary income tax during Civil War Question was whether this was direct federal tax, rather than properly apportioned among the states Court unanimously find that prohibition on direct taxes only applied to head taxes & property taxes levied on land ...

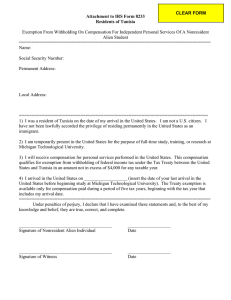

Attachment to IRS Form 8233 Residents of Tunisia

... 2) I am temporarily present in the United States for the purpose of full-time study, training, or research at Michigan Technological University. 3) I will receive compensation for personal services performed in the United States. This compensation qualifies for exemption from withholding of federal ...

... 2) I am temporarily present in the United States for the purpose of full-time study, training, or research at Michigan Technological University. 3) I will receive compensation for personal services performed in the United States. This compensation qualifies for exemption from withholding of federal ...

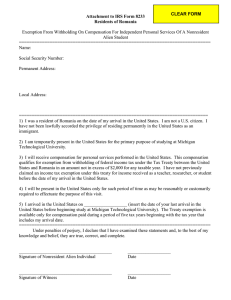

Attachment to IRS Form 8233 Residents of Romania

... 2) I am temporarily present in the United States for the primary purpose of studying at Michigan Technological University. 3) I will receive compensation for personal services performed in the United States. This compensation qualifies for exemption from withholding of federal income tax under the T ...

... 2) I am temporarily present in the United States for the primary purpose of studying at Michigan Technological University. 3) I will receive compensation for personal services performed in the United States. This compensation qualifies for exemption from withholding of federal income tax under the T ...

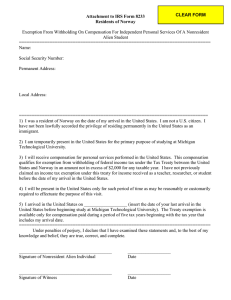

Attachment to IRS Form 8233 Residents of Norway

... 2) I am temporarily present in the United States for the primary purpose of studying at Michigan Technological University. 3) I will receive compensation for personal services performed in the United States. This compensation qualifies for exemption from withholding of federal income tax under the T ...

... 2) I am temporarily present in the United States for the primary purpose of studying at Michigan Technological University. 3) I will receive compensation for personal services performed in the United States. This compensation qualifies for exemption from withholding of federal income tax under the T ...

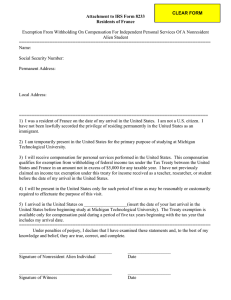

Attachment to IRS Form 8233 Residents of France

... 2) I am temporarily present in the United States for the primary purpose of studying at Michigan Technological University. 3) I will receive compensation for personal services performed in the United States. This compensation qualifies for exemption from withholding of federal income tax under the T ...

... 2) I am temporarily present in the United States for the primary purpose of studying at Michigan Technological University. 3) I will receive compensation for personal services performed in the United States. This compensation qualifies for exemption from withholding of federal income tax under the T ...

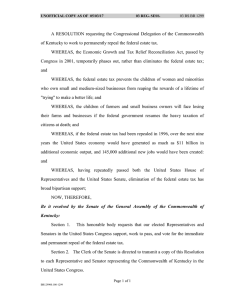

SR 45

... WHEREAS, the Economic Growth and Tax Relief Reconciliation Act, passed by Congress in 2001, temporarily phases out, rather than eliminates the federal estate tax; and WHEREAS, the federal estate tax prevents the children of women and minorities who own small and medium-sized businesses from reaping ...

... WHEREAS, the Economic Growth and Tax Relief Reconciliation Act, passed by Congress in 2001, temporarily phases out, rather than eliminates the federal estate tax; and WHEREAS, the federal estate tax prevents the children of women and minorities who own small and medium-sized businesses from reaping ...

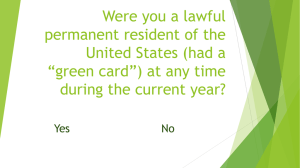

Were you a lawful permanent resident of the United States (had a

... Were you physically present in the United States on at least 183 days during the 3-year period consisting of the current tax year and the preceding 2 years, counting all days of presence in the current tax year, 1/3/ of the days of presence in the first preceding year and 1/6 of the days of presenc ...

... Were you physically present in the United States on at least 183 days during the 3-year period consisting of the current tax year and the preceding 2 years, counting all days of presence in the current tax year, 1/3/ of the days of presence in the first preceding year and 1/6 of the days of presenc ...

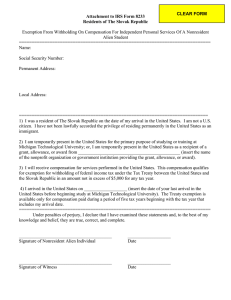

Attachment to IRS Form 8233 Residents of The Slovak Republic

... for exemption for withholding of federal income tax under the Tax Treaty between the United States and the Slovak Republic in an amount not in excess of $5,000 for any tax year. 4) I arrived in the United States on ___________________ (insert the date of your last arrival in the United States before ...

... for exemption for withholding of federal income tax under the Tax Treaty between the United States and the Slovak Republic in an amount not in excess of $5,000 for any tax year. 4) I arrived in the United States on ___________________ (insert the date of your last arrival in the United States before ...

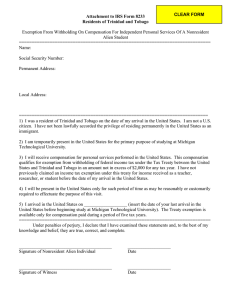

Attachment to IRS Form 8233 Residents of Trinidad and Tobago

... 2) I am temporarily present in the United States for the primary purpose of studying at Michigan Technological University. 3) I will receive compensation for personal services performed in the United States. This compensation qualifies for exemption from withholding of federal income tax under the T ...

... 2) I am temporarily present in the United States for the primary purpose of studying at Michigan Technological University. 3) I will receive compensation for personal services performed in the United States. This compensation qualifies for exemption from withholding of federal income tax under the T ...

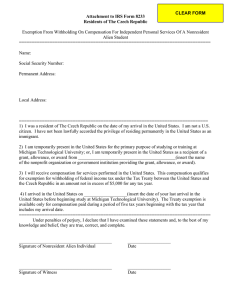

Attachment to IRS Form 8233 Residents of The Czech Republic

... for exemption for withholding of federal income tax under the Tax Treaty between the United States and the Czech Republic in an amount not in excess of $5,000 for any tax year. 4) I arrived in the United States on ___________________(insert the date of your last arrival in the United States before b ...

... for exemption for withholding of federal income tax under the Tax Treaty between the United States and the Czech Republic in an amount not in excess of $5,000 for any tax year. 4) I arrived in the United States on ___________________(insert the date of your last arrival in the United States before b ...

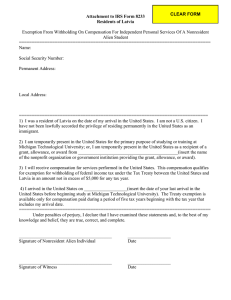

Attachment to IRS Form 8233 Residents of Latvia

... 2) I am temporarily present in the United States for the primary purpose of studying or training at Michigan Technological University; or, I am temporarily present in the United States as a recipient of a grant, allowance, or award from ____________________________________________(insert the name of ...

... 2) I am temporarily present in the United States for the primary purpose of studying or training at Michigan Technological University; or, I am temporarily present in the United States as a recipient of a grant, allowance, or award from ____________________________________________(insert the name of ...