Korea, Norway, Poland, Romania

... I am temporarily present in the United States for the primary purpose of studying at the Portland State University. I will be present in the United States only for such period of time as may be reasonably or customarily required to effectuate the purpose of this visit. I will receive compensation fo ...

... I am temporarily present in the United States for the primary purpose of studying at the Portland State University. I will be present in the United States only for such period of time as may be reasonably or customarily required to effectuate the purpose of this visit. I will receive compensation fo ...

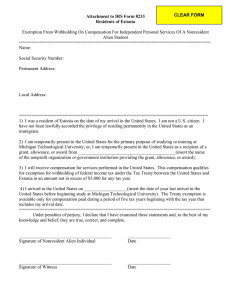

Attachment to IRS Form 8233 Residents of Estonia

... 2) I am temporarily present in the United States for the primary purpose of studying or training at Michigan Technological University; or, I am temporarily present in the United States as a recipient of a grant, allowance, or award from ___________________________________________(insert the name of ...

... 2) I am temporarily present in the United States for the primary purpose of studying or training at Michigan Technological University; or, I am temporarily present in the United States as a recipient of a grant, allowance, or award from ___________________________________________(insert the name of ...

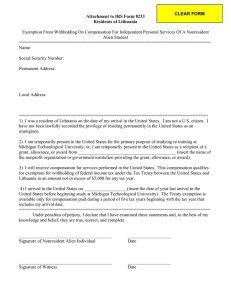

Attachment to IRS Form 8233 Residents of Lithuania

... 2) I am temporarily present in the United States for the primary purpose of studying or training at Michigan Technological University; or, I am temporarily present in the United States as a recipient of a grant, allowance, or award from ___________________________________________ (insert the name of ...

... 2) I am temporarily present in the United States for the primary purpose of studying or training at Michigan Technological University; or, I am temporarily present in the United States as a recipient of a grant, allowance, or award from ___________________________________________ (insert the name of ...

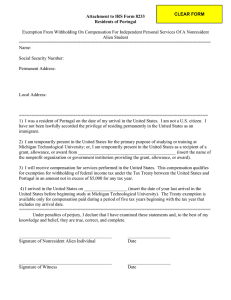

Attachment to IRS Form 8233 Residents of Portugal

... 2) I am temporarily present in the United States for the primary purpose of studying or training at Michigan Technological University; or, I am temporarily present in the United States as a recipient of a grant, allowance, or award from ___________________________________________ (insert the name of ...

... 2) I am temporarily present in the United States for the primary purpose of studying or training at Michigan Technological University; or, I am temporarily present in the United States as a recipient of a grant, allowance, or award from ___________________________________________ (insert the name of ...

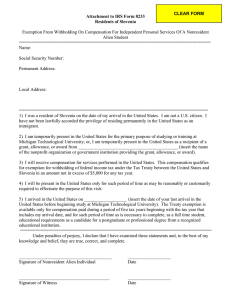

Attachment to IRS Form 8233 Residents of Slovenia

... for exemption for withholding of federal income tax under the Tax Treaty between the United States and Slovenia in an amount not in excess of $5,000 for any tax year. 4) I will be present in the United States only for such period of time as may be reasonably or customarily required to effectuate the ...

... for exemption for withholding of federal income tax under the Tax Treaty between the United States and Slovenia in an amount not in excess of $5,000 for any tax year. 4) I will be present in the United States only for such period of time as may be reasonably or customarily required to effectuate the ...

Attachment to IRS Form 8233 Residents of Venezuela

... for exemption for withholding of federal income tax under the Tax Treaty between the United States and Venezuela in an amount not in excess of $5,000 for any tax year. 4) I will be present in the United States only for such period of time as may be reasonably or customarily required to effectuate th ...

... for exemption for withholding of federal income tax under the Tax Treaty between the United States and Venezuela in an amount not in excess of $5,000 for any tax year. 4) I will be present in the United States only for such period of time as may be reasonably or customarily required to effectuate th ...

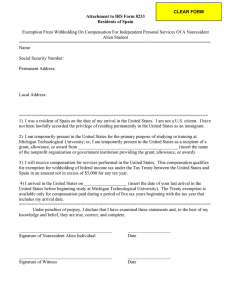

Attachment to IRS Form 8233 Residents of Spain

... 1) I was a resident of Spain on the date of my arrival in the United States. I am not a U.S. citizen. I have not been lawfully accorded the privilege of residing permanently in the United States as an immigrant. 2) I am temporarily present in the United States for the primary purpose of studying or ...

... 1) I was a resident of Spain on the date of my arrival in the United States. I am not a U.S. citizen. I have not been lawfully accorded the privilege of residing permanently in the United States as an immigrant. 2) I am temporarily present in the United States for the primary purpose of studying or ...

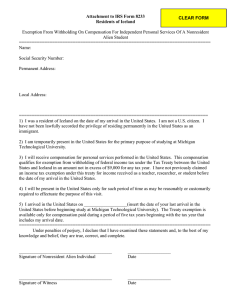

Attachment to IRS Form 8233 Residents of Iceland

... 2) I am temporarily present in the United States for the primary purpose of studying at Michigan Technological University. 3) I will receive compensation for personal services performed in the United States. This compensation qualifies for exemption from withholding of federal income tax under the T ...

... 2) I am temporarily present in the United States for the primary purpose of studying at Michigan Technological University. 3) I will receive compensation for personal services performed in the United States. This compensation qualifies for exemption from withholding of federal income tax under the T ...

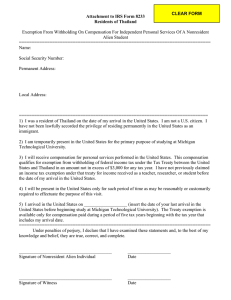

Attachment to IRS Form 8233 Residents of Thailand

... 2) I am temporarily present in the United States for the primary purpose of studying at Michigan Technological University. 3) I will receive compensation for personal services performed in the United States. This compensation qualifies for exemption from withholding of federal income tax under the T ...

... 2) I am temporarily present in the United States for the primary purpose of studying at Michigan Technological University. 3) I will receive compensation for personal services performed in the United States. This compensation qualifies for exemption from withholding of federal income tax under the T ...

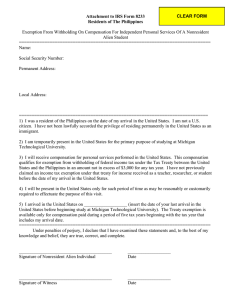

Attachment to IRS Form 8233 Residents of The Philippines

... 2) I am temporarily present in the United States for the primary purpose of studying at Michigan Technological University. 3) I will receive compensation for personal services performed in the United States. This compensation qualifies for exemption from withholding of federal income tax under the T ...

... 2) I am temporarily present in the United States for the primary purpose of studying at Michigan Technological University. 3) I will receive compensation for personal services performed in the United States. This compensation qualifies for exemption from withholding of federal income tax under the T ...

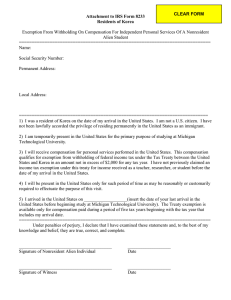

Attachment to IRS Form 8233 Residents of Korea

... 2) I am temporarily present in the United States for the primary purpose of studying at Michigan Technological University. 3) I will receive compensation for personal services performed in the United States. This compensation qualifies for exemption from withholding of federal income tax under the T ...

... 2) I am temporarily present in the United States for the primary purpose of studying at Michigan Technological University. 3) I will receive compensation for personal services performed in the United States. This compensation qualifies for exemption from withholding of federal income tax under the T ...

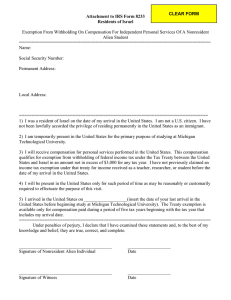

Attachment to IRS Form 8233 Residents of Israel

... 2) I am temporarily present in the United States for the primary purpose of studying at Michigan Technological University. 3) I will receive compensation for personal services performed in the United States. This compensation qualifies for exemption from withholding of federal income tax under the T ...

... 2) I am temporarily present in the United States for the primary purpose of studying at Michigan Technological University. 3) I will receive compensation for personal services performed in the United States. This compensation qualifies for exemption from withholding of federal income tax under the T ...

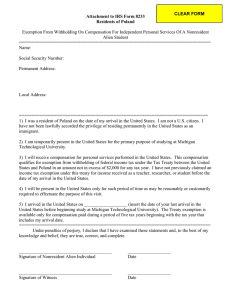

Attachment to IRS Form 8233 Residents of Poland

... 2) I am temporarily present in the United States for the primary purpose of studying at Michigan Technological University. 3) I will receive compensation for personal services performed in the United States. This compensation qualifies for exemption from withholding of federal income tax under the T ...

... 2) I am temporarily present in the United States for the primary purpose of studying at Michigan Technological University. 3) I will receive compensation for personal services performed in the United States. This compensation qualifies for exemption from withholding of federal income tax under the T ...