AMB C R R

... The likelihood that government or bureaucratic inefficiencies, societal tensions, inadequate legal system or international tensions will cause adverse developments for an insurer. Political risk comprises the stability of the government and society, the effectiveness of international diplomatic rela ...

... The likelihood that government or bureaucratic inefficiencies, societal tensions, inadequate legal system or international tensions will cause adverse developments for an insurer. Political risk comprises the stability of the government and society, the effectiveness of international diplomatic rela ...

Risk, Return, and Discount Rates

... – For those who hold more than one asset, is it the risk of each asset they care about, or the risk of their whole portfolio? ...

... – For those who hold more than one asset, is it the risk of each asset they care about, or the risk of their whole portfolio? ...

Paulson`s plan was not a true solution to the crisis

... Given the recent explosion in leverage, the challenge is unlikely to be one of mispricing of the toxic mortgage-backed securities alone. Many people and institutions made leveraged bets that have since gone sour. Their debt cannot be repaid. Creditors are responding accordingly. Now turn to the cri ...

... Given the recent explosion in leverage, the challenge is unlikely to be one of mispricing of the toxic mortgage-backed securities alone. Many people and institutions made leveraged bets that have since gone sour. Their debt cannot be repaid. Creditors are responding accordingly. Now turn to the cri ...

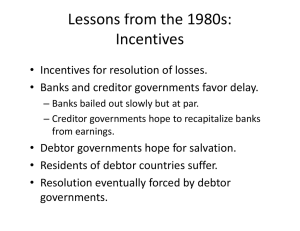

Lessons from the 1980s: Incentives • Incentives for resolution of losses.

... succeed. • Contagion from sovereign to private credit markets. • Arbitrage of country risk. • GDP growth systematically overestimated. • Return to market always next year. ...

... succeed. • Contagion from sovereign to private credit markets. • Arbitrage of country risk. • GDP growth systematically overestimated. • Return to market always next year. ...

PHartmann_Paper1

... payment systems. The literature has very much focused on trade-offs between risk and efficiency, comparing different ways in which the settlement process can be organised in these systems. Pure gross systems, in which each payment is settled independently in real time, would not be subject to contag ...

... payment systems. The literature has very much focused on trade-offs between risk and efficiency, comparing different ways in which the settlement process can be organised in these systems. Pure gross systems, in which each payment is settled independently in real time, would not be subject to contag ...

annual dinner of the chartered institute of bankers

... 13. Distinguished Ladies and Gentlemen, the Ghanaian economy is growing and becoming increasingly complex and high value financial transactions are likely to result in the near future. The economy is also getting integrated into a global economy that is subject to large cross-border capital flows an ...

... 13. Distinguished Ladies and Gentlemen, the Ghanaian economy is growing and becoming increasingly complex and high value financial transactions are likely to result in the near future. The economy is also getting integrated into a global economy that is subject to large cross-border capital flows an ...

France - A.M. Best

... The likelihood that government or bureaucratic inefficiencies, societal tensions, inadequate legal system or international tensions will cause adverse developments for an insurer. Political risk comprises the stability of the government and society, the effectiveness of international diplomatic rela ...

... The likelihood that government or bureaucratic inefficiencies, societal tensions, inadequate legal system or international tensions will cause adverse developments for an insurer. Political risk comprises the stability of the government and society, the effectiveness of international diplomatic rela ...

FREE Sample Here - We can offer most test bank and

... savers of funds, such as households, directly in order to fund their investment projects and fill their borrowing needs. This would be extremely costly because of the up-front information costs faced by potential lenders. These include costs associated with identifying potential borrowers, pooling s ...

... savers of funds, such as households, directly in order to fund their investment projects and fill their borrowing needs. This would be extremely costly because of the up-front information costs faced by potential lenders. These include costs associated with identifying potential borrowers, pooling s ...

From G-SIB to D-SIB

... • For the purposes of microprudential supervision a SIFI can be defined as an institution whose failure would cause its creditors and shareholders to suffer large losses in the form of direct costs. • From a macroprudential perspective, SIFI is a system component that contributes significantly to th ...

... • For the purposes of microprudential supervision a SIFI can be defined as an institution whose failure would cause its creditors and shareholders to suffer large losses in the form of direct costs. • From a macroprudential perspective, SIFI is a system component that contributes significantly to th ...

From G-SIB to D-SIB

... • For the purposes of microprudential supervision a SIFI can be defined as an institution whose failure would cause its creditors and shareholders to suffer large losses in the form of direct costs. • From a macroprudential perspective, SIFI is a system component that contributes significantly to th ...

... • For the purposes of microprudential supervision a SIFI can be defined as an institution whose failure would cause its creditors and shareholders to suffer large losses in the form of direct costs. • From a macroprudential perspective, SIFI is a system component that contributes significantly to th ...

Nicaragua - A.M. Best

... The likelihood that government or bureaucratic inefficiencies, societal tensions, inadequate legal system or international tensions will cause adverse developments for an insurer. Political risk comprises the stability of the government and society, the effectiveness of international diplomatic rela ...

... The likelihood that government or bureaucratic inefficiencies, societal tensions, inadequate legal system or international tensions will cause adverse developments for an insurer. Political risk comprises the stability of the government and society, the effectiveness of international diplomatic rela ...

International Investment

... Relative Size of Emerging Capital Markets (ECM): 1985 $167.7B 1995 $1.9T ...

... Relative Size of Emerging Capital Markets (ECM): 1985 $167.7B 1995 $1.9T ...

slides

... size of rail franchise margins and value for money To outline a framework that public authorities can use to design passenger rail contracts such that the margin required by railway undertakings offers value for money ...

... size of rail franchise margins and value for money To outline a framework that public authorities can use to design passenger rail contracts such that the margin required by railway undertakings offers value for money ...

Lawrence G. McDonald

... Risk Management: 1980s Drexel Burnham / S&L Crisis to 1990s Long Term Capital Management = 10x, LTCM to 2008 Lehman = ...

... Risk Management: 1980s Drexel Burnham / S&L Crisis to 1990s Long Term Capital Management = 10x, LTCM to 2008 Lehman = ...

The Financial Crisis - Wichita State University

... Continuation of Altruism / Pragmatism / Free Lunch mentality will ultimately result in economic disaster: forces in motion to make disaster possible: Social Security deficit, Medicare deficits, government operating deficits, irrational foreign policy: demographics: failed K-12 education system A ...

... Continuation of Altruism / Pragmatism / Free Lunch mentality will ultimately result in economic disaster: forces in motion to make disaster possible: Social Security deficit, Medicare deficits, government operating deficits, irrational foreign policy: demographics: failed K-12 education system A ...

Chapter 6

... βi = index of a securities’ particular return to the factor M = unanticipated movement commonly related to security returns Ei = unexpected event relevant only to this security Assumption: a broad market index like the S&P500 is the common factor ...

... βi = index of a securities’ particular return to the factor M = unanticipated movement commonly related to security returns Ei = unexpected event relevant only to this security Assumption: a broad market index like the S&P500 is the common factor ...

Incorporating Extreme Weather Risks in Asset Management Planning

... Tower Lighting Land Rest Areas Sidewalks Retaining Walls ...

... Tower Lighting Land Rest Areas Sidewalks Retaining Walls ...