Modern Portfolio Theory: Is There Any Opportunity for Real Estate

... or sector allocation should be made upon the differences of geographical and real estate-type (Geurts and Nolan, 1997; Pagliari et. al., 1995). However, the suggestions could not satisfy most of the academics and practitioners. At least this is a good start in order to develop and create a stand-alo ...

... or sector allocation should be made upon the differences of geographical and real estate-type (Geurts and Nolan, 1997; Pagliari et. al., 1995). However, the suggestions could not satisfy most of the academics and practitioners. At least this is a good start in order to develop and create a stand-alo ...

Diapositiva 1 - Working Group on Public Debt

... CaR is used for risk-management purposes in a debt portfolio. This indicator allows assessing the cost-related consequences ...

... CaR is used for risk-management purposes in a debt portfolio. This indicator allows assessing the cost-related consequences ...

NBER WORKING PAPER SERIES OPTIMAL RESERVE MANAGEMENT AND SOVEREIGN DEBT Laura Alfaro

... given. That is, in these models, countries engage in reserve accumulation to seek self-insurance against the potential tightening of international financial constraints rather than income fluctuation per se as in more standard debt models. These models have made important progress in providing an in ...

... given. That is, in these models, countries engage in reserve accumulation to seek self-insurance against the potential tightening of international financial constraints rather than income fluctuation per se as in more standard debt models. These models have made important progress in providing an in ...

Managing biodiversity correctly – Efficient portfolio - Bio

... “Of every clean beast thou shalt take to thee by sevens, the male and his female; and of beasts that are not clean by two, the male and his female, to keep seed alive upon the face of all the earth.”(Genesis 7, 2-3) Similar accounts can be found in other religious texts, for instance in the Koran (c ...

... “Of every clean beast thou shalt take to thee by sevens, the male and his female; and of beasts that are not clean by two, the male and his female, to keep seed alive upon the face of all the earth.”(Genesis 7, 2-3) Similar accounts can be found in other religious texts, for instance in the Koran (c ...

Inequality, stock market participation, and the equity premium

... these models are endowment economies and provide no feedback between returns and investment. In an empirical study, Brav, Constantinides, and Geczy (2002) find that heterogeneity, manifesting itself in the higher moments of the cross-sectional consumption distribution, can explain the equity premium ...

... these models are endowment economies and provide no feedback between returns and investment. In an empirical study, Brav, Constantinides, and Geczy (2002) find that heterogeneity, manifesting itself in the higher moments of the cross-sectional consumption distribution, can explain the equity premium ...

long-term portfolio guide - Responsible Investment Association

... portfolios and mutual funds, with particular focus on public equities. Investments in publicly-traded equities and bonds are the single biggest component in the collective portfolio of institutional investors and many public companies continue to exhibit excessive short-termism, which is often reinf ...

... portfolios and mutual funds, with particular focus on public equities. Investments in publicly-traded equities and bonds are the single biggest component in the collective portfolio of institutional investors and many public companies continue to exhibit excessive short-termism, which is often reinf ...

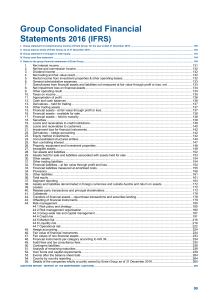

Group Consolidated Financial Statements 2016 (IFRS)

... 23. Equity method investments.................................................................................................................................................... 142 24. Unconsolidated structured entities ............................................................................ ...

... 23. Equity method investments.................................................................................................................................................... 142 24. Unconsolidated structured entities ............................................................................ ...

Une nouvelle approche des relations entre la gouvernance d

... the size of the firm has a significant effect on the relationship between CSR and CFP. They claim that large companies are more likely to engage in CSR initiatives than are small companies. Intangible assets play also a role. For Surroca et al. (2010), intangible assets moderate the relationship bet ...

... the size of the firm has a significant effect on the relationship between CSR and CFP. They claim that large companies are more likely to engage in CSR initiatives than are small companies. Intangible assets play also a role. For Surroca et al. (2010), intangible assets moderate the relationship bet ...

The Causes of Fraud in Financial Crises: Evidence

... to securities issuers who bundle them together into MBSs. Issuers register and sell MBSs and are responsible for their legal compliance. The sale of MBSs also involves the services of an underwriter, usually an investment bank, who works closely with the issuer to price and market MBSs to investors. ...

... to securities issuers who bundle them together into MBSs. Issuers register and sell MBSs and are responsible for their legal compliance. The sale of MBSs also involves the services of an underwriter, usually an investment bank, who works closely with the issuer to price and market MBSs to investors. ...

Government Debt and Risk Premia - Penn Economics

... model (Romer, 1990).4 The long run risks are purely driven by productivity shocks in Kung and Schmid (2015), whereas part of the long run risks rise from tax policy in my model. Croce et al. (2012) demonstrate a sizable tax risk premium in a model with capital structure choice where tax rate drives ...

... model (Romer, 1990).4 The long run risks are purely driven by productivity shocks in Kung and Schmid (2015), whereas part of the long run risks rise from tax policy in my model. Croce et al. (2012) demonstrate a sizable tax risk premium in a model with capital structure choice where tax rate drives ...

Expected Returns on Major Asset Classes

... and firm-specific growth, and to liquidity and volatility developments (credits tend to underperform when liquidity conditions deteriorate or market volatility rises). A factor-based approach is also useful for thinking about the primary function of each asset class in a portfolio (stocks for harves ...

... and firm-specific growth, and to liquidity and volatility developments (credits tend to underperform when liquidity conditions deteriorate or market volatility rises). A factor-based approach is also useful for thinking about the primary function of each asset class in a portfolio (stocks for harves ...

Problems and Reforms in Mortgage

... A. Case Study: Lehman Brothers Inc. Dale George, a former Washington Mutual senior risk manager, correctly described the gatekeepers’ role by comparing them to “brakes that prevent the car from going over a cliff.”22 Lehman Brothers is an example of a company that went “over a cliff” after its execu ...

... A. Case Study: Lehman Brothers Inc. Dale George, a former Washington Mutual senior risk manager, correctly described the gatekeepers’ role by comparing them to “brakes that prevent the car from going over a cliff.”22 Lehman Brothers is an example of a company that went “over a cliff” after its execu ...

A Small Open Economy Model with Sovereign

... the model successfully captures the declines in output, consumption and investment that are actually associated with these episodes. Net exports and sovereign spreads are countercyclical because in the model the risk of default increases when the economy is either more indebted or transiting through ...

... the model successfully captures the declines in output, consumption and investment that are actually associated with these episodes. Net exports and sovereign spreads are countercyclical because in the model the risk of default increases when the economy is either more indebted or transiting through ...

NBER VOLUNTARY WELFARE RESEARCH

... international capital mobility and in the presence of high risk aversion in the debtor country the banks cannot gain from a voluntary write-down of This result is independent of the degree of cooperation among them. ...

... international capital mobility and in the presence of high risk aversion in the debtor country the banks cannot gain from a voluntary write-down of This result is independent of the degree of cooperation among them. ...

Singapore Pilot paper (SGP)

... rate volatility can undermine confidence in cash flow projections, it should also be borne in mind that medium term increases or decreases in exchange values can materially affect the returns on an investment (in this case, Chemco’s investment in JPX). There is some market risk in Chemco’s valuation ...

... rate volatility can undermine confidence in cash flow projections, it should also be borne in mind that medium term increases or decreases in exchange values can materially affect the returns on an investment (in this case, Chemco’s investment in JPX). There is some market risk in Chemco’s valuation ...

Title of presentation

... UK vs. US: equalizing gross yields, UK consumer platforms appear to generate better returns • Anecdotally, UK offers better risk reward than US: Comparing Zopa loans of equal gross yield (USD swapped) to Lending Club ‘A grade’ and ‘B grade’ loans shows that equivalent Zopa loans yields an extra 0.4- ...

... UK vs. US: equalizing gross yields, UK consumer platforms appear to generate better returns • Anecdotally, UK offers better risk reward than US: Comparing Zopa loans of equal gross yield (USD swapped) to Lending Club ‘A grade’ and ‘B grade’ loans shows that equivalent Zopa loans yields an extra 0.4- ...

Short Guide to Impact Investing

... Entrepreneur in Residence at the Case Foundation. In this role he supported the Foundation’s efforts to identify new approaches to inspire, educate and mobilize capital in the impact investing space. Greene currently serves as a Managing Director at Siguler Guff, a multistrategy private equity firm, ...

... Entrepreneur in Residence at the Case Foundation. In this role he supported the Foundation’s efforts to identify new approaches to inspire, educate and mobilize capital in the impact investing space. Greene currently serves as a Managing Director at Siguler Guff, a multistrategy private equity firm, ...

Equity Management

... value of member stock in any year in which the firm showed a loss. Unallocated equity is also sometimes referred to as permanent capital since it does not have to be redeemed. One advantage of retaining profits in the form of unallocated equity is that it does not create additional pressures for equ ...

... value of member stock in any year in which the firm showed a loss. Unallocated equity is also sometimes referred to as permanent capital since it does not have to be redeemed. One advantage of retaining profits in the form of unallocated equity is that it does not create additional pressures for equ ...

The pricing of volatility risk across asset classes

... innovations of US equities over a long sample period. We find that the (unbalanced) panel of univariate volatility innovations is well described by a simple factor structure. Moreover, the principal factor is highly correlated with the various market index volatility innovations, although substanti ...

... innovations of US equities over a long sample period. We find that the (unbalanced) panel of univariate volatility innovations is well described by a simple factor structure. Moreover, the principal factor is highly correlated with the various market index volatility innovations, although substanti ...