Insurance Company Insolvency: Are You Protected?

... regards to their reserves similar to those for banks issued by the Federal Deposit Insurance Corp (FDIC). If these solutions do not solve the insurer’s problems and it can no longer pay policyholder claims, the state of domicile’s insurance department takes over. It will either place the policies wi ...

... regards to their reserves similar to those for banks issued by the Federal Deposit Insurance Corp (FDIC). If these solutions do not solve the insurer’s problems and it can no longer pay policyholder claims, the state of domicile’s insurance department takes over. It will either place the policies wi ...

1 Introduction 2 Analytical Framework

... A solution of this problem defines an equal investment level for each firm (I = K − (1 − δ)K0 ) and an equal firm-specific interest rate (r) and an equal default threshold (ε̄). Note that NI = I is also the total credit taken by all firms. The excess of this amount over national saving comprises the ...

... A solution of this problem defines an equal investment level for each firm (I = K − (1 − δ)K0 ) and an equal firm-specific interest rate (r) and an equal default threshold (ε̄). Note that NI = I is also the total credit taken by all firms. The excess of this amount over national saving comprises the ...

Assessing financial stability in Poland Grzegorz Bielicki

... yields on treasury bills & bonds, and corporate commercial papers & bonds debt and loan burden ratio (liabilities or loans /total assets) equity market indexes investment funds ...

... yields on treasury bills & bonds, and corporate commercial papers & bonds debt and loan burden ratio (liabilities or loans /total assets) equity market indexes investment funds ...

Section 1, Mean variance analysis 1 Risk and return

... first was mean variance analysis as a way to allocate assets in a world of risk and return. The investor was assumed to know the risks and the returns of all available investments, but his or her choices were assumed not effect the market, neither prices nor uncertainties in returns. The second part ...

... first was mean variance analysis as a way to allocate assets in a world of risk and return. The investor was assumed to know the risks and the returns of all available investments, but his or her choices were assumed not effect the market, neither prices nor uncertainties in returns. The second part ...

MODUL 1

... which assumes that people behave selfishly. Certainly, much economic analysis is concerned with how individuals behave, and homo economicus (economic man) is usually assumed to act in his or her self-interest. However, self-interest does not necessarily mean selfish. Some economic models in the fiel ...

... which assumes that people behave selfishly. Certainly, much economic analysis is concerned with how individuals behave, and homo economicus (economic man) is usually assumed to act in his or her self-interest. However, self-interest does not necessarily mean selfish. Some economic models in the fiel ...

issue of PNAS the results of her research

... ment. You have a Catch 22 situation. There’s an old saying that “When anyone can borrow, no one will default,” and I think that’s a pretty good description of what we’ve been through in the last few years. I guess that’s the flip side of a bank always being willing to give you a loan—unless you rea ...

... ment. You have a Catch 22 situation. There’s an old saying that “When anyone can borrow, no one will default,” and I think that’s a pretty good description of what we’ve been through in the last few years. I guess that’s the flip side of a bank always being willing to give you a loan—unless you rea ...

NEST Higher Risk Fund

... We believe that responsible, well-run companies offer superior long-term value to investors. We exercise the voting rights that come with share ownership to protect the interests of our savers. ...

... We believe that responsible, well-run companies offer superior long-term value to investors. We exercise the voting rights that come with share ownership to protect the interests of our savers. ...

Taking Stock: What Ever Happened to the "Invisible Hand"?

... hand would want to move to safety such as cash. b. The non-producing or welfare economy – Can the working population and corporate community continue to be able to pay for benefits to the non-producing? Can our burgeoning welfare state still last into perpetuity and be supported by current levels o ...

... hand would want to move to safety such as cash. b. The non-producing or welfare economy – Can the working population and corporate community continue to be able to pay for benefits to the non-producing? Can our burgeoning welfare state still last into perpetuity and be supported by current levels o ...

structured return for all market conditions

... capitalise(s) on making money, even more so in volatile conditions” “Equity markets may be unpredictable, but they are behaving as they always do. It is the bond market that is particularly difficult for investors right now. They want to know how they can generate returns from their low-risk allocat ...

... capitalise(s) on making money, even more so in volatile conditions” “Equity markets may be unpredictable, but they are behaving as they always do. It is the bond market that is particularly difficult for investors right now. They want to know how they can generate returns from their low-risk allocat ...

Financial markets: Productivity, procyclicality, and policy

... Bekaert, G., Harvey, C., and C. Lundblad, 2005. Does financial liberalization spur growth? Journal of Financial Economics 77, 3-55. ...

... Bekaert, G., Harvey, C., and C. Lundblad, 2005. Does financial liberalization spur growth? Journal of Financial Economics 77, 3-55. ...

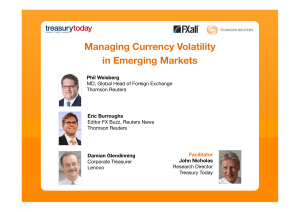

Managing Currency Volatility in Emerging Markets

... It may be necessary to consider different alternatives …. And don’t forget to communicate: • Currency gains come from good management by the business • Currency losses are the fault of the treasurer ...

... It may be necessary to consider different alternatives …. And don’t forget to communicate: • Currency gains come from good management by the business • Currency losses are the fault of the treasurer ...

The Argentine Banking and Exchange rate crisis of 2001: Can

... at the financial system. These dollar denominated deposits funded credit to the private sector, mainly in dollars. Once a devaluation was perceived as highly probable, depositors realized that banks would become insolvent because most of their borrowers would be unable to repay their dollar denomina ...

... at the financial system. These dollar denominated deposits funded credit to the private sector, mainly in dollars. Once a devaluation was perceived as highly probable, depositors realized that banks would become insolvent because most of their borrowers would be unable to repay their dollar denomina ...

Optimum Bank Equity Capital and Value at Risk

... In our model of a banking firm, a risk averse bank management which has to decide on the bank’s business policy regarding assets and liabilities acts in a competitive financial market (For an excellent discussion of bank management see Greenbaum/Thakor 1995, and for modelling a banking firm see, e.g ...

... In our model of a banking firm, a risk averse bank management which has to decide on the bank’s business policy regarding assets and liabilities acts in a competitive financial market (For an excellent discussion of bank management see Greenbaum/Thakor 1995, and for modelling a banking firm see, e.g ...

24765 Match financial products and/or services to customer

... New Zealand Bill of Rights Act 1990; Commerce Act 1986; Companies Act 1993; Consumer Guarantees Act 1993; Credit Contracts and Consumer Finance Act 2003; Electronic Transactions Act 2002; Fair Trading Act 1986; Financial Reporting Act 1993; Financial Transactions Reporting Act 1996; Health and Safet ...

... New Zealand Bill of Rights Act 1990; Commerce Act 1986; Companies Act 1993; Consumer Guarantees Act 1993; Credit Contracts and Consumer Finance Act 2003; Electronic Transactions Act 2002; Fair Trading Act 1986; Financial Reporting Act 1993; Financial Transactions Reporting Act 1996; Health and Safet ...

Vietnam

... Over the last decade, Vietnam has made important strides in building resilience to natural hazards. In 2007, the government approved the National Strategy for Natural Disaster Prevention, Response and Mitigation Towards 2020. Two years later, the government approved the implementation plan, and in 2 ...

... Over the last decade, Vietnam has made important strides in building resilience to natural hazards. In 2007, the government approved the National Strategy for Natural Disaster Prevention, Response and Mitigation Towards 2020. Two years later, the government approved the implementation plan, and in 2 ...

M.Sc. ACTUARIAL SCIENCE

... courses and must score a minimum CGPA of 1.50 or an overall grade of C and above. Each course is evaluated by assigning a letter grade (A, B, C, D or E) to that course by the method of direct grading. The internal ( weightage =1) and external ( weightage =3) components of a course are separately gra ...

... courses and must score a minimum CGPA of 1.50 or an overall grade of C and above. Each course is evaluated by assigning a letter grade (A, B, C, D or E) to that course by the method of direct grading. The internal ( weightage =1) and external ( weightage =3) components of a course are separately gra ...

Chapter 14 Capital requirements for settlement and counterparty risk

... ■ BIPRU 14 in accordance with the IRB approach, then for the purposes of the calculation provided for in ■ BIPRU 4.3.8 R, the following will apply: (1) value adjustments made to take account of the credit quality of the counterparty may be included in the sum of value adjustments and provisions made ...

... ■ BIPRU 14 in accordance with the IRB approach, then for the purposes of the calculation provided for in ■ BIPRU 4.3.8 R, the following will apply: (1) value adjustments made to take account of the credit quality of the counterparty may be included in the sum of value adjustments and provisions made ...