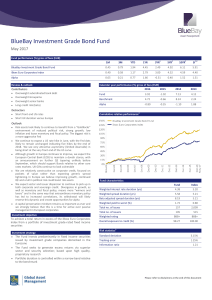

BlueBay Investment Grade Bond Fund

... 3. Risk statistics are annualized and calculated using weekly data points since inception. Risk statistics will be produced once there are 3 complete months of data available; for meaningful results a minimum sample of 36 data points is recommended and where history is less than 3 years caution shou ...

... 3. Risk statistics are annualized and calculated using weekly data points since inception. Risk statistics will be produced once there are 3 complete months of data available; for meaningful results a minimum sample of 36 data points is recommended and where history is less than 3 years caution shou ...

Life business shifts toward less interest- sensitive products

... Returning to regulation, Solvency II is not the only item on insurers’ agendas. The IASB’s implementation target of 2018 for IFRS 9 may be a long way off, but firms should be aware that IFRS 4 Phase II accounting for insurance contracts may be introduced on this date too. By midsummer, the Financial ...

... Returning to regulation, Solvency II is not the only item on insurers’ agendas. The IASB’s implementation target of 2018 for IFRS 9 may be a long way off, but firms should be aware that IFRS 4 Phase II accounting for insurance contracts may be introduced on this date too. By midsummer, the Financial ...

Seasonality in Value vs. Growth Stock Returns

... Journal of Financial Economics 12, 1332. Koogler, P., and E. Maberly, 1994, Additional Evidence of YearEnd Motivated Trading by Individual Investors, 19621986, Journal of the American Taxation Association 16, 122137. La Porta, R., J. Lakonishok, A. Schleifer, and R. W. Vishny, 1997, Good New ...

... Journal of Financial Economics 12, 1332. Koogler, P., and E. Maberly, 1994, Additional Evidence of YearEnd Motivated Trading by Individual Investors, 19621986, Journal of the American Taxation Association 16, 122137. La Porta, R., J. Lakonishok, A. Schleifer, and R. W. Vishny, 1997, Good New ...

IOSR Journal of Economics and Finance (IOSR-JEF)

... recession and its effects are quite devastating. Financial crises are usually unfortunate part of the global industryand according to bankers as well as financiers, who are into small or large businesses, thesecrises are actually unavoidable. Many financialcrises have occurred in last 30 years that ...

... recession and its effects are quite devastating. Financial crises are usually unfortunate part of the global industryand according to bankers as well as financiers, who are into small or large businesses, thesecrises are actually unavoidable. Many financialcrises have occurred in last 30 years that ...

Debt Equity Ratio - Sa-Dhan

... a safety cushion (in the from of equity) there is in the institution to absorb losses. Traditionally, MFIs have had low debt to equity ratios, because as NGOs their ability to borrow from commercial lenders was limited. As MFIs reconstitute themselves as regulated intermediaries, however, DER will p ...

... a safety cushion (in the from of equity) there is in the institution to absorb losses. Traditionally, MFIs have had low debt to equity ratios, because as NGOs their ability to borrow from commercial lenders was limited. As MFIs reconstitute themselves as regulated intermediaries, however, DER will p ...

Risk in emerging markets

... Can this performance be replicated in the coming decade? Overall, we remain optimistic about the future of the emerging-market banks, yet we also believe that they will need to adapt rapidly to a different environment. While overall growth rates are likely to slow in many markets, relatively low pen ...

... Can this performance be replicated in the coming decade? Overall, we remain optimistic about the future of the emerging-market banks, yet we also believe that they will need to adapt rapidly to a different environment. While overall growth rates are likely to slow in many markets, relatively low pen ...

file

... a) A bond that is convertible into equity instruments of the issuer; and b) A loan that pays an inverse floating interest rate (e.g. 8% minus ...

... a) A bond that is convertible into equity instruments of the issuer; and b) A loan that pays an inverse floating interest rate (e.g. 8% minus ...

Portfolio Update

... believe, important diversification from the opportunities available in the debt-burdened if liquid developed markets, with their latent risks of the Scylla and Charybdis of inflation and taxes eroding their ultimate real value. Both hold the attraction for us of being something of blind spots for in ...

... believe, important diversification from the opportunities available in the debt-burdened if liquid developed markets, with their latent risks of the Scylla and Charybdis of inflation and taxes eroding their ultimate real value. Both hold the attraction for us of being something of blind spots for in ...

Tough times continue for Singapore oil rig builders

... The bond was six times oversubscribed and the sale was managed without the help of traditional US brokers. Many large investment banks avoided the deal after warnings that the debt placement could violate international sanctions imposed on Russia two years ago. Demand for Russia’s high yielding debt ...

... The bond was six times oversubscribed and the sale was managed without the help of traditional US brokers. Many large investment banks avoided the deal after warnings that the debt placement could violate international sanctions imposed on Russia two years ago. Demand for Russia’s high yielding debt ...

How to Invest for Income in a Low Interest Rate

... Assuming the risk can be assessed accurately then the issue becomes one of risk tolerance. This is a very important word, because for decades everyone used to focus on risk attitude. The reality is that the investor’s attitude to risk is not especially important (from a financial planning viewpoint) ...

... Assuming the risk can be assessed accurately then the issue becomes one of risk tolerance. This is a very important word, because for decades everyone used to focus on risk attitude. The reality is that the investor’s attitude to risk is not especially important (from a financial planning viewpoint) ...

The impact of low interest rates on insurers and banks

... Darpeix et al. (2015): Comparison between Germany and France According to data from Darpeix et al. (2015), the French insurance market has not experienced such a rise in the asset duration, but a minor increase of 3.6% between 2013 and 2014 This could reflect the presence of structural differenc ...

... Darpeix et al. (2015): Comparison between Germany and France According to data from Darpeix et al. (2015), the French insurance market has not experienced such a rise in the asset duration, but a minor increase of 3.6% between 2013 and 2014 This could reflect the presence of structural differenc ...

Australian Financial Markets: Looking Back and Looking Ahead

... What has been the impact of this on financial markets and the financial system more generally? It is not possible to answer this question with precision, of course, because the impact of deregulation cannot be disentangled from the other forces at work, such as technological change and economic deve ...

... What has been the impact of this on financial markets and the financial system more generally? It is not possible to answer this question with precision, of course, because the impact of deregulation cannot be disentangled from the other forces at work, such as technological change and economic deve ...

Disclosure on Market Discipline as required under Pillar III of Basel

... Bank also has established separate Credit Risk Management Services which looks after Loan Review Mechanism and also helps in ensuring credit compliance with the post-sanction processes/ procedures laid down by the Bank from time to time. Bank has in place a risk grading system for analyzing the risk ...

... Bank also has established separate Credit Risk Management Services which looks after Loan Review Mechanism and also helps in ensuring credit compliance with the post-sanction processes/ procedures laid down by the Bank from time to time. Bank has in place a risk grading system for analyzing the risk ...

NBER WORKING PAPER SERIES SYSTEMIC RISKS AND THE MACROECONOMY Gianni De Nicolò

... key drivers of systemic financial risk and its two-way relationship with real activity. We believe that to accomplish these goals, at least two requirements need to be met. First, measures of systemic risk need to be associated with the potential for undesirable welfare consequences, such as extreme ...

... key drivers of systemic financial risk and its two-way relationship with real activity. We believe that to accomplish these goals, at least two requirements need to be met. First, measures of systemic risk need to be associated with the potential for undesirable welfare consequences, such as extreme ...

your financial future - Sovereign Investment Group LLC

... Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values and yields will decline as interest rates rise, and bonds are subject to availability and change in price. Government bonds and Treasury bills are guaranteed by the U.S. government as to the timely payment of p ...

... Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values and yields will decline as interest rates rise, and bonds are subject to availability and change in price. Government bonds and Treasury bills are guaranteed by the U.S. government as to the timely payment of p ...

Attitude to Risk: Question Text 1. I would enjoy exploring investment

... Low end of sacrifice some long term protection for the likelihood of greater returns. Moderate to Adventurous A typical Moderate to Adventurous investor will be invested mainly in equities but with other assets included to provide some diversification. There may be a small amount of specialised equi ...

... Low end of sacrifice some long term protection for the likelihood of greater returns. Moderate to Adventurous A typical Moderate to Adventurous investor will be invested mainly in equities but with other assets included to provide some diversification. There may be a small amount of specialised equi ...

Financial Sector Regulation in Developing Countries: Reckoning after the crisis

... systems, that means the destination is no longer clear and will not be for some time. That anchor has been removed and will not be replaced until a new system is in place and has functioned for long enough to earn confidence.” (Growth Commission, 2010, p. 25) Since the early 1980s an increasing numb ...

... systems, that means the destination is no longer clear and will not be for some time. That anchor has been removed and will not be replaced until a new system is in place and has functioned for long enough to earn confidence.” (Growth Commission, 2010, p. 25) Since the early 1980s an increasing numb ...

wealth matters.

... Have you heard the saying, “If you don’t know where you’re going, how do you expect to get there?” It is a simple but true statement when it comes to financial planning. Few American households have a comprehensive plan in place that will map out their long term financial goals. In some instances, c ...

... Have you heard the saying, “If you don’t know where you’re going, how do you expect to get there?” It is a simple but true statement when it comes to financial planning. Few American households have a comprehensive plan in place that will map out their long term financial goals. In some instances, c ...