Comparative Financial Statements

... On December 31, 2011, WER Productions reported $100,000 of contributed capital and $20,000 of retained earnings. During 2012, the company had the following transactions. Prepare a statement of stockholders’ equity for the year ended December 31, 2012. a. Issued stock for $50,000. b. Declared and pai ...

... On December 31, 2011, WER Productions reported $100,000 of contributed capital and $20,000 of retained earnings. During 2012, the company had the following transactions. Prepare a statement of stockholders’ equity for the year ended December 31, 2012. a. Issued stock for $50,000. b. Declared and pai ...

Annex 7

... position within its trading book; 20.7. the extent to which the institution may transfer risk or positions between the non–trading and trading books and the criteria for such transfers. 21. An institution shall be entitled to include in the trading book positions the shares or the debt instruments w ...

... position within its trading book; 20.7. the extent to which the institution may transfer risk or positions between the non–trading and trading books and the criteria for such transfers. 21. An institution shall be entitled to include in the trading book positions the shares or the debt instruments w ...

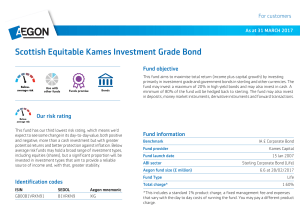

Scottish Equitable Kames Investment Grade Bond

... solution. Most funds in this category only invest in one type of investment, one region or country or one type of company, for example, technology. This increases the risk to you if this is your only investment. That's why it's best used in combination with other funds or types of investment so you' ...

... solution. Most funds in this category only invest in one type of investment, one region or country or one type of company, for example, technology. This increases the risk to you if this is your only investment. That's why it's best used in combination with other funds or types of investment so you' ...

ICAS 2015 Template

... autocorrelation in errors (m2 test). As a rule of thumb in GMM estimation, the number of instruments used should not exceeds the number of groups of cross section units, i.e., the number of banks in the research. This issue is also being under consideration during the GMM estimation. ...

... autocorrelation in errors (m2 test). As a rule of thumb in GMM estimation, the number of instruments used should not exceeds the number of groups of cross section units, i.e., the number of banks in the research. This issue is also being under consideration during the GMM estimation. ...

Managing global finance as a system

... So connected systems tend simultaneously to be both stable and unstable, calm and turbulent, robust-yet-fragile (Acemoglu et al (2013), Gai and Kapadia (2010)). In other words, integration can be double-edged. It generates a world with instances of more frequent and/or larger dislocations. In short, ...

... So connected systems tend simultaneously to be both stable and unstable, calm and turbulent, robust-yet-fragile (Acemoglu et al (2013), Gai and Kapadia (2010)). In other words, integration can be double-edged. It generates a world with instances of more frequent and/or larger dislocations. In short, ...

Public Enterprise Finance: Towards a Synthesis Jenkins

... are viewed as coming from a single pool of social resources with a single opportunity cost, and all ...

... are viewed as coming from a single pool of social resources with a single opportunity cost, and all ...

Dissecting the `MAC` Universe Multi-Asset Credit

... Returns over the last three and five years (investment cycle) to September 2015, have been generally positive for most fixed income sectors. As a result, all strategies analysed delivered positive returns over the period, meeting the objectives of the strategy. It is interesting to note that there i ...

... Returns over the last three and five years (investment cycle) to September 2015, have been generally positive for most fixed income sectors. As a result, all strategies analysed delivered positive returns over the period, meeting the objectives of the strategy. It is interesting to note that there i ...

Disruption in the Capital Markets: What Happened? Joseph P. Forte

... their transactions. The purchaser’s acquisition financing must be in place before the merger process proceeds with the seller. Many of the commitments had CMBS financing components. Over the last several months, the $330 Billion in outstanding leverage finance commitments held by the banks have begu ...

... their transactions. The purchaser’s acquisition financing must be in place before the merger process proceeds with the seller. Many of the commitments had CMBS financing components. Over the last several months, the $330 Billion in outstanding leverage finance commitments held by the banks have begu ...

Focus on Risk Adjusted Returns

... Given the option to add hedge funds to your portfolio, investors should be aware of the particular risk and return benefits to assess when analysing them. “Hedge funds are less constrained than long only investment products and incorporate additional investment strategies such as gearing, scrip borr ...

... Given the option to add hedge funds to your portfolio, investors should be aware of the particular risk and return benefits to assess when analysing them. “Hedge funds are less constrained than long only investment products and incorporate additional investment strategies such as gearing, scrip borr ...

Chapter 13

... effect of interest-rate changes, it does not include the effects of customer behavior. This additional interest-rate risk is captured by showing the effective maturity. For example, the effective maturity for a mortgage includes the expected ...

... effect of interest-rate changes, it does not include the effects of customer behavior. This additional interest-rate risk is captured by showing the effective maturity. For example, the effective maturity for a mortgage includes the expected ...

client investment profile - Davis Financial Management

... appreciation, with the primary consideration being preservation of capital and current income. Some income will be withdrawn. E.g., I want the portfolio to produce income, but also provide enough principal growth so the income will keep pace, or outpace, inflation over a long-time horizon. ...

... appreciation, with the primary consideration being preservation of capital and current income. Some income will be withdrawn. E.g., I want the portfolio to produce income, but also provide enough principal growth so the income will keep pace, or outpace, inflation over a long-time horizon. ...

This PDF is a selection from a published volume from... of Economic Research Volume Title: NBER International Seminar on Macroeconomics 2012

... determination. It also outlines interesting avenues of further research. There are three issues for further research that are worth mentioning in this discussion, but that I will not discuss in detail: First, for further research it would be desirable to examine the relative importance of the differ ...

... determination. It also outlines interesting avenues of further research. There are three issues for further research that are worth mentioning in this discussion, but that I will not discuss in detail: First, for further research it would be desirable to examine the relative importance of the differ ...

Key investor information.

... category is not fixed and may shift over time. The lowest category does not mean a risk-free investment. Equity funds in general are more volatile than bond funds. Equity funds with a focus on small and midcap listed companies are more volatile as price movements of shares within this category tend ...

... category is not fixed and may shift over time. The lowest category does not mean a risk-free investment. Equity funds in general are more volatile than bond funds. Equity funds with a focus on small and midcap listed companies are more volatile as price movements of shares within this category tend ...

chapter 5 - BYU Marriott School

... and standard deviation fall, it is not yet clear whether the move is beneficial. The disadvantage of the shift is apparent from the fact that, if my client is willing to accept an expected return on his total portfolio of 11.2%, he can achieve that return with a lower standard deviation using my fun ...

... and standard deviation fall, it is not yet clear whether the move is beneficial. The disadvantage of the shift is apparent from the fact that, if my client is willing to accept an expected return on his total portfolio of 11.2%, he can achieve that return with a lower standard deviation using my fun ...

The Market of Financial Services: Segmentation and Targeting

... single financial service to several segments Only small modifications are made to the financial service, in order to comply with the requirements of the different segments It is a high risk strategy, in view of the short life cycles for many financial services in today’s turbulent environment It is ...

... single financial service to several segments Only small modifications are made to the financial service, in order to comply with the requirements of the different segments It is a high risk strategy, in view of the short life cycles for many financial services in today’s turbulent environment It is ...

What are GSE Credit Risk Transfer securities?

... or sell any security or instrument or to participate in any trading strategy to any person in any jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it would be unlawful to market such an offer or solicitation. It does not form part of any prospectus. Whil ...

... or sell any security or instrument or to participate in any trading strategy to any person in any jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it would be unlawful to market such an offer or solicitation. It does not form part of any prospectus. Whil ...

Janet L Yellen: Improving the oversight of large financial institutions

... adequacy of large firms. 9 The Fed also looks at other aspects of large banks’ capital planning, such as their risk management, internal controls, and governance. If the Federal Reserve is not satisfied with the results from capital stress tests or identifies shortcomings in a firm’s capital plannin ...

... adequacy of large firms. 9 The Fed also looks at other aspects of large banks’ capital planning, such as their risk management, internal controls, and governance. If the Federal Reserve is not satisfied with the results from capital stress tests or identifies shortcomings in a firm’s capital plannin ...

DNB applies new oversight standards from 2013

... rendering services to one or more financial market infrastructures critical to their adequate performance . An example is SWIFT, which processes worldwide message flows for a large number of FMIs. These five "oversight expectations" have been used in the oversight on SWIFT for several years now. ...

... rendering services to one or more financial market infrastructures critical to their adequate performance . An example is SWIFT, which processes worldwide message flows for a large number of FMIs. These five "oversight expectations" have been used in the oversight on SWIFT for several years now. ...

fulga

... empirical evidence indicates that the random variable considered cannot be well approximated by normal distribution or in the case when we are not able to make distributional assumptions. Historical simulation method calculates the hypothetical value of a change in the current portfolio depending on ...

... empirical evidence indicates that the random variable considered cannot be well approximated by normal distribution or in the case when we are not able to make distributional assumptions. Historical simulation method calculates the hypothetical value of a change in the current portfolio depending on ...

IFRS Week Financial Instruments Presentation and

... A financial instrument may require the entity to deliver cash or another financial asset, or otherwise to settle it in such a way that it would be a financial liability, in the event of the occurrence or non-occurrence of uncertain future events (or on the outcome of uncertain circumstances) that ...

... A financial instrument may require the entity to deliver cash or another financial asset, or otherwise to settle it in such a way that it would be a financial liability, in the event of the occurrence or non-occurrence of uncertain future events (or on the outcome of uncertain circumstances) that ...

Document

... Key message – Geo political risk lowered This is why market has been so strong since the 2006 Lebanon War ...

... Key message – Geo political risk lowered This is why market has been so strong since the 2006 Lebanon War ...