Corporate Finance: Modigliani and Miller

... yield a higher returns and must be better Since firms are in the same industry, their risks are presumably the same What is ignored is financial risk: leverage raises EPS but not prices so it raises EPS-price ratios even of values are the same ...

... yield a higher returns and must be better Since firms are in the same industry, their risks are presumably the same What is ignored is financial risk: leverage raises EPS but not prices so it raises EPS-price ratios even of values are the same ...

МЕЖДИНЕН ДОКЛАД ЗА ДЕЙНОСТТА НА „СВИЛОЗА” АД

... transparency and efficiency, but have no direct impact on the results in this interim financial report so far. 2. Important events during the second quarter of 2008 in relation to the Company’s activity 2.1. Internal transaction with the majority package of shares of Svilosa AD without change of con ...

... transparency and efficiency, but have no direct impact on the results in this interim financial report so far. 2. Important events during the second quarter of 2008 in relation to the Company’s activity 2.1. Internal transaction with the majority package of shares of Svilosa AD without change of con ...

A Project Report Presentation On *SBI Mutual Fund

... inter-bank call money. Aim to provide easy liquidity, preservation of capital and moderate income. Gilt Funds Invest in Gilts which are government securities with medium to long term maturities, typically over one year. Gilt funds invest in government paper called dated securities. Virtually zero ri ...

... inter-bank call money. Aim to provide easy liquidity, preservation of capital and moderate income. Gilt Funds Invest in Gilts which are government securities with medium to long term maturities, typically over one year. Gilt funds invest in government paper called dated securities. Virtually zero ri ...

Focused on Delivering Superior Investment Advice

... The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual. To determine which investments may be appropriate for you, consult your financial advisor prior to inve ...

... The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual. To determine which investments may be appropriate for you, consult your financial advisor prior to inve ...

Downlaod File

... KE= 14.8% [From C] KD= 9.78% [From B] WACC= (30%) (9.78%) (1-30%) + (20%) (11.31%) + (50%) (14.8%) = 46.52 F. How is any firm’s stock price (or the value of the firm) related to WACC? Explain in words. When the decisions of the capital structure affect the WACC therefore these decisions will have an ...

... KE= 14.8% [From C] KD= 9.78% [From B] WACC= (30%) (9.78%) (1-30%) + (20%) (11.31%) + (50%) (14.8%) = 46.52 F. How is any firm’s stock price (or the value of the firm) related to WACC? Explain in words. When the decisions of the capital structure affect the WACC therefore these decisions will have an ...

PDF

... and types of businesses. Since then, other studies on ROE have been conducted to explain the variation of ROE across country and time. As the century draws to an end, substantial changes in the business environment are taking place resulting in markets becoming more integrated due to the effects of ...

... and types of businesses. Since then, other studies on ROE have been conducted to explain the variation of ROE across country and time. As the century draws to an end, substantial changes in the business environment are taking place resulting in markets becoming more integrated due to the effects of ...

Market Discipline and Subordinated Debt: A Review of

... a somewhat lesser degree, the additional information rationale focus attention on marginal, or potentially problem, banks rather than equally across all banks. The information debt yields may provide is clearly most important for banks that are most in need of supervisory intervention. Agency costs ...

... a somewhat lesser degree, the additional information rationale focus attention on marginal, or potentially problem, banks rather than equally across all banks. The information debt yields may provide is clearly most important for banks that are most in need of supervisory intervention. Agency costs ...

Tom Garman`s Thoughts on Employee Education

... Workplace education and advice programs have been underutilized Millions of employees say they cannot afford to save for retirement, and 1 in 4 say credit card debt is a reason Employees do not know how to help themselves Employers do not understand the value of providing their employees eas ...

... Workplace education and advice programs have been underutilized Millions of employees say they cannot afford to save for retirement, and 1 in 4 say credit card debt is a reason Employees do not know how to help themselves Employers do not understand the value of providing their employees eas ...

Equity Linked Debentures

... • The final value is also calculated as the average of the last three months. • Now, if the Nifty’s value closes at 5,000, 5,200, 5,500 in months 34, 35 and 36 respectively, we can calculate the average to 5,233. • So, the final Nifty returns come out to 5,233 4,000/4,000*100 = 30.82 per cent over t ...

... • The final value is also calculated as the average of the last three months. • Now, if the Nifty’s value closes at 5,000, 5,200, 5,500 in months 34, 35 and 36 respectively, we can calculate the average to 5,233. • So, the final Nifty returns come out to 5,233 4,000/4,000*100 = 30.82 per cent over t ...

The return of currency hedging

... The expectation of renewed strength in the U.S. dollar is bringing currencies back into focus. After a year of minor investor interest for U.S. investors, we believe the question of whether to hedge FX1 exposures is going to be an important one in 2017, like it was in 2015. Additionally, currency vo ...

... The expectation of renewed strength in the U.S. dollar is bringing currencies back into focus. After a year of minor investor interest for U.S. investors, we believe the question of whether to hedge FX1 exposures is going to be an important one in 2017, like it was in 2015. Additionally, currency vo ...

A NONPARAMETRIC ANALYSIS OF INVESTMENT BANKS

... Pure investment banks provide funds for the private businesses and governments, by issuing debt and capital securities, and selling them on the market. In addition, they facilitate mergers and acquisitions and provide financial advisory to companies (Shiller, 2009). Traditionally, they do not operat ...

... Pure investment banks provide funds for the private businesses and governments, by issuing debt and capital securities, and selling them on the market. In addition, they facilitate mergers and acquisitions and provide financial advisory to companies (Shiller, 2009). Traditionally, they do not operat ...

Rajan and Zingales, 2001, Financial systems, industrial structure

... concerns about whether the states that deregulated were somehow special are mitigated. Rajan and Zingales (1998a) follow a similar approach, but with an important twist. Instead of examining the effect of changes in financial development on growth as Jayaratne and Strahan do, they examine the differ ...

... concerns about whether the states that deregulated were somehow special are mitigated. Rajan and Zingales (1998a) follow a similar approach, but with an important twist. Instead of examining the effect of changes in financial development on growth as Jayaratne and Strahan do, they examine the differ ...

Why Does the Economy Fall to Pieces after a Financial Crisis?

... The basic static model is an economy with a single production sector that has two inputs, labor and capital. It uses a Cobb–Douglas production function, with a labor elasticity of 0.65. There is a single household, which has a utility function that includes consumption and leisure. The utility funct ...

... The basic static model is an economy with a single production sector that has two inputs, labor and capital. It uses a Cobb–Douglas production function, with a labor elasticity of 0.65. There is a single household, which has a utility function that includes consumption and leisure. The utility funct ...

Managing and preventing fínancial crises

... One has to be careful in making too much of the fact that, in retrospect, there seems to have been a number of indicators that should have given early warnings about what was building up in the financial sector. Still we should try to learn from the mistakes of ignoring these early warning signals a ...

... One has to be careful in making too much of the fact that, in retrospect, there seems to have been a number of indicators that should have given early warnings about what was building up in the financial sector. Still we should try to learn from the mistakes of ignoring these early warning signals a ...

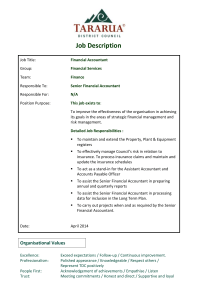

Application for Vacancy - Tararua District Council

... Forty per week, Monday to Friday. Salary Based on qualifications and relevant experience. Appointment Conditions The appointment will be made in accordance with the terms of this Schedule, the April 2014 Job Description and Council employment documents. Acceptance of this position will be deemed to ...

... Forty per week, Monday to Friday. Salary Based on qualifications and relevant experience. Appointment Conditions The appointment will be made in accordance with the terms of this Schedule, the April 2014 Job Description and Council employment documents. Acceptance of this position will be deemed to ...