When the Bubbles Burst…

... • Consider only top quartile of recorded peak to peak price increases as bubbles • Consider only bottom quartile of recorded peak to trough price declines as bubble crashes ...

... • Consider only top quartile of recorded peak to peak price increases as bubbles • Consider only bottom quartile of recorded peak to trough price declines as bubble crashes ...

With widespread deregulation and rapid growth of financial wealth, business

... feedbacks between domestic financial markets and capital flows are much stronger in developing than industrial countries. Exchange rate turbulence rarely spills over to domestic capital markets and the banking sector in industrial countries.10 By contrast, in emerging markets major payments and curr ...

... feedbacks between domestic financial markets and capital flows are much stronger in developing than industrial countries. Exchange rate turbulence rarely spills over to domestic capital markets and the banking sector in industrial countries.10 By contrast, in emerging markets major payments and curr ...

Presentation to the Deutsche Bundesbank Conference Housing Markets and the... Challenges for Monetary Policy and Financial Stability

... target, accompanied by extremely high and growing household debt. In a nutshell, the Sveriges Riksbank has undertaken a somewhat tighter stance of monetary policy than it would were it based purely on macroeconomic conditions. This has resulted in a more gradual return to inflation and unemployment ...

... target, accompanied by extremely high and growing household debt. In a nutshell, the Sveriges Riksbank has undertaken a somewhat tighter stance of monetary policy than it would were it based purely on macroeconomic conditions. This has resulted in a more gradual return to inflation and unemployment ...

Mascaro Company 401(k) Plan

... The right answer for you depends on a number of factors in your own personal situation. These include: How many years until you need to liquidate your account? What other investments do you have? What is your investment goal? What level of risk are you willing to take? Before you try to analyze your ...

... The right answer for you depends on a number of factors in your own personal situation. These include: How many years until you need to liquidate your account? What other investments do you have? What is your investment goal? What level of risk are you willing to take? Before you try to analyze your ...

Equilibrium Risk Shifting and Interest Rate in an

... and Ragot and Dubecq et al.). In Acharya, risky assets are in ‡exible supply so that their quantity (rather than price) adjust to clear the market. All these models share the property that intermediaries’excessive risk-taking is ubiquitous: risky assets are always have excessive space in intermediar ...

... and Ragot and Dubecq et al.). In Acharya, risky assets are in ‡exible supply so that their quantity (rather than price) adjust to clear the market. All these models share the property that intermediaries’excessive risk-taking is ubiquitous: risky assets are always have excessive space in intermediar ...

International Accounting Standard 29 Financial Reporting in Hyperinflationary Economies Scope

... the currencies of hyperinflationary economies. The financial statements of any such subsidiary need to be restated by applying a general price index of the country in whose currency it reports before they are included in the consolidated financial statements issued by its parent. Where such a subsid ...

... the currencies of hyperinflationary economies. The financial statements of any such subsidiary need to be restated by applying a general price index of the country in whose currency it reports before they are included in the consolidated financial statements issued by its parent. Where such a subsid ...

Why Diversified Debt?

... • In short, returns have been too high, and volatility has been too low, and this situation is now normalising ...

... • In short, returns have been too high, and volatility has been too low, and this situation is now normalising ...

WORKING FOR BAC– THE BASICS

... As a person conducting a business or undertaking under WHS law, BAC has a number of duties in relation to ensuring the health and safety of workers and others at the airport. In addition, certain work activities pose specific risks to the health and safety of airport workers and members of the publi ...

... As a person conducting a business or undertaking under WHS law, BAC has a number of duties in relation to ensuring the health and safety of workers and others at the airport. In addition, certain work activities pose specific risks to the health and safety of airport workers and members of the publi ...

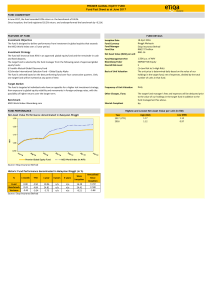

Etiqa Insurance Berhad Overall Risk Level Basis of Unit Valuation

... • In exceptional circumstances, we reserve the right to suspend the creation or cancellation of units. In such an event, a notice for suspension will be published on our website, and would be communicated to the policyholders upon any request for top-up, switching, or withdrawal to or from the fund. ...

... • In exceptional circumstances, we reserve the right to suspend the creation or cancellation of units. In such an event, a notice for suspension will be published on our website, and would be communicated to the policyholders upon any request for top-up, switching, or withdrawal to or from the fund. ...

PDF

... Mortgage termination is an imperative concern because prepayment and default interrupt anticipated principal and interest payments, which can directly affect banks and secondary markets. When prepayment occurs, the bank is forced to restructure an existing loan or make a new loan at a potentially lo ...

... Mortgage termination is an imperative concern because prepayment and default interrupt anticipated principal and interest payments, which can directly affect banks and secondary markets. When prepayment occurs, the bank is forced to restructure an existing loan or make a new loan at a potentially lo ...

PPT - AgriFin

... If net working capital is positive, the conclusion is that part of the ST assets are financed by LT liabilities or equity. This is positive since these assets have a high level of liquidity and a lower period of turnover, but a large amount of net working capital possesses a large volume of free wor ...

... If net working capital is positive, the conclusion is that part of the ST assets are financed by LT liabilities or equity. This is positive since these assets have a high level of liquidity and a lower period of turnover, but a large amount of net working capital possesses a large volume of free wor ...

On the Cross-Section of Expected Returns of German Stocks: A Re

... provide evidence that the size effect is at least partly associated with differential information about small and large firms and thus related to the perceived riskiness of small firm stocks.9 This hypothesis was also tested by Amihud and Mendelson (1989), who proxy the information factor of an ass ...

... provide evidence that the size effect is at least partly associated with differential information about small and large firms and thus related to the perceived riskiness of small firm stocks.9 This hypothesis was also tested by Amihud and Mendelson (1989), who proxy the information factor of an ass ...

Chapter 1

... In open markets, financial instruments are sold to the highest bidder, and they can be traded as often as is desirable before they mature. In negotiated markets, the instruments are sold to one or a few buyers under private contract. Financial capital is raised when newly issued securities are s ...

... In open markets, financial instruments are sold to the highest bidder, and they can be traded as often as is desirable before they mature. In negotiated markets, the instruments are sold to one or a few buyers under private contract. Financial capital is raised when newly issued securities are s ...

1 Binomial Model Hull, Chapter 11 + Sections 17.1 and 17.2

... Step 3u (i = 3). Suppose that instead the stock price goes up to 90. The call you sold is inthe-money at expiration. Buy one share of stock and let the call be exercised, incurring a loss of 90 – 80 = 10. You also own 0.167 shares of stock currently trading at 90/share, for a total value of 0.167 x ...

... Step 3u (i = 3). Suppose that instead the stock price goes up to 90. The call you sold is inthe-money at expiration. Buy one share of stock and let the call be exercised, incurring a loss of 90 – 80 = 10. You also own 0.167 shares of stock currently trading at 90/share, for a total value of 0.167 x ...

Results for non‐financial corporations in the Central Balance Sheet Database for 2014 and the 1 half of

... (1) Public corporations not included in general government ...

... (1) Public corporations not included in general government ...

International Accounting Standard 29

... financial statements of any such subsidiary need to be restated by applying a general price index of the country in whose currency it reports before they are included in the consolidated financial statements issued by its parent. Where such a subsidiary is a foreign subsidiary, its restated financia ...

... financial statements of any such subsidiary need to be restated by applying a general price index of the country in whose currency it reports before they are included in the consolidated financial statements issued by its parent. Where such a subsidiary is a foreign subsidiary, its restated financia ...

Sterling corporate bonds: an investor`s guide

... which is on average lower than EUR or USD as you have large proportions of buy and hold investors. Average issue size is also lower. The chart below outlines some similarities between the GBP and EUR markets, as both have a very high level of concentration risk: the top 100 issuers accounted for mor ...

... which is on average lower than EUR or USD as you have large proportions of buy and hold investors. Average issue size is also lower. The chart below outlines some similarities between the GBP and EUR markets, as both have a very high level of concentration risk: the top 100 issuers accounted for mor ...

PDP-Working Paper

... investors set up their investment policies in ways that avoid purely individualistic procyclical behavior which undermines financial stability. The paper advocates an approach that is based mainly on prevention (i.e., minimizing ex ante the likelihood that an investor may behave procyclically ex pos ...

... investors set up their investment policies in ways that avoid purely individualistic procyclical behavior which undermines financial stability. The paper advocates an approach that is based mainly on prevention (i.e., minimizing ex ante the likelihood that an investor may behave procyclically ex pos ...

Chapt. 1 - Why are FI’s Special

... – A financial system that operates efficiently is beneficial to the economy – such a system will promote adequate capital formation for economic growth, so that firms with the most promising investment opportunities will receive funds, and those with poor opportunities will not. ...

... – A financial system that operates efficiently is beneficial to the economy – such a system will promote adequate capital formation for economic growth, so that firms with the most promising investment opportunities will receive funds, and those with poor opportunities will not. ...

Collateral and Credit Issues in Derivatives Pricing

... researchers. Equilibrium arguments are important when unhedgable risks (which arguably include the bank’s own credit risk) are considered. We consider collateralization as well as credit risk and consider the implications of the analysis for bid-offer spreads. The expected recovery rates on the deri ...

... researchers. Equilibrium arguments are important when unhedgable risks (which arguably include the bank’s own credit risk) are considered. We consider collateralization as well as credit risk and consider the implications of the analysis for bid-offer spreads. The expected recovery rates on the deri ...