Document

... • The larger the DWL from taxation, the greater the argument for smaller government. • The tax on labor income is especially important; it’s the biggest source of government revenue. • For many workers, the marginal tax rate (the tax on the last dollar of earnings) is almost 50%. • How big is the DW ...

... • The larger the DWL from taxation, the greater the argument for smaller government. • The tax on labor income is especially important; it’s the biggest source of government revenue. • For many workers, the marginal tax rate (the tax on the last dollar of earnings) is almost 50%. • How big is the DW ...

Chapter 8 - Taxes

... – Supply-side economics – Tax rates were so high • Reducing them would actually raise tax revenue ...

... – Supply-side economics – Tax rates were so high • Reducing them would actually raise tax revenue ...

Slide 1

... – Supply-side economics – Tax rates were so high • Reducing them would actually raise tax revenue ...

... – Supply-side economics – Tax rates were so high • Reducing them would actually raise tax revenue ...

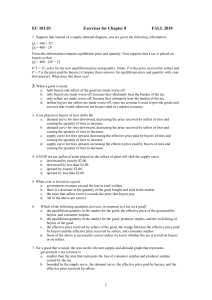

EC 101

... ANS: B 4. A $2.00 tax per gallon of paint placed on the sellers of paint will shift the supply curve a. downward by exactly $2.00. b. downward by less than $2.00. c. upward by exactly $2.00. d. upward by less than $2.00. ANS: C 5. When a tax is levied on a good, a. government revenues exceed the los ...

... ANS: B 4. A $2.00 tax per gallon of paint placed on the sellers of paint will shift the supply curve a. downward by exactly $2.00. b. downward by less than $2.00. c. upward by exactly $2.00. d. upward by less than $2.00. ANS: C 5. When a tax is levied on a good, a. government revenues exceed the los ...

Chap014

... authority, but these payments are not a “burden” because they paid a lower price for the land from the current landlord. • Also works the other way, when a new benefit is announced (e.g., better schools). ...

... authority, but these payments are not a “burden” because they paid a lower price for the land from the current landlord. • Also works the other way, when a new benefit is announced (e.g., better schools). ...

partial factor taxes

... • How does the tax affect the demand schedule? – Consider point a in Figure 12.1. Pa is the maximum price consumers would pay for Qa. – The willingness-to-pay by demanders does NOT change when a tax is imposed on them. Instead, the demand curve as perceived by producers changes. – Producers perceive ...

... • How does the tax affect the demand schedule? – Consider point a in Figure 12.1. Pa is the maximum price consumers would pay for Qa. – The willingness-to-pay by demanders does NOT change when a tax is imposed on them. Instead, the demand curve as perceived by producers changes. – Producers perceive ...

Tax_Shifting

... If government imposes a tax on x1 (indirect unit tax), price of x1 will increase (P1), while P2 (price of x2) will not change. P1/P2 and relative price P2/P1 after the imposition of a tax. The money income will not change, but the real income (amount of goods that could be purchase with the money in ...

... If government imposes a tax on x1 (indirect unit tax), price of x1 will increase (P1), while P2 (price of x2) will not change. P1/P2 and relative price P2/P1 after the imposition of a tax. The money income will not change, but the real income (amount of goods that could be purchase with the money in ...

CHAPTER 8

... THE DEADWEIGHT LOSS OF TAXATION ● How do taxes affect the economic well-being of market participants? ● It does not matter whether a tax on a good is levied on buyers or sellers of the good . . . the price paid by buyers rises, and the price received by sellers falls. ...

... THE DEADWEIGHT LOSS OF TAXATION ● How do taxes affect the economic well-being of market participants? ● It does not matter whether a tax on a good is levied on buyers or sellers of the good . . . the price paid by buyers rises, and the price received by sellers falls. ...

Mankiew Chapter 8

... less price-elastic than meals at fancy restaurants. So, a tax on restaurant meals would cause a larger DWL than a tax on groceries. ...

... less price-elastic than meals at fancy restaurants. So, a tax on restaurant meals would cause a larger DWL than a tax on groceries. ...

NBER WORKING PAPER SERIES INFLATION, TARIFFS AND TAX ENFORCEMENT COSTS

... recognize that various taxes are associated with different collection costs, we can reconcile the empirical observations regarding the use of inflation and ...

... recognize that various taxes are associated with different collection costs, we can reconcile the empirical observations regarding the use of inflation and ...

Taxes and Subsidies

... Smokers have an inelastic demand for cigarettes of about .5 Cigarette companies have a very high elasticity of supply to any one state since they can easily ship their products to other states with relatively lower taxes Buyers bear nearly all of the tax ...

... Smokers have an inelastic demand for cigarettes of about .5 Cigarette companies have a very high elasticity of supply to any one state since they can easily ship their products to other states with relatively lower taxes Buyers bear nearly all of the tax ...

Chapter 8

... Labor tax affects the decision of the second earners (usually married women with children) to work. Many retires decision to work also depends on net wage rate. Higher labor tax encourages jobs that pays “cash under the table.” When two political candidates debate on whether to reduce tax, a p ...

... Labor tax affects the decision of the second earners (usually married women with children) to work. Many retires decision to work also depends on net wage rate. Higher labor tax encourages jobs that pays “cash under the table.” When two political candidates debate on whether to reduce tax, a p ...

PS4s_w08 - uc

... Ans) This question is a really discussion type question because there is no clear cut answer. However, we can think about each of the taxes and apply our intuition. The Property tax of 1-3% does not seem to be that large (in fact, some leftist argue that it should be 5%), but its burden is not that ...

... Ans) This question is a really discussion type question because there is no clear cut answer. However, we can think about each of the taxes and apply our intuition. The Property tax of 1-3% does not seem to be that large (in fact, some leftist argue that it should be 5%), but its burden is not that ...

Problem Set 1 - uc

... Ans) This question is a really discussion type question because there is no clear cut answer. However, we can think about each of the taxes and apply our intuition. The Property tax of 1-3% does not seem to be that large (in fact, some leftist argue that it should be 5%), but its burden is not that ...

... Ans) This question is a really discussion type question because there is no clear cut answer. However, we can think about each of the taxes and apply our intuition. The Property tax of 1-3% does not seem to be that large (in fact, some leftist argue that it should be 5%), but its burden is not that ...

Ch06 Govt actions in markets

... According to the fair rules view, a rent ceiling is unfair because it blocks voluntary exchange. According to the fair results view, a rent ceiling is unfair because it does not generally benefit the poor. A rent ceiling decreases the quantity of housing and the scarce housing is allocated by ...

... According to the fair rules view, a rent ceiling is unfair because it blocks voluntary exchange. According to the fair results view, a rent ceiling is unfair because it does not generally benefit the poor. A rent ceiling decreases the quantity of housing and the scarce housing is allocated by ...

KW06_4_Consumer and producer surplus

... loss represented by the yellow triangle would disappear. This observation ties in with the explanation given in Chapter 4 of why an excise tax generates a deadweight loss to society: the tax causes inefficiency because it discourages mutually beneficial transactions between buyers and sellers. The i ...

... loss represented by the yellow triangle would disappear. This observation ties in with the explanation given in Chapter 4 of why an excise tax generates a deadweight loss to society: the tax causes inefficiency because it discourages mutually beneficial transactions between buyers and sellers. The i ...

Answers to Practice Questions and Problems 1

... a. A woman works 10 hours a week in her family owned restaurant. Not in labor force since she is not working enough to be considered employed (at least 20 hours a week in a family-owned business) nor is she unemployed since she is not actively seeking a job. b. A 13 year old babysits every afternoon ...

... a. A woman works 10 hours a week in her family owned restaurant. Not in labor force since she is not working enough to be considered employed (at least 20 hours a week in a family-owned business) nor is she unemployed since she is not actively seeking a job. b. A 13 year old babysits every afternoon ...

econ.boun.edu.tr

... Groceries are more of a necessity and therefore less price-elastic than meals at fancy restaurants. So, a tax on restaurant meals would cause a larger DWL than a tax on groceries. ...

... Groceries are more of a necessity and therefore less price-elastic than meals at fancy restaurants. So, a tax on restaurant meals would cause a larger DWL than a tax on groceries. ...

Document

... Groceries are more of a necessity and therefore less price-elastic than meals at fancy restaurants. So, a tax on restaurant meals would cause a larger DWL than a tax on groceries. ...

... Groceries are more of a necessity and therefore less price-elastic than meals at fancy restaurants. So, a tax on restaurant meals would cause a larger DWL than a tax on groceries. ...

Slide 1

... The free market vs. central planning Suppose resources were allocated not by the market, but by a central planner who cares about society’s well-being. ...

... The free market vs. central planning Suppose resources were allocated not by the market, but by a central planner who cares about society’s well-being. ...

THE MINISTRY OF FINANCE ------- SOCIALIST REPUBLIC OF VIET

... signed with other countries are properly and fully enforced, the Ministry of Finance provides the following for the organization and guidance for enforcement of the treaties: 1. Tasks and powers of the General Department of Taxation in enforcing the treaties: Under the provisions of the treaties, al ...

... signed with other countries are properly and fully enforced, the Ministry of Finance provides the following for the organization and guidance for enforcement of the treaties: 1. Tasks and powers of the General Department of Taxation in enforcing the treaties: Under the provisions of the treaties, al ...

Chapter 8 - Application- the costs of taxation

... – Supply-side economics – Tax rates were so high • Reducing them would actually raise tax revenue ...

... – Supply-side economics – Tax rates were so high • Reducing them would actually raise tax revenue ...

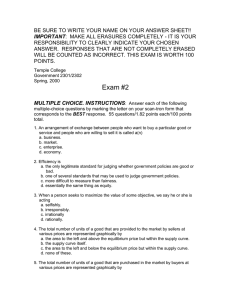

Spring 2000, Exam 2.doc

... share of the economic incidence of an excise tax? a. when the statutory incidence of the tax is imposed on consumers b. when demand for the good on which the tax is imposed is relatively price elastic c. when demand for the good on which the tax is imposed is relatively price inelastic d. when the s ...

... share of the economic incidence of an excise tax? a. when the statutory incidence of the tax is imposed on consumers b. when demand for the good on which the tax is imposed is relatively price elastic c. when demand for the good on which the tax is imposed is relatively price inelastic d. when the s ...

EC 101

... 8. Taxes cause deadweight losses because they a. lead to losses in surplus for consumers and for producers that, when taken together, exceed tax revenue collected by the government. b. distort incentives to both buyers and sellers. c. prevent buyers and sellers from realizing some of the gains from ...

... 8. Taxes cause deadweight losses because they a. lead to losses in surplus for consumers and for producers that, when taken together, exceed tax revenue collected by the government. b. distort incentives to both buyers and sellers. c. prevent buyers and sellers from realizing some of the gains from ...