Statistics - WordPress.com

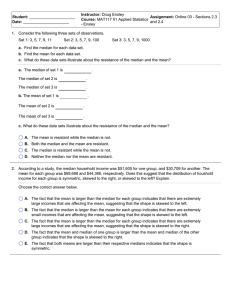

... The mean is affected by unusually large or small data values. The arithmetic mean is the only measure of central tendency where the sum of the deviations of each value from the mean is zero. ...

... The mean is affected by unusually large or small data values. The arithmetic mean is the only measure of central tendency where the sum of the deviations of each value from the mean is zero. ...

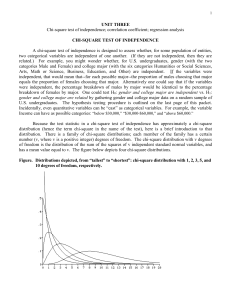

unit three - KSU Web Home

... Where do you find the values for b0 (the y-intercept) and b1 (the slope) on the Excel printout? In the Coefficients column of the long narrow table, with the value of b0 provided next to the term Intercept and the value of b1 provided next to the name of X. How do you graph the line by hand? After w ...

... Where do you find the values for b0 (the y-intercept) and b1 (the slope) on the Excel printout? In the Coefficients column of the long narrow table, with the value of b0 provided next to the term Intercept and the value of b1 provided next to the name of X. How do you graph the line by hand? After w ...

Comparing Means Analysis of Variance

... Repeated measures If one computes means only using the observed data, the mean at time 3 is 14.0, lower than the means at time 1 and time 2. But this is misleading since the values are increasing in every patient! The repeated measure model, in contrast, uses the correlation and change to estimate ...

... Repeated measures If one computes means only using the observed data, the mean at time 3 is 14.0, lower than the means at time 1 and time 2. But this is misleading since the values are increasing in every patient! The repeated measure model, in contrast, uses the correlation and change to estimate ...