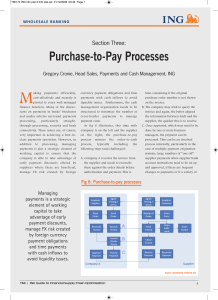

Purchase-to-Pay Processes

... at one of Europe’s largest pension schemes The company had been maintaining a large number of interfaces between proprietary systems at a cost of €30-€40,000 per year. As well as the issue of cost, the firm wanted to achieve greater bank independence, allowing them to decide on our banking relations ...

... at one of Europe’s largest pension schemes The company had been maintaining a large number of interfaces between proprietary systems at a cost of €30-€40,000 per year. As well as the issue of cost, the firm wanted to achieve greater bank independence, allowing them to decide on our banking relations ...

Self-Fulfilling Credit Market Freezes

... equilibrium. The analysis identifies the role and potential limitations of standard instruments such as interest rate cuts and infusion of capital into the financial sector. It also considers less traditional forms of intervention – including direct intervention in lending to nonfinancial companies, ...

... equilibrium. The analysis identifies the role and potential limitations of standard instruments such as interest rate cuts and infusion of capital into the financial sector. It also considers less traditional forms of intervention – including direct intervention in lending to nonfinancial companies, ...

The Framework for the Bank of England`s Operations in the Sterling

... households and firms to hold assets that are more liquid than their liabilities, and enable longer term projects to be financed by a changing population of short-term depositors. But this means banks themselves run liquidity risk, putting the management of that risk at the heart of their business. 9 ...

... households and firms to hold assets that are more liquid than their liabilities, and enable longer term projects to be financed by a changing population of short-term depositors. But this means banks themselves run liquidity risk, putting the management of that risk at the heart of their business. 9 ...

NBER WORKING PAPER SERIES SELF-FULFILLING CREDIT MARKET FREEZES Lucian A. Bebchuk Itay Goldstein

... equilibrium. The analysis identifies the role and potential limitations of standard instruments such as interest rate cuts and infusion of capital into the financial sector. It also considers less traditional forms of intervention – including direct intervention in lending to nonfinancial companies, ...

... equilibrium. The analysis identifies the role and potential limitations of standard instruments such as interest rate cuts and infusion of capital into the financial sector. It also considers less traditional forms of intervention – including direct intervention in lending to nonfinancial companies, ...

Towards a General Theory of Financial Regulation

... emerging nations and financial crises, not recognising these as means not ends and only capable of being effective if the economy has reached a certain stage of growth. Defining regulatory change necessitates understanding the way financial systems can evolve. A taxonomy of regulatory models is a p ...

... emerging nations and financial crises, not recognising these as means not ends and only capable of being effective if the economy has reached a certain stage of growth. Defining regulatory change necessitates understanding the way financial systems can evolve. A taxonomy of regulatory models is a p ...

ECNS 313 Money and Banking Fall 2016 Course Packet Dr. Gilpin

... Even though it may seem that government issued currency is accepted everywhere, this is not always the case. The U.S. Treasury has indicated that there is no Federal statute mandating that a private business, a person, or an organization must accept currency or coin as payment for goods and/or servi ...

... Even though it may seem that government issued currency is accepted everywhere, this is not always the case. The U.S. Treasury has indicated that there is no Federal statute mandating that a private business, a person, or an organization must accept currency or coin as payment for goods and/or servi ...

Origins and Measurement of Financial Repression: The

... often are, placed under its banner. The term financial repression is frequently employed as a pejorative to criticize particular policies, evoking strong reactions in academic and policy discussions. Adding further trouble is the interchangeable use by some scholars of terms like fiscal repressio ...

... often are, placed under its banner. The term financial repression is frequently employed as a pejorative to criticize particular policies, evoking strong reactions in academic and policy discussions. Adding further trouble is the interchangeable use by some scholars of terms like fiscal repressio ...

BIS Working Papers No 118 Should banks be diversified? Evidence

... Overall, our results provide strong support for these two hypotheses. We measure focus using the Herfindahl index for a bank’s (i) non-financial and housing loan portfolio (I–HHI), (ii) overall asset sector portfolio (A–HHI), and (iii) geographical portfolio (G–HHI).9 Thus, a decrease in HHI implie ...

... Overall, our results provide strong support for these two hypotheses. We measure focus using the Herfindahl index for a bank’s (i) non-financial and housing loan portfolio (I–HHI), (ii) overall asset sector portfolio (A–HHI), and (iii) geographical portfolio (G–HHI).9 Thus, a decrease in HHI implie ...

banking mergers and acquisitions in the eu: overview

... M&A transactions announced and completed (120 domestic and 31 cross-border) by banking institutions headquartered in the EU, over the period 1994–20003. The deals were obtained essentially from the Thomson Financial Securities, M&A SDC database and from press coverage. The period under scrutiny is o ...

... M&A transactions announced and completed (120 domestic and 31 cross-border) by banking institutions headquartered in the EU, over the period 1994–20003. The deals were obtained essentially from the Thomson Financial Securities, M&A SDC database and from press coverage. The period under scrutiny is o ...

Bubbles, Banks and Financial Stability

... without triggering a banking crisis or a deep recession. We want to understand why this bubble episode was so different from other recent bubbles. We build a model which focuses on bank exposures to the asset price collapse as an important reason why some busts lead to a banking crisis while others ...

... without triggering a banking crisis or a deep recession. We want to understand why this bubble episode was so different from other recent bubbles. We build a model which focuses on bank exposures to the asset price collapse as an important reason why some busts lead to a banking crisis while others ...

24 February 2017 - RBS: Investor relations

... current account stock market share (business turnover of £0 - 2m) excluding Future W&G. (2) Source: Charterhouse Research 4 quarters ending Q4 2016 (business turnover of £2m - £1bn) excluding Future W&G (3) Source: Main current account stock market share holding level - based on GfK FRS 6 months end ...

... current account stock market share (business turnover of £0 - 2m) excluding Future W&G. (2) Source: Charterhouse Research 4 quarters ending Q4 2016 (business turnover of £2m - £1bn) excluding Future W&G (3) Source: Main current account stock market share holding level - based on GfK FRS 6 months end ...

Federal Republic of Nigeria: Assessment of Community Banks

... With a total number of about one million clients and about one sixth of all banking counters in Nigeria ( which already has a comparatively low banking density), community banks represent an enormous potential to enhance access to financial services for the rural population. They are an indispensabl ...

... With a total number of about one million clients and about one sixth of all banking counters in Nigeria ( which already has a comparatively low banking density), community banks represent an enormous potential to enhance access to financial services for the rural population. They are an indispensabl ...

December 2016

... heritage tagged with the world-class infrastructure and well diversified economy put together the nation stand-alone globally. According to the U.A.E. Ministry of Finance (2016), the U.A.E. accomplished an esteemed level of global competency and fitness among global toppers in the World Competitive ...

... heritage tagged with the world-class infrastructure and well diversified economy put together the nation stand-alone globally. According to the U.A.E. Ministry of Finance (2016), the U.A.E. accomplished an esteemed level of global competency and fitness among global toppers in the World Competitive ...

The Market for OTC Derivatives

... Several stylized observations regarding trading patterns in over-the-counter (OTC) markets for derivatives have recently received considerable attention from policy makers and the public alike. First, the large volume of bilateral trades at varied prices creates an intricate liability structure betw ...

... Several stylized observations regarding trading patterns in over-the-counter (OTC) markets for derivatives have recently received considerable attention from policy makers and the public alike. First, the large volume of bilateral trades at varied prices creates an intricate liability structure betw ...

TARP and market discipline - Lund University School of Economics

... 2014). Our paper is most closely related to two recent studies examining the effect of CPP on the supported banks’ subsequent asset risk, particularly the risk of new loan originations (Black and Hazelwood, 2013 Duchin and Sosyura, 2014), and a study of the effects of bailout expectations on distres ...

... 2014). Our paper is most closely related to two recent studies examining the effect of CPP on the supported banks’ subsequent asset risk, particularly the risk of new loan originations (Black and Hazelwood, 2013 Duchin and Sosyura, 2014), and a study of the effects of bailout expectations on distres ...

Modeling Banking, Sovereign, and Macro Risk in a CCA Global VAR 218 WP/13/

... The first section of the paper will present an outline of Contingent Claims Analysis and how the key risk indicators for banks, banking systems, the corporate sector and sovereigns are estimated. A view into how the risk indicators evolve along with real activity shall help develop a first understan ...

... The first section of the paper will present an outline of Contingent Claims Analysis and how the key risk indicators for banks, banking systems, the corporate sector and sovereigns are estimated. A view into how the risk indicators evolve along with real activity shall help develop a first understan ...

FC Research SRI LANKA BANKING SECTOR HOLD

... likely to remain throughout 2016. With the heavy depreciation of the rupee, increased VAT, SRR hike, policy rate hike and Bank Loan to Value ratio being reduced to 70% it is likely to put the brakes on the consumer spending on a gradual note leading to a gradual reduction in the trade gap. However, ...

... likely to remain throughout 2016. With the heavy depreciation of the rupee, increased VAT, SRR hike, policy rate hike and Bank Loan to Value ratio being reduced to 70% it is likely to put the brakes on the consumer spending on a gradual note leading to a gradual reduction in the trade gap. However, ...

Bashir, AM (2003). Determinants of profitability in Islamic banks

... The concept of Islamic banking was developed in the late 1940s, based on the norms and standards of Sharia law (norms and principles retrieved from Koran). The first Islamic bank, Mit Ghamr Savings Bank, was established in 1963 in Egypt (Chachi, 2005) and since 1970 its principles have been implemen ...

... The concept of Islamic banking was developed in the late 1940s, based on the norms and standards of Sharia law (norms and principles retrieved from Koran). The first Islamic bank, Mit Ghamr Savings Bank, was established in 1963 in Egypt (Chachi, 2005) and since 1970 its principles have been implemen ...

Secured Lending and Borrowers` Riskiness

... qualified than the average investor to evaluate projects, credit allocation may be less efficient when there is a larger fraction of loans that are made on a secured basis. Moreover, if banks find it less expensive to require guarantees than to monitor projects, it is possible that investors that ca ...

... qualified than the average investor to evaluate projects, credit allocation may be less efficient when there is a larger fraction of loans that are made on a secured basis. Moreover, if banks find it less expensive to require guarantees than to monitor projects, it is possible that investors that ca ...

lending in a low interest rate environment

... 2010 and 2014, more solvent firms had a higher probability of having their loan applications accepted than less solvent ones. This link did not exist before the crisis, in 2007, cf. Box 1. A firm’s productivity level also impacts its decision of whether to apply for debt financing as well as the out ...

... 2010 and 2014, more solvent firms had a higher probability of having their loan applications accepted than less solvent ones. This link did not exist before the crisis, in 2007, cf. Box 1. A firm’s productivity level also impacts its decision of whether to apply for debt financing as well as the out ...

challenges smes face in acquiring loans from banks

... Lenders of capital are more than investors in the corporate finance. Even though debt financing allows business owners to maintain their full ownership, it comes with interest which sometimes is higher if the business has higher risk. Business owners looking for debt capital to finance their busines ...

... Lenders of capital are more than investors in the corporate finance. Even though debt financing allows business owners to maintain their full ownership, it comes with interest which sometimes is higher if the business has higher risk. Business owners looking for debt capital to finance their busines ...

The Regulatory Responses to the Global Financial Crisis

... highly leveraged, thinly capitalized, short of funding liquidity and had extensive off-balance sheets exposures – rose dramatically early on in the crisis, freezing market transactions and making valuations of underlying assets even more problematic. The emergence of systemically important non-bank ...

... highly leveraged, thinly capitalized, short of funding liquidity and had extensive off-balance sheets exposures – rose dramatically early on in the crisis, freezing market transactions and making valuations of underlying assets even more problematic. The emergence of systemically important non-bank ...

US Money Market Reform: The Scandi angle

... on the relentless rise in USD Libor fixings and stop the spill-overs and feedback mechanisms to and from other markets such as CCS basis, FX forwards, CP market, etc. ...

... on the relentless rise in USD Libor fixings and stop the spill-overs and feedback mechanisms to and from other markets such as CCS basis, FX forwards, CP market, etc. ...

south korea - Association for Financial Professionals

... The material provided by PNC Bank, National Association (PNC), the Association for Financial Professionals (AFP) and AFP’s contracted information supplier is not intended to be advice on any particular matter. No reader should act on the basis of any matter provided by PNC and AFP and AFP’s contract ...

... The material provided by PNC Bank, National Association (PNC), the Association for Financial Professionals (AFP) and AFP’s contracted information supplier is not intended to be advice on any particular matter. No reader should act on the basis of any matter provided by PNC and AFP and AFP’s contract ...

05RISKS FROM LOW INTEREST RATES – OPPORTUNITIES FROM

... bring about a rise in the cancellation rates of life insurance policies. A strong decline in asset prices would also be likely, which could be exacerbated by reduced market liquidity. A comprehensive capital regulation of interest rate risks would be needed in the banking system. The prompt introduc ...

... bring about a rise in the cancellation rates of life insurance policies. A strong decline in asset prices would also be likely, which could be exacerbated by reduced market liquidity. A comprehensive capital regulation of interest rate risks would be needed in the banking system. The prompt introduc ...

Bank

A bank is a financial intermediary that creates credit by lending money to a borrower, thereby creating a corresponding deposit on the bank's balance sheet. Lending activities can be performed either directly or indirectly through capital markets. Due to their importance in the financial system and influence on national economies, banks are highly regulated in most countries. Most nations have institutionalized a system known as fractional reserve banking under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, known as the Basel Accords.Banking in its modern sense evolved in the 14th century in the rich cities of Renaissance Italy but in many ways was a continuation of ideas and concepts of credit and lending that had their roots in the ancient world. In the history of banking, a number of banking dynasties — notably, the Medicis, the Fuggers, the Welsers, the Berenbergs and the Rothschilds — have played a central role over many centuries. The oldest existing retail bank is Monte dei Paschi di Siena, while the oldest existing merchant bank is Berenberg Bank.