A Project Report Presentation On *SBI Mutual Fund

... inter-bank call money. Aim to provide easy liquidity, preservation of capital and moderate income. Gilt Funds Invest in Gilts which are government securities with medium to long term maturities, typically over one year. Gilt funds invest in government paper called dated securities. Virtually zero ri ...

... inter-bank call money. Aim to provide easy liquidity, preservation of capital and moderate income. Gilt Funds Invest in Gilts which are government securities with medium to long term maturities, typically over one year. Gilt funds invest in government paper called dated securities. Virtually zero ri ...

Are European banks a buy?

... Perhaps the biggest critique of our analysis is through considering valuation. Could the sector be trading on a low valuation versus history, with our analysis missing the wood for the trees? Our analysis hopefully shows this is not the case, but it is worth looking at some of the traditional valuat ...

... Perhaps the biggest critique of our analysis is through considering valuation. Could the sector be trading on a low valuation versus history, with our analysis missing the wood for the trees? Our analysis hopefully shows this is not the case, but it is worth looking at some of the traditional valuat ...

financial stability - European Commission

... - Can institutions withstand the shocks? - What is their capital, liquidity and profit position after the shock? ...

... - Can institutions withstand the shocks? - What is their capital, liquidity and profit position after the shock? ...

Document

... politics were colloquially referred to as “crony capitalism”. But not just direct lobbying could be important, the role of banks in the economy also affects business-government relationships. First of all, the size and importance of individual banks would seem to matter, as governments can allow ind ...

... politics were colloquially referred to as “crony capitalism”. But not just direct lobbying could be important, the role of banks in the economy also affects business-government relationships. First of all, the size and importance of individual banks would seem to matter, as governments can allow ind ...

HR Khan: Banks in India - challenges and opportunities

... witnessed a slowdown. A recent report of the McKinsey Global Institute 2 observes that for making a substantial improvement in the standards of living of the Indian people and alleviating poverty, about 115 million new non-farm jobs will have to be created between 2012 and 2022 and of these, about ...

... witnessed a slowdown. A recent report of the McKinsey Global Institute 2 observes that for making a substantial improvement in the standards of living of the Indian people and alleviating poverty, about 115 million new non-farm jobs will have to be created between 2012 and 2022 and of these, about ...

Analyzing the Creditworthiness of Islamic Financial Institutions

... There are some elements of Islamic finance which make IFIs more creditworthy than ribā-based banks and other elements that make them less creditworthy. But we do not believe that IFIs are inherently more or less creditworthy than ribā-based institutions. Put another way, we do not believe that it is ...

... There are some elements of Islamic finance which make IFIs more creditworthy than ribā-based banks and other elements that make them less creditworthy. But we do not believe that IFIs are inherently more or less creditworthy than ribā-based institutions. Put another way, we do not believe that it is ...

What Should Banks Do? - Levy Economics Institute of Bard College

... required to produce them. In other words, the ephor allows production of profits by financing spending by those not directly involved in producing consumption goods. These profits are “saved” in the form of accumulated capital goods. In the pre-1870 period that Minsky called the “commercial capitali ...

... required to produce them. In other words, the ephor allows production of profits by financing spending by those not directly involved in producing consumption goods. These profits are “saved” in the form of accumulated capital goods. In the pre-1870 period that Minsky called the “commercial capitali ...

towards more responsibility and competitiveness in the european

... Derivatives play an important role in the economy. But they also concentrated risk in some financial institutions and amplified it through the interconnections between our financial firms. For example, the crisis was clearly linked to highly complex derivatives based on bundles of thousands of good ...

... Derivatives play an important role in the economy. But they also concentrated risk in some financial institutions and amplified it through the interconnections between our financial firms. For example, the crisis was clearly linked to highly complex derivatives based on bundles of thousands of good ...

The future of Turkey`s capital markets

... After a decade of high growth, Turkey’s economy has reached a certain maturity with output per capita exceeding US$10,000, supported by globally competitive industries. On the other hand, the Country’s capital markets development has lagged behind overall economic development. Peer group comparisons ...

... After a decade of high growth, Turkey’s economy has reached a certain maturity with output per capita exceeding US$10,000, supported by globally competitive industries. On the other hand, the Country’s capital markets development has lagged behind overall economic development. Peer group comparisons ...

Foreign competition in US banking markets

... been expanding into foreign markets at a relatively rapid rate. At the November 1989 conference on globalization, a well-known economist remarked that he had never met a bank that had too much capital. Many in the audience chuckled at this remark with knowing agreement. In the context of American mo ...

... been expanding into foreign markets at a relatively rapid rate. At the November 1989 conference on globalization, a well-known economist remarked that he had never met a bank that had too much capital. Many in the audience chuckled at this remark with knowing agreement. In the context of American mo ...

financial markets group

... use of equity market finance. As for the bond markets, the annual growth rate of issuance by euro area non- financial firms has been well above 20 per cent over the past three to four years. The overall size of the debt market – including also previously predominant government and bank bonds – is no ...

... use of equity market finance. As for the bond markets, the annual growth rate of issuance by euro area non- financial firms has been well above 20 per cent over the past three to four years. The overall size of the debt market – including also previously predominant government and bank bonds – is no ...

Interpreting the Causes of the Great Recession of 2008

... restrict conflicts of interest, and restrain the opportunities to take advantage of these problems which will never be fully corrected, in particular, by restricting excessive risk taking and certain practices and products where potential social costs exceed the benefits. 10 The same failure to unde ...

... restrict conflicts of interest, and restrain the opportunities to take advantage of these problems which will never be fully corrected, in particular, by restricting excessive risk taking and certain practices and products where potential social costs exceed the benefits. 10 The same failure to unde ...

What is a good banking system - Re

... hundredth one. Had CDOs and CLOs and the shadow banking system would not have existed, we would still be prone to banking crisis. So while it is important to learn lessons specific to this crisis we must not lose sight of the broader picture which clearly says that banking is a fragile business. The ...

... hundredth one. Had CDOs and CLOs and the shadow banking system would not have existed, we would still be prone to banking crisis. So while it is important to learn lessons specific to this crisis we must not lose sight of the broader picture which clearly says that banking is a fragile business. The ...

Download attachment

... than commercial bank (30-40%). Asset Quality: Loan Quality due to economic crisis the NPL/TL was 12% quite similar to that of commercial bank. Earning of SFHs increase but commercial banks decrease 5. Contribution ...

... than commercial bank (30-40%). Asset Quality: Loan Quality due to economic crisis the NPL/TL was 12% quite similar to that of commercial bank. Earning of SFHs increase but commercial banks decrease 5. Contribution ...

the wizard of bubbleland

... intermediaries, channeling domestic saving away from local uses and into international capital markets. A related strategy has focused on reducing the burden of external debt by attempting to pay down those obligations, with the funds coming from a combination of reduced fiscal deficits and increase ...

... intermediaries, channeling domestic saving away from local uses and into international capital markets. A related strategy has focused on reducing the burden of external debt by attempting to pay down those obligations, with the funds coming from a combination of reduced fiscal deficits and increase ...

Practice set and Solutions 1

... 1) A mutual fund represents a pool of financial resources obtained from individuals and companies, which is invested in the money and capital markets. This process represents another method for economic savers to channel funds to companies and government units that need extra funds. 2) Money market ...

... 1) A mutual fund represents a pool of financial resources obtained from individuals and companies, which is invested in the money and capital markets. This process represents another method for economic savers to channel funds to companies and government units that need extra funds. 2) Money market ...

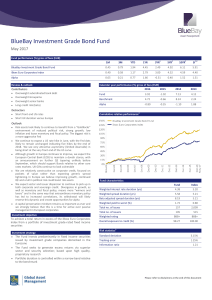

BlueBay Investment Grade Bond Fund

... 2018. We see very attractive asymmetry (limited downside) in being short at the very front end of the US curve Although growth in Europe continues to improve, we expect the European Central Bank (ECB) to maintain a dovish stance, with an announcement on further QE tapering unlikely before September, ...

... 2018. We see very attractive asymmetry (limited downside) in being short at the very front end of the US curve Although growth in Europe continues to improve, we expect the European Central Bank (ECB) to maintain a dovish stance, with an announcement on further QE tapering unlikely before September, ...

Credit cycle and systemic risk

... credit spreads, etc..). • The leverage can be approximated by credit-to-GDP ratio: • increases until the financial cycle turns over; normally the turnover happens in an orderly way (a case of cycle without a crisis in Chart) without a need for an extra policy action. • sometimes the turn is disorder ...

... credit spreads, etc..). • The leverage can be approximated by credit-to-GDP ratio: • increases until the financial cycle turns over; normally the turnover happens in an orderly way (a case of cycle without a crisis in Chart) without a need for an extra policy action. • sometimes the turn is disorder ...

Finance capital and the nature of capitalism in India today

... for sustained growth was the growth of the mass market for manufactures. This required land reform that broke down semi-feudal relations in the agricultural sector, so as to accelerate productivity and output growth by providing the actual cultivators – whether tenants or peasants – with the means a ...

... for sustained growth was the growth of the mass market for manufactures. This required land reform that broke down semi-feudal relations in the agricultural sector, so as to accelerate productivity and output growth by providing the actual cultivators – whether tenants or peasants – with the means a ...