economy overall pipeline malaysian capital raising expected at rm75b

... Tengku Abdul Aziz said if all the economic stimulus measures announced yesterday are executed well, GDP growth could actually be closer to the upper end of the official target of 5.5%. He noted, however, there may be some time lag before the full positive effects work through the financial and capit ...

... Tengku Abdul Aziz said if all the economic stimulus measures announced yesterday are executed well, GDP growth could actually be closer to the upper end of the official target of 5.5%. He noted, however, there may be some time lag before the full positive effects work through the financial and capit ...

Belarus in recession, banking sector in difficulties

... a ssets, with Russian credit institutions comprising the lion’s share: BPS-Sberbank (10.4% of total assets), Belvneshekonombank (5.5%), and Belgazprombank (5.0%). The largest non-Russian FOB is Priorbank, a subsidiary of Austria’s Raiffeisen Group, accounting for about 4.3% of total assets (Raiffe ...

... a ssets, with Russian credit institutions comprising the lion’s share: BPS-Sberbank (10.4% of total assets), Belvneshekonombank (5.5%), and Belgazprombank (5.0%). The largest non-Russian FOB is Priorbank, a subsidiary of Austria’s Raiffeisen Group, accounting for about 4.3% of total assets (Raiffe ...

annexure

... a. This category of Investments will henceforth be referred to as ‘Other Investments’. b. All provisions of the Act, Regulations, Circulars and Guidelines pertaining to investments falling under Section 27A (2) and 27B (3) of Insurance Act, 1938 shall continue to be applicable as such. ...

... a. This category of Investments will henceforth be referred to as ‘Other Investments’. b. All provisions of the Act, Regulations, Circulars and Guidelines pertaining to investments falling under Section 27A (2) and 27B (3) of Insurance Act, 1938 shall continue to be applicable as such. ...

Nordea`s strategic direction

... reasonable, no assurance can be given that such expectations will prove to have been correct. Accordingly, results could differ materially from those set out in the forward-looking statements as a result of various factors. Important factors that may cause such a difference for Nordea include, but a ...

... reasonable, no assurance can be given that such expectations will prove to have been correct. Accordingly, results could differ materially from those set out in the forward-looking statements as a result of various factors. Important factors that may cause such a difference for Nordea include, but a ...

The Role of the Financial Sector

... Guarantees are better suited for tackling credit constraints, and are particularly efficient when private banks are excessively risk averse and the guarantor has superior enforcement capacity or information on collateral value. Cheap funding is ideal for targeting firms that generate positive spillo ...

... Guarantees are better suited for tackling credit constraints, and are particularly efficient when private banks are excessively risk averse and the guarantor has superior enforcement capacity or information on collateral value. Cheap funding is ideal for targeting firms that generate positive spillo ...

Some Recent Trends in Commercial Banking

... we exclude from the financial sector debt the part that is owed by governmentsponsored enterprises (GSE) and other federally related mortgage pools. In other words, financial sector debt has been growing faster, not just at GSEs (a well-known fact), but across the board. ...

... we exclude from the financial sector debt the part that is owed by governmentsponsored enterprises (GSE) and other federally related mortgage pools. In other words, financial sector debt has been growing faster, not just at GSEs (a well-known fact), but across the board. ...

Banking Crises

... definitions are liable to be inconclusive. Grossman (1994) defines a banking crisis as occurring when: (1) a high proportion of banks fail (e.g., the United States during the Great Depression, Austria following 1873); (2) an especially large or important bank failed (e.g., France’s Union Générale i ...

... definitions are liable to be inconclusive. Grossman (1994) defines a banking crisis as occurring when: (1) a high proportion of banks fail (e.g., the United States during the Great Depression, Austria following 1873); (2) an especially large or important bank failed (e.g., France’s Union Générale i ...

Slide sem título - World Bank Group

... reduction in profitability from 2001 to 2004 being basically due to the appreciation of the Brazilian currency (Real) • Remaining government institutions were restructured and significantly improved their earnings performance • Domestic private banks confirm their good phase with a leap in profits f ...

... reduction in profitability from 2001 to 2004 being basically due to the appreciation of the Brazilian currency (Real) • Remaining government institutions were restructured and significantly improved their earnings performance • Domestic private banks confirm their good phase with a leap in profits f ...

Japan`s Financial Problems

... markets, corporate governance emphasizing managerial control, encouragement of company-based unions and so-called lifetime employment (in large firms), encouragement of cartels and other forms of cooperative industrial behavior, enforcement of very strong protectionist barriers on both trade and inv ...

... markets, corporate governance emphasizing managerial control, encouragement of company-based unions and so-called lifetime employment (in large firms), encouragement of cartels and other forms of cooperative industrial behavior, enforcement of very strong protectionist barriers on both trade and inv ...

The financial system: Strengths and weaknesses

... which have a significantly negative impact on economic developments. Difficulties within a single financial institution, or major price changes in a single market, which do not have pervasive effects on the financial system as a whole and/or economic activity, are therefore not classified as financi ...

... which have a significantly negative impact on economic developments. Difficulties within a single financial institution, or major price changes in a single market, which do not have pervasive effects on the financial system as a whole and/or economic activity, are therefore not classified as financi ...

Report

... software capitalisation policy ($441 million), impairment of the Group’s investment in AmBank ($260 million), a net gain in relation to Bank of Tianjin ($29 million) and Group restructuring expenses ($101 million), as well as the Esanda dealer finance sale ($56 million). An information pack on these ...

... software capitalisation policy ($441 million), impairment of the Group’s investment in AmBank ($260 million), a net gain in relation to Bank of Tianjin ($29 million) and Group restructuring expenses ($101 million), as well as the Esanda dealer finance sale ($56 million). An information pack on these ...

European banks` balance sheets strongest for a

... European banks as a result of regulatory fines, restructuring charges and goodwill write-downs, as well as weak top lines. Concerns also remain that the weak macro backdrop around the world, which could lead to further declines in interest rates into negative territory, will impair banks’ earnings a ...

... European banks as a result of regulatory fines, restructuring charges and goodwill write-downs, as well as weak top lines. Concerns also remain that the weak macro backdrop around the world, which could lead to further declines in interest rates into negative territory, will impair banks’ earnings a ...

ifs_quickguide-0114

... rate of interest based on the face value of the bond when issued. TIPS bonds are designed to provide long-term inflation protection by attaching the face value of the bond to changes in inflation. When inflation increases, the face value of the bond also increases. If inflation becomes negative, the ...

... rate of interest based on the face value of the bond when issued. TIPS bonds are designed to provide long-term inflation protection by attaching the face value of the bond to changes in inflation. When inflation increases, the face value of the bond also increases. If inflation becomes negative, the ...

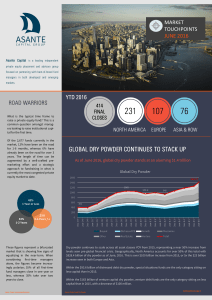

global dry powder continues to stack up

... This communication is furnished on a strictly confidential basis, for discussion purposes only and may not be relied upon for the purposes of entering into any transaction. Under no circumstances shall this communication be deemed or construed to be an offer to sell or a solicitation of an offer to ...

... This communication is furnished on a strictly confidential basis, for discussion purposes only and may not be relied upon for the purposes of entering into any transaction. Under no circumstances shall this communication be deemed or construed to be an offer to sell or a solicitation of an offer to ...

Market concentration and competition in Vietnamese banking sector.

... have higher profit, protecting them against financial shocks. The role of larger banks is also supported by the view of Boot and Thakor (2000) and Meon and Weill (2005), proposed that larger banks do not need to give credit to risky investors, and can therefore select their clients, which increase ...

... have higher profit, protecting them against financial shocks. The role of larger banks is also supported by the view of Boot and Thakor (2000) and Meon and Weill (2005), proposed that larger banks do not need to give credit to risky investors, and can therefore select their clients, which increase ...

The value of illiquidity

... or warranty that such objectives or expectations will be achieved or risks are fully disclosed. The information and opinions contained in this document is based upon information obtained from sources believed to be reliable and in good faith but no responsibility is accepted for any misrepresentatio ...

... or warranty that such objectives or expectations will be achieved or risks are fully disclosed. The information and opinions contained in this document is based upon information obtained from sources believed to be reliable and in good faith but no responsibility is accepted for any misrepresentatio ...

Financial Development in the CIS-7 Countries

... enhanced services at a lower cost. Setting up such infrastructure requires public investment, since any subset of banks would not have either the incentives, or sufficient skills and funds, or both, to invest in an activity that does not yield exclusive private benefits (see Santomero and Seater, 20 ...

... enhanced services at a lower cost. Setting up such infrastructure requires public investment, since any subset of banks would not have either the incentives, or sufficient skills and funds, or both, to invest in an activity that does not yield exclusive private benefits (see Santomero and Seater, 20 ...

To Analysis of the Financial Performance Management and Risk

... The study has seen many positive developments in the Indian banking sector from last ten years. The policy makers, which comprise the Reserve Bank of India (RBI), Ministry of Finance and related government and financial sector regulatory entities, have made several notable efforts to improve regulat ...

... The study has seen many positive developments in the Indian banking sector from last ten years. The policy makers, which comprise the Reserve Bank of India (RBI), Ministry of Finance and related government and financial sector regulatory entities, have made several notable efforts to improve regulat ...