Working Papers - Federal Reserve Bank of Philadelphia

... as the Fair, Isaac--or FICO--credit score) actually maintained on the databases of the credit bureaus. Combining common information sets with common selection criteria can further increase the correlation of credit analysis and, potentially, of lending decisions across banks. To the extent that adve ...

... as the Fair, Isaac--or FICO--credit score) actually maintained on the databases of the credit bureaus. Combining common information sets with common selection criteria can further increase the correlation of credit analysis and, potentially, of lending decisions across banks. To the extent that adve ...

Quantifying the Value of Implicit Government Guarantees for Large

... investors rather than equity investors, we expect that such support affects credit spreads much more than it affects equity prices. Therefore, we look at price implications along two dimensions: comparing large financial institutions against small financial institutions and comparing Credit Default ...

... investors rather than equity investors, we expect that such support affects credit spreads much more than it affects equity prices. Therefore, we look at price implications along two dimensions: comparing large financial institutions against small financial institutions and comparing Credit Default ...

UK Fixed Interest

... This fund will use derivatives in a number of ways to achieve its objectives. Derivatives offer a way to gain exposure to the returns of a specified equity or bond market without having to directly own it. They allow a manager to buy or sell an investment at a specified future date for a specified p ...

... This fund will use derivatives in a number of ways to achieve its objectives. Derivatives offer a way to gain exposure to the returns of a specified equity or bond market without having to directly own it. They allow a manager to buy or sell an investment at a specified future date for a specified p ...

AESS01

... top of the agenda, not just of supervisora authorities, but of public policymakers more generally. These developments include the explosiva growth in the volume of -financiar transactions, the increased complexity of new instruments, costly crises in national financiar systems, and severas high-prof ...

... top of the agenda, not just of supervisora authorities, but of public policymakers more generally. These developments include the explosiva growth in the volume of -financiar transactions, the increased complexity of new instruments, costly crises in national financiar systems, and severas high-prof ...

The Changing Landscape of the Financial Services

... Section 20 subsidiaries to 10 percent in September 1989 and to 25 percent in December 1996. Also in 1996, the Federal Reserve began contemplating the elimination of previously instituted “firewalls” between bank and nonbank activity within the subsidiary structure of a BHC. The firewalls had been i ...

... Section 20 subsidiaries to 10 percent in September 1989 and to 25 percent in December 1996. Also in 1996, the Federal Reserve began contemplating the elimination of previously instituted “firewalls” between bank and nonbank activity within the subsidiary structure of a BHC. The firewalls had been i ...

Some preliminary proposals for re-regulating financial systems

... of private finance. This required both a more generalised opening of the capital account of the balance of payments and a mix of deregulation, in effect a liberalisation, and reregulation of national financial systems. At that time the change was depicted as the passage from a structural to a pruden ...

... of private finance. This required both a more generalised opening of the capital account of the balance of payments and a mix of deregulation, in effect a liberalisation, and reregulation of national financial systems. At that time the change was depicted as the passage from a structural to a pruden ...

Financial Systems, Industrial Structure and Growth

... follows. They identify an industry's need for exter nal finance (the difference between investments ...

... follows. They identify an industry's need for exter nal finance (the difference between investments ...

Developments and Issues in the Canadian Market

... ABCP provides funding on an anonymous basis, which could be important for some who might otherwise issue traditional commercial paper or bankers’ acceptances.5 In contrast, in ...

... ABCP provides funding on an anonymous basis, which could be important for some who might otherwise issue traditional commercial paper or bankers’ acceptances.5 In contrast, in ...

Fact Sheet - Erste Group Bank AG

... In bank retail business, strong performance in volume generation by the franchise resulted in sales of secured loans increasing by 34% annually, with Prima Casa new production 66% yoy. The retail performing loans balance grew at around RON 16.9 billion, on the back of new lending outgrowing volumes ...

... In bank retail business, strong performance in volume generation by the franchise resulted in sales of secured loans increasing by 34% annually, with Prima Casa new production 66% yoy. The retail performing loans balance grew at around RON 16.9 billion, on the back of new lending outgrowing volumes ...

Financial Abandonment in Britain and the United States

... change over time,makingit less likely that the money will be repaid. This means that the more quicklythe loan can be repaid,the less it will cost. This state of affairstends to favour those with greater financialresources, since they will be able to pay back the money more quicklyand, at less expens ...

... change over time,makingit less likely that the money will be repaid. This means that the more quicklythe loan can be repaid,the less it will cost. This state of affairstends to favour those with greater financialresources, since they will be able to pay back the money more quicklyand, at less expens ...

Bogotá, 30 de diciembre de 2005

... During the first quarter of 2008, total assets of the financial sector showed an overall increase, in line with profit gains. On March 2008 the aggregate financial sector reported a 13.9% annual increase of total assets, reaching $419.1 trillion. This increase in total assets was led by credit insti ...

... During the first quarter of 2008, total assets of the financial sector showed an overall increase, in line with profit gains. On March 2008 the aggregate financial sector reported a 13.9% annual increase of total assets, reaching $419.1 trillion. This increase in total assets was led by credit insti ...

Saving and Investing in the New Economy

... opportunities. The ―mortgage- backed securities‖ and ―collateralized debt obligations‖ that have been discussed in the news during the past few years represent a small number of financial products that have emerged over the last two decades. The economy has been further complicated by the increased ...

... opportunities. The ―mortgage- backed securities‖ and ―collateralized debt obligations‖ that have been discussed in the news during the past few years represent a small number of financial products that have emerged over the last two decades. The economy has been further complicated by the increased ...

Taking Firms and Markets Seriously: A Study on Bank Behavior

... monitoring is expensive and there are limits to information. Moreover, in most banks debt is mainly held by depositors who hold only a relatively small deposit each and who lack incentives to perform efficient monitoring. Thus, depositors need to be represented by a regulator who can intervene on th ...

... monitoring is expensive and there are limits to information. Moreover, in most banks debt is mainly held by depositors who hold only a relatively small deposit each and who lack incentives to perform efficient monitoring. Thus, depositors need to be represented by a regulator who can intervene on th ...

ch03 - U of L Class Index

... Units of these trusts hold shares of firms in market indices in proportion to their weights in the index Differences from traditional mutual funds: ...

... Units of these trusts hold shares of firms in market indices in proportion to their weights in the index Differences from traditional mutual funds: ...

The Origins of the Financial Crisis

... new group of eligible borrowers increased housing demand and helped inflate home prices. These new financial innovations thrived in an environment of easy monetary policy by the Federal Reserve and poor regulatory oversight. With interest rates so low and with regulators turning a blind eye, financ ...

... new group of eligible borrowers increased housing demand and helped inflate home prices. These new financial innovations thrived in an environment of easy monetary policy by the Federal Reserve and poor regulatory oversight. With interest rates so low and with regulators turning a blind eye, financ ...

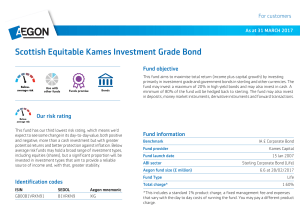

Scottish Equitable Kames Investment Grade Bond

... There's no guarantee this fund will meet its objectives. All our funds carry a level of risk, in particular the value of your investment may go down as well as up. You may get back less than you invested. The table below draws your attention to the key risks specific to this fund. Risk Type ...

... There's no guarantee this fund will meet its objectives. All our funds carry a level of risk, in particular the value of your investment may go down as well as up. You may get back less than you invested. The table below draws your attention to the key risks specific to this fund. Risk Type ...

The Impact of Regulation on Financial Services Industry Groups

... financial services industry over the past two decades, thus serving as catalysts to this crisis. Following the 1999 Financial Services Modernization Act (also known as the Gramm Leach Bliley (GLB) Act), mergers among commercial and investment banks and other financial service firms produced large fi ...

... financial services industry over the past two decades, thus serving as catalysts to this crisis. Following the 1999 Financial Services Modernization Act (also known as the Gramm Leach Bliley (GLB) Act), mergers among commercial and investment banks and other financial service firms produced large fi ...

High Yield Bond Fund

... Bond values fluctuate in response to the financial condition of individual issuers, general market and economic conditions, and changes in interest rates. Changes in market conditions and government policies may lead to periods of heightened volatility in the bond market and reduced liquidity for ce ...

... Bond values fluctuate in response to the financial condition of individual issuers, general market and economic conditions, and changes in interest rates. Changes in market conditions and government policies may lead to periods of heightened volatility in the bond market and reduced liquidity for ce ...

Revisions to the Basel III leverage ratio framework, issued by the

... risk-based capital ratio for many banks and more than a “backstop” measure. Under the non-risk-based leverage ratio framework, profitability of low-risk and low-margin transactions, such as repo, call loan and plain vanilla derivatives, tends to look relatively unfavorable, which could adversely aff ...

... risk-based capital ratio for many banks and more than a “backstop” measure. Under the non-risk-based leverage ratio framework, profitability of low-risk and low-margin transactions, such as repo, call loan and plain vanilla derivatives, tends to look relatively unfavorable, which could adversely aff ...

PDF Version - Federal Reserve Bank of Minneapolis

... dollar volume of seasonal borrowing also remained small compared to what could have been borrowed. In 1978, for example, annual average borrowing totaled $121 million—only 17 percent of the funds available. The small proportion of eligible banks that have used the privilege suggests at the very leas ...

... dollar volume of seasonal borrowing also remained small compared to what could have been borrowed. In 1978, for example, annual average borrowing totaled $121 million—only 17 percent of the funds available. The small proportion of eligible banks that have used the privilege suggests at the very leas ...