June - sibstc

... Factors determining exchange rates There are many factors to decide the currency’s values and it can be understood in simpler terms too. A currency will tend to become more valuable when its demand is higher than the supply. A currency will tend to become less valuable when its demand is less than s ...

... Factors determining exchange rates There are many factors to decide the currency’s values and it can be understood in simpler terms too. A currency will tend to become more valuable when its demand is higher than the supply. A currency will tend to become less valuable when its demand is less than s ...

The Current Account, Fiscal Policy and Medium Run Income

... With greater international integration of goods, services and assets markets, the average size of current account imbalances in emerging and advanced economies has increased over recent decades, a phenomenon which has concerned domestic and international financial markets and policymakers. In defici ...

... With greater international integration of goods, services and assets markets, the average size of current account imbalances in emerging and advanced economies has increased over recent decades, a phenomenon which has concerned domestic and international financial markets and policymakers. In defici ...

53 - WTO Documents Online - World Trade Organization

... and a further buildup in foreign reserves, but limited progress in reducing inflation. After having declined by around 15 per cent during 1997–99, real GDP grew by an estimated 1–1½ per cent in the first half of 2000 (year on year), thanks to buoyant exports and stock-building; final domestic demand ...

... and a further buildup in foreign reserves, but limited progress in reducing inflation. After having declined by around 15 per cent during 1997–99, real GDP grew by an estimated 1–1½ per cent in the first half of 2000 (year on year), thanks to buoyant exports and stock-building; final domestic demand ...

Fund Focus - Schroders

... We think that many of the most exciting currency opportunities are arising in the developing world. So, we are currently overweight eastern European currencies such as the Polish zloty, the Czech koruna and the Hungarian forint. It is true that these currencies collapsed dramatically in 2008 – there ...

... We think that many of the most exciting currency opportunities are arising in the developing world. So, we are currently overweight eastern European currencies such as the Polish zloty, the Czech koruna and the Hungarian forint. It is true that these currencies collapsed dramatically in 2008 – there ...

Fiscal Policy during and after the Bubble

... – Very controversial idea – Some evidence for it including Ireland in 1987 ...

... – Very controversial idea – Some evidence for it including Ireland in 1987 ...

System of National Accounts

... • Not welfare measure (though often used as one) • (Most) activity within household for own consumption excluded ...

... • Not welfare measure (though often used as one) • (Most) activity within household for own consumption excluded ...

Exchange rates and reserves accumulation

... that a liberal policy towards multinationals is sufficient to ensure positive effects, is not compatible with empirical data. Moreover, from the point of view of the balance of payments, FDI and increasing reinvestment can generate in the long run a structural trend towards financial fragility. The ...

... that a liberal policy towards multinationals is sufficient to ensure positive effects, is not compatible with empirical data. Moreover, from the point of view of the balance of payments, FDI and increasing reinvestment can generate in the long run a structural trend towards financial fragility. The ...

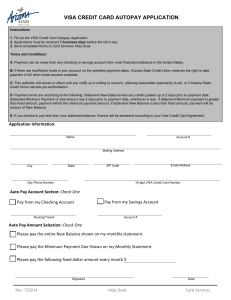

Visa Credit Card Auto Pay Application

... VISA CREDIT CARD AUTOPAY APPLICATION Instructions: 1. Fill out the VISA Credit Card Autopay Application. 2. Applications must be received 7 business days before the bill is due. 3. Send completed forms to Card Services Help Desk. Terms and Conditions: A: Payment can be made from any checking or savi ...

... VISA CREDIT CARD AUTOPAY APPLICATION Instructions: 1. Fill out the VISA Credit Card Autopay Application. 2. Applications must be received 7 business days before the bill is due. 3. Send completed forms to Card Services Help Desk. Terms and Conditions: A: Payment can be made from any checking or savi ...

Deficit, Surpluses, and the Public Debt

... Fortunately, the majority of our debt is owned by Americans. When we make interest payments on it, the money stays with Americans. Increased foreign purchase of our debt will drastically could result in higher taxes and a decline in GDP. ...

... Fortunately, the majority of our debt is owned by Americans. When we make interest payments on it, the money stays with Americans. Increased foreign purchase of our debt will drastically could result in higher taxes and a decline in GDP. ...

I.Why RMB exchange rate issue

... III.Comments on RMB exchange rate issue 1、Exchange rate issue is sovereignty of any economy The determination mechanism of exchange rate is actually different from any exchange rate theories,which at least neglecting three preconditions: ● Sovereignty cannot be neglected in any markets,which reflec ...

... III.Comments on RMB exchange rate issue 1、Exchange rate issue is sovereignty of any economy The determination mechanism of exchange rate is actually different from any exchange rate theories,which at least neglecting three preconditions: ● Sovereignty cannot be neglected in any markets,which reflec ...

The Contemporaneous (Third Industrial Revolution)

... 1. Household income and consumer goods imports 2. Investment in fixed capital and imports of capital goods 3. Domestic output (export or domestic absorption) and imports of intermediate goods (Vertical Specialization) Using April 2015 version of the Penn Tables 8.1, on a selection of G-20 countries ...

... 1. Household income and consumer goods imports 2. Investment in fixed capital and imports of capital goods 3. Domestic output (export or domestic absorption) and imports of intermediate goods (Vertical Specialization) Using April 2015 version of the Penn Tables 8.1, on a selection of G-20 countries ...

Capital Account Liberalisation and China`s Effect on Global Capital

... however, disrupted by the Asian financial crisis. China’s capital account liberalisation process has resumed over the past few years, raising the question about the sequencing of capital account liberalisation. The debate gained prominence following the renminbi depreciation in August 2015 and subse ...

... however, disrupted by the Asian financial crisis. China’s capital account liberalisation process has resumed over the past few years, raising the question about the sequencing of capital account liberalisation. The debate gained prominence following the renminbi depreciation in August 2015 and subse ...

The Causes, Solution and Consequences of the 1997

... problem of co-existence of fixed exchange rate regime and liberalized capital flows minimal exchange rate risk for foreign capital positive interest-rate differential (Czech real interest rates higher than in other transition countries) increasing ratio of short-term capital on the financial account ...

... problem of co-existence of fixed exchange rate regime and liberalized capital flows minimal exchange rate risk for foreign capital positive interest-rate differential (Czech real interest rates higher than in other transition countries) increasing ratio of short-term capital on the financial account ...

Economists try to predict trends in the world economy by applying

... world. It is the combined economic activity that takes place in each individual economy plus the activity between countries. It includes all production, trade, financial flows, investment, technology, labour and economic behaviour in nations and between nations. Economists try to predict trends in t ...

... world. It is the combined economic activity that takes place in each individual economy plus the activity between countries. It includes all production, trade, financial flows, investment, technology, labour and economic behaviour in nations and between nations. Economists try to predict trends in t ...

BM410-18 International Analysis and

... • It is the risk that a foreign government will, by fiat, take control and ownership of a foreign operation of a multinational company • What is the likelihood of this happening? • The probability continues to diminish as more countries join the international ...

... • It is the risk that a foreign government will, by fiat, take control and ownership of a foreign operation of a multinational company • What is the likelihood of this happening? • The probability continues to diminish as more countries join the international ...

NBER WORKING PAPER SERIES INTERNATIONAL LIQUIDITY: THE FISCAL DIMENSION Maurice Obstfeld

... and their own demands on the borrowers. These include (at least so far) a rejection of outright sovereign debt restructuring outside of Greece, in part because widespread restructuring might imperil banks elsewhere in Europe as well as the capital of the ECB, which has heavily underwritten the banki ...

... and their own demands on the borrowers. These include (at least so far) a rejection of outright sovereign debt restructuring outside of Greece, in part because widespread restructuring might imperil banks elsewhere in Europe as well as the capital of the ECB, which has heavily underwritten the banki ...

Improving Profitability by Managing FX Risk

... Allow you to also participate in upside Now used by your direct competitors ...

... Allow you to also participate in upside Now used by your direct competitors ...

white paper of Nautiluscoin

... Fund (NSF), while the second tool, a PoS multipool, will be implemented with the switch to the dynamic proof-of-stake system. The NSF was conceived to stabilize the price of Nautiluscoin and ultimately increase the purchasing power of the users and holders of the currency. However, a logical flaw w ...

... Fund (NSF), while the second tool, a PoS multipool, will be implemented with the switch to the dynamic proof-of-stake system. The NSF was conceived to stabilize the price of Nautiluscoin and ultimately increase the purchasing power of the users and holders of the currency. However, a logical flaw w ...

ODA to Latin America

... • On the other hand if debt is used to intervene in the foreign exchange market to support an overvalued exchange rate that is not good. • In this case a rising debt level was buying faster economic growth in the short run at the risk of a default or lower economic growth in the future caused by a m ...

... • On the other hand if debt is used to intervene in the foreign exchange market to support an overvalued exchange rate that is not good. • In this case a rising debt level was buying faster economic growth in the short run at the risk of a default or lower economic growth in the future caused by a m ...

Dealing with the benefits and costs - Bank for International Settlements

... If the domestic currency can be used for invoicing and payment instruments, the country’s exporters, importers, borrowers and lenders can eliminate the exchange rate risk inherent in international trading and financial transactions. However, in Korea, the won is rarely used as an invoice currency fo ...

... If the domestic currency can be used for invoicing and payment instruments, the country’s exporters, importers, borrowers and lenders can eliminate the exchange rate risk inherent in international trading and financial transactions. However, in Korea, the won is rarely used as an invoice currency fo ...

The Causes, Solution and Consequences of the 1997

... problem of co-existence of fixed exchange rate regime and liberalized capital flows minimal exchange rate risk for foreign capital positive interest-rate differential (Czech real interest rates higher than in other transition countries) increasing ratio of short-term capital on the financial account ...

... problem of co-existence of fixed exchange rate regime and liberalized capital flows minimal exchange rate risk for foreign capital positive interest-rate differential (Czech real interest rates higher than in other transition countries) increasing ratio of short-term capital on the financial account ...

Governing the Global Economy

... Great Depression demonstrated that unregulated international economy was unstable. In line with the ideas of Keynes markets had to be “managed”. All industrialized states in the post war period adopted Keynesian techniques of economic management ...

... Great Depression demonstrated that unregulated international economy was unstable. In line with the ideas of Keynes markets had to be “managed”. All industrialized states in the post war period adopted Keynesian techniques of economic management ...

Cambridge International Examinations Cambridge

... The population of Bulgaria is 7.5 million and yet over a million Bulgarians have left the country in recent years to work abroad, especially in Spain and Greece. The value of the money they have sent back home, known as migrant remittances, has risen from US$900 million in 2008 to US$990 million in ...

... The population of Bulgaria is 7.5 million and yet over a million Bulgarians have left the country in recent years to work abroad, especially in Spain and Greece. The value of the money they have sent back home, known as migrant remittances, has risen from US$900 million in 2008 to US$990 million in ...

refocus

... Having said that, we are currently running with significant cash exposures in our funds. A downgrade to junk status, might just give us the buying opportunity in good quality local assets that we have been waiting for. ...

... Having said that, we are currently running with significant cash exposures in our funds. A downgrade to junk status, might just give us the buying opportunity in good quality local assets that we have been waiting for. ...