The Perils of Paradigm Maintenance in the Face of Crisis

... Keynesianism in the North and developmentalism in the South. The resulting economic policy package became known as neoliberalism or, in more innocuous terms, the ‘Washington Consensus,’ that is, the consensus that is now supposed to be shattered. Then as in now, we tend to assume that systemic crisi ...

... Keynesianism in the North and developmentalism in the South. The resulting economic policy package became known as neoliberalism or, in more innocuous terms, the ‘Washington Consensus,’ that is, the consensus that is now supposed to be shattered. Then as in now, we tend to assume that systemic crisi ...

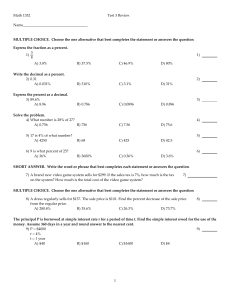

Midterm #2

... If there is no long-run trend in interest rates, then the money market equilibrium equation says (after some calculus has been applied to it) that inflation will be equal to zero if: a. the rate of money growth is equal to the real interest rate. b. the rate of money growth is equal to the elasticit ...

... If there is no long-run trend in interest rates, then the money market equilibrium equation says (after some calculus has been applied to it) that inflation will be equal to zero if: a. the rate of money growth is equal to the real interest rate. b. the rate of money growth is equal to the elasticit ...

Math 1332 T3Rs11 - HCC Learning Web

... C) a. amount financed: $3800; b. total installment price: $3975; c. finance charge: $175 D) a. amount financed: $3500; b. total installment price: $4010; c. finance charge: $510 Solve the problem. 16) A particular credit card calculates interest using the unpaid balance method. The monthly interest ...

... C) a. amount financed: $3800; b. total installment price: $3975; c. finance charge: $175 D) a. amount financed: $3500; b. total installment price: $4010; c. finance charge: $510 Solve the problem. 16) A particular credit card calculates interest using the unpaid balance method. The monthly interest ...

91403 Sample Assessment Schedule

... Fiscal policy involves changes in government spending and/or revenue to achieve economic goals. Fiscal policy could be used by increasing household disposable incomes through less tax or more government spending on such things as transfer payments and Kiwisaver contributions (specific examples not r ...

... Fiscal policy involves changes in government spending and/or revenue to achieve economic goals. Fiscal policy could be used by increasing household disposable incomes through less tax or more government spending on such things as transfer payments and Kiwisaver contributions (specific examples not r ...

AP Macreconomics - Graphical Overview

... 24. What are the determinants (shift factors) of aggregate demand? Changes in consumer spending, investment, government spending, and net exports will cause AD to shift. If consumer wealth increases, expectations become positive, household indebtedness decreases, or taxes decrease, AD will s ...

... 24. What are the determinants (shift factors) of aggregate demand? Changes in consumer spending, investment, government spending, and net exports will cause AD to shift. If consumer wealth increases, expectations become positive, household indebtedness decreases, or taxes decrease, AD will s ...

Overview of the Fund’s response to the Crisis

... Policies/outcomes similar to comparable nonprogram countries ...

... Policies/outcomes similar to comparable nonprogram countries ...

Chapter 6.pmd

... The balance of payments (BoP) record the transactions in goods, services and assets between residents of a country with the rest of the world for a specified time period typically a year. Table 6.1 gives the balance of payments summary for the Indian Economy for the year 2012-13. There are two main ...

... The balance of payments (BoP) record the transactions in goods, services and assets between residents of a country with the rest of the world for a specified time period typically a year. Table 6.1 gives the balance of payments summary for the Indian Economy for the year 2012-13. There are two main ...

Interdependence, Exchange Rate Flexibility, And National Economies

... and a gain in international reserves. The latter reserve inflow will more than offset any tendency for reserves to decline due to the trade account deficit. That is because, if imports are a reasonably stable proportion of income, the trade deficit would be limited by the size of the rise in income. ...

... and a gain in international reserves. The latter reserve inflow will more than offset any tendency for reserves to decline due to the trade account deficit. That is because, if imports are a reasonably stable proportion of income, the trade deficit would be limited by the size of the rise in income. ...

Document

... balances. However, the controls should be of temporary character and they should be approved by the EU Council. When a country realizes a liberalization of the capital account, it should pay attention to the development of the domestic financial system. The experience from the currency crises in th ...

... balances. However, the controls should be of temporary character and they should be approved by the EU Council. When a country realizes a liberalization of the capital account, it should pay attention to the development of the domestic financial system. The experience from the currency crises in th ...

Meaning and scope

... • Fiscal Deficit: • Fiscal deficit was of the order of 4 per cent of gross domestic product (GDP) at the beginning of 1980s, and was estimated at more than 8 per cent in 1990-91. The growing fiscal deficit had to be met by borrowing which led to a mammoth internal debt of the government. • The serv ...

... • Fiscal Deficit: • Fiscal deficit was of the order of 4 per cent of gross domestic product (GDP) at the beginning of 1980s, and was estimated at more than 8 per cent in 1990-91. The growing fiscal deficit had to be met by borrowing which led to a mammoth internal debt of the government. • The serv ...

Proposition III (the principle of policy effectiveness)

... sophisticated and effective techniques for measuring and managing the resulting risks. Central to many of the techniques was the concept of Value-at-Risk (VAR), enabling inferences about forward-looking risk to be drawn from the observation of past patterns of price movement. This technique, develop ...

... sophisticated and effective techniques for measuring and managing the resulting risks. Central to many of the techniques was the concept of Value-at-Risk (VAR), enabling inferences about forward-looking risk to be drawn from the observation of past patterns of price movement. This technique, develop ...

14.02 Principles of Macroeconomics

... investor expects that the exchange rate will be unchanged next year, at E. 1. Derive the condition on i, i* and E that must hold for the US investor to be indifferent between buying US bonds or Eurobonds (this is exactly the uncovered interest parity we saw in class with zero expected depreciation). ...

... investor expects that the exchange rate will be unchanged next year, at E. 1. Derive the condition on i, i* and E that must hold for the US investor to be indifferent between buying US bonds or Eurobonds (this is exactly the uncovered interest parity we saw in class with zero expected depreciation). ...

Submission to the Review of Export Policies and Programs

... phone banking service in Africa and Afghanistan and expects to supply 40 million low-income Indian customers starting this year. Hindustan Unilever has sales in India exceeding US$3.5 Billion – the majority of which goes to low-income consumers. IBM has business in India valued at over US$1Billion s ...

... phone banking service in Africa and Afghanistan and expects to supply 40 million low-income Indian customers starting this year. Hindustan Unilever has sales in India exceeding US$3.5 Billion – the majority of which goes to low-income consumers. IBM has business in India valued at over US$1Billion s ...

Macroprudential Policies in a Global Perspective Guillermo Calvo COmmenTaRY

... to discuss Pareto-improving borrowing taxes and other forms of government intervention. The first part of the paper shows that if the dominant distortion resides at home, then domestic macroprudential policy, and not controls on capital inflows, are in order. This is a straightforward result in term ...

... to discuss Pareto-improving borrowing taxes and other forms of government intervention. The first part of the paper shows that if the dominant distortion resides at home, then domestic macroprudential policy, and not controls on capital inflows, are in order. This is a straightforward result in term ...

To view this press release as a Word file

... instance, in the United States during the Korean War. Government revenues also declined in relation to GDP in recent years, reaching 38 percent of GDP in 2011. This is mainly the result of the reduction in direct statutory tax rates, which has led to a change in the tax mix. In 2003, the deficit was ...

... instance, in the United States during the Korean War. Government revenues also declined in relation to GDP in recent years, reaching 38 percent of GDP in 2011. This is mainly the result of the reduction in direct statutory tax rates, which has led to a change in the tax mix. In 2003, the deficit was ...

Financial Reform and Vulnerability:How to Open but Remain Safe?

... This increases the fragility of the banking system to adverse external shocks, particularly if the degree of capital mobility is high Under any pegged rate regime, capital outflows affect the financial system through an expansion or contraction of bank balance sheets; they can lead to instability in ...

... This increases the fragility of the banking system to adverse external shocks, particularly if the degree of capital mobility is high Under any pegged rate regime, capital outflows affect the financial system through an expansion or contraction of bank balance sheets; they can lead to instability in ...

Chapter 15

... In 1970: Mexico foreign borrowing from private creditors was 1% of GDP 1980: 8% of GDP.... more than half of the debt was “short term”: had to be repaid within 1 year At first, borrowing seemed to help: GDP per capita rose 2.4% 19721981 But it turned out that Mexico had borrowed “too much too quick ...

... In 1970: Mexico foreign borrowing from private creditors was 1% of GDP 1980: 8% of GDP.... more than half of the debt was “short term”: had to be repaid within 1 year At first, borrowing seemed to help: GDP per capita rose 2.4% 19721981 But it turned out that Mexico had borrowed “too much too quick ...

Open Economy Macroeconomics 26

... Current account: Includes payments for imports and exports of goods and services, incomes flowing into and out of the country, and net transfers of money. Capital account: Summarizes the flow of money into and out of domestic and foreign assets, including investments by foreign companies in domestic ...

... Current account: Includes payments for imports and exports of goods and services, incomes flowing into and out of the country, and net transfers of money. Capital account: Summarizes the flow of money into and out of domestic and foreign assets, including investments by foreign companies in domestic ...

High Level Seminar No.4 Financial Crisis and Access to Finance

... This Material is provided for informational purposes only. This Material (1) is for the use of the intended addressee non-retail (2) recipients only and the contents of this Material may not be reproduced, redistributed, or copied in whole or in part for any purpose without Exotix prior express cons ...

... This Material is provided for informational purposes only. This Material (1) is for the use of the intended addressee non-retail (2) recipients only and the contents of this Material may not be reproduced, redistributed, or copied in whole or in part for any purpose without Exotix prior express cons ...

Global Imbalances and the Key Currency Regime: The Case for a

... income) could be made consistent with the increasing uncompetitiveness of United States goods in relation to European or Japanese goods, there was no reason why any major participant should wish to disturb these arrangements. But with the passage of time these preconditions became increasingly tenuo ...

... income) could be made consistent with the increasing uncompetitiveness of United States goods in relation to European or Japanese goods, there was no reason why any major participant should wish to disturb these arrangements. But with the passage of time these preconditions became increasingly tenuo ...

Economy in Brief

... Investment growth remains strong Business non-residential investment jumped more than 20% for the third consecutive quarter. Within that category, machinery and equipment investment soared more than 25% for the third consecutive time. Non-residential construction rose about 7% after increasing nearl ...

... Investment growth remains strong Business non-residential investment jumped more than 20% for the third consecutive quarter. Within that category, machinery and equipment investment soared more than 25% for the third consecutive time. Non-residential construction rose about 7% after increasing nearl ...

Document

... – BOP determines Supply and demand for euro (€) – foreign exchange market determines e. – Receipts (e.g. Exports): Demand for Euro. – Payments (e.g. Imports): Supply of Euro. ...

... – BOP determines Supply and demand for euro (€) – foreign exchange market determines e. – Receipts (e.g. Exports): Demand for Euro. – Payments (e.g. Imports): Supply of Euro. ...

What is Wrong With the Washington Consensus and What Should

... capital funds to freely move across national boundaries, then "the authorities had no direct control over the domestic rate of interest or the other inducements to home investment, [and] measures to increase the favorable balance of trade [are]...the only direct means at their disposal for increasin ...

... capital funds to freely move across national boundaries, then "the authorities had no direct control over the domestic rate of interest or the other inducements to home investment, [and] measures to increase the favorable balance of trade [are]...the only direct means at their disposal for increasin ...