Description on economic indicators

... capacity utilization rates precede inflation, and expectation in the foreign exchange market is that the central bank will raise interest rates in order to avoid or fight inflation. Capital Account Definition: Balance of international transactions in financial capital. The ¡¥capital account¡¦ is ass ...

... capacity utilization rates precede inflation, and expectation in the foreign exchange market is that the central bank will raise interest rates in order to avoid or fight inflation. Capital Account Definition: Balance of international transactions in financial capital. The ¡¥capital account¡¦ is ass ...

PDF

... in that year, however, were of the order of $40 trillion! Clearly, the financial plans are dominating the foreign exchange markets, not international trade. The third change in the international economy was the shift, in 1973, from the Bretton Woods fixed exchange rate system to a system of flexible ...

... in that year, however, were of the order of $40 trillion! Clearly, the financial plans are dominating the foreign exchange markets, not international trade. The third change in the international economy was the shift, in 1973, from the Bretton Woods fixed exchange rate system to a system of flexible ...

Midterm 2 Answer Key

... the value chain require more skilled labor than activities lower on the value chain. b) Suppose that Foreign uniformly increases its tariff level, effectively increasing the cost of importing all goods and services from abroad. How does this affect the slicing of the value chain? How will an increas ...

... the value chain require more skilled labor than activities lower on the value chain. b) Suppose that Foreign uniformly increases its tariff level, effectively increasing the cost of importing all goods and services from abroad. How does this affect the slicing of the value chain? How will an increas ...

Course Student Name

... the regulation? 101.13. What is the private demand with the regulation? 96.78. With the regulation, how much does the chart indicate in terms of government sales of the currency or government purchases? The chart indicates government purchases of 4.35. What would tend to happen to the stock of reser ...

... the regulation? 101.13. What is the private demand with the regulation? 96.78. With the regulation, how much does the chart indicate in terms of government sales of the currency or government purchases? The chart indicates government purchases of 4.35. What would tend to happen to the stock of reser ...

Currency Crises in Asia and Lain America: A Comparison Shoji

... serious or if capital inflows halt for some reason, foreign investors regard the dollar peg system unsustainable and have incentives for a currency attack. Comparing with the base year of 1994 in which the real exchange rate (evaluated by wholesale price index) is normalized to one, Table 2 clearly ...

... serious or if capital inflows halt for some reason, foreign investors regard the dollar peg system unsustainable and have incentives for a currency attack. Comparing with the base year of 1994 in which the real exchange rate (evaluated by wholesale price index) is normalized to one, Table 2 clearly ...

Foreign Trade

... • Jay Inslee (D.-Wash.): “I’m not familiar with that proposal, urn, but it’s coming to the point now that turning a blind eye to it for the next ten years is not the answer.” Nota bene: Freedonia, Marx Brothers fans will recall, was the country in which the movie “Duck Soup” was set. Source: “Parlia ...

... • Jay Inslee (D.-Wash.): “I’m not familiar with that proposal, urn, but it’s coming to the point now that turning a blind eye to it for the next ten years is not the answer.” Nota bene: Freedonia, Marx Brothers fans will recall, was the country in which the movie “Duck Soup” was set. Source: “Parlia ...

7-8. Bank and Subscription Businesses

... Accounts, owners come & go several x/year/household differing records of individual names & addresses over years demographic information, by individuals and households; behavior scores/activity Hachim Haddouti, adv. DBMS & DW CSC5301, Ch6 ...

... Accounts, owners come & go several x/year/household differing records of individual names & addresses over years demographic information, by individuals and households; behavior scores/activity Hachim Haddouti, adv. DBMS & DW CSC5301, Ch6 ...

Country report DOMINICAN REPUBLIC

... weakness of the US recovery and the possibility of strongly increasing oil prices amid rising tensions in the Middle East, which would hit the heavily oil-dependent Dominican Republic hard. An escalation of the sovereign debt crisis in the euro area could lead to, both, a considerable decline in tou ...

... weakness of the US recovery and the possibility of strongly increasing oil prices amid rising tensions in the Middle East, which would hit the heavily oil-dependent Dominican Republic hard. An escalation of the sovereign debt crisis in the euro area could lead to, both, a considerable decline in tou ...

krugman_ethemes

... innovation. By counterfeiting goods and smuggling them into industrialized countries, Chinese pirates are making it more difficult for firms to recoup their substantial fixed cost investments. This will ultimately reduce the production and trade of these differentiated products. 3. Could the amount ...

... innovation. By counterfeiting goods and smuggling them into industrialized countries, Chinese pirates are making it more difficult for firms to recoup their substantial fixed cost investments. This will ultimately reduce the production and trade of these differentiated products. 3. Could the amount ...

c21

... A) equilibrium in the goods market. B) a desired level of trade or capital flows. C) where the IS and BP curve intersect. D) a domestic rate of growth consistent with a low unemployment rate. Answer: D 16) Many economists argue that the sharp reduction in U.S. net exports in the mid 1980s was due to ...

... A) equilibrium in the goods market. B) a desired level of trade or capital flows. C) where the IS and BP curve intersect. D) a domestic rate of growth consistent with a low unemployment rate. Answer: D 16) Many economists argue that the sharp reduction in U.S. net exports in the mid 1980s was due to ...

The Economic Crisis and Contemporary Capitalism Prabhat Patnaik

... wealth-holders demand more of the asset and hence causes an actual further increase. And so the process goes on creating a speculative bubble. Of course the decision to demand more of an asset depends not only upon its expected price appreciation, but also upon the evaluation of the risk associated ...

... wealth-holders demand more of the asset and hence causes an actual further increase. And so the process goes on creating a speculative bubble. Of course the decision to demand more of an asset depends not only upon its expected price appreciation, but also upon the evaluation of the risk associated ...

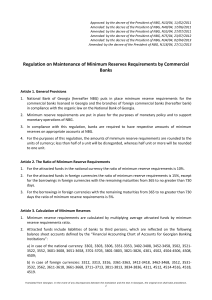

Regulation on Maintenance of Minimum Reserves Requirements by

... such by NBG, regardless of whether or not it is included in the calculation of the regulatory capital. c) such liabilities on the balance sheet which are not related to the movement of cash flows. d) in certain occasions, other types of liabilities with prior written approval of NBG. e) liabilities ...

... such by NBG, regardless of whether or not it is included in the calculation of the regulatory capital. c) such liabilities on the balance sheet which are not related to the movement of cash flows. d) in certain occasions, other types of liabilities with prior written approval of NBG. e) liabilities ...

Mexican Economic Performance During the Looney, R.E.

... Echeverria period were for transfers, most of which went to public enterprises. The most important of these under budgetary control are the oil company (PEMEX), the electricity companies, and the railways. Clearly a substantial subsidy element was (and still is) involved in the operations of many of ...

... Echeverria period were for transfers, most of which went to public enterprises. The most important of these under budgetary control are the oil company (PEMEX), the electricity companies, and the railways. Clearly a substantial subsidy element was (and still is) involved in the operations of many of ...

FE_04 - University of Hawaii

... Inflation declines & interest rates rise => improvement in current account. Bank reserves accumulate The money supply eases again. ...

... Inflation declines & interest rates rise => improvement in current account. Bank reserves accumulate The money supply eases again. ...

Document

... How Does International Trade Affect the Market for Goods and Services? • The relationship between national income and the current account is an interactive one. – This interaction is seen in Figure 14.3. • The net effect of an increase in exports (caused in Fig. 14.3 by an increase in foreign incom ...

... How Does International Trade Affect the Market for Goods and Services? • The relationship between national income and the current account is an interactive one. – This interaction is seen in Figure 14.3. • The net effect of an increase in exports (caused in Fig. 14.3 by an increase in foreign incom ...

PDF Download

... initiatives: these could involve (i) stronger fiscal-policy frameworks at the national level; (ii) enhanced fiscal policy co-operation in a smaller group of fiscally responsible EU states; or (iii) attempts to coordinate monetary policy and fiscal policy reform at the EU level, for example by the EC ...

... initiatives: these could involve (i) stronger fiscal-policy frameworks at the national level; (ii) enhanced fiscal policy co-operation in a smaller group of fiscally responsible EU states; or (iii) attempts to coordinate monetary policy and fiscal policy reform at the EU level, for example by the EC ...

Slide 1

... The central bank must adjust the interest rate to keep the exchange rate from changing. Shocks to foreign interest rate are absorbed in the domestic interest rate, implying domestic monetary policy shocks (shifts in MP). • Floating exchange rate regime (nonpeg) Central bank free to adjust inte ...

... The central bank must adjust the interest rate to keep the exchange rate from changing. Shocks to foreign interest rate are absorbed in the domestic interest rate, implying domestic monetary policy shocks (shifts in MP). • Floating exchange rate regime (nonpeg) Central bank free to adjust inte ...

Emerging Economic Entity Crises in Post Financial Crisis Era – The

... The impact of America’s escape from QE on Chinese market is not that obvious compared to that on India and other countries, but in the influence of “integration of global economy” and the large background of global assets back flowing to developed market in Europe and America, the domestic currency ...

... The impact of America’s escape from QE on Chinese market is not that obvious compared to that on India and other countries, but in the influence of “integration of global economy” and the large background of global assets back flowing to developed market in Europe and America, the domestic currency ...

18-12 Fixed Exchange Rates

... • If one country lost official international reserves (gold) so that its money supply decreased, then another country gained them so that its money ...

... • If one country lost official international reserves (gold) so that its money supply decreased, then another country gained them so that its money ...

Oil Gold - CounterPoint Asset Management

... Large persistent current account deficits are usually indicative of economies living beyond their means. Economic growth is under these circumstances usually sustained by surplus savings from abroad, which thanks to the financial repression in developed market economies has been easily financed up t ...

... Large persistent current account deficits are usually indicative of economies living beyond their means. Economic growth is under these circumstances usually sustained by surplus savings from abroad, which thanks to the financial repression in developed market economies has been easily financed up t ...

Part I Overview and Poverty Impact of Main Macroeconomic Policies

... While the research evidence shows that budgetary stability is a necessary – though not sufficient – precondition for PPG (Klasen 2004), several countries are characterized by a weak fiscal policy. This is most often due to the inability or unwillingness to raise an adequate amount of tax revenue – a ...

... While the research evidence shows that budgetary stability is a necessary – though not sufficient – precondition for PPG (Klasen 2004), several countries are characterized by a weak fiscal policy. This is most often due to the inability or unwillingness to raise an adequate amount of tax revenue – a ...

The Macroeconomics of Public Expenditure

... • If perfect international capital mobility, then only tool is fiscal policy • If imperfect, then both fiscal and monetary policy (limited) are available tools ...

... • If perfect international capital mobility, then only tool is fiscal policy • If imperfect, then both fiscal and monetary policy (limited) are available tools ...

THE COST OF CAPITAL FOR FOREIGN INVESTMENTS

... a. Weights must be a proportion using market, not book value. b. Calculating WACC, weights must be marginal reflecting future debt structure. ...

... a. Weights must be a proportion using market, not book value. b. Calculating WACC, weights must be marginal reflecting future debt structure. ...

Chapter 36 THE INTERNATIONAL MONETARY SYSTEM: ORDER OR

... Bretton Woods System ● The Bretton Woods System ♦ However, just as under the gold standard, this medicine was often unpalatable. ♦ The Bretton Woods system collapsed in 1971 in the face of the U.S. chronic balance of payments deficit. ...

... Bretton Woods System ● The Bretton Woods System ♦ However, just as under the gold standard, this medicine was often unpalatable. ♦ The Bretton Woods system collapsed in 1971 in the face of the U.S. chronic balance of payments deficit. ...