Part 3, Market Pricing Continued, Financial Experts and Other Make

... You and Me,” independently thinking groups (like capital markets) are better at arriving at accurate answers than even the smartest individuals in the group. That’s in part because their wisdom is already bundled into prices, which adjust with great speed and relative accuracy to any new, unanticipa ...

... You and Me,” independently thinking groups (like capital markets) are better at arriving at accurate answers than even the smartest individuals in the group. That’s in part because their wisdom is already bundled into prices, which adjust with great speed and relative accuracy to any new, unanticipa ...

IFC Russia Capitalization Fund

... Government now focussing on lending to “real sector” Availability of / priority for Bank Capitalization programs currently lower • Capital needs still enormous, sources of capital undefined Underlying belief / hope for “immaculate recovery” (непорочное экономическое ...

... Government now focussing on lending to “real sector” Availability of / priority for Bank Capitalization programs currently lower • Capital needs still enormous, sources of capital undefined Underlying belief / hope for “immaculate recovery” (непорочное экономическое ...

Comments on Faria & Mauro

... – But just putting these in a regression (not instrumented) may not tell us very much • Likely correlated with broader institutions • Probably there is some form of “seesaw” effect: – If you push down on one end (lower some cost for new entrants to become large firms) then the other end will pop up ...

... – But just putting these in a regression (not instrumented) may not tell us very much • Likely correlated with broader institutions • Probably there is some form of “seesaw” effect: – If you push down on one end (lower some cost for new entrants to become large firms) then the other end will pop up ...

Miners in dire straits as gold loses its luster

... round of cost-cutting aimed at protecting investors’ dividends as the oil price slumps for a second time this year. The slump in oil prices pushed the Bloomberg commodities index to a 6-year low over concerns of weaker Chinese growth and rising supplies across the board. “The upstream industry is wi ...

... round of cost-cutting aimed at protecting investors’ dividends as the oil price slumps for a second time this year. The slump in oil prices pushed the Bloomberg commodities index to a 6-year low over concerns of weaker Chinese growth and rising supplies across the board. “The upstream industry is wi ...

quantitative finance after the recent financial crisis

... in Statistics from Columbia University in 1995. He was an Assistant Professor at Rutgers University (1995-1996) and subsequently the University of Michigan (1996-1998). He joined the Department of Industrial Engineering and Operations Research at Columbia University in 1998 and was promoted to full ...

... in Statistics from Columbia University in 1995. He was an Assistant Professor at Rutgers University (1995-1996) and subsequently the University of Michigan (1996-1998). He joined the Department of Industrial Engineering and Operations Research at Columbia University in 1998 and was promoted to full ...

Offshore Corporate Tax Loopholes

... Because U.S. firms are officially holding $2.1 trillion in untaxed profits offshore, they are proposing a “repatriation tax holiday,” which would allow them to bring that money home at a special low tax rate. Supporters say this would increase domestic investment, creating jobs. A tax holiday was tr ...

... Because U.S. firms are officially holding $2.1 trillion in untaxed profits offshore, they are proposing a “repatriation tax holiday,” which would allow them to bring that money home at a special low tax rate. Supporters say this would increase domestic investment, creating jobs. A tax holiday was tr ...

Chapter 1

... the following terms: economics, finance, the financial system, net lenders, net borrowers, direct and indirect finance, financial markets, financial intermediaries, liquidity, the business cycle, depository institutions, and monetary policy. ...

... the following terms: economics, finance, the financial system, net lenders, net borrowers, direct and indirect finance, financial markets, financial intermediaries, liquidity, the business cycle, depository institutions, and monetary policy. ...

Roger Fiszelson`s presentation - Confederation of International

... according to its origin: either face-to-day operating costs, either to the uncontrolled increase of the scope of the State or to increased social transfers, is not at all the same impact on public finances as the debt taken out for the construction of infrastructure investments, tangible or intangi ...

... according to its origin: either face-to-day operating costs, either to the uncontrolled increase of the scope of the State or to increased social transfers, is not at all the same impact on public finances as the debt taken out for the construction of infrastructure investments, tangible or intangi ...

Park Your Cash in a Safe Neighborhood

... "If we suspect that cash is going to be on the sidelines for some time, we might look at a capital preservation fund of some sort that might pay a 3% yield and be invested in very short-term government securities," McGervey says. Determining fixed expenses and considering post-retirement income sour ...

... "If we suspect that cash is going to be on the sidelines for some time, we might look at a capital preservation fund of some sort that might pay a 3% yield and be invested in very short-term government securities," McGervey says. Determining fixed expenses and considering post-retirement income sour ...

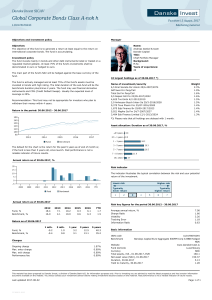

Global Corporate Bonds Class A-nok h

... The fund invests mainly in bonds and other debt instruments listed or traded on a regulated market globally. At least 75% of the fund's investments shall be denominated in euro or hedged to euro. The main part of the fund's NAV will be hedged against the base currency of the fund. The fund is active ...

... The fund invests mainly in bonds and other debt instruments listed or traded on a regulated market globally. At least 75% of the fund's investments shall be denominated in euro or hedged to euro. The main part of the fund's NAV will be hedged against the base currency of the fund. The fund is active ...

Is Your Portfolio in Sync with Your Retirement Withdrawal Strategy?

... LLC, its affiliates, and its employees are not in the business of providing tax, regulatory, accounting, or legal advice. These materials and any tax-related statements are not intended or written to be used, and cannot be used or relied upon, by any taxpayer for the purpose of avoiding tax penaltie ...

... LLC, its affiliates, and its employees are not in the business of providing tax, regulatory, accounting, or legal advice. These materials and any tax-related statements are not intended or written to be used, and cannot be used or relied upon, by any taxpayer for the purpose of avoiding tax penaltie ...

a macro-perspective

... The starting point is the establishment of event-contingent budgeting Disaster risk financing can strengthen public disaster planning Several market-based instruments are available, including national and international risk pools ...

... The starting point is the establishment of event-contingent budgeting Disaster risk financing can strengthen public disaster planning Several market-based instruments are available, including national and international risk pools ...

Investing, Saving, Bonds, Stock

... These documents are known as financial assets. They represent claims on property or income of the borrower. A financial system is a system that allows the transfer of money between savers and borrowers. ...

... These documents are known as financial assets. They represent claims on property or income of the borrower. A financial system is a system that allows the transfer of money between savers and borrowers. ...

AWM 2011 Second Quarter Newsletter

... trillion in Federal outlays, which is equivalent to Washington borrowing $0.42 of each dollar it is spending. ...

... trillion in Federal outlays, which is equivalent to Washington borrowing $0.42 of each dollar it is spending. ...

Voya Financial Advisors, Inc

... limitation, (1) general economic conditions, (2) performance of financial markets, (3) interest rate levels, (4) increasing levels of loan defaults (5) changes in laws and regulations and (6) changes in the policies of governments and/or regulatory authorities. The opinions, views and information ex ...

... limitation, (1) general economic conditions, (2) performance of financial markets, (3) interest rate levels, (4) increasing levels of loan defaults (5) changes in laws and regulations and (6) changes in the policies of governments and/or regulatory authorities. The opinions, views and information ex ...

- Liontrust

... downgraded by market analysts. These are the stocks that exhibit signs of mispricing and may fit into one of our three groups: growth opportunities, value opportunities and special situations. Having identified interesting stocks, we undertake more in-depth analysis to ensure they meet our criteria ...

... downgraded by market analysts. These are the stocks that exhibit signs of mispricing and may fit into one of our three groups: growth opportunities, value opportunities and special situations. Having identified interesting stocks, we undertake more in-depth analysis to ensure they meet our criteria ...

The Current Situation

... • 4. Tax Concessions – Governments offer tax abatements in an effort to attract industry. – Within new industry/businesses comes the need for public capital investment in the form of schools, law enforcement, emergency services, sewers, roads, etc. – The reduction of taxation offered to new enterpri ...

... • 4. Tax Concessions – Governments offer tax abatements in an effort to attract industry. – Within new industry/businesses comes the need for public capital investment in the form of schools, law enforcement, emergency services, sewers, roads, etc. – The reduction of taxation offered to new enterpri ...

RTF 80kB - Commonwealth Grants Commission

... If the intention were to consider needs relating to net worth/financial capital ie for earnings on net worth not to be treated as EPC, SA would suggest that the valuation gains which give rise to net worth over and above the accumulation of net operating surpluses, which tend to be greater in higher ...

... If the intention were to consider needs relating to net worth/financial capital ie for earnings on net worth not to be treated as EPC, SA would suggest that the valuation gains which give rise to net worth over and above the accumulation of net operating surpluses, which tend to be greater in higher ...

1818 Society Form 8938 and Other Important

... The Wolf Group, PC • 4401 Fair Lakes Court, Suite 310, Fairfax, VA 22033 • Tel: (703) 502-9500 ...

... The Wolf Group, PC • 4401 Fair Lakes Court, Suite 310, Fairfax, VA 22033 • Tel: (703) 502-9500 ...

Fiscal Policy with Floating Exchange Rates

... International Finance Theory and Policy - Chapter 70-2: Last Updated ...

... International Finance Theory and Policy - Chapter 70-2: Last Updated ...

Program Assistant, Supervisory

... Teamwork and Co-operation is the ability to work co-operatively within diverse teams, work groups and across the organization to achieve group and organizational goals. It includes the desire and ability to understand and respond effectively to other people from diverse backgrounds with diverse view ...

... Teamwork and Co-operation is the ability to work co-operatively within diverse teams, work groups and across the organization to achieve group and organizational goals. It includes the desire and ability to understand and respond effectively to other people from diverse backgrounds with diverse view ...

Municipal Tax Exemption and the American Jobs Act

... marginal tax rates below 35% (for example, AMT taxpayers pay 28% and insurance companies pay credit quality and market risk premia also factor heavily just about 30% due to some disallowance of tax into the valuation of municipals relative to taxable bond free income). markets. In the current market ...

... marginal tax rates below 35% (for example, AMT taxpayers pay 28% and insurance companies pay credit quality and market risk premia also factor heavily just about 30% due to some disallowance of tax into the valuation of municipals relative to taxable bond free income). markets. In the current market ...