Inequality and crises: coincidence or causation?

... “So in the longer term, it's hard to see where the buying power will come from unless America's vast middle class has more take-home pay.” But underconsumption has both conceptual problems and empirical troubles. ...

... “So in the longer term, it's hard to see where the buying power will come from unless America's vast middle class has more take-home pay.” But underconsumption has both conceptual problems and empirical troubles. ...

Fiscal Consolidation Strategy: An Update For The Budget Reform

... be employed to reduce federal spending and thereby, return the U.S. federal budget to the precrisis level relative to GDP. Because the U.S. federal budget was close to balance before the crisis, (the federal deficit was only 1.3 percent of GDP in 2007) this strategy would mitigate the size of any ta ...

... be employed to reduce federal spending and thereby, return the U.S. federal budget to the precrisis level relative to GDP. Because the U.S. federal budget was close to balance before the crisis, (the federal deficit was only 1.3 percent of GDP in 2007) this strategy would mitigate the size of any ta ...

Estimating the rate of return to capital in the EU

... o Share accruing to capital: 1/3 (parameter from the literature) o Indirect taxes can be accrued to reproducible capital (e.g. excise taxes on fuel or energy) and to the labour side (e.g. VAT) o Estimation strategy: (Tax on products and imports less subsidies ...

... o Share accruing to capital: 1/3 (parameter from the literature) o Indirect taxes can be accrued to reproducible capital (e.g. excise taxes on fuel or energy) and to the labour side (e.g. VAT) o Estimation strategy: (Tax on products and imports less subsidies ...

U.S. Government and Federal Agency Securities

... its agencies fund a variety of public projects and activities by issuing bonds. U.S. government bonds are issued through the U.S. Treasury, and U.S. government agency bonds are issued by the various agencies. Combined, Treasury and agency bonds comprise over half of the U.S. bond market. Treasury bo ...

... its agencies fund a variety of public projects and activities by issuing bonds. U.S. government bonds are issued through the U.S. Treasury, and U.S. government agency bonds are issued by the various agencies. Combined, Treasury and agency bonds comprise over half of the U.S. bond market. Treasury bo ...

Slide 1

... • Profit or Loss: Revenues minus expenses, profit if revenues exceed expenses; loss if expenses exceed revenues. ...

... • Profit or Loss: Revenues minus expenses, profit if revenues exceed expenses; loss if expenses exceed revenues. ...

Account Code

... • Agency Funds –Include some student clubs, professional societies (and conferences they sponsor), and other non-CSM organizations that we keep records for. These funds are not considered part of CSM’s reportable assets but still must follow state fiscal rules. – 6 digit fund numbers beginning with ...

... • Agency Funds –Include some student clubs, professional societies (and conferences they sponsor), and other non-CSM organizations that we keep records for. These funds are not considered part of CSM’s reportable assets but still must follow state fiscal rules. – 6 digit fund numbers beginning with ...

Financial Results

... and comments contained in this material are not under the scope of investment advisory services. Investment advisory services are given according to the investment advisory contract, signed between the intermediary institutions, portfolio management companies, investment banks and the clients. Opini ...

... and comments contained in this material are not under the scope of investment advisory services. Investment advisory services are given according to the investment advisory contract, signed between the intermediary institutions, portfolio management companies, investment banks and the clients. Opini ...

Beverly Hirtle (New York Fed)

... Macroeconomic and financial market conditions? Conditions of other firms and other market participants? ...

... Macroeconomic and financial market conditions? Conditions of other firms and other market participants? ...

Lesson 10-2 Principles of Saving and Investing

... Long-Term Focus – A systematic saving and investing plan is designed for growth in the long run, not for short-term results. ...

... Long-Term Focus – A systematic saving and investing plan is designed for growth in the long run, not for short-term results. ...

EPIC RECESSION - Kyklos Productions

... -Traditional Policies and Epic Recessions -Overview of Policies and Programs, 2007-2009 -The Greenspan Legacy in Monetary Policy -Bernanke the Protégé -The Perils of Paulson ...

... -Traditional Policies and Epic Recessions -Overview of Policies and Programs, 2007-2009 -The Greenspan Legacy in Monetary Policy -Bernanke the Protégé -The Perils of Paulson ...

KNN Public Finance

... Issuance amounts are subject to change based on future AV growth, market conditions, interest rates at the time of sale, and structure assumptions. Bonds issued after 2015 may be required to use AB 182 compliant capital appreciation bonds or the District may need to use Bond Anticipation Notes. ...

... Issuance amounts are subject to change based on future AV growth, market conditions, interest rates at the time of sale, and structure assumptions. Bonds issued after 2015 may be required to use AB 182 compliant capital appreciation bonds or the District may need to use Bond Anticipation Notes. ...

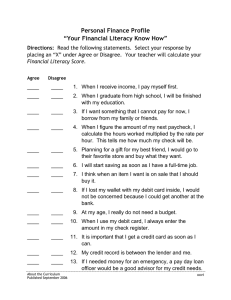

Introduction - Missouri Center for Career Education

... 17. Buying stock in a company would be a good way for me to invest my weekly paycheck. Purchasing stock is an investment option once all fixed expenses are accounted for and the variable expenses have been covered to the best of one’s ability. Investing in stock must be considered for a long term. S ...

... 17. Buying stock in a company would be a good way for me to invest my weekly paycheck. Purchasing stock is an investment option once all fixed expenses are accounted for and the variable expenses have been covered to the best of one’s ability. Investing in stock must be considered for a long term. S ...

basis of accounting. Budgets

... Chapter 200. Chapter 200 details the requirements for adoption of local government ad valorem millage rates. Chapter 129 sets forth specific requirements for the form and content of county budgets and their execution and amendment. In addition to State Statute, the County’s budget approval process i ...

... Chapter 200. Chapter 200 details the requirements for adoption of local government ad valorem millage rates. Chapter 129 sets forth specific requirements for the form and content of county budgets and their execution and amendment. In addition to State Statute, the County’s budget approval process i ...

E

... better and cheaper services for saving money and making payments. These services allow firms and households to avoid the cost of barter or cash transactions, cut the costs of remitting funds, and provide the opportunity to accumulate assets and smooth income. Insurance services help firms and househ ...

... better and cheaper services for saving money and making payments. These services allow firms and households to avoid the cost of barter or cash transactions, cut the costs of remitting funds, and provide the opportunity to accumulate assets and smooth income. Insurance services help firms and househ ...

1. You were hired as a consultant to Keys Company, and you were

... 5. The Nunnally Company has equal amounts of low-risk, average-risk, and high-risk projects. Nunnally estimates that its overall WACC is 12%. The CFO believes that this is the correct WACC for the company’s average-risk projects, but that a lower rate should be used for lower risk projects and a hig ...

... 5. The Nunnally Company has equal amounts of low-risk, average-risk, and high-risk projects. Nunnally estimates that its overall WACC is 12%. The CFO believes that this is the correct WACC for the company’s average-risk projects, but that a lower rate should be used for lower risk projects and a hig ...

macroprudential cap on debt-to-income ratio and

... and is beneficial in terms of social welfare if the cap on DTI is targeted to reduce the deviation of household debt. The implementation of an efficient macroprudential policy leads to an important discussion about the role of monetary policy during a credit boom. To this end, I first consider opti ...

... and is beneficial in terms of social welfare if the cap on DTI is targeted to reduce the deviation of household debt. The implementation of an efficient macroprudential policy leads to an important discussion about the role of monetary policy during a credit boom. To this end, I first consider opti ...

Ensure comprehensive financial regulation

... • Discussions of the report by international organizations on agricultural and food commodity price volatility, and on hedging and risk management tools Regulation of commodity derivatives • Assessment of the work on regulation and supervision of commodity derivatives, to prepare concrete recommenda ...

... • Discussions of the report by international organizations on agricultural and food commodity price volatility, and on hedging and risk management tools Regulation of commodity derivatives • Assessment of the work on regulation and supervision of commodity derivatives, to prepare concrete recommenda ...

AFairTaxforAmerica

... alternative minimum, Social Security, Medicare, self-employment, and corporate taxes. The FairTax includes no exemptions because exempting items is neither fair nor simple. Respected economists have shown that the wealthy spend much more on unprepared food, clothing, housing, and medical care than d ...

... alternative minimum, Social Security, Medicare, self-employment, and corporate taxes. The FairTax includes no exemptions because exempting items is neither fair nor simple. Respected economists have shown that the wealthy spend much more on unprepared food, clothing, housing, and medical care than d ...

BU 110 Personal Financial Planning SMC First Class Course

... Students who successfully complete this course will be able to: ...

... Students who successfully complete this course will be able to: ...

external employment Role of financial inclusion in meeting the SDGs

... immediate costs or benefits. ...

... immediate costs or benefits. ...

Tax havens and development

... Tax havens harm efficiency in the financial markets thereby increasing risk premiums (obligations and debt hidden in tax havens) Undermine national tax systems and increase the costs of taxation Reduce the efficiency of resource allocation Make it more profitable to engage in economic crime May lead ...

... Tax havens harm efficiency in the financial markets thereby increasing risk premiums (obligations and debt hidden in tax havens) Undermine national tax systems and increase the costs of taxation Reduce the efficiency of resource allocation Make it more profitable to engage in economic crime May lead ...

May 2, 2014 Dear Client: Last year was a year of planned, positive

... Income) and 2) the market environment. The most obvious asset classes for indexing include those that are efficient, well researched, highly liquid, and can be accessed through inexpensive index vehicles. The best example would be the use of an S&P 500 Index Fund to represent the U.S. Large Cap equi ...

... Income) and 2) the market environment. The most obvious asset classes for indexing include those that are efficient, well researched, highly liquid, and can be accessed through inexpensive index vehicles. The best example would be the use of an S&P 500 Index Fund to represent the U.S. Large Cap equi ...

Reconciling the Cambridge and Wall Street

... • Several chapters on money and credit in Robinson’s (1956) The Accumulation of Capital. – the loaned amounts depend on the interest covering ratio, that is, the ratio of (profit) income to due interest payments. – the borrowing power of entrepreneurs will depend on “the strictness of the banks’ sta ...

... • Several chapters on money and credit in Robinson’s (1956) The Accumulation of Capital. – the loaned amounts depend on the interest covering ratio, that is, the ratio of (profit) income to due interest payments. – the borrowing power of entrepreneurs will depend on “the strictness of the banks’ sta ...