Lectures 5 - 7

... uncertainty or volatility of projected cash flows demands a detailed understanding of “backdoor” sources or repayment – most important the assets themselves i.e. the sale of the building. Lenders will also implicitly include liquidation values in lending criteria through the conservatism of advanc ...

... uncertainty or volatility of projected cash flows demands a detailed understanding of “backdoor” sources or repayment – most important the assets themselves i.e. the sale of the building. Lenders will also implicitly include liquidation values in lending criteria through the conservatism of advanc ...

slovene capital market development strategy

... additional opportunities for the state’s withdrawal from companies through IPOs; strengthening the international competitiveness of Slovenia's financial sector. The main focus has to be stabilisation, restructuring and future growth of the Slovene economy. Accepting the concept of private proper ...

... additional opportunities for the state’s withdrawal from companies through IPOs; strengthening the international competitiveness of Slovenia's financial sector. The main focus has to be stabilisation, restructuring and future growth of the Slovene economy. Accepting the concept of private proper ...

Trends in consumer sentiment and spending

... (25th to 50th percentile) with households that make up the highest income quartile (75th to 100th percentile). For households in the second lowest income quartile, a 1 percentage point decrease in the DUR corresponds to a 0.25 percentage point decrease in consumption spending growth, while the corre ...

... (25th to 50th percentile) with households that make up the highest income quartile (75th to 100th percentile). For households in the second lowest income quartile, a 1 percentage point decrease in the DUR corresponds to a 0.25 percentage point decrease in consumption spending growth, while the corre ...

Why Do Interest Rates Change?

... In 1914 first rating company Moody’s Investor Service. In 1916 rating company Standard & Poor’s. The development of rating from the 1960’s-70’s in USA and 1970’s – 1980’s in Europe. The first activities was related with rating of debenture bonds and bills of exchange. Nowadays rating companies carry ...

... In 1914 first rating company Moody’s Investor Service. In 1916 rating company Standard & Poor’s. The development of rating from the 1960’s-70’s in USA and 1970’s – 1980’s in Europe. The first activities was related with rating of debenture bonds and bills of exchange. Nowadays rating companies carry ...

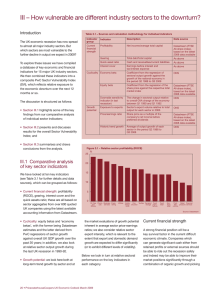

III – How vulnerable are different industry sectors to

... prices tend to move more than proportionately with the overall stock market, and vice versa for equity betas less than 1). The relatively high volatility of shares in these two sectors may primarily come from their dependence on global commodity markets that are ...

... prices tend to move more than proportionately with the overall stock market, and vice versa for equity betas less than 1). The relatively high volatility of shares in these two sectors may primarily come from their dependence on global commodity markets that are ...

Dependence Analysis of the Market Index Using Fuzzy c

... thereon, was calculated the mean financial return produced by each cluster in the trimester t + 1 , the cluster that yielded a higher mean financial return was denominated winner cluster and the cluster with least mean financial return was denominated lose cluster. Thereafter, the mean financial ret ...

... thereon, was calculated the mean financial return produced by each cluster in the trimester t + 1 , the cluster that yielded a higher mean financial return was denominated winner cluster and the cluster with least mean financial return was denominated lose cluster. Thereafter, the mean financial ret ...

A strategy for restoring confidence and economic growth through green investment and innovation (1 MB) (opens in new window)

... sustainability of public debt and, with short-term interest rates close to zero, the effectiveness of monetary policy to stimulate growth is reaching its limits. So the question arises: can policymakers do anything to improve the short-term economic outlook? Some have argued that deregulation will h ...

... sustainability of public debt and, with short-term interest rates close to zero, the effectiveness of monetary policy to stimulate growth is reaching its limits. So the question arises: can policymakers do anything to improve the short-term economic outlook? Some have argued that deregulation will h ...

Kaufmann Large Cap Fund - Investor Fact Sheet

... The holdings percentages are based on net assets at the close of business on 3/31/17 and may not necessarily reflect adjustments that are routinely made when presenting net assets for formal financial statement purposes. Because this is a managed portfolio, the investment mix will change. Total retu ...

... The holdings percentages are based on net assets at the close of business on 3/31/17 and may not necessarily reflect adjustments that are routinely made when presenting net assets for formal financial statement purposes. Because this is a managed portfolio, the investment mix will change. Total retu ...

Mexico_Central_America_en.pdf

... a considerable burden on public finances. The plans of the new government, which include a commitment to narrowing the fiscal deficit and raising expenditure on investment and poverty reduction, ...

... a considerable burden on public finances. The plans of the new government, which include a commitment to narrowing the fiscal deficit and raising expenditure on investment and poverty reduction, ...

PDF Download

... this deficit is “sustainable,” although foreign earnings may be expected to rise with increasing ownership of US assets, so a constant current account deficit implies a declining trade deficit. Whether the deficit will in fact continue at this level remains to be seen. Whether it is desirable depend ...

... this deficit is “sustainable,” although foreign earnings may be expected to rise with increasing ownership of US assets, so a constant current account deficit implies a declining trade deficit. Whether the deficit will in fact continue at this level remains to be seen. Whether it is desirable depend ...

first financial holdings, inc.

... (14) economic downturn risk resulting in deterioration in the credit markets; (15) greater than expected noninterest expenses; (16) excessive loan losses; (17) failure to realize synergies and other financial benefits from, and to limit liabilities associates with, mergers and acquisitions, includin ...

... (14) economic downturn risk resulting in deterioration in the credit markets; (15) greater than expected noninterest expenses; (16) excessive loan losses; (17) failure to realize synergies and other financial benefits from, and to limit liabilities associates with, mergers and acquisitions, includin ...

Emerging Market Equity Fund Investor: SEMNX SEMNX | Advisor: SEMVX SEMVX

... Important Information: Source: Schroders. Morningstar: The Investor Shares of the Emerging Market Equity Fund was rated 4 stars overall (out of 591 funds), 3 stars for the 3 year period (out of 591 funds), 3 stars for the 5 year period (out of 410 funds), 4 stars for the 10 year period (out of 179 f ...

... Important Information: Source: Schroders. Morningstar: The Investor Shares of the Emerging Market Equity Fund was rated 4 stars overall (out of 591 funds), 3 stars for the 3 year period (out of 591 funds), 3 stars for the 5 year period (out of 410 funds), 4 stars for the 10 year period (out of 179 f ...

Boom, Bust or What? - Harry Walker Agency

... A few days later, I witnessed an equally unusual discussion of basketball and economics. Before a crowded lecture hall at Columbia University, the economist and former adviser to both Bush presidents, Glenn Hubbard, wrote a series of words on the blackboard. Among them: Milton Friedman, Yeats, bask ...

... A few days later, I witnessed an equally unusual discussion of basketball and economics. Before a crowded lecture hall at Columbia University, the economist and former adviser to both Bush presidents, Glenn Hubbard, wrote a series of words on the blackboard. Among them: Milton Friedman, Yeats, bask ...

The Role of the State in Financial Markets

... enable the financial system to perform its main function of allocating scarce capital more efficiently and will thus benefit the rest of the economy. I argue that much of the rationale for liberalizing financial markets is based neither on a sound economic understanding of how these markets work nor ...

... enable the financial system to perform its main function of allocating scarce capital more efficiently and will thus benefit the rest of the economy. I argue that much of the rationale for liberalizing financial markets is based neither on a sound economic understanding of how these markets work nor ...

A Note on Unconventional Monetary Policy in HANK

... private sector, rather than the government, supplies liquid assets to the household sector. Our main conclusion is that, even in this economy, the direct intertemporal substitution channel is very small and almost all of the response of consumption is due to general equilibrium indirect effects. Her ...

... private sector, rather than the government, supplies liquid assets to the household sector. Our main conclusion is that, even in this economy, the direct intertemporal substitution channel is very small and almost all of the response of consumption is due to general equilibrium indirect effects. Her ...

Would Poland Benefit From a Fiscal Responsibility Law?

... The 1999 pension reform was a major effort toward restoring the long-term stability of public finances, but less-favorable-than-envisaged developments since then resulted in less progress than targeted. Owing to a decline in employment, the coverage of the pension system has declined. This and ...

... The 1999 pension reform was a major effort toward restoring the long-term stability of public finances, but less-favorable-than-envisaged developments since then resulted in less progress than targeted. Owing to a decline in employment, the coverage of the pension system has declined. This and ...

cash - Initial Set Up

... On January 1, Air Canada purchased parts from American Airlines by issuing a note payable of $12,000, due in two years. At 7% interest rates, the note is equivalent to $10,481 now. ...

... On January 1, Air Canada purchased parts from American Airlines by issuing a note payable of $12,000, due in two years. At 7% interest rates, the note is equivalent to $10,481 now. ...

Chapter 3: Australia`s existing regulatory framework

... company and distribution of its assets before the potential losses become too great. The process of winding-up any company, but particularly financial institutions, can be lengthy, complex and expensive. ...

... company and distribution of its assets before the potential losses become too great. The process of winding-up any company, but particularly financial institutions, can be lengthy, complex and expensive. ...

Global Markets and National Politics: Collision Course or Virtuous

... of the state to mitigate market dislocations by redistributing wealth and risk. Second, although there are costs associated with interventionist government (the familiar refrain of neoclassical economics about tax distortions, crowding out, and regulatory rigidities), numerous government programs ge ...

... of the state to mitigate market dislocations by redistributing wealth and risk. Second, although there are costs associated with interventionist government (the familiar refrain of neoclassical economics about tax distortions, crowding out, and regulatory rigidities), numerous government programs ge ...

Fair Value: Fact or Opinion

... If life were simple, the value of an asset would be analyzed by looking at how an exactly identical asset - in terms of risk, growth and cash flows - is priced. Identical assets can be found with real assets or even with fixed income assets, but difficult to find with risky assets or businesses. In ...

... If life were simple, the value of an asset would be analyzed by looking at how an exactly identical asset - in terms of risk, growth and cash flows - is priced. Identical assets can be found with real assets or even with fixed income assets, but difficult to find with risky assets or businesses. In ...

Minsky`s moment _ The Economist

... today for money tomorrow. A firm pays now for the construction of a factory; profits from running the facility will, all going well, translate into money for it in coming years. Put crudely, money today can come from one of two sources: the firm’s own cash or that of others (for example, if the firm ...

... today for money tomorrow. A firm pays now for the construction of a factory; profits from running the facility will, all going well, translate into money for it in coming years. Put crudely, money today can come from one of two sources: the firm’s own cash or that of others (for example, if the firm ...

Zambia at 50 Cracking the figures 2015 Budgetary

... abolition of profits-based taxes for mining companies. Overall, it is estimated that the total direct tax contribution of the mining sector will increase from 9.5% of total Government spending to 12.7%. ...

... abolition of profits-based taxes for mining companies. Overall, it is estimated that the total direct tax contribution of the mining sector will increase from 9.5% of total Government spending to 12.7%. ...

Andre Schneider

... Supply of inputs for product While sales may not be increasing by any significant amount, raw material prices are. This will pose a significant threat to certain segments of this industry that rely heavily on commodities used to produce fabric care products. ...

... Supply of inputs for product While sales may not be increasing by any significant amount, raw material prices are. This will pose a significant threat to certain segments of this industry that rely heavily on commodities used to produce fabric care products. ...