bringing democratic choice to europe`s economic

... was to issue money — the kind of institution that had basically only been imagined before the 1990s by antistatist liberal economist and philosopher Friedrich Hayek and some of his wilder disciples. By the time of the monetary union, some influential interpreters saw Hayek as one of the inspirations ...

... was to issue money — the kind of institution that had basically only been imagined before the 1990s by antistatist liberal economist and philosopher Friedrich Hayek and some of his wilder disciples. By the time of the monetary union, some influential interpreters saw Hayek as one of the inspirations ...

Homeownership and Investment in Risky Assets in Europe

... developed mortgage markets, while the seven bank-based economies have less developed mortgage markets. The SHARE provides extensive information on household income and wealth. Therefore, the SHARE is an important source of data when examining a household’s portfolio. The 2004 SHARE surveyed 32,405 i ...

... developed mortgage markets, while the seven bank-based economies have less developed mortgage markets. The SHARE provides extensive information on household income and wealth. Therefore, the SHARE is an important source of data when examining a household’s portfolio. The 2004 SHARE surveyed 32,405 i ...

Re-building and Recovery - RBS: Investor relations

... subject to risks and uncertainties. For example, certain of the market risk disclosures are dependent on choices about key model characteristics and assumptions and are subject to various limitations. By their nature, certain of the market risk disclosures are only estimates and, as a result, actual ...

... subject to risks and uncertainties. For example, certain of the market risk disclosures are dependent on choices about key model characteristics and assumptions and are subject to various limitations. By their nature, certain of the market risk disclosures are only estimates and, as a result, actual ...

New Submission Email - Central Bank of Ireland

... If Yes to admission to trading on a regulated market, name of regulated market: [Name of regulated market] Is this document related to a programme: [Yes/No] If Yes, name of programme: [please insert name of programme and date of programme document] Is this document Passported: [Yes/No] List of Docum ...

... If Yes to admission to trading on a regulated market, name of regulated market: [Name of regulated market] Is this document related to a programme: [Yes/No] If Yes, name of programme: [please insert name of programme and date of programme document] Is this document Passported: [Yes/No] List of Docum ...

collque coface 2004 partie I VA

... ECAs confront substantial changes in business environment Tough competition (private insurers in ST) More experience and technology brought in by the private sector ...

... ECAs confront substantial changes in business environment Tough competition (private insurers in ST) More experience and technology brought in by the private sector ...

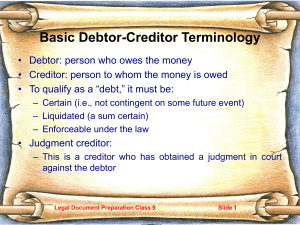

Slides in Microsoft PowerPoint Format

... Repossessions, losses, etc. Expenses of preparing petition, including attorney’s fees, etc. Legal Document Preparation Class 9 ...

... Repossessions, losses, etc. Expenses of preparing petition, including attorney’s fees, etc. Legal Document Preparation Class 9 ...

May 2003 - Banco de España

... As regards the structure of assets, the relative weight of credit to the private sector increased by somewhat more than three percentage points to 56.9 %. This notwithstanding, the growth of this item slowed to 6.7 % from 11.4 % in the previous year. Meanwhile, doubtful assets grew by 13 %, as again ...

... As regards the structure of assets, the relative weight of credit to the private sector increased by somewhat more than three percentage points to 56.9 %. This notwithstanding, the growth of this item slowed to 6.7 % from 11.4 % in the previous year. Meanwhile, doubtful assets grew by 13 %, as again ...

SECTION I MACROECONOMIC ASPECTS OF FINANCIAL STABILITY

... each other and their endurance to shocks are the main issues monitored closely by central banks in recent years. For this reason, when analyzing the financial sector, not only financial institutions but also their interaction with all other sectors in the economy are taken into consideration. It is ...

... each other and their endurance to shocks are the main issues monitored closely by central banks in recent years. For this reason, when analyzing the financial sector, not only financial institutions but also their interaction with all other sectors in the economy are taken into consideration. It is ...

“Financial Markets, Institutions and Policies in the context of

... financial market is a market in which financial assets (securities) such as stocks and bonds can be purchased or sold. Funds are transferred in financial markets when one party purchases financial assets previously held by another party. Financial markets facilitate the flow of funds and thereby all ...

... financial market is a market in which financial assets (securities) such as stocks and bonds can be purchased or sold. Funds are transferred in financial markets when one party purchases financial assets previously held by another party. Financial markets facilitate the flow of funds and thereby all ...

Self certification for companies, trusts and partnerships

... Non-reporting member of participating foreign financial institution group – This category applies to financial institutions that are part of a participating foreign financial institution group and that implement policies and procedures to close or transfer any reportable accounts to other group mem ...

... Non-reporting member of participating foreign financial institution group – This category applies to financial institutions that are part of a participating foreign financial institution group and that implement policies and procedures to close or transfer any reportable accounts to other group mem ...

letter

... fair value accounting models and acting in an expeditious manner. We also applaud the FASB for the proposed OTTI FSP as we agree that it is a significant improvement from the current accounting model. We have focused our letter on a few aspects of the proposed FSPs that we believe the FASB should co ...

... fair value accounting models and acting in an expeditious manner. We also applaud the FASB for the proposed OTTI FSP as we agree that it is a significant improvement from the current accounting model. We have focused our letter on a few aspects of the proposed FSPs that we believe the FASB should co ...

Cash Flow Review Techniques - RBAP-MABS

... The AO can verify whether the estimated total monthly household income of the applicant, as shown in the cash flow, is consistent with the living condition of the applicant and his family when he/she visit the borrower’s house during the CI/BI. The AO may compare the applicant’s house and living c ...

... The AO can verify whether the estimated total monthly household income of the applicant, as shown in the cash flow, is consistent with the living condition of the applicant and his family when he/she visit the borrower’s house during the CI/BI. The AO may compare the applicant’s house and living c ...

Enter title of submission (to appear in header)

... closely linked to the general state of the domestic economy. ...

... closely linked to the general state of the domestic economy. ...

PowerPoint Slides for Chapter 15

... important than direct finance, in which businesses raise funds directly from lenders in financial markets. 4. Financial intermediaries, particularly banks, are the most important source of external funds used to finance businesses. ...

... important than direct finance, in which businesses raise funds directly from lenders in financial markets. 4. Financial intermediaries, particularly banks, are the most important source of external funds used to finance businesses. ...

SCHNITZER STEEL INDUSTRIES INC (Form: 8-K

... generally identify these forward-looking statements because they contain "expect", "believe", "anticipate", "estimate" and other words that convey a similar meaning. One can also identify these statements as statements that do not relate strictly to historical or current facts. Examples of factors a ...

... generally identify these forward-looking statements because they contain "expect", "believe", "anticipate", "estimate" and other words that convey a similar meaning. One can also identify these statements as statements that do not relate strictly to historical or current facts. Examples of factors a ...

BSL 4: Corporate finance

... • Cashflow: cash or assets that can readily be turned into cash (e.g., money in the firm’s bank account, liquid securities) that firm receives during specified period, less cash or equivalents that firm pays during same period • Earnings: revenues - expenses, based on accounting rules • Why do cashf ...

... • Cashflow: cash or assets that can readily be turned into cash (e.g., money in the firm’s bank account, liquid securities) that firm receives during specified period, less cash or equivalents that firm pays during same period • Earnings: revenues - expenses, based on accounting rules • Why do cashf ...

ECONOMICS SERIES SWP 2010/12 A NONPARAMETRIC

... panel based nonparametric model. Our motivation for this paper is as follows. The bulk of the empirical research provides support for a positive relationship between the financial system and economic growth. However, while there is no tension and conflict in this literature in terms of the role that ...

... panel based nonparametric model. Our motivation for this paper is as follows. The bulk of the empirical research provides support for a positive relationship between the financial system and economic growth. However, while there is no tension and conflict in this literature in terms of the role that ...

DOC - Europa.eu

... removed, as counterparty risk remains (if one of the counterparties defaulted, the hedge would be undone). This is why gross exposure matters. Pricing CDS is difficult. Compared to interest rate swaps, where risks are well understood and contracts rely on widely available and tested data for their ...

... removed, as counterparty risk remains (if one of the counterparties defaulted, the hedge would be undone). This is why gross exposure matters. Pricing CDS is difficult. Compared to interest rate swaps, where risks are well understood and contracts rely on widely available and tested data for their ...

efficiency of the financial intermediaries and economic growth

... processes described can happen simultaneously, the question is which effect is bigger. Obviously the outcome can be different in various countries/regions or time intervals. ...

... processes described can happen simultaneously, the question is which effect is bigger. Obviously the outcome can be different in various countries/regions or time intervals. ...

lebanon annual report 2014

... support progress toward price and exchange rate stability and economic growth. In this context, the central bank implemented an $800M economic stimulus package in 2014, which targeted start-up companies and some other sectors of the economy including housing, tourism, and manufacturing. It also ini ...

... support progress toward price and exchange rate stability and economic growth. In this context, the central bank implemented an $800M economic stimulus package in 2014, which targeted start-up companies and some other sectors of the economy including housing, tourism, and manufacturing. It also ini ...

Document

... 32. A primary market is which of these? a. Where stocks are sold b. Where bonds are sold c. Where intermediaries are the buyers and sellers d. Where a security is initially sold for the first time ANSWER: d 33. If Michelle wanted to purchase newly issued stock from a new computer company, she would ...

... 32. A primary market is which of these? a. Where stocks are sold b. Where bonds are sold c. Where intermediaries are the buyers and sellers d. Where a security is initially sold for the first time ANSWER: d 33. If Michelle wanted to purchase newly issued stock from a new computer company, she would ...

8 Some Lessons from the Argentine Crisis: A Fund Staff

... The third main danger of a fixed exchange rate system was less apparent at the time of the Mexican or EMU crises, and has only become clear as the Asian crises have been more extensively analysed. That is that a fixed exchange rate can allow serious weaknesses to develop in economic agents’ balance sh ...

... The third main danger of a fixed exchange rate system was less apparent at the time of the Mexican or EMU crises, and has only become clear as the Asian crises have been more extensively analysed. That is that a fixed exchange rate can allow serious weaknesses to develop in economic agents’ balance sh ...

FRBSF L CONOMIC

... credit growth has a significant positive impact on consumption growth in the United States and other countries. In these studies, changes in credit growth can be interpreted as capturing changes in lending practices or other factors that affect consumer access to borrowed money. For example, a perio ...

... credit growth has a significant positive impact on consumption growth in the United States and other countries. In these studies, changes in credit growth can be interpreted as capturing changes in lending practices or other factors that affect consumer access to borrowed money. For example, a perio ...

Regulation af Debt and Equity

... pressures, financial transactions may impose unacceptable risks on the economy without offering adequate compensation. Accordingly, the regulation of securities offerings, the conventions governing markets, and the regulation of intermediaries may control the risks created by these contracts. These ...

... pressures, financial transactions may impose unacceptable risks on the economy without offering adequate compensation. Accordingly, the regulation of securities offerings, the conventions governing markets, and the regulation of intermediaries may control the risks created by these contracts. These ...