Final Exam Study Guide Answer Section

... 41. One way drivers can reduce the risk of financial losses that result from accidents is to buy ____________________. 42. The most basic type of coverage (required by most states) is _________________________. 43. Medical payments coverage is also called ___________________________________. 44. ___ ...

... 41. One way drivers can reduce the risk of financial losses that result from accidents is to buy ____________________. 42. The most basic type of coverage (required by most states) is _________________________. 43. Medical payments coverage is also called ___________________________________. 44. ___ ...

Personal Financial Planner Preface

... Since this publication is designed to adapt to every personal financial situation, some of the sheets may be appropriate for you at this time, and not at other times in your life. Each of the sheets in the first 11 sections is referenced to specific page numbers of Personal Finance, Seventh Edition, ...

... Since this publication is designed to adapt to every personal financial situation, some of the sheets may be appropriate for you at this time, and not at other times in your life. Each of the sheets in the first 11 sections is referenced to specific page numbers of Personal Finance, Seventh Edition, ...

NATIONAL CONFERENCE OF INSURANCE LEGISLATORS

... WHEREAS, the widespread use of asbestos in industrial and consumer products has exposed millions of Americans to dangerous levels of asbestos fibers since at least the early twentieth century; and WHEREAS, asbestos exposure has been tied to serious health conditions, including a variety of pulmonary ...

... WHEREAS, the widespread use of asbestos in industrial and consumer products has exposed millions of Americans to dangerous levels of asbestos fibers since at least the early twentieth century; and WHEREAS, asbestos exposure has been tied to serious health conditions, including a variety of pulmonary ...

learn more - Sagicor Life Insurance Company

... represents our core promise to consumers. It sets an expectation in the customers’ mind of what they should expect from us. “Wise Financial Thinking for Life” represents more than the way Sagicor is run; it is the very essence of what we offer to share with our customers. ...

... represents our core promise to consumers. It sets an expectation in the customers’ mind of what they should expect from us. “Wise Financial Thinking for Life” represents more than the way Sagicor is run; it is the very essence of what we offer to share with our customers. ...

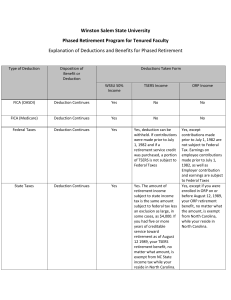

Explanation of Deductions and Benefits for Phased Retirement

... Yes, deduction can be withheld. If contributions were made prior to July 1, 1982 and if a retirement service credit was purchased, a portion of TSERS is not subject to Federal Taxes ...

... Yes, deduction can be withheld. If contributions were made prior to July 1, 1982 and if a retirement service credit was purchased, a portion of TSERS is not subject to Federal Taxes ...

Profiles Mag 2007 - Insurance Brokers Association of Manitoba

... “I don’t think I could use a more appropriate word than mutual respect,” Elias says of HED’s work environment. “I think it pervades our company.” Seventeen senior managers are part of the two companies’ stock ownership plans. A minority interest is also held by Western Financial Group, an Alberta-ba ...

... “I don’t think I could use a more appropriate word than mutual respect,” Elias says of HED’s work environment. “I think it pervades our company.” Seventeen senior managers are part of the two companies’ stock ownership plans. A minority interest is also held by Western Financial Group, an Alberta-ba ...

Person Sickness

... date of coverage will not be covered unless the loss begins more than six months after the effective date of coverage. Other than the Physician Visits Benefit, we will not pay benefits for losses incurred as a result of an injury. We will not pay benefits for a covered person’s giving birth within t ...

... date of coverage will not be covered unless the loss begins more than six months after the effective date of coverage. Other than the Physician Visits Benefit, we will not pay benefits for losses incurred as a result of an injury. We will not pay benefits for a covered person’s giving birth within t ...

Jumpstart Financial Literacy

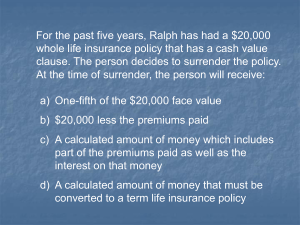

... Sally's health insurance policy requires her to pay the first $500 of medical costs each year before the insurance company will pay any of her medical bills. This policy provision is the: a) Co-insurance clause b) Premium c) Annual deductible ...

... Sally's health insurance policy requires her to pay the first $500 of medical costs each year before the insurance company will pay any of her medical bills. This policy provision is the: a) Co-insurance clause b) Premium c) Annual deductible ...

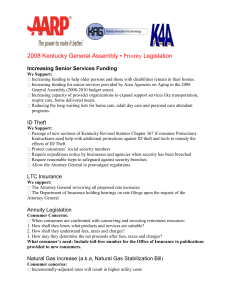

2008 Kentucky General Assembly Priority Legislation

... In Kentucky, the cost of a nursing home today is about $55, 480 annually, or about $152 a day. In 2006, KY spent 71% ($862.8 million) of its total long-term care on institutional expenditures and 29% ($356.6 million) on community expenditures. The cost of long-term care insurance is on the rise. Mos ...

... In Kentucky, the cost of a nursing home today is about $55, 480 annually, or about $152 a day. In 2006, KY spent 71% ($862.8 million) of its total long-term care on institutional expenditures and 29% ($356.6 million) on community expenditures. The cost of long-term care insurance is on the rise. Mos ...

Make your next move - Imeriti Financial Network

... Through the Value Protection Rider available at issue. The money returned will be adjusted for any loans, withdrawals and benefits paid, and may have tax implications. Rider contains complete terms and conditions. If surrendered before the planned premiums are paid, the surrender value will be paid ...

... Through the Value Protection Rider available at issue. The money returned will be adjusted for any loans, withdrawals and benefits paid, and may have tax implications. Rider contains complete terms and conditions. If surrendered before the planned premiums are paid, the surrender value will be paid ...

CUBIC 2016 Personal Finance Syllabus

... • Key concepts and practices in investments, including a review of securities; • The role of insurance in financial planning. ...

... • Key concepts and practices in investments, including a review of securities; • The role of insurance in financial planning. ...

CUBIC 2015 Personal Finance Syllabus

... • Deductions and exemptions • Capital gains/losses • Determination of taxable income • Filing taxes 4) Protecting your financial plans and goals: the use of insurance • Rationale for insurance • A review of insurance vehicles • Emergency cash • Auto/homeowner/rental insurance • Disability insurance ...

... • Deductions and exemptions • Capital gains/losses • Determination of taxable income • Filing taxes 4) Protecting your financial plans and goals: the use of insurance • Rationale for insurance • A review of insurance vehicles • Emergency cash • Auto/homeowner/rental insurance • Disability insurance ...

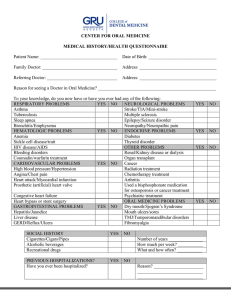

CENTER FOR ORAL MEDICINE MEDICAL HISTORY/HEALTH

... Our office will gladly file health insurance claims on your behalf through the College of Dental Medicine business office. Patient balances remaining after your insurance has processed your claim will be due and payable within thirty (30) days of your insurance company's payment or their notice of n ...

... Our office will gladly file health insurance claims on your behalf through the College of Dental Medicine business office. Patient balances remaining after your insurance has processed your claim will be due and payable within thirty (30) days of your insurance company's payment or their notice of n ...

Pilot Corporation of America prides itself on being a

... ACCIDENTAL DEATH & DISMEMBERMENT INSURANCE If your death is the result of an accident, in addition to the company paid life insurance benefit, your beneficiary will receive an amount equal to 2x your annual base pay rounded up to the next thousand. The maximum benefit is $500,000. For accidental dis ...

... ACCIDENTAL DEATH & DISMEMBERMENT INSURANCE If your death is the result of an accident, in addition to the company paid life insurance benefit, your beneficiary will receive an amount equal to 2x your annual base pay rounded up to the next thousand. The maximum benefit is $500,000. For accidental dis ...

Which Type of Insurance is Best for You? ( 97k)

... you have a great deal of flexibility with respect to when the premiums are paid and how they are invested, with PAR there are very few choices. The insurer itself invests your additional premiums – you have no control. The growth can be achieved through the crediting of dividends, which strongly ref ...

... you have a great deal of flexibility with respect to when the premiums are paid and how they are invested, with PAR there are very few choices. The insurer itself invests your additional premiums – you have no control. The growth can be achieved through the crediting of dividends, which strongly ref ...

Population Policies

... Some financial incentives for multiple children Punitive taxes for over 25 with no children ...

... Some financial incentives for multiple children Punitive taxes for over 25 with no children ...

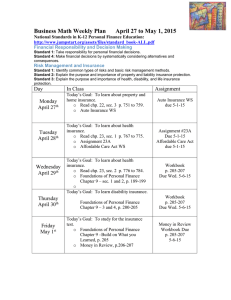

Math 9 Weekly Plan

... o Read chp. 22, sec. 3 p. 751 to 759. o Auto Insurance WS Today’s Goal: To learn about health insurance. o Read chp. 23, sec. 1 p. 767 to 775. ...

... o Read chp. 22, sec. 3 p. 751 to 759. o Auto Insurance WS Today’s Goal: To learn about health insurance. o Read chp. 23, sec. 1 p. 767 to 775. ...

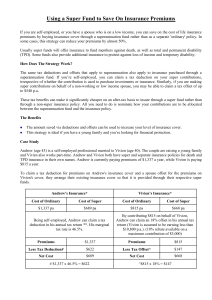

Using a Super Fund to Save On Insurance

... Using a Super Fund to Save On Insurance Premiums If you are self-employed, or you have a spouse who is on a low income, you can save on the cost of life insurance premiums by buying insurance cover through a superannuation fund rather than as a separate 'ordinary' policy. In some cases, this strateg ...

... Using a Super Fund to Save On Insurance Premiums If you are self-employed, or you have a spouse who is on a low income, you can save on the cost of life insurance premiums by buying insurance cover through a superannuation fund rather than as a separate 'ordinary' policy. In some cases, this strateg ...

Life insurance

Life insurance (or commonly final expense insurance or life assurance, especially in the Commonwealth) is a contract between an insured (insurance policy holder) and an insurer or assurer, where the insurer promises to pay a designated beneficiary a sum of money (the ""benefits"") in exchange for a premium, upon the death of the insured person. Depending on the contract, other events such as terminal illness or critical illness can also trigger payment. The policy holder typically pays a premium, either regularly or as one lump sum. Other expenses (such as funeral expenses) can also be included in the benefits.Life policies are legal contracts and the terms of the contract describe the limitations of the insured events. Specific exclusions are often written into the contract to limit the liability of the insurer; common examples are claims relating to suicide, fraud, war, riot, and civil commotion.Life-based contracts tend to fall into two major categories: Protection policies – designed to provide a benefit, typically a lump sum payment, in the event of specified event. A common form of a protection policy design is term insurance. Investment policies – where the main objective is to facilitate the growth of capital by regular or single premiums. Common forms (in the U.S.) are whole life, universal life, and variable life policies.↑