* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Chapter 18

Rate of return wikipedia , lookup

Corporate venture capital wikipedia , lookup

Mark-to-market accounting wikipedia , lookup

Investment banking wikipedia , lookup

History of investment banking in the United States wikipedia , lookup

Private equity in the 2000s wikipedia , lookup

Short (finance) wikipedia , lookup

Private equity wikipedia , lookup

Special-purpose acquisition company wikipedia , lookup

Stock trader wikipedia , lookup

Interbank lending market wikipedia , lookup

Private equity secondary market wikipedia , lookup

Socially responsible investing wikipedia , lookup

Fund governance wikipedia , lookup

Money market fund wikipedia , lookup

Private money investing wikipedia , lookup

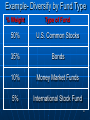

Chapter Eighteen Mutual Funds 1 McGraw-Hill/Irwin © 2006 The McGraw-Hill Companies, Inc., All Rights Reserved. Mutual Fund Definition Security that gives small investors access to a well diversified portfolio of • Equities • Bonds • Other securities Shareholders participates in gain/loss of fund Shares issued & redeemed as needed 2 Mutual Fund cont. Net asset value (NAV) determined each day Portfolio objective stated in prospectus Majority of mutual funds fail to beat the market Past performance is no guarantee of future results 3 Advantages and Disadvantages of Mutual Funds Diversification Professional Management Time Savings Performance Expenses Selection problems 4 Diversification Chose securities from different industries Economy does not affect companies equally 5 Advantages and Disadvantages of Mutual Funds Alternatively diversify portfolio in different kinds of assets such as • • • • • Bonds Preferred stock Convertible securities International securities Real estate 6 Mutual Funds cont. Buy different types of mutual funds to achieve diversification, e.g. Corporate U.S. government bond fund Domestic equity fund International equity fund Real estate investment trust Municipal bond fund Short-term money market fund 7 Closed-End versus Open-End Funds Close & Open refer to distribution & redemption Closed-end fund Fixed number of shares Cannot buy the shares directly from the fund (except at the inception of the fund) Limitation on shares outstanding Fund does not stand ready to buy shares back Purchasers/sellers must trade with each other 8 Closed-End versus Open-End Funds Open-end fund Represents opposite of closed-end fund Always ready to sell new shares Always ready to buy back old shares Shares of closed-end funds trade on security exchanges or over-the-counter just as any other stock might 9 Total value of securities - Liabiliti es Net asset valu e (NAV) Shares oustanding Example Total value of securities ……. $140 million Liabilities ……………………… $5 million Shares outstanding ………….. 10 million $140 million - $5 million NAV $13.50 10 million shares 10 Exchange Traded Funds (ETFs) Passively managed Low-cost Tax-efficient baskets of stocks Focus on • • • • Countries Sectors Regions Indices 11 Exchange Traded Funds (ETFs) Best advancement for individual investors in the past decade No other development, with the possible exception of the rise of Eliot Spitzer, New York attorney-general, has inflicted greater damage to the mutual fund industry that has monopolized the investor market for the past 50 years 12 Exchange Traded Funds (ETFs) Index-based funds imitate market indexes e.g. • S&P 500 Index (SPDRs) • Dow Jones Index (called DIAMONDS) Major advantage of ETFs: Investor can buy “the market” or “an industry” just like buying a common stock ETFs discussed more fully in the next chapter 13 Investing in Open-Ended Funds Load versus No-Load Funds No-Load Funds Information on Mutual Funds 14 More than 95% of the investment funds in U.S. are open-ended 15 Load versus No-Load Funds Fund type Commission in % Load funds 7.25% or higher Low-load funds 2 to 3% Back-end load Exit fee 2 to 3% may decline with time No Load Zero 16 No-Load Funds Do not charge commissions Sold directly by investment company through • Advertisements • Prospectuses • 800-number telephone orders About 50% of all mutual fund assets are no-load funds Account for approx. 50% of new sales Why buy load funds when you can buy no-load funds? (HOPE for a better return!) 17 No-Load Funds How do no-load funds justify their existence? Answer: charge assets management fee plus expenses (12b-1 fees) - 0.75 to 1.25% Load funds have similar management fees Fund with a 12b-1 fee of .25% or less is still considered a no-load fund 18 Invest $1,000 in a load mutual fund Pay a 7.25% commission Only 92.75% go toward purchasing shares $1,000 investment becomes $927.50 Fund must go up by $72.50 or 7.82% just to break even $72.50 7.82% $927.50 19 Figure 18-2 Load and No-Load Fund Assets as a Share of Fund Assets, 1984 -2003 20 Figure 18-2 Load and No-Load Fund Assets as a Share of Fund Assets, 1984 -2003 21 Differing Objectives and the Diversity of Mutual Funds Matching Investment Objectives with Fund Types Money Market Funds Growth Funds Growth with Income Balanced Funds Index Funds Bond Funds Sector Funds 22 Differing Objectives and the Diversity of Mutual Funds Sector Funds (riskier) • • • • • Energy Medical Technology Computer Technology Leisure Defense Foreign Funds 23 Differing Objectives and the Diversity of Mutual Funds Specialty Funds - investing primarily in the securities of a particular • • • • Industry Sector Type of security Geographic region Examples: Underlined hyperlinks www.sbs.gov.uk/phoenix www.calvertgroup.com www.usfunds.com 24 Differing Objectives and the Diversity of Mutual Funds Hedge Funds • The name is misleading • Not restricted to hedging/reducing risk • Neither bullish or bearish • Highly leveraged 25 Differing Objectives and the Diversity of Mutual Funds Hedge Funds continued • Engage in wide range of activities for superior return: Buying (long) Short selling Buy/sell puts and calls at the same time in the attempt to gain an edge • Limited partnership • Charge management fees only on profits (20%) 26 Matching Investment Objectives with Fund Types Volatility of return Safety of principal • • • • Little deviation of returns Choose money market funds Intermediate-term bond funds Expect lower returns Aggressive growth stock funds • Provide the highest expected return • Biggest risk 27 Matching OBJECTIVES FUND TYPES Almost all mutual funds allow redemption at any time Bond funds provide highest annual current yield Aggressive growth funds the lowest yield Liquidity Income Growth-Income Balanced funds 28 Example- Diversify by Fund Type % Weight Type of Fund 50% U.S. Common Stocks 35% Bonds 10% Money Market Funds 5% International Stock Fund 29 The Prospectus Investment Objectives and Policies Portfolio (or “Investment Holdings”) Management Fees and Expenses Turnover Rate Expense ratio Per share income Capital changes 30 Shareholder Services Automatic reinvestment Safekeeping Exchange privilege Preauthorized check plan Systematic withdrawal plan Checking privileges 31 Dollar Averaging Investor buys Fixed dollar’s worth Given security Regular intervals Regardless of security’s price Ignores current market outlook 32 In January, low price $12, purchased large numbers: 16.66 shares In April, high price $19, purchased low numbers: 10.52 shares 33 Computing Total Return on Your Investment Assume invested in a fund for one year Three potential sources of return: Change in net asset value (NAV) Dividends distributed Capital gains distributed 34 Websites www.morningstar.com www.quicken.com www.my.yahoo.com Comments Basic site containing detailed information about mutual funds, portfolio tracking, & analysis Provides mutual fund data & quotes along with portfolio tracking & financial planning information Permits tracking of mutual funds in portfolios 35 Websites moneycentral.msn.com www.ici.org Comments Provides information about mutual funds Investment Company Institute 36 Summary Investment funds allow investors to pool their resources under professional managers Closed-end a fixed number of shares, and purchasers and sellers of shares must deal with each other (via brokers) Open-end fund are more prevalent • Ready to sell new shares or buy back old shares • Load fund up to 7.25% sales commissions • No-Load fund 37 Summary Mutual funds specialize: Money market management Growth in common stocks Bond portfolio management Special sectors of the economy • Energy • Computers • Foreign investments Funds with an international orientation have enjoyed strong popularity in the last decade 38 Summary Examining a fund’s prospectus one can determine Investment objectives Policies Portfolio holdings Turnover rate Management fees (SEC 12b-1) Special services • • • • Automatic reinvestment of distributions Exchange privileges among different funds Systematic withdrawal plans Check writing privileges 39 Summary Return to fund holders may come from Capital appreciation Yield Over the long term, mutual funds have not outperformed the popular market averages offer an opportunity for • Low-cost • Efficient diversification • Normally have experienced management Few funds have above-average returns 40