* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

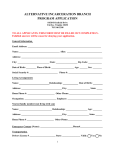

Download H1 2007 - First Trust Bank

Survey

Document related concepts

Financial economics wikipedia , lookup

Private equity secondary market wikipedia , lookup

Securitization wikipedia , lookup

Financialization wikipedia , lookup

Interbank lending market wikipedia , lookup

Stock valuation wikipedia , lookup

Stock selection criterion wikipedia , lookup

Investment fund wikipedia , lookup

Public finance wikipedia , lookup

Syndicated loan wikipedia , lookup

Investment management wikipedia , lookup

Investment banking wikipedia , lookup

Land banking wikipedia , lookup

History of investment banking in the United States wikipedia , lookup

Transcript

Allied Irish Banks, p.l.c. Merrill Lynch Banking & Insurance CEO Conference “Delivering Growth in a Riskier World” Eugene Sheehy, Group Chief Executive London, Tuesday 2nd October 2007 Forward looking statements A number of statements we will be making in our presentation and in the accompanying slides will not be based on historical fact, but will be “forwardlooking” statements within the meaning of the United States Private Securities Litigation Reform Act of 1995. Actual results may differ materially from those projected in the forward looking statements. Factors that could cause actual results to differ materially from those in the forward looking statements include, but are not limited to, global, national and regional economic conditions, levels of market interest rates, credit or other risks of lending and investment activities, competitive and regulatory factors and technology change. Any ‘forward-looking statements made by or on behalf of the Group speak only as of the date they are made. The following commentary is on a continuing operations basis. The growth percentages (excl. EPS) are shown on an underlying basis, adjusted for the impact of exchange rate movements on the translation of foreign locations’ profit and excluding interest rate hedge volatility. visit www.aibgroup.com/investorrelations 2 Delivering growth in a riskier world AIB investor sentiment dominated by two themes in 2007 Global market conditions Irish economy and the housing market 3 Global market conditions AIB in a good position High quality resilient loan portfolios; lead indicators remain positive Minimal exposure to CDOs / US sub-prime No exposure to conduits or SIVs Basis risk having a moderate effect in 2007 Top quality securities portfolios Primarily affects Irish mortgage book Not immune to current indiscriminate valuation writedowns Robust capital and funding positions 4 Impaired loans by Division As at 31 December, 2006 ILs/ Total Actual Provisions/ ILs Advances ILs €m % % As at 30 June, 2007 ILs/ Total Actual Provisions/ ILs Advances ILs €m % % 366 0.6 81 AIB Bank ROI 385 0.6 85 130 0.6 74 Capital Markets 77 0.3 97 205 0.9 71 AIB Bank UK 214 0.9 67 232 4.9 73 Poland 219 3.9 76 933 0.9 76 Total 895 0.7 80 5 Asset quality – key indicators remain strong Dec 2006 Jun 2007 0.9 Impaired loans (ILs) % 0.7 4.9 Criticised loans / total loans % 4.8 0.4 Gross new ILs % 0.4 76 Total provisions / ILs % 80 12 Bad debt charge bps 4 6 Capital Markets – high quality loan portfolios Ireland 16 UK 22 US 6 Project Finance Leveraged Finance (US 60%, Europe 40%) 17 24 5 10 Structured Securities Institutional / Other Average portfolio margin to 164 bps International expansion built on people experience / sector specialism More difficult conditions would create opportunities Leveraged finance highly diversified 470 cases, average hold c. €9m 7 Low level exposure to market “hotspots” c. 0.6% of AIB loan book Characteristics CLOs / CDOs Asset portfolio of €359m, investment grade All performing well, no write downs, all held to maturity US / Europe split 51% / 49%, average deal size €9.6m Own managed CLOs / CDOs Asset manager for 6 funds, total funds managed €2bn, US sub prime ABS Portfolio of $238m, 31 transactions, average deal size US sub prime “whole loans” Portfolio of $149m April 2007 vintage loans purchased all performing well, no write downs Holder of small equity tranches totalling c. €35m $7.7m, investment grade All performing well, no write downs, all held to maturity at very attractive yields Assets selected directly by AIB from top US originator, performing well, held to maturity 8 Solid capital position 8.0% 7.9% * 7.6% 30% 27% 26% Jun 06 Dec 06 Jun 07 Jun Dec-06 Tier 1 ratio Preference share % Tier 1 Jun-07 Total capital ratio 10.4% Tier 1 7.6% (target minimum c. 7%) Core tier 1 5.6% (preference shares 26%, target range 20 – 30%) No requirement for recourse to shareholders Basel II - no material change expected to capital position Application made to Regulator Targeting foundation level IRB * Restated to reflect 2006 dividend paid 9 Funding % 100 10% 9% 80 7% 4% 8% 9% 4% 8% 60 22% 23% Capital Senior Debt ACS CDs & CPs Deposits by banks Customer a/cs 40 20 49% 47% 0 2006 H1 2007 10 AIB term debt distribution Debt distribution € (m) 6,000 Euro 75% 5,000 STG 16% 4,000 US$ 8% 3,000 JY 1% 2,000 Step-up issues – adjusted to earliest step-up date 1,000 20 07 20 08 20 09 20 10 20 11 20 12 20 13 20 15 20 16 20 17 20 20 20 25 Pe rp . 0 ACS Snr-Priv.Place. Snr-Benchmk Tier (ii) € (m) Asset Covered Securities 7,000 Senior Debt - Private Placements 4,250 Senior Debt - Benchmark Issues 9,850 Tier (ii) 3,530 Tier (i) 2,700 Total 27,330 Tier (i) Moody’s S&P Fitch Aaa AAA AAA Aa2 A+(p) AA- Aa2 A+ (p) AA- Aa3 A(Lwr)/A-(Uppr) A+ A1 A- A+ 11 Irish economy % GDP 2007 (f) 5.0 2008 (f) 3.3 Growth slowing in a changing, more broad based economy House market trends are a rational adjustment Moderate price reductions following long period of buoyancy Buyers responding to lower affordability; developers reducing supply Positive demographics underpin long term demand Personal disposable income and spending are increasing Private sector credit demand remains good Government finances in excellent condition National development plan €184bn underway Employment continues to grow, unemployment 4.6% 12 Home mortgages – Republic of Ireland Irish mortgages c. 6% of group profit Principal focus on our own customers Very solid, resilient portfolio Arrears profile remains very low 55 53 50 bps 47 45 40 35 35 34 34 30 2003 2004 2005 2006 H1 2007 Primary emphasis remains on repayment capacity Conservative LTVs and loan durations New business LTVs across all ranges virtually unchanged in 2007 Maximum term 35 years, 83% mature within 25 years Aggressive posture on quality business 13 Property & construction – solid & well diversified Low level of impaired loans for this sector Property & construction 0.4%, total book 0.7% Loan book diversified by geography 1% 3% 4% Republic of Ireland USA Northern Ireland Poland Great Britain Other 26% 56% 10% Further diversified by wide range of sub sectors & borrowers 14 Irish property & construction – high quality, good demand AIB Bank RoI Division portfolios 36% 3% 34% 20% 7% Commercial investment: spread by sector, tenant & covenant, retail 26%, office 33%, industrial 8%, mixed 33% Residential investment: wide tenant spread, highly granular / small bite sizes, conservative approach to location, occupancy, repayment capacity and LTV Commercial development: emphasis on pre-sales / pre-lets / recourse to independent cash flows, typical LTV 70-75% for proven developers in favourable locations, low exposure to speculative development Residential development: finance usually phased / linked to presales / recourse to independent cash flows for proven developers, typical LTV 70 – 80%, focus on loan reduction in 1 -2 year timeframe Contracting: working capital for established players Good customer demand in a changing environment Pipeline underpins confidence in our outlook for growth Strong demand continues in commercial investment & development Increasing investment / development appetite for overseas assets; now c. 12% of RoI book Financial flexibility of proven developers to increase investment portfolios 15 AIB – a snapshot “The 4 Pillars” Ireland Capital Markets UK + “Store of Value” + M&T Poland + + Single enterprise support framework “€400m investment, 4,000 people, focused on service quality, risk mitigation and managed cost” 16 Premium positions in high growth markets Republic of Ireland Extending our no. 1 position in a resilient economy UK Significant headroom for growth in selected GB mid market business sectors; strong franchise in an improving N.I. environment Poland Well set for rapid organic growth and expansion – franchise built on solid foundations in a buoyant economy; 2007 (f) GDP c. 6% Rest of World Applying skills to carefully selected, high potential international corporate markets and niches. Active partnership with outstanding US regional bank 17 Consistent, sustained & broad based growth Operating profit by division H1 2007 AIB Bank RoI €527m 17% Capital Markets €331m 12% AIB Bank UK €223m 19% Poland €155m 37% M&T* * after tax contribution €74m 1% AIB Bank RoI 40% Capital Markets 25% AIB Bank UK 17% Poland 12% M&T 6% 18 Strength in diversity Pre-tax profit by geography * H1 2007 15% 24% 4% 9% 48% ROI USA UK Poland RoW * Management estimate of continuing operations reflecting the geographic markets from which profit was generated. Does not include profit on disposal / development of properties and interest rate hedge volatility 19 AIB Bank Republic of Ireland Gaining market share in a competitive environment 26 Total Lending 21 30 Business Lending 24 Mortgages 19 19 Personal Lending 19 19 Deposits 12 10 AIB YoY growth to June 2007 Est. Rest of Market Achieving high quality growth through investment in strength and depth of franchise Supporting experienced business customers in their areas of proven expertise Targeting loan and deposit growth of c. 20% and c. 5% respectively Ahead of aggressive profit growth plan in wealth management (€50m in 2006, €150m in 2010) Aviva JV outperforming; significant expansion of private banking capability Attacking underweight position in retail banking Clear no. 1 in personal account openings 20 Capital Markets 10 year PBT CAGR 21% Strong recurring customer based income, 87% of total Targeting loan growth of c. 20% in 2007 H1 2007 Ireland International Customer Proprietary 18% Treasury Corporate Banking Investment Banking 69% * Corporate Banking 19% Carefully chosen, well understood sectors / niches 81% Conservative risk appetite Strong risk management framework Tougher credit conditions will present opportunity Global Treasury H1 2007 13% Strong performance in customer services 78%** Difficult market conditions 22% Highly controlled risk environment High quality securities portfolio H1 2007 Investment Banking Strong performances in asset management, stockbroking and corporate finance * Includes AIA, previously included in Investment Banking ** before distributions to other divisions 21 AIB Bank United Kingdom Growth driven by intense focus on dual priorities Premium product and service delivery in response to buoyant customer demand + Realignment of franchises to maximise efficiency Targeting loan growth of c. 20% and deposit growth of over 20% in 2007 Great Britain Focus on high growth niches Chosen mid market business sectors Increasing our presence in healthcare, environment, education, professional services Leveraging business relationships to build complementary private banking service Actively recruiting high quality people to underpin momentum Northern Ireland Strong growth in improved economy Realising benefits of “hub & spoke” approach Branch reconfiguration aligned to local market potential Removal of support activities to dedicated centres Refreshed product suite 22 Poland Much improved economic conditions facilitating high quality growth Targeting loan and deposit growth of c. 30% and 10% respectively Leading positions in fund management and brokerage services underline ability to “punch above our weight” Return on invested capital exceeds 40% Branches 377 branches, 605 ATMs 50 new branches planned for 2007 Expansion in key markets Corporate Business Centres Warsaw, Poznan, Wroclaw, Krakow, Gdansk 65% total loans under CBC mgt. 3 new locations in 2007 – Katowice / Szczecin / Łodz External Channels “Mini Bank” franchise Direct Banking Intermediaries / mobile sales GDANSK SZCZECIN WARSAW POZNAN LODZ WROCLAW KATOWICE KRAKOW 23 M&T Continues to perform well in a challenging US market Premium valuation underlines management quality Internal rate of return 17% (4 years to April 2007) AIB shareholding 24.9%; recently announced acquisition will reduce to c. 24.2% Significant store of value 24 Delivering growth in a riskier world Rich mix of earnings by geography & business unit underpins stability Growth Resilience and options for growth Improving productivity while investing to sustain growth Highly skilled experienced people High quality asset portfolios Solid capital and funding positions Diversity Efficiency 25 Contacts Our Group Investor Relations Department will be happy to facilitate your requests for any further information Alan Kelly [email protected] +353-1-6412162 Rose O’Donovan rose.m.o’[email protected] +353-1-6414191 Pat Clarke [email protected] +353-1-6412381 Karla Doyle [email protected] +353-1-6413469 +353-1-660 0311 +353-1-641 2075 Visit our website www.aibgroup.com/investorrelations 26