* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download All findings, interpretations, and conclusions of this presentation

Survey

Document related concepts

Mark-to-market accounting wikipedia , lookup

Systemic risk wikipedia , lookup

Quantitative easing wikipedia , lookup

Investment banking wikipedia , lookup

Environmental, social and corporate governance wikipedia , lookup

Investment management wikipedia , lookup

History of private equity and venture capital wikipedia , lookup

Security (finance) wikipedia , lookup

Private equity wikipedia , lookup

Socially responsible investing wikipedia , lookup

Securitization wikipedia , lookup

Private equity secondary market wikipedia , lookup

Early history of private equity wikipedia , lookup

Private equity in the 2000s wikipedia , lookup

Transcript

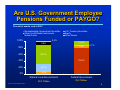

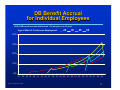

All findings, interpretations, and conclusions of this presentation represent the views of the author(s) and not those of the Wharton School or the Pension Research Council. © 2008 Pension Research Council of the Wharton School of the University of Pennsylvania. All rights reserved. Discussion: International Perspectives on Public Retirement Systems The Future of Public Employee Retirement Systems May 1st, 2008 Peter Brady* Investment Company Institute *The views presented reflect the conclusions of the author and do not necessarily reflect the views of the Investment Company Institute or its members. Discussion Inspired by the Papers • Moving from pay-as-you-go pensions to funded pensions Nonmarketable government securities Investment risk premium • Funded pensions and demographic shifts 4 Moving from PAYGO Pensions to Funded Pensions Reasons to Shift to Funded Pensions • Increase national savings • Strengthen property rights • Take advantage of market risk premium 6 PAYGO Plans • Advantages of PAYGO If population in steady state, can fund fully indexed benefits with constant contribution rate • Taxes are claim on future productive activity • Disadvantages of PAYGO Demographic shifts may require benefit cuts or increased contributions No new, or possible decreased, national savings • Capital deepening 7 Are U.S. Government Employee Pensions Funded or PAYGO? Percent of assets, end of 2007 Nonmarketable Government Securities Other Credit Market Instruments Mutual Funds 100% 2.4% 8.9% 0.7% 59.4% 40% 79.5% 20% 24.4% 0% 4.9% Source: Federal Reserve Board 12.4% 7.4% 80% 60% U.S. Treasury Securities Equity Other Assets State & Local Governments Federal Government $3.3 Trillion $1.2 Trillion 8 Is Social Security Partially Funded? U.S. Federal Government Budget Surplus and Social Security Surplus, Billions of Dollars, 1980-2007 On-Budget Surplus Social Security Surplus Total Surplus 300 Billions of dollars 200 100 0 -100 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 -200 -300 -400 -500 -600 -700 Year Source: Congressional Budget Office, The Budget and Economic Outlook Fiscal Years 2008 to 2017, January 2007 9 Moving from PAYGO to a Funded System • Accumulated pension benefits still need to be paid • How will contributions be invested? Government bonds • Marketable • Nonmarketable Private securities • How will contributions be financed? New taxes New debt issuance • Is this margin investing? Ad absurdum: Why not finance all government activities? 10 Can Funding Make Taxpayers Better Off? • Need to change real behavior Shifting assets will not help in aggregate Stocks, bonds, and taxes all represent claims on future productive activity • Increased national savings could impact aggregate economy Capital deepening Easier to pay off future claims Simple Model of Economy Assumptions: Initial Government Debt Level Initial Market Value of Corporate Equity 1,000,000 1,000,000 Interest Rate on Government Debt Equity Rate of Return Equity Issuance 6% 10% 60,000 Government Pension Contribution Private Household Savings 60,000 60,000 12 Model Results After 20 Years Invest in Government Debt Invest in Corporate Equity 2,207,135 3,436,500 2,207,135 0 0 3,436,500 Private Household Assets 11,164,000 9,934,635 Government Debt 1,000,000 3,207,135 Equity 10,164,000 6,727,500 Total Government Debt 3,207,135 3,207,135 Total Corporate Equity 10,164,000 10,164,000 Government Pension Assets Government Debt Equity Private Assets versus Government Debt • Investment Risk Premium • Investing in market assets or paying down debt both could lead to economy-wide capital deepening • Other rationales for investing in market assets Behavioral public finance Distributional issues • Which groups made better off? • Assignable property rights 14 Funded Pensions and Demographic Shifts Funded Plans Not Immune to Demographic Shocks • Typical DB pension benefits accrue unevenly • As long as age composition of workforce remains stable, contributions as percent of payroll remain stable • Even in a fully funded plan, aging of the workforce increases funding costs as percent of payroll 16 DB Benefit Accrual for Individual Employees PDV of DB benefit accruals with formula 1.5% per year up to 30 years 25 Age at Start of Continuous Employment: 35 45 55 40% 30% 20% 10% 0% 21 23 Source: Author’s Calculation 25 27 29 31 33 35 37 39 41 43 45 47 49 51 53 55 57 59 61 63 65 17 Depends on Definition of “Funded” • If changes in workforce can be forecast, can adjust funding as percent of payroll • If decline of industry or increased productivity unexpected, may be hard to forecast aging of workforce