* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Aggregate Demand

Survey

Document related concepts

Full employment wikipedia , lookup

Exchange rate wikipedia , lookup

Economic democracy wikipedia , lookup

Modern Monetary Theory wikipedia , lookup

2000s commodities boom wikipedia , lookup

Real bills doctrine wikipedia , lookup

Economic calculation problem wikipedia , lookup

Monetary policy wikipedia , lookup

Nominal rigidity wikipedia , lookup

Interest rate wikipedia , lookup

Helicopter money wikipedia , lookup

Business cycle wikipedia , lookup

Money supply wikipedia , lookup

Ragnar Nurkse's balanced growth theory wikipedia , lookup

Keynesian economics wikipedia , lookup

Transcript

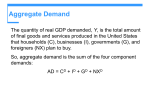

Aggregate Demand Introduction & Determinants • A negative demand shock to the economy as a whole is a leftward shift of the aggregate demand curve • Aggregate demand curve shows the relationship between the aggregate price level and the quantity of aggregate output demanded by households, businesses, the government, and the rest of the world Aggregate Demand • Aggregate demand curve is downward sloping, meaning a negative relationship between the aggregate price level and the quantity of aggregate output demanded Aggregate Demand • Higher aggregate price level, other things equal, reduces the quantity of aggregate output demanded • Lower aggregate price level, other things equal, increases the quantity of aggregate output demanded Aggregate Demand • • • • GDP = C + I + G + X – IM C = consumer spending I = investment spending G = government purchases of goods and services • X = exports to other countries • IM = imports Why is the Aggregate Demand Curve Downward Sloping? • C + I + G + X – IM is the quantity of domestically produced final goods and services demanded during a given period • G is decided by the government • Other variables are private-sector decisions Why is the Aggregate Demand Curve Downward Sloping? • Does not slope downward due to the law of demand • Movements up or down the aggregate demand curve are a simultaneous change in the prices of all final goods and services • Goods and services in consumer spending aren’t relevant to the aggregate demand curve • If consumers decide to buy fewer clothes but more cars, this doesn’t change the total quantity of final goods and services they demand Why is the Aggregate Demand Curve Downward Sloping? • Why does a rise in aggregate price level lead to a fall in the quantity of all domestically produced final goods and serviced demanded? • Wealth Effect • Interest Rate Effect Why is the Aggregate Demand Curve Downward Sloping? • Increase in the aggregate price level, other things equal, reduces the purchasing power of many assets • Ex: $5,000 in bank account • Aggregate price level rise by 25% • $5,000 would buy only as much as $4,000 would have previously bought • Less money, loss of purchasing power The Wealth Effect • A fall in the aggregate price level increases the purchasing power of consumers’ assets and leads to more consumer demand • Wealth effect of a change in the aggregate price level is the change in consumer spending caused by the altered purchasing power of consumers’ assets • Due to wealth effect, consumer spending, C, falls when the aggregate price level rises – leading to a downward-sloping aggregate demand curve The Wealth Effect • Money = cash and bank deposits on which people can write checks • People and firms hold money because it reduces the cost and inconvenience of making transactions • Increase in the aggregate price level, other things equal, reduces the purchasing power of a given amount of money holdings • Basket of goods and services requires people and firms to pay more money The Interest Rate Effect • Aggregate price level increase leads to the public increasing its money holdings • Borrowing or selling assets • Reduces the funds available for lending to other borrowers and drive interest rates up • Rise in interest rate reduces investment spending because it makes the cost of borrowing higher • Rise in interest rate also reduces consumer spending The Interest Rate Effect • A rise in aggregate price level depresses investment spending, I, and consumer spending, C, through its effect on the purchasing power of money holdings • Interest rate effect of a change in the aggregate price level is the change in investment and consumer spending caused by altered interest rates that result from changes in the demand for money The Interest Rate Effect • The aggregate demand curve shifts because of: • changes in expectations • wealth • the stock of physical capital • government policies • fiscal policy • monetary policy • All five factors set the multiplier process in motion Shifts of the Aggregate Demand Curve •If consumers and firms become more optimistic, . . . . . . aggregate demand increases. •If consumers and firms become more pessimistic, . . . . . . aggregate demand decreases. Changes in Expectations •If the real value of household assets rises, . . . . . . aggregate demand increases. •If the real value of household assets falls, . . . . . . aggregate demand decreases. Changes in Wealth •If the existing stock of physical capital is relatively small, .. aggregate demand increases. •If the existing stock of physical capital is relatively large, ..aggregate demand decreases. Change in Stock of Physical Capital •Fiscal policy is the use of taxes, government transfers, or government purchases of goods and services to stabilize the economy •If the government increases spending or cuts taxes, . . . .. aggregate demand increases. •If the government reduces spending or raises taxes, . . . . aggregate demand decreases. Fiscal Policy •Monetary policy is the central bank’s use of changes in the quantity of money or the interest rate to stabilize the economy •If the central bank increases the quantity of money, . .. . . aggregate demand increases. •If the central bank reduces the quantity of money, . . . . . . aggregate demand decrease Monetary Policy