* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Lecture 3

Market sentiment wikipedia , lookup

Contract for difference wikipedia , lookup

Efficient-market hypothesis wikipedia , lookup

Securities fraud wikipedia , lookup

Black–Scholes model wikipedia , lookup

Foreign exchange market wikipedia , lookup

Financial crisis wikipedia , lookup

Exchange rate wikipedia , lookup

Stock market wikipedia , lookup

Algorithmic trading wikipedia , lookup

Purchasing power parity wikipedia , lookup

Stock exchange wikipedia , lookup

Currency intervention wikipedia , lookup

Futures contract wikipedia , lookup

Short (finance) wikipedia , lookup

Commodity market wikipedia , lookup

Day trading wikipedia , lookup

Stock selection criterion wikipedia , lookup

2010 Flash Crash wikipedia , lookup

Futures exchange wikipedia , lookup

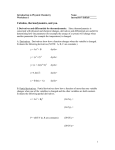

Introduction Chapter 1 Geng Niu Gezhi Building 1220 [email protected] 1 Course evaluation Assignments + participation (30%) Midterm exam (30%) Final exam (40%) 2 Textbook (main) Options, Futures, and Other Derivatives, 8th edition (John C. Hull) Classical textbook; many editions (very similar across editions though). Used wildly in Master of Finance programs and MBA programs with finance tracks around the world. Less on math, more on intuitions 3 Supplementary materials: Fixed Income Markets and Their Derivatives, 2th edition (Suresh M. Sundaresan) Bond Markets, Analysis and Strategies, 5th edition (Frank J. Fabozz) FRM (Financial Risk Management) Exam notes. 4 Some useful online resources http://www.cmegroup.com/ (Chicago Mercantile Exchange & Chicago Board of Trade) http://finance.yahoo.com/ http://www.cffex.com.cn/en_new/ (China Finance Futures Exchange) http://www.shfe.com.cn/en/ (Shanghai Futures Exchange) http://www.dce.com.cn/portal/cate?cid=1114494099100 (Dalian Commodity Exchange) http://english.czce.com.cn/ (Zhengzhou Commodity Exchange) http://eng.cfachina.org/ (China Futures Association) 5 Dynamics of some assets: what’s in common? Glod Price 2000.000 1800.000 1600.000 1400.000 1200.000 1000.000 800.000 600.000 400.000 200.000 0.000 Oil Price 120.00 100.00 80.00 60.00 40.00 20.00 0.00 U.S. / Euro Exchange Rate S&P 500 2500.00 2.0000 2000.00 1.5000 1500.00 1.0000 1000.00 0.5000 500.00 0.0000 0.00 6 How Derivatives are Used To hedge risks: risk management To speculate (bet on the future direction of the market) To lock in an arbitrage (riskless) profit 7 Derivatives are relevant to many sectors Financial sector (banks, hedge funds, mutual funds, asset management company, etc): provide competitive financial products Other companies: interest rates, exchange rates, commodity prices (grain, oil, gold, copper…) Government: how to regulate financial market properly? 8 Why Study Derivatives Pricing Learn the language of modern finance Foundation of financial engineering and risk management Prepare for graduate studies in finance Prepare for professional certificates: CFA, FRM, ect.. Prepare for job interviews Understand financial news 9 The derivatives pricing literature is very huge. Mathematical techniques involved can be quite challenging Advanced computational skills are also needed. Derivatives pricing is considered “rocket science”. 10 What you will learn in this course are still the basics. They are mostly “toy models”. However, this course prepares you for future learning. Intuitions are often more Impartment and useful. So, be confident and have fun ! 11 What is a Derivative? A derivative is an instrument whose value depends on, or is derived from, the value of another asset (the underlying asset). Examples: futures, forwards, swaps, options, exotics… 12 Examples Forward & Future: an agreement to buy or sell an asset at a certain time for a certain price. Call Option: the holder has the right to buy the underlying asset by a certain date for a certain price. Put Option: the holder has the right to sell the underlying asset by a certain date for a certain price. 13 14 th 19 US grain trade finance Inland farmers came to east coast to sell their grain to dealers who, in turn, shipped it all over the country. Too much supply right after the harvest. Unpurchased crops were left to rot. In the off-season price became too high when crops were unavailable. Not good for both the farmers and the dealers. 15 th 19 US grain trade finance Farmers (sellers) and dealers (buyers) began to commit to future exchanges of grain for cash: forward contract Such contracts became common and began to change hands before the delivery date. The (forward) price would go up and down depending on market conditions. people who had no intention buying or selling grain began to trade: speculators 16 th 19 US grain trade finance Forward contracts are often not easy to change hands. Standardized forward contracts began to emerge: futures contract. A counterparty to every trade – its members buy every contract that traders sell and sell every contract that traders buy: cleaning house. Exchanges in Chicago and New York began to develop. 17 How Derivatives Are Traded On exchanges such as the Chicago Board Options Exchange In the over-the-counter (OTC) market where traders working for banks, fund managers and corporate treasurers contact each other directly 18 Size of OTC and Exchange-Traded Markets (Figure 1.1, Page 3) Source: Bank for International Settlements. Chart shows total principal amounts for OTC market and value of underlying assets for exchange market 19 Motivating example On Sep 1, your company, based in the U.S., agreed to buy heavy equipment from a German manufacturer. Payment of 1 million euro was due upon delivery, Dec 1. Between Sep 1 and Dec 1, the price of the euro in relation to the U.S. dollar will fluctuate: hard to predict. What if the value of the euro were to rise, say, from 1.36 dollar/euro to 1.461 dollar/euro? 20 Motivating example 21 Motivating example: To get rid of this risk, the U.S company could: Bought the euros they needed for this purchase on Sep 1: a large amount of working capital would be tied up. Or, hedge their exposure to FX risk by purchasing forward or futures contracts: agree to pay 1.36 million U.S. dollar. to buy 1 million euro on Dec 1. Who would take the other side of this trade? 22 Forward Price The forward price for a contract is the delivery price that would be applicable to the contract if were negotiated today (i.e., it is the delivery price that would make the contract worth exactly zero) The forward price may be different for contracts of different maturities (as shown by the table) 23 Foreign Exchange Quotes for USD/GBP, May 24, 2010 (See page 5) Spot Bid 1.4407 Offer 1.4411 1-month forward 1.4408 1.4413 3-month forward 1.4410 1.4415 6-month forward 1.4416 1.4422 24 Terminology The party that has agreed to buy has what is termed a long position The party that has agreed to sell has what is termed a short position 25 Example (page 5) On May 24, 2010 the treasurer of a US corporation enters into a long forward contract to buy £1 million in six months at an exchange rate of 1.4422 This obligates the corporation to pay $1,442,200 for £1 million on November 24, 2010 What are the possible outcomes? 26 Profit from a Long Forward Position (K= delivery price=forward price at time contract is entered into) Profit K Price of Underlying at Maturity, ST: USD/GPB 27 Profit from a Short Forward Position (K= delivery price=forward price at time contract is entered into) Profit K Price of Underlying at Maturity, ST: USD/GPB Options, Futures, and Other Derivatives, 8th Edition, Copyright © John C. Hull 2012 28 Futures Contracts (page 7) Agreement to buy or sell an asset for a certain price at a certain time Similar to forward contract Whereas a forward contract is traded OTC, a futures contract is traded on an exchange 29 Exchanges Trading Futures CME Group (formerly Chicago Mercantile Exchange and Chicago Board of Trade) NYSE Euronext BM&F (Sao Paulo, Brazil) TIFFE (Tokyo) and many more (see list at end of book) 30 Examples of Futures Contracts Agreement to: Buy 100 oz. of gold @ US$1400/oz. in December Sell £62,500 @ 1.4500 US$/£ in March Sell 1,000 bbl. of oil @ US$90/bbl. in April 31 Options A call option is an option to buy a certain asset by a certain date for a certain price (the strike price) A put option is an option to sell a certain asset by a certain date for a certain price (the strike price) 32 Long Call (Figure 9.1, Page 195) Profit from buying one European call option: option price = $5, strike price = $100, option life = 2 months 30 Profit ($) 20 10 70 0 -5 80 90 100 Terminal stock price ($) 110 120 130 33 American vs European Options An American option can be exercised at any time during its life A European option can be exercised only at maturity 34 Bid price: the price at which the market maker is prepared to buy Offer price: the price at which the market maker is prepared to sell 35 Google Call Option Prices (June 15, 2010; Stock Price is bid 497.07, offer 497.25); See Table 1.2 page 8; Source: CBOE Strike Price Jul 2010 Bid Jul 2010 Offer Sep 2010 Bid Sep 2010 Offer Dec 2010 Bid Dec 2010 Offer 460 43.30 44.00 51.90 53.90 63.40 64.80 480 28.60 29.00 39.70 40.40 50.80 52.30 500 17.00 17.40 28.30 29.30 40.60 41.30 520 9.00 9.30 19.10 19.90 31.40 32.00 540 4.20 4.40 12.70 13.00 23.10 24.00 560 1.75 2.10 7.40 8.40 16.80 17.70 36 Google Put Option Prices (June 15, 2010; Stock Price is bid 497.07, offer 497.25); See Table 1.3 page 9; Source: CBOE Strike Price Jul 2010 Bid Jul 2010 Offer Sep 2010 Bid Sep 2010 Offer Dec 2010 Bid Dec 2010 Offer 460 6.30 6.60 15.70 16.20 26.00 27.30 480 11.30 11.70 22.20 22.70 33.30 35.00 500 19.50 20.00 30.90 32.60 42.20 43.00 520 31.60 33.90 41.80 43.60 52.80 54.50 540 46.30 47.20 54.90 56.10 64.90 66.20 560 64.30 66.70 70.00 71.30 78.60 80.00 37 Options vs Futures/Forwards A futures/forward contract gives the holder the obligation to buy or sell at a certain price An option gives the holder the right to buy or sell at a certain price 38 Types of Traders Hedgers: to reduce risk Speculators: to make profit from taking the risk Arbitrageurs: look for riskless profit 39 Hedging Examples (pages 10-12) A US company will pay £10 million for imports from Britain in 3 months and decides to hedge using a long position in a forward contract An investor owns 1,000 Microsoft shares currently worth $28 per share. A twomonth put with a strike price of $27.50 costs $1. The investor decides to hedge by buying 10 contracts 40 Value of Microsoft Shares with and without Hedging (Fig 1.4, page 12) 40,000 Value of Holding ($) 35,000 No Hedging 30,000 Hedging 25,000 Stock Price ($) 20,000 20 25 30 35 40 41 Speculation Example An investor with $2,000 to invest feels that a stock price will increase over the next 2 months. The current stock price is $20 and the price of a 2-month call option with a strike of 22.50 is $1 What are the alternative strategies? 42 Arbitrage Example A stock price is quoted as £100 in London and $140 in New York The current exchange rate ($/ £ )is 1.4300 What is the arbitrage opportunity? What if the exchange rate ($/ £ ) is 1.3700 43 Different Opinions on Derivatives “Derivatives are extremely efficient tools for risk management” “Derivatives are financial weapons of mass destruction” 44 Why Derivatives Are Important Derivatives play a key role in transferring risks in the economy The underlying assets include stocks, currencies, interest rates, commodities, debt instruments, electricity, insurance payouts, the weather, etc Many financial transactions have embedded derivatives The real options approach to assessing capital investment decisions has become widely accepted 45 Dangers Traders can switch from being hedgers to speculators or from being arbitrageurs to speculators It is important to set up controls to ensure that trades are using derivatives in for their intended purpose Soc Gen (see Business Snapshot 1.3 on page 17) is an example of what can go wrong 46 China Aviation Oil suffers $550 million derivatives loss China Aviation Oil (CAO): a Singapore listed company that purchases jet fuel and supplies jet fuel to China’s civil aviation industry. In early 2004, the management team judged that oil price would further decrease and began to heavily sell calls and buy puts: speculating! However, the Nymex oil futures contract increased to $55.17 per barrel on October 26 compared with just $34 at in early 2004: resulting a huge loss for CAO. 47 48 China Aviation Oil suffers $550 million derivatives loss CAO concealed these losses by accounting manipulation. The managing director, Chen Jiulin, was sentenced for 3 years and 4 months by the Singapore court. Q2 Q3 First 9 months CAO EBT 19.0 19.3 11.3 49.6 PwC adjusted EBT -58.0 -314.6 -379.0 Q1 -6.4 49 Hedge Funds (see Business Snapshot 1.2, page 11) Hedge funds are not subject to the same rules as mutual funds and cannot offer their securities publicly: only to sophisticated individuals. Mutual funds must disclose investment policies, makes shares redeemable at any time, limit use of leverage take no short positions. Hedge funds are not subject to these constraints. Hedge funds use complex trading strategies are big users of derivatives for hedging, speculation and arbitrage 50 No Arbitrage Theory and Efficient Market Hypothesis No Arbitrage: Two assets with the same future payoffs must have the same price today. Otherwise, you can earn a positive profit for certain. How? Buy the cheap asset and sell the expensive one. Result: Demand for the cheap asset increases and so is its price. 51 Assumption The market is efficient. If there were arbitrage opportunities, some investors would have taken these opportunities already. Thus, these opportunities will be eliminated immediately. 52 An old joke An economist will not pick up a twenty-dollar bill on the ground. Why? If it were really there, someone would have picked it up already. Arbitrage opportunities (free money) cannot exist. 53 Derivatives Market in China Commodity-based financial derivatives: The first commodities futures market in China, the China Zhengzhou Grain Wholesale Market, opened on 12 October 1990. Subsequently, the Shanghai Futures Exchange and Dalian Commodity Exchange have also started operations 54 Derivatives Market in China Exchange rate derivatives RMB forwards: In April 1997, the Bank of China started its RMB forward exchange settlement and sales business. RMB foreign exchange swaps: introduced in April 2006. RMB futures: In August 2006, CME launched futures and option contracts on the CNY against the US dollar, euro and Japanese yen. Wulin Suo 55 China Financial Futures Exchange (CFFEX) was jointly founded by Shanghai Futures Exchange, Zhengzhou Commodity Exchange, Dalian Commodity Exchange, Shanghai Stock Exchange and Shenzhen Stock Exchange on September 8, 2006 in Shanghaj 56 Derivatives Market in China CSI 300: 300 largest A-Shares listed on the Shanghai Stock Exchange and Shenzhen Stock Exchange. SSE 50 : 50 largest stocks of good liquidity and representativeness from Shanghai security market 57 Derivatives Market in China Stock index option An option based on the SSE 50 Index ETF was launched as the debut product on February 9, 2015 in China, traded in Shanghai stock exchange. 58 Derivatives Market in China Exchange Traded Fund (ETF): an openended index fund that is listed and traded on the stock exchange like any other ordinary stocks. China 50 ETF: closely track the Shanghai Stock Exchange 50 (SSE 50) Index 59