* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Multi-Seller Commercial Paper - Dorris - Artic

Survey

Document related concepts

Financialization wikipedia , lookup

Private equity secondary market wikipedia , lookup

Federal takeover of Fannie Mae and Freddie Mac wikipedia , lookup

International asset recovery wikipedia , lookup

Interest rate ceiling wikipedia , lookup

Credit rationing wikipedia , lookup

Credit rating agencies and the subprime crisis wikipedia , lookup

Syndicated loan wikipedia , lookup

Mark-to-market accounting wikipedia , lookup

Fractional-reserve banking wikipedia , lookup

Shadow banking system wikipedia , lookup

Interbank lending market wikipedia , lookup

Transcript

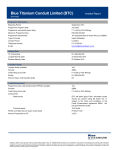

Multi-Seller Commercial Paper Conduits and Securitization A Brief History and Current Challenges by Malcolm S. Dorris and Anna E. Panayotou Published in The Journal of Structured and Project Finance (Winter 2004), a publication of Institutional Investor, Inc. xc www.dechert.com Copyright 2004 Dechert LLP. All rights reserved. Materials have been abridged from laws, court decisions and administrative rulings and should not be considered as legal opinions on specific facts or as a substitute for legal counsel. d Multi-Seller Commercial Paper Conduits and Securitization A Brief History and Current Challenges by Malcolm S. Dorris and Anna E. Panayotou In their article entitled “A Primer on Securitization” in the Summer 2003 issue of this Journal (Volume 9, Number 2), W. Alexander Roever and Frank J. Fabozzi set out an excellent summary of the basics of securitization, which entails the pooling and repackaging of the cash flows of financial assets into securities that are sold in the capital markets. Securitization performs a crucial economic role by providing liquidity to most major economic sectors, including the residential and commercial mortgage industries, the automobile industry, the consumer credit industry, the leasing industry, the bank commercial loan market and the corporate bond market. Through securitization, most credit risk is transferred from the originator of the asset to the performance of an asset pool. In this article, we explore the use in securitization of multi-seller commercial paper conduits ( “multi-seller CP conduits”) in greater detail.1 conduit is contained in the Exhibit. Most multi-seller CP conduits are sponsored and administered by large commercial banks and the sellers are, more often than not, existing customers of such banks. The bank sponsors do not own equity interests in such conduits. They organize and administer them to offer an alternative source of funding to customers owning financial assets with historically-measurable cash flows (such as trade receivables). A multi-seller CP conduit offers a bank’s customers a variety of advantages not available through conventional financing or other forms of asset securitization. Funding through commercial paper is frequently the lowest cost funding available to the customer. It may be the only alternative to conventional bank financing if the customer or the assets lack the attributes necessary for access to the public or private capital markets. A multi-seller CP conduit offers confidentiality, since the identity of the sellers in the conduit need not be disclosed to the commercial paper investors. Multi-seller CP conduits also offer structuring flexibility and access to a variable principal amount through revolving facilities. A multi-seller CP conduit is a special-purpose entity that regularly buys interests in pools of financial assets from one or more sellers and funds such purchases by selling commercial paper notes primarily to institutional investors. A structural overview of a multi-seller CP Exhibit Multi-Seller Commercial Paper Conduit Structural Overview Obligors Obligors Obligors Seller No.1 Seller No. 2 Seller No. 3 Special Purpose Entity Special Purpose Entity Special Purpose Entity Pool Specific Credit Enhancement Programwide Credit Enhancement Pool Specific Credit Enhancement Conduit Commercial Paper Investors Pool Specific Credit Enhancement Programwide Liquidity Support Multi-Seller Commercial Paper Conduits and Securitization - A Brief History and Current Challenges Negotiations may be easier for the customer than in the case of private placements or public offerings. In addition, rating agency review may be more limited. The use of asset-backed commercial paper conduits began in 1985. Since then it has burgeoned into a major financing tool. At the end of 2002, $715 billion in assetbacked commercial paper notes was outstanding. Assetbacked commercial paper outstanding at June 30, 2003 dropped to $683 billion, reflecting, among other matters, the impact of new regulatory and accounting rules discussed below. Asset-backed commercial paper notes are short-term debt obligations of the conduit with maturities of no more than 270 days and typically much shorter. Purchasers of such notes are primarily large institutional investors such as insurance companies and money market funds. Such notes are attractive investments for money market funds because they may not invest in obligations which mature in more than 397 days. Commercial paper notes are sold through commercial paper dealers that enter into placement agreements with the conduit. The commercial paper notes are not registered under the Securities Act of 1933, as amended (the “Act”), and are sold in reliance upon various exceptions under the Act, including the “private placement” exception provided by Section 4(2). In order to preserve that exemption, resale and transfer of the commercial paper notes by investors is limited. In addition, multi-seller CP conduits are exempt from regulation under the Investment Company Act of 1940, as amended (the “40 Act”).2 Commercial paper notes are fixed-rate notes usually sold at a discount to their face amount. The short-term nature of commercial paper notes means that the cost of funding through such notes is more similar to floating-rate debt than to fixed-rate debt. When commercial banks first established multi-seller CP conduits, they were used primarily to fund pools of trade receivables. Since then, the asset pool composition of such conduits has become much more diverse. Although trade receivables continue to account for roughly 15% of all assets in multi-seller CP conduits, other asset types now include credit card receivables, auto loans, auto leases, equipment loans, equipment leases, aircraft and engine leases, student loans, consumer loans, commercial loans, home equity loans, residential mortgage loans, film receivables, floorplan-financed assets, insurance premiums, future flows and a variety of other asset types. Multi-seller CP conduit transactions in the United States have a two-step sale structure3: First, the seller transfers assets in a legal true sale to a wholly-owned special purpose subsidiary of the seller (“SPE”). This step Page 2 requires opinions of counsel as to “true sale” and “nonconsolidation.” Through this step, the seller may obtain off-balance-sheet treatment and the conduit’s exposure to the risk of the bankruptcy of the seller is made more remote. Then, in the second step, the SPE subsequently sells an undivided percentage interest in the assets to the conduit. By increasing and decreasing the percentage amount of the conduit’s undivided interest in the assets, a multi-seller CP conduit is able to provide a seller with the equivalent of a revolving facility through which newly created assets may be purchased over an agreed-upon period of time (subject to various events that would trigger the end of the revolving feature). This feature is useful particularly to companies with seasonal businesses. In contrast, the longer-term securitization market offers such companies less flexibility. Credit Enhancement Multi-seller CP conduit transactions have two types of credit enhancement: pool-specific, which is built into the structure of each transaction, and program-wide, which is built into the structure of the conduit. Pool-specific credit enhancement provides protection against credit losses (the inability of the obligors of the receivables to make payment), dilution (reductions in amounts payable due to returns, offsets, disputes or any other claims that the obligors may have against the seller), and yield risk (the rate of interest payable on the assets not matching the rate of interest payable on the conduit’s commercial paper notes). Pool-specific credit enhancement covers risks arising from a particular seller’s assets and is not available to cover losses on the assets of other sellers in the same multi-seller CP conduit. Poolspecific credit enhancement often takes the form of overcollateralization (the value of the assets exceeds the principal amount of funding made available to the seller), excess spread (the rate of interest paid on the assets exceeds the rate of interest paid on the commercial paper notes) which is captured in a reserve account, and/or the funding of a reserve account at closing using a portion of the initial proceeds from the sale of the assets. The amount and form of pool-specific enhancement is determined based on historical losses and dilutions, and servicing risk (how difficult it would be to replace the servicer) among other factors. Increasingly, pool-specific credit enhancement is dynamic, rather than simply a fixed percentage of the asset pool. For example, if the performance of an asset pool deteriorates below expectations, the transaction documents will call for an increase in the required reserve amount. Pool-specific credit enhancement is structured to meet the credit quality Dechert LLP Multi-Seller Commercial Paper Conduits and Securitization - A Brief History and Current Challenges levels set by the rating agencies in order to maintain the rating of the conduit’s commercial paper notes. Program-wide credit enhancement is built into the structure of the multi-seller CP conduit. The organizational documents of the conduit set forth the required facilities. Such facilities are constructed so they will be available to be drawn to cover losses on any transaction in the conduit. Thus, if total collections are insufficient to make payments on the conduit’s maturing commercial paper due to deteriorating asset quality, such payments may be made from the program-wide credit enhancement facility. The rating of any provider of such program-wide credit enhancement, which may be the conduit’s bank sponsor or a third party, must be at least equal to the rating of the conduit’s commercial paper notes. Forms of program-wide credit enhancement include letters of credit, committed loan or purchase facilities, cash collateral invested in enumerated approved investments or an insurance policy from a highly-rated monoline insurer. The amount of program enhancement required for a multi-seller CP conduit is determined by the rating agencies and depends on historic portfolio performance and seller concentrations, among other factors. The cost of program-wide credit enhancement is passed on to the sellers. Multi-seller CP conduits are classified as either “fullysupported” or “partially-supported,” depending on the amount of credit enhancement available to such conduit. If the conduit’s credit enhancement is enough to cover all credit risk, the conduit is said to be “fully supported.” In such cases rating agencies base the rating of the conduit’s commercial paper notes on an analysis of the conduit’s program documentation and on the ratings of the creditsupport providers, rather than on the quality of the asset pools. This allows for easier and quicker closing of transactions, but such conduits have higher costs. In contrast, the rating agencies may conduct more due diligence and credit analysis of sellers and asset pools in transactions involving a multi-seller CP conduit that is “partially-supported.” Whether a rating agency will require such review depends on many factors, including the track record of the multi-seller CP conduit and the experience and sophistication of its sponsor. Rating agencies may require transactions in partially-supported conduits to be reviewed either pre-closing or post-closing, depending on their assessment of the multi-seller CP conduit, the seller and the assets. Some “pre-closing review” multi-seller CP conduits are able to place transactions into their programs without prior review by the rating agencies by increasing the program-wide credit enhancement facility by the amount of commercial paper sold to fund the transaction. This feature permits multi- Dechert LLP seller CP conduits to enter into transactions that must close quickly. Liquidity Facilities In addition to credit support, rating agencies also require that each multi-seller CP conduit have liquidity facilities. Unlike credit enhancement, which protects a multi-seller CP conduit from asset defaults and dilution, liquidity facilities make funds available to the conduit when factors other than credit deterioration result in a cash flow shortfall such that commercial paper investors would not receive timely repayment on maturing commercial paper notes. Such factors include a disruption in the commercial paper markets that prevents a conduit from “rolling” maturing commercial paper and timing mismatches between maturing commercial paper notes and cash collections on asset pools. Liquidity facilities may take the form of either a loan agreement pursuant to which loans are made to the conduit secured by the asset pools in the conduit, or an asset purchase agreement, pursuant to which the liquidity provider purchases nondefaulted assets from the conduit. In practice, the liquidity facilities of some conduits also have been available to fund the purchase of new receivables when no termination event has existed. New regulatory constraints discussed below may make it more difficult for such facilities to serve any function other than “pure” liquidity. As with credit enhancement facilities, liquidity facilities may be either program-wide or pool-specific. A programwide liquidity facility may be drawn on to support all of the commercial paper notes issued by a multi-seller CP conduit, whereas pool-specific liquidity may be drawn upon only with respect to the commercial paper notes issued to fund the particular transaction to which such notes relate. Historically, the cost of liquidity facilities has been affected by seller-specific and more general factors. With respect to each asset pool, a liquidity provider will examine the credit rating and business of the seller, and the credit quality and term of the assets in order to gauge the risk that the facility will be drawn. More generally, ratings downgrades of bank liquidity providers, consolidation in the banking sector and proposals by the Bank for International Settlements (“BIS”) affecting regulatory capital requirements have made liquidity scarcer and more expensive. The industry has responded by developing alternative forms of liquidity, including “liquidity notes” or “extendible notes.” Liquidity notes are issued by an SPE that is separate and apart from the multi-seller CP conduit. Page 3 Multi-Seller Commercial Paper Conduits and Securitization - A Brief History and Current Challenges It is managed by the multi-seller CP conduit’s sponsor. The “liquidity SPE” enters into an agreement with the multi-seller CP conduit pursuant to which it commits to purchase pools of assets. The liquidity SPE sells its liquidity notes to institutional investors in the amount of this commitment, thus tapping the capital markets for funding as opposed to commercial banks or insurers. The liquidity SPE uses the proceeds of the sale of its liquidity notes to purchase the commercial paper notes of the multi-seller CP conduit. Like commercial paper notes, liquidity notes are issued for short maturities (one to 90 days) at a discount to their face amount. Unlike commercial paper notes, if liquidity notes cannot be “rolled” at maturity, the liquidity SPE may extend the maturity date of such notes for a period of up to 390 days from their date of issuance. After extension, the liquidity notes carry a higher rate of interest paid monthly until maturity. If called upon to purchase asset pools from the multi-seller CP conduit, the liquidity SPE pays for such asset pools by using its holdings of the multi-seller CP conduit’s commercial paper. The result is that the aggregate outstanding principal amount of the multi-seller CP conduit’s commercial paper notes is reduced. Accounting Issues Recent accounting changes and additional proposed accounting and regulatory changes have created considerable uncertainty for multi-seller CP conduits. This uncertainty has slowed growth and in some cases increased pricing. rewards of the SPE, then the entity required to consolidate the SPE is not the entity having the majority of the voting control but the entity that bears the majority of the variability of the risks (or is entitled to the majority of the rewards to the extent no one party bears the majority of the variability of the risk). Under these rules, the commercial bank sponsor of a multi-seller CP conduit would be required to consolidate the assets and liabilities of the conduit, even though it owns no equity in the conduit. After a comment period in which various concerns were expressed, FASB clarified and modified Initial FIN 46 in a revised version dated October 31, 2003 entitled “Proposed Interpretation of Consolidation of Variable Interest Entities, a modification of FASB Interpretation No. 46” (“Revised FIN 46”). Revised FIN 46 clarified certain provisions and included certain limited-scope exceptions to its application.4 Consolidation of the assets and the liabilities of a multiseller CP conduit on the sponsor’s financial statements could have a negative impact on various financial ratios and covenants required to be maintained by such banks and on the ability of bank holding companies to raise capital. Additionally, consolidation would require bank sponsors to maintain increased regulatory capital. Sponsors have reacted in a variety of ways including: n n n Previous accounting rules did not require the commercial bank sponsor of a multi-seller CP conduit to consolidate the assets and liabilities of such conduit -- even though the sponsor had many operational, administrative and economic interests in the conduit (e.g., referral agent, administrator, liquidity provider and credit support provider)--as long as the sponsor did not have voting control of such conduit. In January 2003, the Financial Accounting Standards Board (“FASB”), the representative body of independent public accountants that promulgates generally accepted accounting principals in the United States, released an exposure draft of Interpretation Number 46, Consolidation of Variable Interest Entities (“Initial FIN 46”). (See “Is My SPE a VIE Under FIN 46 and, If So, So What? by J. Paul Forrester and Benjamin S. Neuhausen, Journal of Structured and Project Finance, Fall 2003.) The basic concept underlying Initial FIN 46 was that if the equity in an SPE is insufficient to enable it to stand on its own without additional support and the equity investors do not participate in decisions affecting the economic risks and Page 4 n n increasing conduit charges to compensate for higher costs, reducing the size of conduits, limiting transactions in conduits to the sponsor’s own customers and to transactions that move assets (such as mortgages loans, commercial loans and credit card receivables) off the bank’s own balance sheet, requiring the assets to be more highly rated or wrapped by a financial guarantor, and selling the “expected loss” piece to third parties willing to consolidate the assets and liabilities of the conduit in exchange for anticipated high rates of return. With respect to the sale of the “expected loss” piece, such transactions most often have taken the form of the sale of subordinated debt (which is treated like equity) to private equity firms through privately placed transactions exempt from the Act. If these accounting changes result in higher costs to users of multi-seller CP conduits, sellers may choose to use the longer-term, asset-backed market, to the extent that they qualify for such a market. Dechert LLP Multi-Seller Commercial Paper Conduits and Securitization - A Brief History and Current Challenges Some conduit sponsors reacted to the probability that Initial FIN 46 would force them to consolidated multiseller CP conduits by attempting to assure that such conduits would be recognized by accountants as “qualified special purpose entities” (“QSPEs”) under FASB’s Financial Accounting Standard 140 (“FASB 140”), since a QSPE will be exempt from the revised consolidation rules. To qualify conduits as QSPEs, some bank sponsors imposed strict limits on such conduits’ activities. To take one example, one bank eliminated the ability of its conduits to draw on its liquidity facility to fund new purchases of assets, limiting the use of the facility exclusively to refunding maturing commercial paper during market disruptions. Efforts to remake conduits into QSPEs were further complicated by proposed amendments to FASB 140 released in June 2003 (see discussion below). FASB has postponed the effective date for application of the consolidation rules of Revised FIN 46 for all “variable interests” acquired before February 1, 2003 until the end of the first accounting period ending after December 15, 2003 (i.e. December 31, 2003 for calendar year end companies) thus providing additional time for bank sponsors to make adjustments in their multi-seller CP conduit programs. For the moment, foreign commercial banks that sponsor multi-seller CP conduits are not affected by these changes in United States accounting rules. As a result, they may have an advantage over U.S. commercial bank sponsors since they may be able to offer lower costs. On June 10, 2003, FASB issued its exposure draft entitled Proposed Statement of Financial Accounting Standards: Qualifying Special Purpose Entities and Isolation of Transferred Assets, an amendment of FASB Statement No. 140 (the “140 Exposure Draft”). The stated goal of the 140 Exposure Draft was to remove the incentive to convert certain entities to QSPEs to avoid consolidation.5 The 140 Exposure Draft changes requirements for being a QSPE in several ways. For example, the entity may not enter into an agreement with the transferor pursuant to which the transferor is committed to “deliver additional cash or other assets to the SPE or its beneficial interest holders [its investors].”6 One possibly inadvertent result of this proposal is that it may prohibit the transferor in a typical two-step conduit transaction from agreeing to standard transferor indemnities and repurchase obligations for breaches of representations and warranties and for dilution. Other proposed amendments which might impact multi-seller CP conduit transactions include: Dechert LLP 1. limiting the ability of transferors to make decisions about the reissuance of beneficial interests, which might be deemed to apply to the daily fluctuation of the conduit’s undivided interest in the pool of receivables, 7 2. prohibiting a QSPE from holding derivative instruments entered into with the transferor,8 and 3. requiring the second SPE in a two-step transaction to be a QSPE which would require an additional QSPE to be interposed between the QSPE subsidiary of the seller and the non-QSPE conduit9. In their comments to FASB on the 140 Exposure Draft, multi-seller CP conduit professionals have urged FASB to clarify these matters. Regulatory Capital Issues Another challenge to the continued viability of multiseller CP conduits stems from proposed changes to the regulatory capital that banks are required to maintain against the assets they hold. In 1975, the supervisory authorities and central banks of major developed countries established the Basel Committee on Banking Supervision at the Bank for International Settlements in Basel, Switzerland (the “Basel Committee”). In 1988, the Basel Committee issued capital adequacy guidelines which then were adopted by the major industrialized nations (“Basel I”). Beginning in June 1999, the Basel Committee has pursued the goal of achieving a consensus on a revised accord (“Basel II”). The Basel Committee issued its Third Consultative Paper on Basel II on April 29, 2003. The goal of the Basel Committee is to complete Basel II by mid-2004 with implementation to take effect in member countries by the end of 2006. On August 4, 2003, the four relevant regulatory agencies in the United States issued an Advance Notice of Proposed Rulemaking which constitutes the agencies’ plan to implement Basel II in the United States (the “U.S. Proposal”). After the release of the Basel II proposal, securitization professionals were critical of the capital treatment that it accorded to securitizations. After reviewing comments, the Basel Committee issued a press release on October 11, 2003 indicating that it planned on “simplifying the treatment of asset securitization, including the elimination of the ‘Supervisory Formula’ and replacing it by a less complex formula.”10 Despite this announcement, U.S. securitization professionals continue to express concerns about the perceived impact of Basel II and the U.S. Page 5 Multi-Seller Commercial Paper Conduits and Securitization - A Brief History and Current Challenges Proposal. In its letter dated November 3, 2003 (the “Comment Letter”), to the Board of Governors of the Federal Reserve System, the Office of the Comptroller of the Currency, the Federal Deposit Insurance Corporation, and the Office of Thrift Supervision, the American Securitization Forum summarized its concerns with respect to asset-backed commercial paper by saying that “the current proposal does not present a workable internal approach for the calculation of capital for ABCP conduit facilities and the resulting capital requirements significantly overstate the risks of these facilities.”11 It pointed out that, under the U.S. Proposal, in order to apply Basel II, banks would be required to have liquidity and credit enhancement facilities externally rated, “which would be time-consuming and add costs for each transaction while providing relatively little benefit given the relatively low risk of a liquidity facility, infrequency of draws and very low losses under these facilities historically.”12 Instead, it urged the use of the bank’s own internal ratings and systems to gauge risk, subject to the approval of the bank’s regulator.13 Working groups of the Basel Committee are currently working on the “simplifications” noted in its Press Release of October 11, 2003. It remains to be seen whether further changes will be made to Basel II and how it will be incorporated into U.S. law. 7 140 Exposure Draft p. 2, proposed addition of new paragraph 35(f) 8 140 Exposure Draft p. 2, proposed amendment to paragraph 35(c)(2) 9 140 Exposure Draft p. 3 proposed amendment to paragraph 83 10 Bank for International Settlements, “Basel II: Significant Progress on Major Issues”, 11 October, 2003. 11 Comment Letter, p.2 12 Comment Letter, p.10 13 Comment Letter p.2 14 Comment Letter, p. 2 The accounting and regulatory issues posed by Revised FIN 46, proposed amendments to FASB 140 and Basel II are the most significant challenges to face multi-seller CP conduits during their 18-year history. As the Comment Letter notes, the ultimate implementation of Basel II will affect whether securitization will continue to play the liquidity and risk dispersion roles that it has effectively performed for nearly two decades. 14 Endnotes 1 This article does not examine securities arbitrage conduits established to take advantage of arbitrage opportunities in the fixed securities markets. 2 See Rule 3a-7 under Section 3(a) and Section 3(c)(5) of the 40 Act. 3 Outside the United States, one-step transactions are common due to differences in the bankruptcy laws. 4 Revised FIN 46, p. ii. The comment period on for Revised FIN 46 expired on December 1, 2003. 5 140 Exposure Draft p. ii 6 140 Exposure Draft p. 2 Page 6 Dechert LLP