* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Understanding the Bond Market

Survey

Document related concepts

Investment fund wikipedia , lookup

Federal takeover of Fannie Mae and Freddie Mac wikipedia , lookup

Syndicated loan wikipedia , lookup

Systemic risk wikipedia , lookup

Government debt wikipedia , lookup

Household debt wikipedia , lookup

Mark-to-market accounting wikipedia , lookup

First Report on the Public Credit wikipedia , lookup

Quantitative easing wikipedia , lookup

Securitization wikipedia , lookup

Investment management wikipedia , lookup

Financial economics wikipedia , lookup

Financial Crisis Inquiry Commission wikipedia , lookup

Transcript

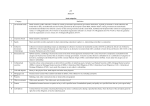

Understanding the Bond Market Bonds are a well-established asset class holding trillions of dollars globally. Even though they pass for “boring” in the general public and with some novice investors, debt instruments are anything but. When you understand them in more depth, you will gain new insights into many news stories from recent years, such as the subprimes market, the Eurozone financial crisis, the credit crunch, quantitative easing, the fiscal cliff… The fixed income asset class is fascinating and complex: financial engineering has produced a plethora of finely-tuned instruments, optimising and balancing elements of risk, return, timing, marketability, relationships with specific variables, a wide variety of outcomes… In this well-rounded, comprehensive course, you will learn all you need to know, from the basic mechanics of how this market works, right up to the intricate detail of securitisation and credit default swaps. You will gain a confident grasp of the language, concepts and attractiveness of this asset class. Who should attend? People who are being inducted into fund management, selling financial services products and working in a policy-setting role within a government agency. Course Outline Participants in the Debt Market Benefits and Disadvantages of Debt Securities Government bonds, economic policy and global financial crises Corporate Financing Revenue, GO (General Obligation) and Project bonds Hybrid Instruments Securitisation and Asset Backed Securities Bond Exchange Traded Funds Asset Liability Matching Review